The relationship between pension scheme administration and ...

The relationship between pension scheme administration and ...

The relationship between pension scheme administration and ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

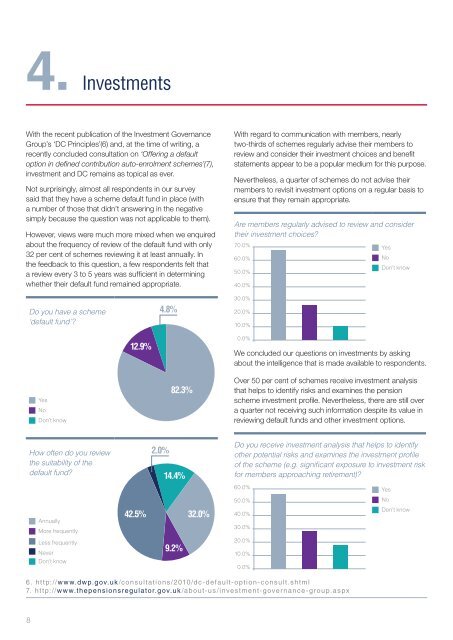

4.InvestmentsWith the recent publication of the Investment GovernanceGroup’s ‘DC Principles’(6) <strong>and</strong>, at the time of writing, arecently concluded consultation on ‘Offering a defaultoption in defined contribution auto-enrolment <strong>scheme</strong>s’(7),investment <strong>and</strong> DC remains as topical as ever.Not surprisingly, almost all respondents in our surveysaid that they have a <strong>scheme</strong> default fund in place (witha number of those that didn’t answering in the negativesimply because the question was not applicable to them).However, views were much more mixed when we enquiredabout the frequency of review of the default fund with only32 per cent of <strong>scheme</strong>s reviewing it at least annually. Inthe feedback to this question, a few respondents felt thata review every 3 to 5 years was sufficient in determiningwhether their default fund remained appropriate.With regard to communication with members, nearlytwo-thirds of <strong>scheme</strong>s regularly advise their members toreview <strong>and</strong> consider their investment choices <strong>and</strong> benefitstatements appear to be a popular medium for this purpose.Nevertheless, a quarter of <strong>scheme</strong>s do not advise theirmembers to revisit investment options on a regular basis toensure that they remain appropriate.Are members regularly advised to review <strong>and</strong> considertheir investment choices?70.0%60.0%50.0%40.0%YesNoDon’t knowDo you have a <strong>scheme</strong>‘default fund’?4.8%30.0%20.0%10.0%12.9%0.0%We concluded our questions on investments by askingabout the intelligence that is made available to respondents.YesNoDon’t know82.3%Over 50 per cent of <strong>scheme</strong>s receive investment analysisthat helps to identify risks <strong>and</strong> examines the <strong>pension</strong><strong>scheme</strong> investment profile. Nevertheless, there are still overa quarter not receiving such information despite its value inreviewing default funds <strong>and</strong> other investment options.How often do you reviewthe suitability of thedefault fund?AnnuallyMore frequentlyLess frequentlyNeverDon’t know2.0%14.4%42.5% 32.0%9.2%Do you receive investment analysis that helps to identifyother potential risks <strong>and</strong> examines the investment profileof the <strong>scheme</strong> (e.g. significant exposure to investment riskfor members approaching retirement)?60.0%50.0%40.0%30.0%20.0%10.0%0.0%YesNoDon’t know6. http://www.dwp.gov.uk/consultations/2010/dc-default-option-consult.shtml7. ht tp://www.the<strong>pension</strong>sregulator.gov.uk/about-us/investment-governance-group.aspx8