Moody's Raises Malaysia's Credit Rating Outlook to ... - Maybank

Moody's Raises Malaysia's Credit Rating Outlook to ... - Maybank

Moody's Raises Malaysia's Credit Rating Outlook to ... - Maybank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

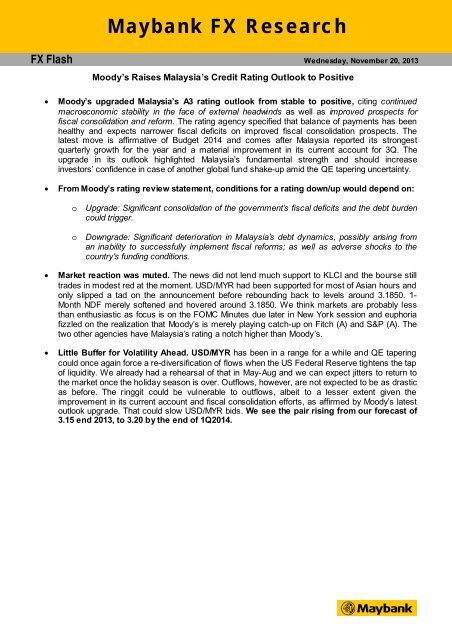

<strong>Maybank</strong> FX ResearchFX Flash Wednesday, November 20, 2013Moody’s <strong>Raises</strong> Malaysia’s <strong>Credit</strong> <strong>Rating</strong> <strong>Outlook</strong> <strong>to</strong> Positive• Moody’s upgraded Malaysia’s A3 rating outlook from stable <strong>to</strong> positive, citing continuedmacroeconomic stability in the face of external headwinds as well as improved prospects forfiscal consolidation and reform. The rating agency specified that balance of payments has beenhealthy and expects narrower fiscal deficits on improved fiscal consolidation prospects. Thelatest move is affirmative of Budget 2014 and comes after Malaysia reported its strongestquarterly growth for the year and a material improvement in its current account for 3Q. Theupgrade in its outlook highlighted Malaysia’s fundamental strength and should increaseinves<strong>to</strong>rs’ confidence in case of another global fund shake-up amid the QE tapering uncertainty.• From Moody’s rating review statement, conditions for a rating down/up would depend on:o Upgrade: Significant consolidation of the government’s fiscal deficits and the debt burdencould trigger.o Downgrade: Significant deterioration in Malaysia’s debt dynamics, possibly arising froman inability <strong>to</strong> successfully implement fiscal reforms; as well as adverse shocks <strong>to</strong> thecountry's funding conditions.• Market reaction was muted. The news did not lend much support <strong>to</strong> KLCI and the bourse stilltrades in modest red at the moment. USD/MYR had been supported for most of Asian hours andonly slipped a tad on the announcement before rebounding back <strong>to</strong> levels around 3.1850. 1-Month NDF merely softened and hovered around 3.1850. We think markets are probably lessthan enthusiastic as focus is on the FOMC Minutes due later in New York session and euphoriafizzled on the realization that Moody’s is merely playing catch-up on Fitch (A) and S&P (A). Thetwo other agencies have Malaysia’s rating a notch higher than Moody’s.• Little Buffer for Volatility Ahead. USD/MYR has been in a range for a while and QE taperingcould once again force a re-diversification of flows when the US Federal Reserve tightens the tapof liquidity. We already had a rehearsal of that in May-Aug and we can expect jitters <strong>to</strong> return <strong>to</strong>the market once the holiday season is over. Outflows, however, are not expected <strong>to</strong> be as drasticas before. The ringgit could be vulnerable <strong>to</strong> outflows, albeit <strong>to</strong> a lesser extent given theimprovement in its current account and fiscal consolidation efforts, as affirmed by Moody’s lates<strong>to</strong>utlook upgrade. That could slow USD/MYR bids. We see the pair rising from our forecast of3.15 end 2013, <strong>to</strong> 3.20 by the end of 1Q2014.

