Download Freight Subsidy Scheme - Invest in Assam

Download Freight Subsidy Scheme - Invest in Assam

Download Freight Subsidy Scheme - Invest in Assam

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

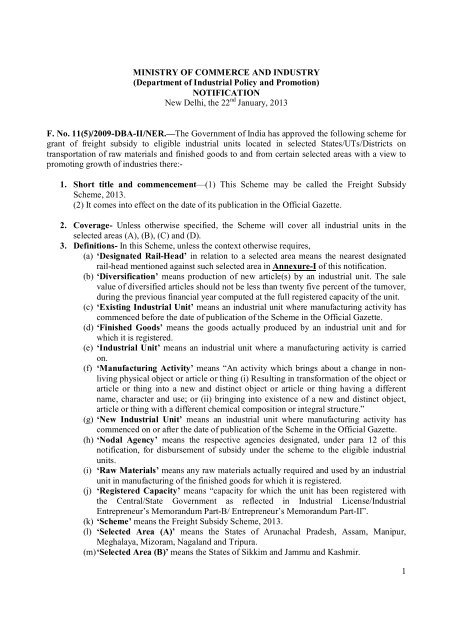

MINISTRY OF COMMERCE AND INDUSTRY(Department of Industrial Policy and Promotion)NOTIFICATIONNew Delhi, the 22 nd January, 2013F. No. 11(5)/2009-DBA-II/NER.—The Government of India has approved the follow<strong>in</strong>g scheme forgrant of freight subsidy to eligible <strong>in</strong>dustrial units located <strong>in</strong> selected States/UTs/Districts ontransportation of raw materials and f<strong>in</strong>ished goods to and from certa<strong>in</strong> selected areas with a view topromot<strong>in</strong>g growth of <strong>in</strong>dustries there:-1. Short title and commencement—(1) This <strong>Scheme</strong> may be called the <strong>Freight</strong> <strong>Subsidy</strong><strong>Scheme</strong>, 2013.(2) It comes <strong>in</strong>to effect on the date of its publication <strong>in</strong> the Official Gazette.2. Coverage- Unless otherwise specified, the <strong>Scheme</strong> will cover all <strong>in</strong>dustrial units <strong>in</strong> theselected areas (A), (B), (C) and (D).3. Def<strong>in</strong>itions- In this <strong>Scheme</strong>, unless the context otherwise requires,(a) ‘Designated Rail-Head’ <strong>in</strong> relation to a selected area means the nearest designatedrail-head mentioned aga<strong>in</strong>st such selected area <strong>in</strong> Annexure-I of this notification.(b) ‘Diversification’ means production of new article(s) by an <strong>in</strong>dustrial unit. The salevalue of diversified articles should not be less than twenty five percent of the turnover,dur<strong>in</strong>g the previous f<strong>in</strong>ancial year computed at the full registered capacity of the unit.(c) ‘Exist<strong>in</strong>g Industrial Unit’ means an <strong>in</strong>dustrial unit where manufactur<strong>in</strong>g activity hascommenced before the date of publication of the <strong>Scheme</strong> <strong>in</strong> the Official Gazette.(d) ‘F<strong>in</strong>ished Goods’ means the goods actually produced by an <strong>in</strong>dustrial unit and forwhich it is registered.(e) ‘Industrial Unit’ means an <strong>in</strong>dustrial unit where a manufactur<strong>in</strong>g activity is carriedon.(f) ‘Manufactur<strong>in</strong>g Activity’ means “An activity which br<strong>in</strong>gs about a change <strong>in</strong> nonliv<strong>in</strong>gphysical object or article or th<strong>in</strong>g (i) Result<strong>in</strong>g <strong>in</strong> transformation of the object orarticle or th<strong>in</strong>g <strong>in</strong>to a new and dist<strong>in</strong>ct object or article or th<strong>in</strong>g hav<strong>in</strong>g a differentname, character and use; or (ii) br<strong>in</strong>g<strong>in</strong>g <strong>in</strong>to existence of a new and dist<strong>in</strong>ct object,article or th<strong>in</strong>g with a different chemical composition or <strong>in</strong>tegral structure.”(g) ‘New Industrial Unit’ means an <strong>in</strong>dustrial unit where manufactur<strong>in</strong>g activity hascommenced on or after the date of publication of the <strong>Scheme</strong> <strong>in</strong> the Official Gazette.(h) ‘Nodal Agency’ means the respective agencies designated, under para 12 of thisnotification, for disbursement of subsidy under the scheme to the eligible <strong>in</strong>dustrialunits.(i) ‘Raw Materials’ means any raw materials actually required and used by an <strong>in</strong>dustrialunit <strong>in</strong> manufactur<strong>in</strong>g of the f<strong>in</strong>ished goods for which it is registered.(j) ‘Registered Capacity’ means “capacity for which the unit has been registered withthe Central/State Government as reflected <strong>in</strong> Industrial License/IndustrialEntrepreneur’s Memorandum Part-B/ Entrepreneur’s Memorandum Part-II”.(k) ‘<strong>Scheme</strong>’ means the <strong>Freight</strong> <strong>Subsidy</strong> <strong>Scheme</strong>, 2013.(l) ‘Selected Area (A)’ means the States of Arunachal Pradesh, <strong>Assam</strong>, Manipur,Meghalaya, Mizoram, Nagaland and Tripura.(m) ‘Selected Area (B)’ means the States of Sikkim and Jammu and Kashmir.1

