Operational risk capital and insurance in emerging markets

Operational risk capital and insurance in emerging markets

Operational risk capital and insurance in emerging markets

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

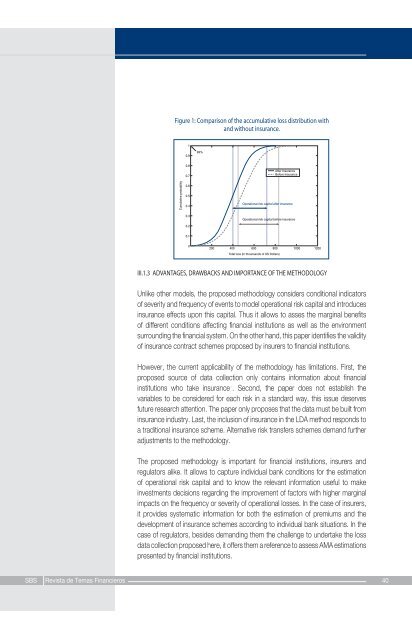

Figure 1: Comparison of the accumulative loss distribution withFigure 1: Comparison of the accumulative loss distribution with <strong>and</strong> without<strong>and</strong> without <strong><strong>in</strong>surance</strong>.<strong><strong>in</strong>surance</strong>.10.999%Cumulative probability0.80.70.60.50.40.30.2After InsuranceBefore Insurance<strong>Operational</strong> <strong>risk</strong> <strong>capital</strong> after <strong><strong>in</strong>surance</strong><strong>Operational</strong> <strong>risk</strong> <strong>capital</strong> before <strong><strong>in</strong>surance</strong>0.10200 400 600 800 1000 1200Total loss (In thouns<strong>and</strong>s of US Dollars)III.1.3 ADVANTAGES, DRAWBACKS AND IMPORTANCE OF THE METHODOLOGYUnlike other models, the proposed methodology considers conditional <strong>in</strong>dicatorsof severity <strong>and</strong> frequency of events to model operational <strong>risk</strong> <strong>capital</strong> <strong>and</strong> <strong>in</strong>troduces<strong><strong>in</strong>surance</strong> effects upon this <strong>capital</strong>. Thus it allows to asses the marg<strong>in</strong>al benefitsof different conditions affect<strong>in</strong>g f<strong>in</strong>ancial <strong>in</strong>stitutions as well as the environmentsurround<strong>in</strong>g the f<strong>in</strong>ancial system. On the other h<strong>and</strong>, this paper identifies the validityof <strong><strong>in</strong>surance</strong> contract schemes proposed by <strong>in</strong>surers to f<strong>in</strong>ancial <strong>in</strong>stitutions.However, the current applicability of the methodology has limitations. First, theproposed source of data collection only conta<strong>in</strong>s <strong>in</strong>formation about f<strong>in</strong>ancial<strong>in</strong>stitutions who take <strong><strong>in</strong>surance</strong> . Second, the paper does not establish thevariables to be considered for each <strong>risk</strong> <strong>in</strong> a st<strong>and</strong>ard way, this issue deservesfuture research attention. The paper only proposes that the data must be built from<strong><strong>in</strong>surance</strong> <strong>in</strong>dustry. Last, the <strong>in</strong>clusion of <strong><strong>in</strong>surance</strong> <strong>in</strong> the LDA method responds toa traditional <strong><strong>in</strong>surance</strong> scheme. Alternative <strong>risk</strong> transfers schemes dem<strong>and</strong> furtheradjustments to the methodology.The proposed methodology is important for f<strong>in</strong>ancial <strong>in</strong>stitutions, <strong>in</strong>surers <strong>and</strong>regulators alike. It allows to capture <strong>in</strong>dividual bank conditions for the estimationof operational <strong>risk</strong> <strong>capital</strong> <strong>and</strong> to know the relevant <strong>in</strong>formation useful to make<strong>in</strong>vestments decisions regard<strong>in</strong>g the improvement of factors with higher marg<strong>in</strong>alimpacts on the frequency or severity of operational losses. In the case of <strong>in</strong>surers,it provides systematic <strong>in</strong>formation for both the estimation of premiums <strong>and</strong> thedevelopment of <strong><strong>in</strong>surance</strong> schemes accord<strong>in</strong>g to <strong>in</strong>dividual bank situations. In thecase of regulators, besides dem<strong>and</strong><strong>in</strong>g them the challenge to undertake the lossdata collection proposed here, it offers them a reference to assess AMA estimationspresented by f<strong>in</strong>ancial <strong>in</strong>stitutions.SBS Revista de Temas F<strong>in</strong>ancieros 40