1O9d91u

1O9d91u

1O9d91u

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

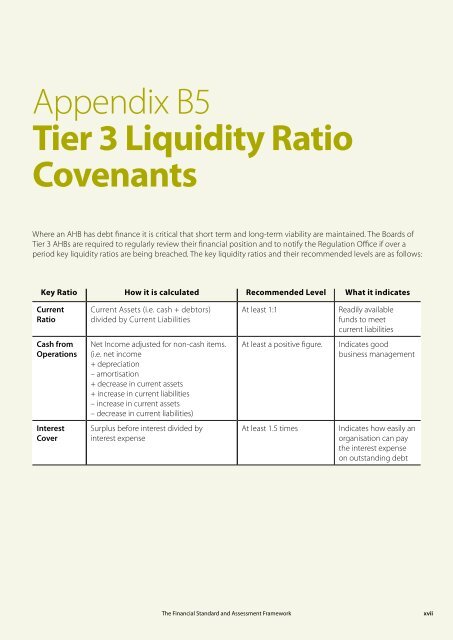

Appendix B5Tier 3 Liquidity RatioCovenantsWhere an AHB has debt finance it is critical that short term and long-term viability are maintained. The Boards ofTier 3 AHBs are required to regularly review their financial position and to notify the Regulation Office if over aperiod key liquidity ratios are being breached. The key liquidity ratios and their recommended levels are as follows:Key Ratio How it is calculated Recommended Level What it indicatesCurrentRatioCurrent Assets (i.e. cash + debtors)divided by Current LiabilitiesAt least 1:1Readily availablefunds to meetcurrent liabilitiesCash fromOperationsNet Income adjusted for non-cash items.(i.e. net income+ depreciation– amortisation+ decrease in current assets+ increase in current liabilities– increase in current assets– decrease in current liabilities)At least a positive figure.Indicates goodbusiness managementInterestCoverSurplus before interest divided byinterest expenseAt least 1.5 timesIndicates how easily anorganisation can paythe interest expenseon outstanding debtThe Financial Standard and Assessment Frameworkxvii