(n) ‘Selected Area (C)’ means the Union Territories of Andaman and Nicobar Islands andLakshadweep.(o) ‘Selected Area (D)’ means the State of Himachal Pradesh, Darjeel<strong>in</strong>g district of WestBengal and the State of Uttarakhand (exclud<strong>in</strong>g district of Haridwar).(p) ‘Substantial Expansion’ means an <strong>in</strong>crease of at least 25% of the registered capacityof the <strong>in</strong>dustrial unit through additional capital <strong>in</strong>vestment. However, if such <strong>in</strong>creaseis due to merger/amalgamation of two or more <strong>in</strong>dustrial units, it will not beconsidered as substantial expansion for the purpose of subsidy under the scheme.4. Sunset Clause— The scheme will automatically term<strong>in</strong>ate after five years from the date ofits publication <strong>in</strong> the Official Gazette.5. Ineligible <strong>in</strong>dustries/goods/movements (Negative List) – (1) The <strong>in</strong>dustrial units/itemslisted <strong>in</strong> Annexure-II of this notification will not be eligible for subsidy under the <strong>Scheme</strong>.(2) Unless otherwise specified, subsidy under the scheme will not be applicable to IndustrialUnit for movement of raw materials and f<strong>in</strong>ished goods with<strong>in</strong> the Sate/Union Territory <strong>in</strong>which they are located.6. Applicability—Unless otherwise specified,(1) This scheme is applicable to all eligible <strong>in</strong>dustrial units, both <strong>in</strong> the public and the privatesectors irrespective of their size, located <strong>in</strong> the selected areas and which commencecommercial production with<strong>in</strong> the period of validity of the scheme.(2) <strong>Subsidy</strong> under the <strong>Scheme</strong> will be admissible to eligible <strong>in</strong>dustrial units for a period of fiveyears from the date of commencement of commercial production.(3) Eligible <strong>in</strong>dustrial units <strong>in</strong> Micro, Small & Medium Enterprises (MSME) Sector, whichundergo substantial expansion dur<strong>in</strong>g the period of validity of the scheme, will be providedsubsidy under the scheme for an additional period of five years from the date ofcommencement of commercial production consequent to substantial expansion, over andabove the subsidy already drawn.(4) Exist<strong>in</strong>g eligible <strong>in</strong>dustrial units located <strong>in</strong> the selected areas are also eligible for subsidyunder the scheme <strong>in</strong> respect of the additional transport costs of raw materials and f<strong>in</strong>ishedgoods aris<strong>in</strong>g as a result of substantial expansion or diversification effected by them after thecommencement of the <strong>Scheme</strong>. <strong>Subsidy</strong> <strong>in</strong> such cases will be restricted to the transport costsof the additional raw materials required and additional f<strong>in</strong>ished goods produced as a result ofthe substantial expansion or diversification.7. Quantum of <strong>Subsidy</strong>—(1) Unless otherwise specified, the quantum of subsidy to the<strong>in</strong>dustrial units located <strong>in</strong> Selected Area (A) would be computed as follows:(a) 90% of the transport cost for movement of raw materials by rail from nearestdesignated rail-head i.e. Siliguri/New Jalpaiguri to the railway station nearest to thelocation of the <strong>in</strong>dustrial unit and thereafter the cost of movement by road to thelocation of <strong>in</strong>dustrial unit will be reimbursed. Similarly, while calculat<strong>in</strong>g the transportcosts of f<strong>in</strong>ished goods the cost of movement by road from the location of <strong>in</strong>dustrialunit to the nearest railway station and thereafter the cost of movement by rail toSiliguri/New Jalpaiguri will be reimbursed. For materials mov<strong>in</strong>g entirely by road orany other mode of transport, reimbursement of the transport cost will be limited to theamount which the <strong>in</strong>dustrial unit might have paid, had the raw material moved fromSiliguri/New Jalpaiguri by rail upto the railway station nearest to the location of the<strong>in</strong>dustrial unit and thereafter by road. Similarly <strong>in</strong> the case of movement of f<strong>in</strong>ished2

goods mov<strong>in</strong>g entirely by road or any other mode(s) of transport <strong>in</strong> such selected area,reimbursement of the transport costs will be limited to the amount which the <strong>in</strong>dustrialunit might have paid had the f<strong>in</strong>ished goods moved from the location of the <strong>in</strong>dustrialunits to the nearest railway station by road and therefore by rail to Siliguri/NewJalpaiguri. In case of transportation of raw material/f<strong>in</strong>ished goods by Inland WaterTransport, an <strong>in</strong>dustrial unit will be eligible for subsidy equivalent to 90% of thetransport cost for transportation by Inland Waterways Transport (IWT) from Dhubri toany other location on the Brahmaputra river right upto Sadiya along the NationalWaterway-2 and thereafter by road to the <strong>in</strong>dustrial unit and vice-versa, <strong>in</strong> respect ofraw materials which are brought <strong>in</strong>to and f<strong>in</strong>ished goods which are taken out of suchselected area. However <strong>in</strong> such cases, subsidy will be subject to a ceil<strong>in</strong>g of 90% of theamount which the <strong>in</strong>dustrial unit might have paid had the transportation beenundertaken from Siliguri/New Jalpaiguri (designated Rail head) by rail upto railwaystation nearest to the location of the <strong>in</strong>dustrial unit and thereafter by road and viceversa.(b) Reimbursement of 90% of the transport costs for movement of raw materials from oneState to another with<strong>in</strong> such selected area. The actual cost of transportation or, the costof movement by road from where raw material is be<strong>in</strong>g procured to the railway stationnearest to it and thereafter by rail from that railway station to the Railway Stationnearest to the <strong>in</strong>dustrial unit and subsequently by road to the location of the <strong>in</strong>dustrialunit, whichever is less, will be taken <strong>in</strong>to account.(c) Reimbursement of 50% of the transport costs for the movement of f<strong>in</strong>ished goods fromone State to another with<strong>in</strong> such selected area. The actual cost of transportation or, thecost of movement from the location of the <strong>in</strong>dustrial unit to the nearest RailwayStation by road and thereafter by rail to the railway station nearest to the locationwhere the f<strong>in</strong>ished goods is to be received and subsequently by road from that railwaystation to the location where f<strong>in</strong>ished goods has been received, whichever is less, willbe taken <strong>in</strong>to account.(d) Reimbursement of 90% of the transport costs for movement of steel as raw materialfrom Guwahati Stockyard of Steel Authority of India Limited (SAIL) upto the locationof the <strong>in</strong>dustrial units.(e) Reimbursement of 75% of the air freight on movement of electroniccomponents/products partly by air and partly by rail/road. The subsidy would beadmissible @ 75% on the air freight from Calcutta upto the airport nearest to thelocation of the <strong>in</strong>dustrial unit and thereafter @ of 90% for movement by rail/road uptothe location of the <strong>in</strong>dustrial unit and vice-versa.(2)Unless otherwise specified, the quantum of subsidy admissible to an <strong>in</strong>dustrial unitlocated <strong>in</strong> Selected Area (B) would be as under:(a) 90% of the transport costs for movement of raw materials and/or f<strong>in</strong>ished goodsbetween the location of the <strong>in</strong>dustrial unit and the nearest designated rail-head by roadand vice-versa or actual, whichever is less will be reimbursed, if raw material is brought<strong>in</strong>to and f<strong>in</strong>ished goods are taken out of such selected area.3

(b) In the case of <strong>in</strong>dustrial units located <strong>in</strong> the state of Jammu & Kashmir, if movementof electronic components/products takes place partly by air and partly by rail/road, thesubsidy would be reimbursed @75% on the air freight from Delhi to the airport nearest tothe location of the <strong>in</strong>dustrial unit and thereafter @90% for movement by rail/road uptothe location of the <strong>in</strong>dustrial unit and vice-versa.(3) Unless otherwise specified, the quantum of subsidy admissible for reimbursement toan <strong>in</strong>dustrial unit located <strong>in</strong> Selected Area (C) would be 90% of the transport costs bysea and road between Chennai Port and the location of he <strong>in</strong>dustrial unit <strong>in</strong> the caseof Andaman & Nicobar Islands and between Coch<strong>in</strong> Port and the location of the<strong>in</strong>dustrial unit <strong>in</strong> the case of Lakshadweep, if raw material is brought <strong>in</strong>to andf<strong>in</strong>ished goods are taken out of such selected area. If any other port on the ma<strong>in</strong>landis used for the purpose of freight subsidy, the transport costs will be taken, as whatthe <strong>in</strong>dustrial unit would have <strong>in</strong>curred had Chennai or Coch<strong>in</strong> Port, as the case maybe, been used, or the actual transport costs, whichever is less.(4) Unless otherwise specified, the quantum of subsidy admissible to an <strong>in</strong>dustrial unitlocated <strong>in</strong> Selected Area (D) would be as under:(a) 75% of the transport costs for movement of raw materials and/or f<strong>in</strong>ishedgoods between the location of the <strong>in</strong>dustrial unit and the nearest designatedrail-head and vice-versa, if raw material is brought <strong>in</strong>to and f<strong>in</strong>ished goodsare taken out of such selected area.(b) 75% of the transport costs for movement of steel as raw material from theStockyard of Steel Authority of India Limited (SAIL) at Parwanoo upto thelocation of the <strong>in</strong>dustrial units <strong>in</strong> the State of Himachal Pradesh.(c) 75% of the transport costs for movement of <strong>in</strong>dustrial raw materials fromthe State Corporation’s designated depots situated <strong>in</strong> eligible districts ofUttarakhand and Himachal Pradesh to the site of the <strong>in</strong>dustrial unit located<strong>in</strong> the hill districts of the State.(d) In the case of <strong>in</strong>dustrial units located <strong>in</strong> the state of Himachal Pradesh, ifmovement of electronic components/products takes place partly by air andpartly by rail/road, the freight subsidy would be reimbursed @75% on theair freight from Delhi to the airport nearest to the location of the <strong>in</strong>dustrialunit and thereafter @75% for movement by rail/road upto the location of the<strong>in</strong>dustrial unit and vice-versa.8. Registration under the <strong>Scheme</strong>—(1) Industrial unit, desirous of claim<strong>in</strong>g subsidy under the<strong>Scheme</strong>, shall get registered with the District Industries Centre concerned, prior to the date ofcommencement of its commercial production for new <strong>in</strong>dustrial units or before undertak<strong>in</strong>gsubstantial expansion for exist<strong>in</strong>g <strong>in</strong>dustrial unit.(2) The General Manager of the District Industries Centre concerned shall bethe competent authority to issue Registration Certificate. No <strong>in</strong>dustrial unitshould be registered for benefits under the scheme if such <strong>in</strong>dustrial unit iscovered under Negative List given at Annexure-II of this notification.9. Submission of claim under the scheme- (1) The <strong>in</strong>dustrial unit, claim<strong>in</strong>g subsidy under the<strong>Scheme</strong> shall submit its claims <strong>in</strong> the prescribed application form, as applicable from time totime, to the District Industries Centre concerned; along with requisite documents, with<strong>in</strong> one4

year from the date of <strong>in</strong>curr<strong>in</strong>g expenditure on transportation of raw material and f<strong>in</strong>ishedgoods on which subsidy is be<strong>in</strong>g claimed by it. The documents which are required to besubmitted with each claim application are listed <strong>in</strong> Annexure-III of this notification. Inaddition, the documents which are required to be submitted only with first claim under thescheme are listed <strong>in</strong> Annexure-IV of this notification. State Government/Union Territoryconcerned or Central Government may also lay down the production of any other documentswhich <strong>in</strong> their op<strong>in</strong>ion is necessary to decide the eligibility of claimant <strong>in</strong>dustrial unit forsubsidy under the scheme.(2) The number of subsidy claims under the scheme that may be preferred by an <strong>in</strong>dustrialunit shall not ord<strong>in</strong>arily exceed one every quarter. However, the Director of Industries may athis discretion enterta<strong>in</strong> more number of claims <strong>in</strong> a f<strong>in</strong>ancial year, if the f<strong>in</strong>ancial position ofthe <strong>in</strong>dustrial unit so warrants.10. Role and functions of the State Government/Union Territory Adm<strong>in</strong>istration under thescheme- (1) The State Government/Union Territory Adm<strong>in</strong>istration concerned shallprescribe a system of registration of <strong>in</strong>dustrial units which seek to apply for subsidy underthe scheme prior to commencement of commercial production. At the time of suchregistration, the unit shall declare its capacity as <strong>in</strong>dicated <strong>in</strong> Industrial License/IndustrialEntrepreneur’s Memorandum-Part-A/ Entrepreneur’s Memorandum-I.(2) The State Government/Union Territory Adm<strong>in</strong>istration concerned shall set up a StateLevel Committee (SLC), consist<strong>in</strong>g of the Pr<strong>in</strong>cipal Secretary/Secretary (IndustryDepartment of the State Government/Union Territory concerned), Director of Industries ofthe State/Union Territory concerned and a representative each from the F<strong>in</strong>ance Departmentof the State /Union Territory concerned, Transport Department of the State /Union Territoryconcerned, nodal agency concerned and Department of Industrial Policy & Promotion,Government of India, for disbursement of subsidy, to consider and recommend all subsidyclaims, under the scheme, aris<strong>in</strong>g <strong>in</strong> the State/Union Territory.(3) State Government/ Union Territory Adm<strong>in</strong>istration concerned shall draw upproceduresand arrangements for scrut<strong>in</strong>iz<strong>in</strong>g the claims for subsidy under the scheme.(4) State Government/ Union Territory Adm<strong>in</strong>istration concerned shall carry out periodicalchecks to ensure that the raw materials and the f<strong>in</strong>ished goods <strong>in</strong> respect of which subsidyunder the scheme has been given were actually used/produced for the purpose by a system ofscrut<strong>in</strong>iz<strong>in</strong>g of consumption of the raw materials and the output of the f<strong>in</strong>ished goods andcross verification with power consumed, payment of VAT, excise duty etc.(5) The claim documents submitted by the eligible <strong>in</strong>dustrial units shall be scrut<strong>in</strong>ized by theDistrict Industries Centre concerned and their official(s) shall also carry out physicalverification of te <strong>in</strong>dustrial unit to ensure its physical existence as well as the genu<strong>in</strong>eness ofthe claim before forward<strong>in</strong>g its recommendation to Directorate of Industries for furtherconsideration.(6) Directorate of Industries of the State/Union Territory concerned shall verify the claimdocuments and the recommendations of the District Industries Centre prior to plac<strong>in</strong>g the5

