2006 - Central Bank of Trinidad and Tobago

2006 - Central Bank of Trinidad and Tobago

2006 - Central Bank of Trinidad and Tobago

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

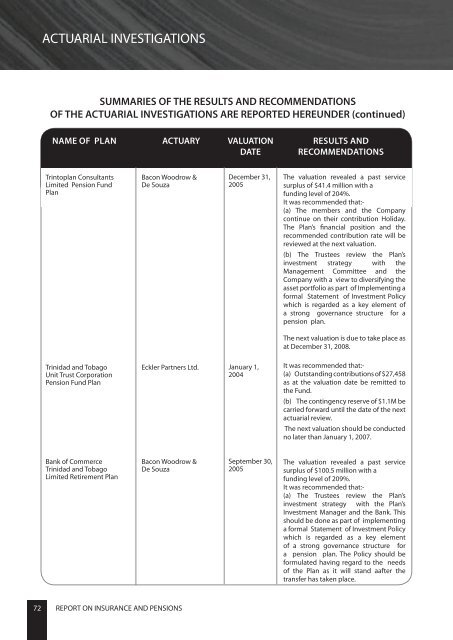

ACTUARIAL INVESTIGATIONSSUMMARIES OF THE RESULTS AND RECOMMENDATIONSOF THE ACTUARIAL INVESTIGATIONS ARE REPORTED HEREUNDER (continued)NAME OF PLANACTUARYVALUATIONDATERESULTS ANDRECOMMENDATIONSTrintoplan ConsultantsLimited Pension FundPlanBacon Woodrow &89.087De Souza10.9100.003December 31,200589.76310.1920.04590.9089.0580.034The valuation revealed a past service91.868 93.004surplus <strong>of</strong> $41.4 million with afunding level 8.100 <strong>of</strong> 204%. 6.963It was recommended that:-(a) The members 0.032 <strong>and</strong> the 0.033 Companycontinue on their contribution Holiday.The Plan’s financial position <strong>and</strong> therecommended contribution rate will bereviewed at the next valuation.(b) The Trustees review the Plan’sinvestment strategy with theManagement Committee <strong>and</strong> theCompany with a view to diversifying theasset portfolio as part <strong>of</strong> Implementing aformal Statement <strong>of</strong> Investment Policywhich is regarded as a key element <strong>of</strong>a strong governance structure for apension plan.The next valuation is due to take place asat December 31, 2008.<strong>Trinidad</strong> <strong>and</strong> <strong>Tobago</strong>Unit Trust CorporationPension Fund PlanEckler Partners Ltd.January 1,2004It was recommended that:-(a) Outst<strong>and</strong>ing contributions <strong>of</strong> $27,458as at the valuation date be remitted tothe Fund.(b) The contingency reserve <strong>of</strong> $1.1M becarried forward until the date <strong>of</strong> the nextactuarial review.The next valuation should be conductedno later than January 1, 2007.<strong>Bank</strong> <strong>of</strong> Commerce<strong>Trinidad</strong> <strong>and</strong> <strong>Tobago</strong>Limited Retirement PlanBacon Woodrow &De SouzaSeptember 30,2005The valuation revealed a past servicesurplus <strong>of</strong> $100.5 million with afunding level <strong>of</strong> 209%.It was recommended that:-(a) The Trustees review the Plan’sinvestment strategy with the Plan’sInvestment Manager <strong>and</strong> the <strong>Bank</strong>. Thisshould be done as part <strong>of</strong> implementinga formal Statement <strong>of</strong> Investment Policywhich is regarded as a key element<strong>of</strong> a strong governance structure fora pension plan. The Policy should beformulated having regard to the needs<strong>of</strong> the Plan as it will st<strong>and</strong> aafter thetransfer has taken place.72REPORT ON INSURANCE AND PENSIONS