- Page 4:

TABLE OF CONTENTSParagraph Referenc

- Page 7 and 8:

REPORT ON INSURANCE AND PENSIONSFOR

- Page 9 and 10:

OVERVIEW OF THE INSURANCE INDUSTRYG

- Page 11 and 12:

OVERVIEW OF THE INSURANCE INDUSTRYF

- Page 13 and 14:

OVERVIEW OF THE INSURANCE INDUSTRYF

- Page 15 and 16:

LONG-TERM INSURANCE BUSINESSCompani

- Page 17 and 18:

LONG-TERM INSURANCE BUSINESSPolicie

- Page 19 and 20:

LONG-TERM INSURANCE BUSINESSFIGURE

- Page 21 and 22: LONG-TERM INSURANCE BUSINESSStatuto

- Page 23 and 24: LONG-TERM INSURANCE BUSINESSInvestm

- Page 25 and 26: LONG-TERM INSURANCE BUSINESSRevenue

- Page 27 and 28: LONG-TERM INSURANCE BUSINESSSCHEDUL

- Page 29 and 30: LONG-TERM INSURANCE BUSINESSFIGURE

- Page 31 and 32: LONG-TERM INSURANCE BUSINESSREINSUR

- Page 33: GENERAL INSURANCE BUSINESSCompanies

- Page 36 and 37: INSURANCE COMPANIESDEPOSITS RETAINE

- Page 38 and 39: INSURANCE COMPANIESGENERAL INSURANC

- Page 40 and 41: INSURANCE COMPANIESSCHEDULE SHOWING

- Page 42 and 43: INSURANCE COMPANIESUnderwriting Res

- Page 44 and 45: INSURANCE COMPANIESREINSURANCE - MO

- Page 46 and 47: INSURANCE COMPANIESSCHEDULE SHOWING

- Page 48 and 49: INSURANCE COMPANIESFIGURE 10OTHER I

- Page 50 and 51: INSURANCE COMPANIESREINSURANCE - PR

- Page 52 and 53: INSURANCE COMPANIESREINSURANCE - OT

- Page 54 and 55: INSURANCE COMPANIESMARGIN OF SOLVEN

- Page 56 and 57: INSURANCE COMPANIES5. ASSOCIATION O

- Page 58 and 59: INSURANCE INTERMEDIARIESExamination

- Page 60 and 61: PENSION FUND PLANS7.09 The followin

- Page 62 and 63: PENSION FUND PLANSBalance Sheets7.1

- Page 64 and 65: PENSION FUND PLANSFIGURE 12PENSION

- Page 66 and 67: ACTUARIAL INVESTIGATIONSSUMMARIES O

- Page 68 and 69: ACTUARIAL INVESTIGATIONSSUMMARIES O

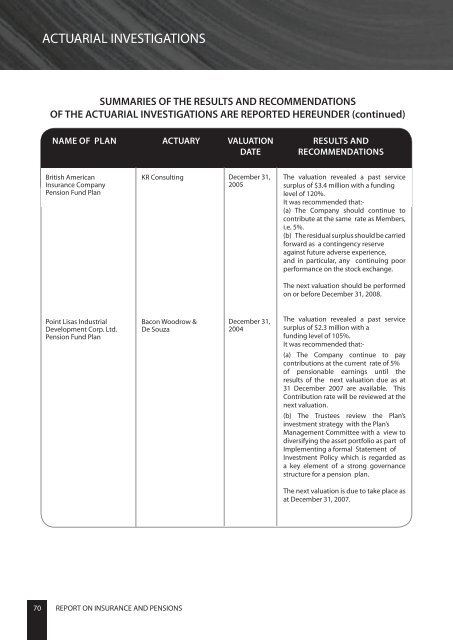

- Page 70 and 71: ACTUARIAL INVESTIGATIONSSUMMARIES O

- Page 74 and 75: ACTUARIAL INVESTIGATIONSSUMMARIES O

- Page 77: ACTUARIAL INVESTIGATIONSSUMMARIES O

- Page 80 and 81: APPENDIX ADirectors:Secretary:Audit

- Page 82 and 83: APPENDIX ADirectors:Secretary:Audit

- Page 84 and 85: APPENDIX ACARIBBEAN INSURANCE COMPA

- Page 86 and 87: APPENDIX ACOLONIAL FIRE AND GENERAL

- Page 89 and 90: SUMMARY OF BALANCE SHEETS OF INCORP

- Page 91 and 92: SUMMARY OF BALANCE SHEETS OF INCORP

- Page 93 and 94: SUMMARY OF BALANCE SHEETS OF INCORP

- Page 95 and 96: SUMMARY OF BALANCE SHEETS OF INCORP

- Page 97 and 98: SUMMARY OF BALANCE SHEETS OF INCORP

- Page 99 and 100: SUMMARY OF BALANCE SHEETS OF INCORP

- Page 101 and 102: SUMMARY OF BALANCE SHEETS OF INCORP

- Page 103 and 104: SUMMARY OF BALANCE SHEETS OF INCORP

- Page 105 and 106: SUMMARY OF BALANCE SHEETS OF INCORP

- Page 107 and 108: SUMMARY OF BALANCE SHEETS OF INCORP

- Page 109 and 110: SUMMARY OF BALANCE SHEETS OF INCORP

- Page 111 and 112: SUMMARY OF BALANCE SHEETS OF INCORP

- Page 113 and 114: SUMMARY OF BALANCE SHEETS OF INCORP