same before the SLC. They will coord<strong>in</strong>ate the meet<strong>in</strong>gs of the SLC; prepare the agendanotes and m<strong>in</strong>utes of such meet<strong>in</strong>gs.(7) State Government/Union Territory Adm<strong>in</strong>istration concerned shall ma<strong>in</strong>ta<strong>in</strong> a matrix asper Annexure-V of this notification <strong>in</strong> respect of every <strong>in</strong>dustrial unit registered under thescheme. The Director and F<strong>in</strong>ancial Advisor of the concerned Directorate of Industries shallsubmit to the SLC a check-list as per Annexure-VI of this notification for each and everyclaim which is placed before the SLC for its consideration.(8) State Government/Union Territory Adm<strong>in</strong>istration concerned shall refer the subsidyclaims recommended by the SLC to the Department of Industrial Policy and Promotion,Government of India.(9) State Government/Union Territory Adm<strong>in</strong>istration concerned shall ensure at least onemeet<strong>in</strong>g of the SLC <strong>in</strong> every three months to avoid accumulation of claim cases. The agendanote for the SLC meet<strong>in</strong>g, giv<strong>in</strong>g details of the claim cases as per Annexure-VI, shall becirculated at least two weeks <strong>in</strong> advance to all the members of the SLC.11. Role and functions of the SLC- (1) The SLC will operate at the State/Union Territory Leveland will exam<strong>in</strong>e and recommend all claims of subsidy under the scheme aris<strong>in</strong>g <strong>in</strong> theState/Union Territory concerned.(2) The SLC shall ensure that the recommendations made are with due diligence and aftercross verification with the documents of the concerned Departments to ensure thattransportation of such raw materials/f<strong>in</strong>ished goods has actually taken place for whichsubsidy is be<strong>in</strong>g recommended. It may also be ensured that the subsidy amount be<strong>in</strong>grecommended by the SLC does not <strong>in</strong>volve any cash payment made by the unit fortransportation of raw material/f<strong>in</strong>ished goods.(3) Along with other necessary documents, the SLC shall also ensure that the claimant hassubmitted proof of raw materials ‘imported’ <strong>in</strong>to and f<strong>in</strong>ished goods ‘exported’ out of theselected States/Union Territory/areas where the <strong>in</strong>dustrial unit is located, from the registeredchartered accountants. The SLC may lay down the production of any other documents which<strong>in</strong> its op<strong>in</strong>ion is necessary to recommend the eligibility of claimant for the subsidy under thescheme. The Directorate of Industries of the State Government/Union Territory concernedwould give a certificate of such verification made by them.(5) SLC shall also ensure that the subsidy be<strong>in</strong>g claimed by the unit is not aris<strong>in</strong>g out oftransportation of raw material and f<strong>in</strong>ished goods by their own goods carriers.12. Nodal agencies- (1) Unless otherwise specified, the respective nodal agencies fordisbursement of subsidy under the scheme shall be as follows:-(a) the North East Development F<strong>in</strong>ance Corporation (NEDFi) for the State of ArunachalPradesh, <strong>Assam</strong>, Manipur, Meghalaya, Mizoram, Nagaland, Tripura and Sikkim;(b) the Himachal Pradesh State Industrial and Infrastructure Development CorporationLtd. (HPSIDC) for the State of Himachal Pradesh;(c) the Jammu & Kashmir Development F<strong>in</strong>ance Corporation Ltd. (JKDFC) for the Stateof Jammu & Kashmir and6

(d) the State Industrial and Infrastructure Development Corporation of Uttaranchal(SIDCUL) for the State of Uttarakhand.(2) In the Union Territories of Andaman & Nicobar Islands and Lakshadweep, disbursementsof subsidy to the <strong>in</strong>dustrial units will be made through the Union Territory adm<strong>in</strong>istration.(3) In the case of Darjeel<strong>in</strong>g District of West Bengal, disbursements of subsidy to the<strong>in</strong>dustrial units will be made through the State Government.13. Role and functions of Nodal Agency- (1) The nodal agency shall, after careful scrut<strong>in</strong>y ofthe freight subsidy claims <strong>in</strong> accordance with the provisions of the scheme and the guidel<strong>in</strong>esissued to them separately from time to time, disburse freight subsidy to the eligible <strong>in</strong>dustrialunits by the electronic mode from the fund released by the Department of Industrial Policyand Promotion.(2) Immediately after disbursal of subsidy but not later than one month from the date ofreceipt of funds from the Central Government, nodal agencies will furnish utilizationcertificate prescribed under General F<strong>in</strong>ancial Rules (GFR) to the Department of IndustrialPolicy & Promotion alongwith a list of <strong>in</strong>dustrial units to whom subsidy has been disbursedgiv<strong>in</strong>g details of date of disbursement, mode of payment etc. If the nodal agency is unable todisburse subsidy to some of the <strong>in</strong>dustrial units with<strong>in</strong> one month from the date of release offunds for such <strong>in</strong>dustrial units by the Central Government, the reason for the same alongwitha list of such <strong>in</strong>dustrial units shall be forwarded by the nodal agency concerned to the CentralGovernment with a copy to the State Government /Union Territory Adm<strong>in</strong>istrationconcerned.14. Role of the Central Government- (1) The Department of Industrial Policy and Promotion(DIPP), M<strong>in</strong>istry of Commerce and Industry, Government of India will periodically reviewand suggest modification(s) <strong>in</strong> procedure for scrut<strong>in</strong>y of the claims, payment of freightsubsidy, etc.(2) Wherever needed, DIPP shall arrange for pre-scrut<strong>in</strong>y of the subsidy claimsrecommended by the SLCs before releas<strong>in</strong>g funds to the Nodal Agencies for disbursement tothe eligible <strong>in</strong>dustrial units.(3) Any clarification, if required, on any of the provision of the scheme will be provided bythe Department of Industrial Policy and Promotion and the same shall be f<strong>in</strong>al and b<strong>in</strong>d<strong>in</strong>g onall concerned.15. Other features of the <strong>Scheme</strong>- (1) <strong>Freight</strong> charges for movement by road/sea will bedeterm<strong>in</strong>ed on the basis of transport/transshipment rates fixed by the Central Government/State Government /Union Territory Adm<strong>in</strong>istration concerned from time to time or theactual freight paid, whichever is less.(2) Cost of load<strong>in</strong>g or unload<strong>in</strong>g and other handl<strong>in</strong>g charges from railway station/airport/portto the site of the <strong>in</strong>dustrial unit will not be taken <strong>in</strong>to account for the purpose of determ<strong>in</strong><strong>in</strong>gtransport costs.7

