Chapter 6 - SME Corporation Malaysia

Chapter 6 - SME Corporation Malaysia

Chapter 6 - SME Corporation Malaysia

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

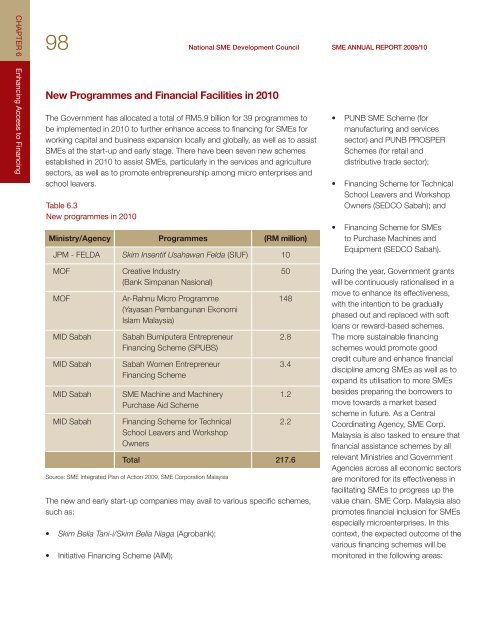

CHAPTER 698 National <strong>SME</strong> Development Council <strong>SME</strong> ANNUAL REPORT 2009/10Enhancing Access to FinancingNew Programmes and Financial Facilities in 2010The Government has allocated a total of RM5.9 billion for 39 programmes tobe implemented in 2010 to further enhance access to financing for <strong>SME</strong>s forworking capital and business expansion locally and globally, as well as to assist<strong>SME</strong>s at the start-up and early stage. There have been seven new schemesestablished in 2010 to assist <strong>SME</strong>s, particularly in the services and agriculturesectors, as well as to promote entrepreneurship among micro enterprises andschool leavers.Table 6.3New programmes in 2010Ministry/Agency Programmes (RM million)JPM - FELDA Skim Insentif Usahawan Felda (SIUF) 10MOFMOFMID SabahMID SabahMID SabahMID SabahCreative Industry(Bank Simpanan Nasional)Ar-Rahnu Micro Programme(Yayasan Pembangunan EkonomiIslam <strong>Malaysia</strong>)Sabah Bumiputera EntrepreneurFinancing Scheme (SPUBS)Sabah Women EntrepreneurFinancing Scheme<strong>SME</strong> Machine and MachineryPurchase Aid SchemeFinancing Scheme for TechnicalSchool Leavers and WorkshopOwners501482.83.41.22.2Total 217.6Source: <strong>SME</strong> Integrated Plan of Action 2009, <strong>SME</strong> <strong>Corporation</strong> <strong>Malaysia</strong>The new and early start-up companies may avail to various specific schemes,such as:• Skim Belia Tani-i/Skim Belia Niaga (Agrobank);• Initiative Financing Scheme (AIM);• PUNB <strong>SME</strong> Scheme (formanufacturing and servicessector) and PUNB PROSPERSchemes (for retail anddistributive trade sector);• Financing Scheme for TechnicalSchool Leavers and WorkshopOwners (SEDCO Sabah); and• Financing Scheme for <strong>SME</strong>sto Purchase Machines andEquipment (SEDCO Sabah).During the year, Government grantswill be continuously rationalised in amove to enhance its effectiveness,with the intention to be graduallyphased out and replaced with softloans or reward-based schemes.The more sustainable financingschemes would promote goodcredit culture and enhance financialdiscipline among <strong>SME</strong>s as well as toexpand its utilisation to more <strong>SME</strong>sbesides preparing the borrowers tomove towards a market basedscheme in future. As a CentralCoordinating Agency, <strong>SME</strong> Corp.<strong>Malaysia</strong> is also tasked to ensure thatfinancial assistance schemes by allrelevant Ministries and GovernmentAgencies across all economic sectorsare monitored for its effectiveness infacilitating <strong>SME</strong>s to progress up thevalue chain. <strong>SME</strong> Corp. <strong>Malaysia</strong> alsopromotes financial inclusion for <strong>SME</strong>sespecially microenterprises. In thiscontext, the expected outcome of thevarious financing schemes will bemonitored in the following areas: