Operational risk capital and insurance in emerging markets

Operational risk capital and insurance in emerging markets

Operational risk capital and insurance in emerging markets

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

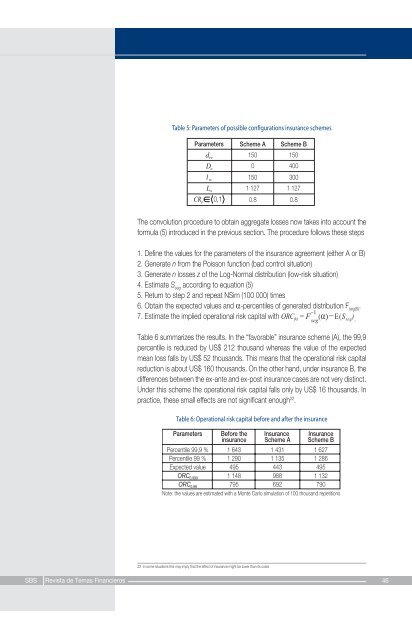

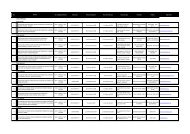

Table 5: Parameters of possible configurations <strong><strong>in</strong>surance</strong> schemesThe convolution procedure to obta<strong>in</strong> aggregate losses now takes <strong>in</strong>to account theformula (5) <strong>in</strong>troduced <strong>in</strong> the previous section. The procedure follows these steps1. Def<strong>in</strong>e the values for the parameters of the <strong><strong>in</strong>surance</strong> agreement (either A or B)2. Generate n from the Poisson function (bad control situation)3. Generate n losses z of the Log-Normal distribution (low-<strong>risk</strong> situation)4. Estimate S seg accord<strong>in</strong>g to equation (5)5. Return to step 2 <strong>and</strong> repeat NSim (100 000) times6. Obta<strong>in</strong> the expected values <strong>and</strong> a-percentiles of generated distribution F seg(S) .7. Estimate the implied operational <strong>risk</strong> <strong>capital</strong> with ORC fa = F _ 1seg (a) _ E(S seg ) .Table 6 summarizes the results. In the “favorable” <strong><strong>in</strong>surance</strong> scheme (A), the 99,9percentile is reduced by US$ 212 thous<strong>and</strong> whereas the value of the expectedmean loss falls by US$ 52 thous<strong>and</strong>s. This means that the operational <strong>risk</strong> <strong>capital</strong>reduction is about US$ 160 thous<strong>and</strong>s. On the other h<strong>and</strong>, under <strong><strong>in</strong>surance</strong> B, thedifferences between the ex-ante <strong>and</strong> ex-post <strong><strong>in</strong>surance</strong> cases are not very dist<strong>in</strong>ct.Under this scheme the operational <strong>risk</strong> <strong>capital</strong> falls only by US$ 16 thous<strong>and</strong>s. Inpractice, these small effects are not significant enough 22 .Table 6: <strong>Operational</strong> <strong>risk</strong> <strong>capital</strong> before <strong>and</strong> after the <strong><strong>in</strong>surance</strong>22 In some situations this may imply that the effect of <strong><strong>in</strong>surance</strong> might be lower than its costsSBS Revista de Temas F<strong>in</strong>ancieros 46