(3) In the case of small <strong>in</strong>dustrial units with a capital <strong>in</strong>vestment of Rs. 1,00,000 or less, therequirement of production of certificate, regard<strong>in</strong>g the proof of raw materials, ‘imported’ <strong>in</strong>toand f<strong>in</strong>ished goods ‘exported’ out of the selected States/Union Territory/areas where the<strong>in</strong>dustrial unit is situated, from Chartered Accountant may be waived subject to the conditionthat such claims are properly verified by the concerned State Government /Union Territoryauthorities before the subsidy is sanctioned. The State Government /Union Territoryauthorities would give a certificate of such verification made by them.(4) In the State of Mizoram, if it is not possible for the exist<strong>in</strong>g <strong>in</strong>dustrial units to furnish acertificate from the registered Chartered Accountant for non-availability of a registeredChartered Accountant, the <strong>in</strong>dustrial unit(s) may be asked to provide a certification from thesale tax authorities and counter signed by Commissioner/Director Industries of the State fortransportation of raw material/f<strong>in</strong>ished goods <strong>in</strong> lieu of Chartered Accountant certificate. Theposition regard<strong>in</strong>g availability of registered Chartered Accountant may be reviewed regularlyby the Government of Mizoram and the alternate course of provid<strong>in</strong>g certificate may besuspended as and when a registered Chartered Accountant becomes available and thereafterthe <strong>in</strong>dustrial units may be asked to provide the required certificate from the registeredChartered Accountant.16. All false statements made by an <strong>in</strong>dustrial unit or any misrepresentation of facts by it willdisqualify it from the grant of freight subsidy under the scheme. However, beforedisqualify<strong>in</strong>g, a reasonable opportunity will be given to the <strong>in</strong>dustrial unit to state its case.17. The ‘Transport <strong>Subsidy</strong> <strong>Scheme</strong> (TSS), 1971’ announced vide Notification No. F.6(26)/71-IC dated 23 rd July 1971 and as amended from time to time will cease to operate with effectfrom the date of notification of the scheme for new units. Industrial units which have reportedcommencement of commercial production before notification of the scheme and subsidy isbe<strong>in</strong>g claimed by such <strong>in</strong>dustrial unit or units under the provisions of ‘TSS, 1971’ willcont<strong>in</strong>ue to be governed by the ‘TSS, 1971’. However, an <strong>in</strong>dustrial unit, registered under the‘TSS, 1971’ which has not claimed subsidy under the ‘TSS, 1971’ before date of publicationof the <strong>Freight</strong> <strong>Subsidy</strong> <strong>Scheme</strong>, 2013 <strong>in</strong> the Official Gazette, will be covered under the<strong>Freight</strong> <strong>Subsidy</strong> <strong>Scheme</strong>, 2013 as ‘New Industrial Unit’ provided it is otherwise eligible forsubsidy as per the provisions of the <strong>Freight</strong> <strong>Subsidy</strong> <strong>Scheme</strong>, 2013. Registration of such<strong>in</strong>dustrial units under TSS, 1971 shall be transferred to registration under the <strong>Freight</strong> <strong>Subsidy</strong><strong>Scheme</strong>, 2013 by the concerned District Industries Centre.18. The State Government/Union Territory concerned and the Nodal Agency concerned shallma<strong>in</strong>ta<strong>in</strong> data separately for the <strong>Freight</strong> <strong>Subsidy</strong> <strong>Scheme</strong> and the Transport <strong>Subsidy</strong> <strong>Scheme</strong>,1971 as per the proforma at Annexure-V.19. Government of India reserves the right to modify any part of the <strong>Scheme</strong> <strong>in</strong> public <strong>in</strong>terest atany time.20. All M<strong>in</strong>istries/Departments concerned of the Government of India are requested to amendtheir respective Acts/rules/notifications etc. and issue necessary <strong>in</strong>structions for giv<strong>in</strong>g effectto these decisions.SHUBHRA SINGH, Jt. Secy.8

ANNEXURE-IDESIGNATED RAIL-HEADS under FREIGHT SUBSIDY SCHEMESelected AreasDesignated Rail-HeadsI. Jammu & Kashmir (i) Jammu;(ii) Kathua;(iii) UdhampurII. Himachal Pradesh(i) Kalka;(ii) Kiratpur Sahib;(iii) Pathankot and(iv) Jagadhiri (Yamuna Nagar)III. State of Uttarakhand compris<strong>in</strong>g of the districts ofDehradun, Na<strong>in</strong>ital, Almora, Pauri Garhwal, TehriGarhwal, Pithoragarh, Uttar Kashi and Chamoli.(i) Rishikesh;(ii) Rampur;(iii) Harrawala;(iv) Jwalapur;(v) Laksar;(vi) Roorkee;(vii) Haldi Road;(viii) Rudrpur City;(ix) Bilaspur Road;(x) KashipurIV. North East Region (<strong>in</strong>clud<strong>in</strong>g Sikkim) (i) Siliguri;(ii) New Jalpaiguri;V. Darjeel<strong>in</strong>g District of West Bengal (i) Siliguri;(ii) New Jalpaiguri;ANNEXURE-IINEGATIVE LIST FOR FREIGHT SUBSIDY SCHEME, 20131. The follow<strong>in</strong>g Industrial Units will not be eligible for benefits under <strong>Freight</strong> <strong>Subsidy</strong> <strong>Scheme</strong>,2013(i) Plantations, Ref<strong>in</strong>eries and Power generat<strong>in</strong>g units;(ii) Units not comply<strong>in</strong>g with environmental standards or not hav<strong>in</strong>g applicable EnvironmentalClearance from M/o Environment & Forests (MoEF) or State Environmental Impact AssessmentsAuthority (SEIAA) or not hav<strong>in</strong>g requisite consent to establish and operate from the concernedCentral Pollution Control Board/State Pollution Control Board also will not be eligible for subsidyunder scheme.9

