The real options approach to valuation - Haskayne School of Business

The real options approach to valuation - Haskayne School of Business

The real options approach to valuation - Haskayne School of Business

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

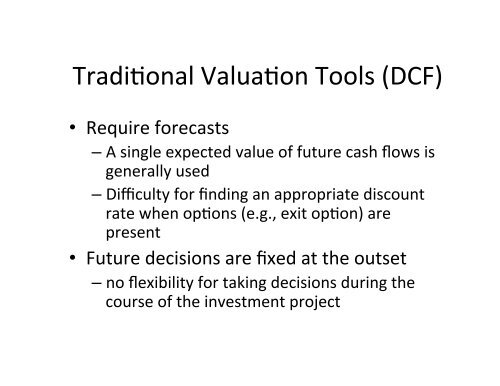

Tradi*onal Valua*on Tools (DCF) • Require forecasts – A single expected value <strong>of</strong> future cash flows is generally used – Difficulty for finding an appropriate discount rate when op*ons (e.g., exit op*on) are present • Future decisions are fixed at the outset – no flexibility for taking decisions during the course <strong>of</strong> the investment project