FX ResearchDisclaimerThis report is for information purposes only and under no circumstances is it <strong>to</strong> be considered or intended as an offer <strong>to</strong> sell or asolicitation of an offer <strong>to</strong> buy the securities or financial instruments referred <strong>to</strong> herein, or an offer or solicitation <strong>to</strong> any person <strong>to</strong> enter in<strong>to</strong>any transaction or adopt any investment strategy. Inves<strong>to</strong>rs should note that income from such securities or financial instruments, if any,may fluctuate and that each security’s or financial instrument’s price or value may rise or fall. Accordingly, inves<strong>to</strong>rs may receive back lessthan originally invested. Past performance is not necessarily a guide <strong>to</strong> future performance. This report is not intended <strong>to</strong> provide personalinvestment advice and does not take in<strong>to</strong> account the specific investment objectives, the financial situation and the particular needs ofpersons who may receive or read this report. Inves<strong>to</strong>rs should therefore seek financial, legal and other advice regarding theappropriateness of investing in any securities and/or financial instruments or the investment strategies discussed or recommended in thisreport.The information contained herein has been obtained from sources believed <strong>to</strong> be reliable but such sources have not been independentlyverified by Malayan Banking Berhad and/or its affiliates and related corporations (collectively, “<strong>Maybank</strong>”) and consequently norepresentation is made as <strong>to</strong> the accuracy or completeness of this report by <strong>Maybank</strong> and it should not be relied upon as such.Accordingly, no liability can be accepted for any direct, indirect or consequential losses or damages that may arise from the use or relianceof this report. <strong>Maybank</strong> and its officers, direc<strong>to</strong>rs, associates, connected parties and/or employees may from time <strong>to</strong> time have positions orbe materially interested in the securities and/or financial instruments referred <strong>to</strong> herein and may further act as market maker or haveassumed an underwriting commitment or deal with such securities and/or financial instruments and may also perform or seek <strong>to</strong> performinvestment banking, advisory and other services for or relating <strong>to</strong> those companies whose securities are mentioned in this report. Anyinformation or opinions or recommendations contained herein are subject <strong>to</strong> change at any time, w ithout prior notice.This report may contain forward looking statements which are often but not always identified by the use of words such as “anticipate”,“believe”, “estimate”, “intend”, “plan”, “expect”, “forecast”, “predict” and “project” and statements that an event or result “may”, “will”, “can”,“should”, “could” or “might” occur or be achieved and other similar expressions. Such forward looking statements are based onassumptions made and information currently available <strong>to</strong> us and are subject <strong>to</strong> certain risks and uncertainties that could cause the actualresults <strong>to</strong> differ materially from those expressed in any forward looking statements. Readers are cautioned not <strong>to</strong> place undue relevanceon these forward looking statements. <strong>Maybank</strong> expressly disclaims any obligation <strong>to</strong> update or revise any such forward looking statements<strong>to</strong> reflect new information, events or circumstances after the date of this publication or <strong>to</strong> reflect the occurrence of unanticipated events.This report is prepared for the use of <strong>Maybank</strong>’s clients and may not be reproduced, altered in any way, transmitted <strong>to</strong>, copied ordistributed <strong>to</strong> any other party in whole or in part in any form or manner w ithout the prior express written consent of <strong>Maybank</strong>. <strong>Maybank</strong>accepts no liability whatsoever for the actions of third parties in this respect.This report is not directed <strong>to</strong> or intended for distribution <strong>to</strong> or use by any person or entity who is a citizen or resident of or located in anylocality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary <strong>to</strong> law or regulation.Published by:Malayan Banking Berhad(Incorporated in Malaysia)Saktiandi Supaat Leslie Tang Fiona LimHead, FX Research Senior FX Analyst FX Analystsaktiandi@maybank.com.sg leslietang@maybank.com.sg Fionalim@maybank.com.sg(+65) 63201379 (+65) 63201378 (+65) 6320137420 November 2013 Page 2 of 2