(iii) Any other <strong>in</strong>dustry/activity through a separate notification as and when considered necessary bythe Government. It will be effective from the date of such notifications.2. The follow<strong>in</strong>g raw materials/f<strong>in</strong>ished goods will not be eligible for benefits under <strong>Freight</strong> <strong>Subsidy</strong><strong>Scheme</strong>, 2013(i) All goods fall<strong>in</strong>g under Chapter 24 of the First Schedule to the Central Excise Tariff Act,1985 (5 of 1986) which perta<strong>in</strong> to tobacco and manufactured tobacco substitutes.(ii) Pan Masala as covered under Chapter 21 of the First Schedule to the Central Excise TariffAct, 1985 (5 of 1986)(iii) Plastic carry bags of less than 20 microns as specified by the M<strong>in</strong>istry of Environment andForests Notification No. S.O. 705(E) dated 02.09.1999 and S.O. 698(E) dated 17.06.2003.(iv) Goods fall<strong>in</strong>g under Chapter 27 of the First Schedule to the Central Excise Tariff Act, 1985(5 of 1986) produced by petroleum oil or gas ref<strong>in</strong>eries.(v) Low value addition activities like preservation dur<strong>in</strong>g storage, clean<strong>in</strong>g operations, pack<strong>in</strong>g,repack<strong>in</strong>g or re-label<strong>in</strong>g, sort<strong>in</strong>g, alteration of retail sale price etc take place.(vi) Coke (<strong>in</strong>clud<strong>in</strong>g Calc<strong>in</strong>ed Petroleum Coke).(vii) Fly Ash.ANNEXURE-IIICheck-list <strong>in</strong> which the unit will report to the DIC at the time of first claim of subsidy under<strong>Freight</strong> <strong>Subsidy</strong> <strong>Scheme</strong>, 20131. Name & address of unit2. SSI / IEM registration3. Date of physical <strong>in</strong>spection4. Transport subsidy registration certificate5. Date of 1 st commercial production6. Sale Tax Registration Certificate no.7. Income Tax Registration Certificate no.8. PAN Card no. <strong>in</strong> the name of the unit9. List of Board of Directors/ Partners (along with PAN card no.)10. Articles of Memorandum of Association/ Partnership Deed.11.Company registration certificate.12. Land Documents13. Service Tax registration certificate no.14. State Electricity Board/ Power Department power sanction letter & NOC for <strong>in</strong>stallation of DGset if applicable.10

15. Bank Account No. & name16. Capacity assessment certificate <strong>in</strong>dicat<strong>in</strong>g quantum of f<strong>in</strong>ished goods produced per unitconsumption of power and diesel (Jo<strong>in</strong>t assessment report by the concerned officers of MSME,Commissioner Industries and Distt. Industries Centre)17. Factory license No. & date18. N.O.C. from local authority (Gram Panchayat, Municipal Corporation etc.)19. N.O.C. from M<strong>in</strong>es M<strong>in</strong>erals Department if applicable.20. Distance eligibility certificate for Road/Rail/IWT from competent authority21. Is the unit covered <strong>in</strong> negative list?ANNEXURE-IVCheck-list <strong>in</strong> which the unit will report to the DIC at the time of each claim of subsidy under<strong>Freight</strong> <strong>Subsidy</strong> <strong>Scheme</strong>, 20131. Name & address of unit2. Period of claim3. Date of receipt of the claim at Distt. Industries & Commerce Centre4. Physical verification report of DI&CC5. Statement of raw material purchased6. Statement show<strong>in</strong>g utilization of raw material and f<strong>in</strong>ished products manufactured dur<strong>in</strong>g theclaim period.7. Statement of f<strong>in</strong>ished goods transported to places outside NER/with<strong>in</strong> NER dur<strong>in</strong>g the claimperiod.8. VAT clearance certificate for the relevant period.9. VAT payment challan/VAT return10. Affidavit as per prescribed format that the unit has not claimed subsidy from any other source.11. Balance sheet for the relevant period show<strong>in</strong>g carriage <strong>in</strong>ward and outward.12. Power bills and proof of payment for the relevant period.13. CA Certificate <strong>in</strong> respect of Raw material & F<strong>in</strong>ished Goods for the relevant period.14. N.O.C. from Pollution Control Board for the relevant period.15. Bills and challan for raw materials purchased from the supplier for the relevant period.16. Receipt from transporters for carry<strong>in</strong>g goods (raw material/f<strong>in</strong>ished products) for the relevantperiod.17. Bills and challan consignment note for f<strong>in</strong>ished goods dispatched.18. In case of excisable goods produced by the unit:(a) Certificate from Excise Deptt. show<strong>in</strong>g the quality cleared on quarterly basis.(b) Excise Payment challan/Refund statement show<strong>in</strong>g quantity & value.19. In case of local sale; detailed address of purchasers with payment receipt details (cash/chequeetc) CA certificate on the body of the statement.20. In case of purchase of RM from outside NER and from with<strong>in</strong> NER: Copy of challan andConsignment Note of transporter endorsed to purchaser.21. Employment Certificate from Competent Authority along with list of employees.11

