The real options approach to valuation - Haskayne School of Business

The real options approach to valuation - Haskayne School of Business

The real options approach to valuation - Haskayne School of Business

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

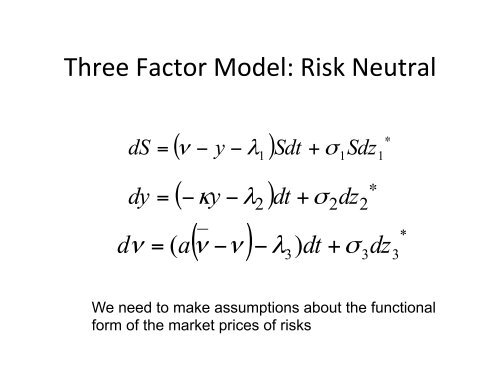

Three Fac<strong>to</strong>r Model: Risk Neutral dSdy( )∗ν − y − λ Sdt + σ=1 1Sdz1( )∗−κy− λ dt + σ= 2 2dz2( ν ν ) λ dt σ*dν= ( a − − + dz3 )33We need <strong>to</strong> make assumptions about the functionalform <strong>of</strong> the market prices <strong>of</strong> risks