Revista Tinerilor Economiºti - Centru E-learning de Instruire al ...

Revista Tinerilor Economiºti - Centru E-learning de Instruire al ...

Revista Tinerilor Economiºti - Centru E-learning de Instruire al ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

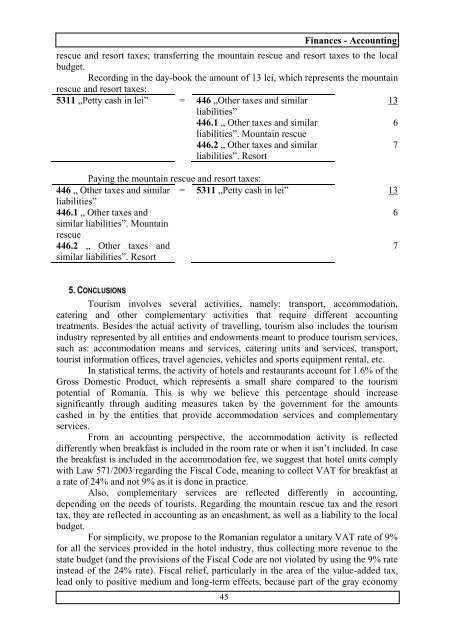

Finances - Accountingrescue and resort taxes; transferring the mountain rescue and resort taxes to the loc<strong>al</strong>budget.Recording in the day-book the amount of 13 lei, which represents the mountainrescue and resort taxes:5311 „Petty cash in lei” = 446 „Other taxes and similarliabilities”446.1 „ Other taxes and similarliabilities”. Mountain rescue446.2 „ Other taxes and similarliabilities”. Resort1367Paying the mountain rescue and resort taxes:446 „ Other taxes and similarliabilities”446.1 „ Other taxes andsimilar liabilities”. Mountainrescue446.2 „ Other taxes andsimilar liabilities”. Resort= 5311 „Petty cash in lei” 13675. CONCLUSIONSTourism involves sever<strong>al</strong> activities, namely: transport, accommodation,catering and other complementary activities that require different accountingtreatments. Besi<strong>de</strong>s the actu<strong>al</strong> activity of travelling, tourism <strong>al</strong>so inclu<strong>de</strong>s the tourismindustry represented by <strong>al</strong>l entities and endowments meant to produce tourism services,such as: accommodation means and services, catering units and services, transport,tourist information offices, travel agencies, vehicles and sports equipment rent<strong>al</strong>, etc.In statistic<strong>al</strong> terms, the activity of hotels and restaurants account for 1.6% of theGross Domestic Product, which represents a sm<strong>al</strong>l share compared to the tourismpotenti<strong>al</strong> of Romania. This is why we believe this percentage should increasesignificantly through auditing measures taken by the government for the amountscashed in by the entities that provi<strong>de</strong> accommodation services and complementaryservices.From an accounting perspective, the accommodation activity is reflecteddifferently when breakfast is inclu<strong>de</strong>d in the room rate or when it isn’t inclu<strong>de</strong>d. In casethe breakfast is inclu<strong>de</strong>d in the accommodation fee, we suggest that hotel units complywith Law 571/2003 regarding the Fisc<strong>al</strong> Co<strong>de</strong>, meaning to collect VAT for breakfast ata rate of 24% and not 9% as it is done in practice.Also, complementary services are reflected differently in accounting,<strong>de</strong>pending on the needs of tourists. Regarding the mountain rescue tax and the resorttax, they are reflected in accounting as an encashment, as well as a liability to the loc<strong>al</strong>budget.For simplicity, we propose to the Romanian regulator a unitary VAT rate of 9%for <strong>al</strong>l the services provi<strong>de</strong>d in the hotel industry, thus collecting more revenue to thestate budget (and the provisions of the Fisc<strong>al</strong> Co<strong>de</strong> are not violated by using the 9% rateinstead of the 24% rate). Fisc<strong>al</strong> relief, particularly in the area of the v<strong>al</strong>ue-ad<strong>de</strong>d tax,lead only to positive medium and long-term effects, because part of the gray economy45