22. Affidavit by the unit certify<strong>in</strong>g registration no. of trucks carry<strong>in</strong>g raw material and f<strong>in</strong>ishedgoods to and from the factory for the relevant period.23. Attested copies of RC of vehicles transport<strong>in</strong>g raw material and f<strong>in</strong>ished goods to and from thefactory and road permit issued by Transport Department or authentic Govt. documents <strong>in</strong>corporat<strong>in</strong>gthe truck no.24. Has the unit undergone expansion? If so, new capacity assessment certificate to be attached.25. Bank Statement for payment made to transporters dur<strong>in</strong>g the period (payment by cheque only)26. In case of f<strong>in</strong>ished products sold outside NER or with<strong>in</strong> NER:(a) Copy of C-Form aga<strong>in</strong>st the consignment sold to the party &(b) Photocopy of consignment note acknowledged by the purchasers27. Is there any multiplicity of claim for the same period?28. In case of Flour Mill follow<strong>in</strong>g documents are to be enclosed:-(a) Delivery certificate from Railway department if carried by Rail(b) Agriculture cess payment challan <strong>in</strong> case of raw materials transported by road (whereapplicable)(c) Quarterly Sales Tax Return cover<strong>in</strong>g the claims period authenticated by Sales Tax Deptt.show<strong>in</strong>g quantity and value.(d) All Railway receipt should be <strong>in</strong> the name of the unit as consignee(e) Raw materials brought from Railway station to factory detailed statement and paymentshould be made by cheque only.(f) Certificate relat<strong>in</strong>g to PDS quota for each quota (whether received or not received) fromappropriate authority.12

ANNEXURE-VMatrix to be ma<strong>in</strong>ta<strong>in</strong>ed by the Directorate of Industries for every unit registeredunder <strong>Freight</strong> <strong>Subsidy</strong> <strong>Scheme</strong>, 2013Name of the Unit: _________________Date of commencement of commercial production: __________________Period of claimYEAR-I YEAR-II YEAR-III YEAR-IV YEAR-VQUARTER QUARTER QUARTER QUARTER QUARTER1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4Date of receipt <strong>in</strong>DICDate of receipt <strong>in</strong>SLCClaim amountrecommended bySLC (Rs.)Remarks13

ANNEXURE-VICheck-list to be submitted to the SLC for consider<strong>in</strong>g subsidy claims under <strong>Freight</strong> <strong>Subsidy</strong><strong>Scheme</strong>, 20131. Name and address of the unit2. Period of claim3. Date of receipt of claim at DIC4. Whether the claim has been submitted to DIC with<strong>in</strong> one year from the date of <strong>in</strong>curr<strong>in</strong>gexpenditure <strong>in</strong> the respect of which subsidy is be<strong>in</strong>g claimed by the <strong>in</strong>dustrial unit?5. Amount claimed by the unit6. Amount of claim recommended by the Directorate of Industries7. Scrut<strong>in</strong>y of Check-List, as per Annexure-III of the notification of the scheme, completed (forfirst claim only)8. Scrut<strong>in</strong>y of Check-List, as per Annexure-IV of the notification of the scheme, completed9. Eligibility of 5 year claim period (to be supported by the Matrix, ma<strong>in</strong>ta<strong>in</strong>ed by the Directorateof Industries, as per Annexure-V of the notification of the scheme)10. The eligibility of the unit for quantum of subsidy be<strong>in</strong>g claimed <strong>in</strong> terms of percentage? (i.e.50-90%)11. Is the claim sub-judice?12. The claim has been cross-checked with other Govt. agencies such as Excise Deptt., Sales TaxOffice, State Transport Authority and Electrical Department13. <strong>Subsidy</strong> not claimed on ‘by products’14. <strong>Subsidy</strong> claimed on f<strong>in</strong>ished goods/ raw materials does not exceed registered capacity of thefirm15. Claim perta<strong>in</strong>s to manufactur<strong>in</strong>g activity def<strong>in</strong>ed under the scheme16. Case specific checks:-(a) for wood based unit, all conditions laid down by Hon’ble Supreme Court fulfilled.(b) no claim for transportation cleared <strong>in</strong> respect of “own vehicle”(c) transportation of coke breeze not <strong>in</strong>cluded by cement produc<strong>in</strong>g units(d) claim by four mills is not <strong>in</strong> respect of wheat purchased from Food Corporation of India17. Claim of subsidy restricted to actual consumption of raw material and not the total raw materialProcured18. Whether all the transaction <strong>in</strong> respect of cost of transportation, for which claim has been filedby the <strong>in</strong>dustrial unit has been through Cheque/ Demand Draft/ Bank Transfer only?19. Remarks (if any)Copy for <strong>in</strong>formation and necessary action to:(i) All M<strong>in</strong>istries/ Departments of the Government of India and the Plann<strong>in</strong>g Commission(ii) Chief Secretaries of the States of Arunachal Pradesh, <strong>Assam</strong>, Himachal Pradesh, Jammu &Kashmir, Manipur, Meghalaya, Mizoram, Nagaland, Tripura, Sikkim, Uttarakhand and West14

Bengal, Union Territory of Andaman & Nicobar and Lakshadweep.(iii) Secretary (Industries) of the States of Arunachal Pradesh, <strong>Assam</strong>, Himachal Pradesh, Jammu &Kashmir, Manipur, Meghalaya, Mizoram, Nagaland, Tripura, Sikkim, Uttarakhand and WestBengal, Union Territory of Andaman & Nicobar and Lakshadweep.(iv) The North East Industrial Development F<strong>in</strong>ance Corporation (NEDFi).(v) The Himachal Pradesh State Industrial and Infrastructure Development Corporation Ltd.(HPSIDC).(vi) The Jammu & Kashmir Development F<strong>in</strong>ance Corporation Ltd. (JKDFC).(vii) The State Industrial and Infrastructure Development Corporation of Uttaranchal (SIDCUL)Copy also to:(i) Cab<strong>in</strong>et Secretariat(ii) PMO--------------------------------------------------15