The real options approach to valuation - Haskayne School of Business

The real options approach to valuation - Haskayne School of Business

The real options approach to valuation - Haskayne School of Business

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

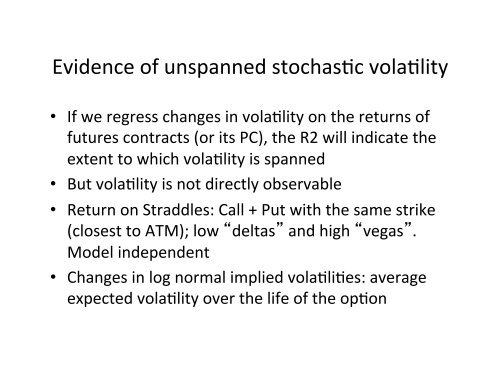

Evidence <strong>of</strong> unspanned s<strong>to</strong>chas*c vola*lity • If we regress changes in vola*lity on the returns <strong>of</strong> futures contracts (or its PC), the R2 will indicate the extent <strong>to</strong> which vola*lity is spanned • But vola*lity is not directly observable • Return on Straddles: Call + Put with the same strike (closest <strong>to</strong> ATM); low “deltas” and high “vegas”. Model independent • Changes in log normal implied vola*li*es: average expected vola*lity over the life <strong>of</strong> the op*on