ROFIN-SINAR Technologies

ROFIN-SINAR Technologies

ROFIN-SINAR Technologies

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>ROFIN</strong>-<strong>SINAR</strong> <strong>Technologies</strong> 04 February 2011<br />

Healthy 1Q10/11 results and raise in management guidance<br />

2<br />

Please see the important disclaimer & company disclosures at the end of this report<br />

BHF-BANK Research<br />

Rofin-Sinar’s 1Q10/11 results came in higher than we expected and above management’s guidance. Revenues of<br />

US$137.1m (vs. BHF-BANK estimate of US$131.1m) increased by 10.3% QoQ and reached pre-crisis levels. With<br />

the exception of the machine tool industry, where revenues remained flat QoQ, all end markets contributed to sequential<br />

growth, i.e. automotive & sub-suppliers +47%, semiconductor/electronics/solar +14%, others +10%.<br />

Geographically, demand from European customers rebounded the strongest compared to the previous quarter<br />

(+19%), while North America (+8% QoQ) and Asia (+2% QoQ) also showed further improvements in demand. Quarterly<br />

order intake of US$144.6m matched our forecasts and also recovered to pre-crisis levels. In its conference<br />

call, management stated that order intake to date in the second quarter is encouraging (BHF-BANK estimate:<br />

US$151.0m, +4.4% QoQ). Mainly due to the improvement in the top line, 1Q10/11 operating profit of US$21.5m<br />

and net income of US$14.9m beat our estimates of US$ 21.0m and US$12.6m, respectively.<br />

Largely due to stronger demand coming from the machine tool sector as well as very healthy order intakes from all<br />

end markets in January, management raised its FY11 guidance, which now targets revenues of US$540-560m, up<br />

from US$500-520m. Moreover, management raised its EBT-margin goal by 1 percentage point to 14-16%.<br />

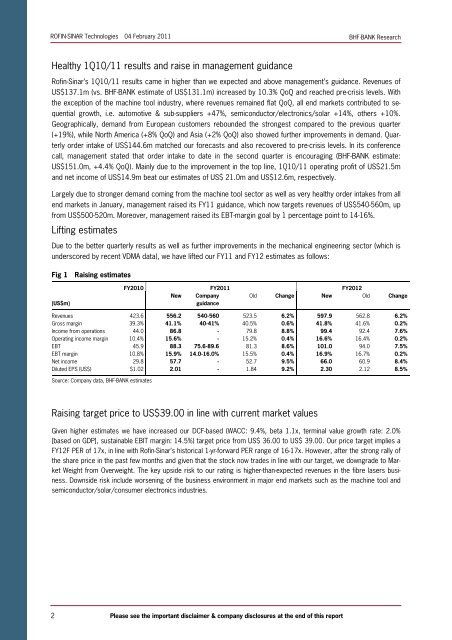

Lifting estimates<br />

Due to the better quarterly results as well as further improvements in the mechanical engineering sector (which is<br />

underscored by recent VDMA data), we have lifted our FY11 and FY12 estimates as follows:<br />

Fig 1 Raising estimates<br />

(US$m)<br />

FY2010 FY2011 FY2012<br />

New Company<br />

guidance<br />

Old Change New Old Change<br />

Revenues 423.6 556.2 540-560 523.5 6.2% 597.9 562.8 6.2%<br />

Gross margin 39.3% 41.1% 40-41% 40.5% 0.6% 41.8% 41.6% 0.2%<br />

Income from operations 44.0 86.8 - 79.8 8.8% 99.4 92.4 7.6%<br />

Operating income margin 10.4% 15.6% - 15.2% 0.4% 16.6% 16.4% 0.2%<br />

EBT 45.9 88.3 75.6-89.6 81.3 8.6% 101.0 94.0 7.5%<br />

EBT margin 10.8% 15.9% 14.0-16.0% 15.5% 0.4% 16.9% 16.7% 0.2%<br />

Net income 29.8 57.7 - 52.7 9.5% 66.0 60.9 8.4%<br />

Diluted EPS (US$) $1.02 2.01 - 1.84 9.2% 2.30 2.12 8.5%<br />

Source: Company data, BHF-BANK estimates<br />

_<br />

Raising target price to US$39.00 in line with current market values<br />

Given higher estimates we have increased our DCF-based (WACC: 9.4%, beta 1.1x, terminal value growth rate: 2.0%<br />

[based on GDP], sustainable EBIT margin: 14.5%) target price from US$ 36.00 to US$ 39.00. Our price target implies a<br />

FY12F PER of 17x, in line with Rofin-Sinar’s historical 1-yr-forward PER range of 16-17x. However, after the strong rally of<br />

the share price in the past few months and given that the stock now trades in line with our target, we downgrade to Market<br />

Weight from Overweight. The key upside risk to our rating is higher-than-expected revenues in the fibre lasers business.<br />

Downside risk include worsening of the business environment in major end markets such as the machine tool and<br />

semiconductor/solar/consumer electronics industries.