AGRR - March/April 2008 - AGRR Magazine

AGRR - March/April 2008 - AGRR Magazine

AGRR - March/April 2008 - AGRR Magazine

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

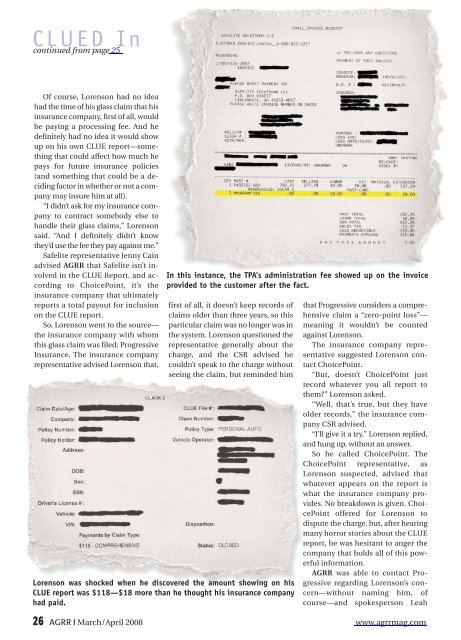

CLUED Incontinued from page 25Of course, Lorenson had no ideahad the time of his glass claim that hisinsurance company, first of all, wouldbe paying a processing fee. And hedefinitely had no idea it would showup on his own CLUE report—somethingthat could affect how much hepays for future insurance policies(and something that could be a decidingfactor in whether or not a companymay insure him at all).“I didn’t ask for my insurance companyto contract somebody else tohandle their glass claims,” Lorensonsaid. “And I definitely didn’t knowthey’d use the fee they pay against me.”Safelite representative Jenny Cainadvised <strong>AGRR</strong> that Safelite isn’t involvedin the CLUE Report, and accordingto ChoicePoint, it’s theinsurance company that ultimatelyreports a total payout for inclusionon the CLUE report.So, Lorenson went to the source—the insurance company with whomthis glass claim was filed: ProgressiveInsurance. The insurance companyrepresentative advised Lorenson that,In this instance, the TPA’s administration fee showed up on the invoiceprovided to the customer after the fact.first of all, it doesn’t keep records ofclaims older than three years, so thisparticular claim was no longer was inthe system. Lorenson questioned therepresentative generally about thecharge, and the CSR advised hecouldn’t speak to the charge withoutseeing the claim, but reminded himLorenson was shocked when he discovered the amount showing on hisCLUE report was $118—$18 more than he thought his insurance companyhad paid.that Progressive considers a comprehensiveclaim a “zero-point loss”—meaning it wouldn’t be countedagainst Lorenson.The insurance company representativesuggested Lorenson contactChoicePoint.“But, doesn’t ChoicePoint justrecord whatever you all report tothem?” Lorenson asked.“Well, that’s true, but they haveolder records,” the insurance companyCSR advised.“I’ll give it a try,” Lorenson replied,and hung up, without an answer.So he called ChoicePoint. TheChoicePoint representative, asLorenson suspected, advised thatwhatever appears on the report iswhat the insurance company provides.No breakdown is given. ChoicePointoffered for Lorenson todispute the charge, but, after hearingmany horror stories about the CLUEreport, he was hesitant to anger thecompany that holds all of this powerfulinformation.<strong>AGRR</strong> was able to contact Progressiveregarding Lorenson’s concern—withoutnaming him, ofcourse—and spokesperson Leah26 <strong>AGRR</strong> <strong>March</strong>/<strong>April</strong> <strong>2008</strong> www.agrrmag.com