- Page 115 and 116: SUMMARY OF BALANCE SHEETS OF INCORP

- Page 117 and 118: APPENDIX BLIST OF REGISTERED AGENTS

- Page 119 and 120: List of Registered AgentsList of Ag

- Page 121 and 122: List of Registered AgentsList of Ag

- Page 123 and 124:

List of Registered AgentsList of Ag

- Page 125 and 126:

List of Registered AgentsList of Ag

- Page 127 and 128:

List of Registered AgentsList of Ag

- Page 129 and 130:

List of Registered AgentsList of Ag

- Page 131 and 132:

List of Registered AgentsList of Ag

- Page 133 and 134:

List of Registered AgentsList of Ag

- Page 135 and 136:

List of Registered AgentsList of Ag

- Page 137 and 138:

List of Registered AgentsList of Ag

- Page 139 and 140:

List of Registered AgentsList of Ag

- Page 141 and 142:

List of Registered AgentsList of Ag

- Page 143 and 144:

List of Registered AgentsList of Ag

- Page 145 and 146:

List of Registered AgentsList of Ag

- Page 147 and 148:

APPENDIX CLIST OF REGISTERED BROKER

- Page 149 and 150:

LIST OF REGISTERED BROKERSLIST OF B

- Page 151 and 152:

LIST OF REGISTERED BROKERSLIST OF B

- Page 153 and 154:

Appendix dLIST OF ADJUSTERS REGISTE

- Page 155 and 156:

Appendix eLIST OF PENSION PLANS REG

- Page 157 and 158:

list of registered pension plansLIS

- Page 159 and 160:

list of registered pension plansINS

- Page 161 and 162:

list of registered pension plansINS

- Page 163 and 164:

list of registered pension plansINS

- Page 165 and 166:

list of registered pension plansANN

- Page 167 and 168:

list of registered pension plansWIN

- Page 169 and 170:

TABLESTABLE IREVENUE ACCOUNT IN RES

- Page 171 and 172:

TABLESTABLE IIREVENUE ACCOUNT IN RE

- Page 173 and 174:

1.2.3.4.1.2.3.4.TABLESTABLE IIIREVE

- Page 175 and 176:

1.2.3.4.5.6.7.8.9.101.1.TABLESTABLE

- Page 177 and 178:

1.2.3.4.5.TABLESTABLE VIREVENUE ACC

- Page 179 and 180:

TABLESTABLE VIIILONG-TERM INSURANCE

- Page 181 and 182:

TABLESTABLE XCOMPANIESLOCAL1.Americ

- Page 183 and 184:

TABLESTABLE XIASTATEMENT OF STATUTO

- Page 185 and 186:

1.234567891011121314151617181920212

- Page 187 and 188:

TABLESTABLE XVREVENUE ACCOUNT IN RE

- Page 189 and 190:

TABLESTABLE XVIIREVENUE ACCOUNT IN

- Page 191 and 192:

123456789101112131415161TABLESTABLE

- Page 193 and 194:

1234567891011121314151TABLESTABLE X

- Page 195 and 196:

TABLESTABLE XXIISUMMARY AND VALUATI

- Page 197 and 198:

TABLESTABLE XXIVSUMMARY AND VALUATI

- Page 199 and 200:

TABLESTABLE XXVIGUARDIAN LIFE OF TH

- Page 201 and 202:

TABLESTABLE XXVIIISUMMARY AND VALUA

- Page 203 and 204:

TABLESTABLE XXXNAME OF PLAN Fund at

- Page 205 and 206:

TABLESTABLE XXXI continuedDEPOSIT A

- Page 207 and 208:

TABLESTABLE XXXI continuedDEPOSIT A

- Page 209 and 210:

TABLESNAME OF PLANBrought Forward26

- Page 211 and 212:

TABLESNAME OF PLANBrought Forward76

- Page 213 and 214:

TABLESTABLE XXXIII continuedSELF-AD

- Page 215:

TABLESTABLE XXXIII continuedSELF-AD