2006 - Central Bank of Trinidad and Tobago

2006 - Central Bank of Trinidad and Tobago

2006 - Central Bank of Trinidad and Tobago

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

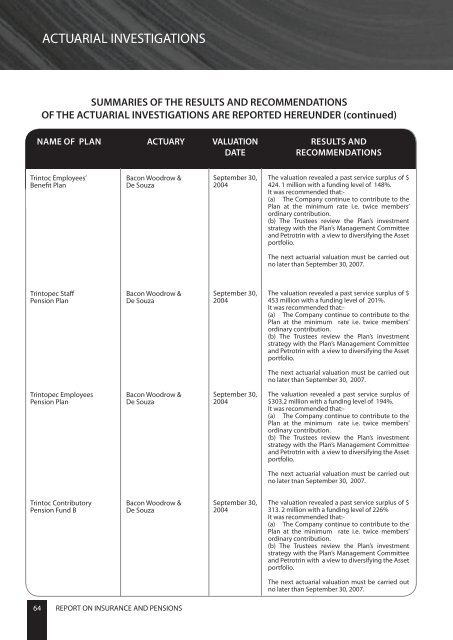

ACTUARIAL INVESTIGATIONSSUMMARIES OF THE RESULTS AND RECOMMENDATIONSOF THE ACTUARIAL INVESTIGATIONS ARE REPORTED HEREUNDER (continued)NAME OF PLANACTUARYVALUATIONDATERESULTS ANDRECOMMENDATIONSTrintoc Employees’Benefit PlanBacon Woodrow &De Souza89.08710.9100.003September 30,200489.76310.1920.04590.9089.0580.034The valuation revealed a past service surplus <strong>of</strong> $424. 1 million91.868with a funding93.004level <strong>of</strong> 148%.It was recommended that:-8.100 6.963(a) The Company continue to contribute to thePlan at the 0.032 minimum rate 0.033 i.e. twice members’ordinary contribution.(b) The Trustees review the Plan’s investmentstrategy with the Plan’s Management Committee<strong>and</strong> Petrotrin with a view to diversifying the Assetportfolio.The next actuarial valuation must be carried outno later than September 30, 2007.Trintopec StaffPension PlanBacon Woodrow &De SouzaSeptember 30,2004The valuation revealed a past service surplus <strong>of</strong> $453 million with a funding level <strong>of</strong> 201%.It was recommended that:-(a) The Company continue to contribute to thePlan at the minimum rate i.e. twice members’ordinary contribution.(b) The Trustees review the Plan’s investmentstrategy with the Plan’s Management Committee<strong>and</strong> Petrotrin with a view to diversifying the Assetportfolio.The next actuarial valuation must be carried outno later than September 30, 2007.Trintopec EmployeesPension PlanBacon Woodrow &De SouzaSeptember 30,2004The valuation revealed a past service surplus <strong>of</strong>$303.2 million with a funding level <strong>of</strong> 194%.It was recommended that:-(a) The Company continue to contribute to thePlan at the minimum rate i.e. twice members’ordinary contribution.(b) The Trustees review the Plan’s investmentstrategy with the Plan’s Management Committee<strong>and</strong> Petrotrin with a view to diversifying the Assetportfolio.The next actuarial valuation must be carried outno later tnan September 30, 2007.Trintoc ContributoryPension Fund BBacon Woodrow &De SouzaSeptember 30,2004The valuation revealed a past service surplus <strong>of</strong> $313. 2 million with a funding level <strong>of</strong> 226%It was recommended that:-(a) The Company continue to contribute to thePlan at the minimum rate i.e. twice members’ordinary contribution.(b) The Trustees review the Plan’s investmentstrategy with the Plan’s Management Committee<strong>and</strong> Petrotrin with a view to diversifying the Assetportfolio.The next actuarial valuation must be carried outno later than September 30, 2007.64REPORT ON INSURANCE AND PENSIONS