Improved Pricing on the Stock Market with Trading Agents

Improved Pricing on the Stock Market with Trading Agents - SAIS

Improved Pricing on the Stock Market with Trading Agents - SAIS

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

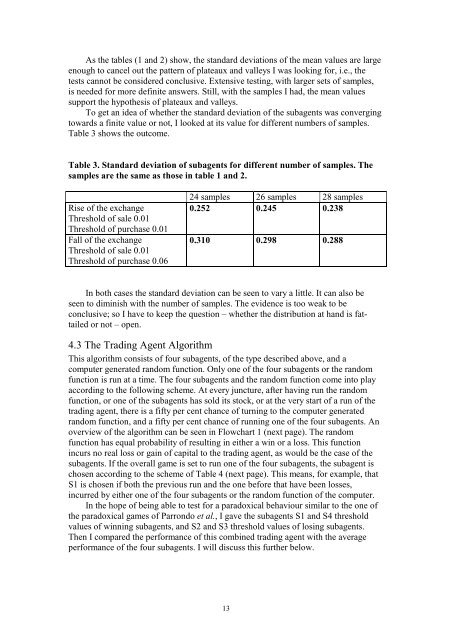

As <strong>the</strong> tables (1 and 2) show, <strong>the</strong> standard deviati<strong>on</strong>s of <strong>the</strong> mean values are largeenough to cancel out <strong>the</strong> pattern of plateaux and valleys I was looking for, i.e., <strong>the</strong>tests cannot be c<strong>on</strong>sidered c<strong>on</strong>clusive. Extensive testing, <strong>with</strong> larger sets of samples,is needed for more definite answers. Still, <strong>with</strong> <strong>the</strong> samples I had, <strong>the</strong> mean valuessupport <strong>the</strong> hypo<strong>the</strong>sis of plateaux and valleys.To get an idea of whe<strong>the</strong>r <strong>the</strong> standard deviati<strong>on</strong> of <strong>the</strong> subagents was c<strong>on</strong>vergingtowards a finite value or not, I looked at its value for different numbers of samples.Table 3 shows <strong>the</strong> outcome.Table 3. Standard deviati<strong>on</strong> of subagents for different number of samples. Thesamplesare<strong>the</strong>sameasthoseintable1and2.Rise of <strong>the</strong> exchangeThreshold of sale 0.01Threshold of purchase 0.01Fall of <strong>the</strong> exchangeThreshold of sale 0.01Threshold of purchase 0.0624 samples 26 samples 28 samples0.252 0.245 0.2380.310 0.298 0.288In both cases <strong>the</strong> standard deviati<strong>on</strong> can be seen to vary a little. It can also beseen to diminish <strong>with</strong> <strong>the</strong> number of samples. The evidence is too weak to bec<strong>on</strong>clusive; so I have to keep <strong>the</strong> questi<strong>on</strong> – whe<strong>the</strong>r <strong>the</strong> distributi<strong>on</strong> at hand is fattailedor not – open.4.3 The <strong>Trading</strong> Agent AlgorithmThis algorithm c<strong>on</strong>sists of four subagents, of <strong>the</strong> type described above, and acomputer generated random functi<strong>on</strong>. Only <strong>on</strong>e of <strong>the</strong> four subagents or <strong>the</strong> randomfuncti<strong>on</strong> is run at a time. The four subagents and <strong>the</strong> random functi<strong>on</strong> come into playaccording to <strong>the</strong> following scheme. At every juncture, after having run <strong>the</strong> randomfuncti<strong>on</strong>, or <strong>on</strong>e of <strong>the</strong> subagents has sold its stock, or at <strong>the</strong> very start of a run of <strong>the</strong>trading agent, <strong>the</strong>re is a fifty per cent chance of turning to <strong>the</strong> computer generatedrandom functi<strong>on</strong>, and a fifty per cent chance of running <strong>on</strong>e of <strong>the</strong> four subagents. Anoverview of <strong>the</strong> algorithm can be seen in Flowchart 1 (next page). The randomfuncti<strong>on</strong> has equal probability of resulting in ei<strong>the</strong>r a win or a loss. This functi<strong>on</strong>incurs no real loss or gain of capital to <strong>the</strong> trading agent, as would be <strong>the</strong> case of <strong>the</strong>subagents. If <strong>the</strong> overall game is set to run <strong>on</strong>e of <strong>the</strong> four subagents, <strong>the</strong> subagent ischosen according to <strong>the</strong> scheme of Table 4 (next page). This means, for example, thatS1 is chosen if both <strong>the</strong> previous run and <strong>the</strong> <strong>on</strong>e before that have been losses,incurred by ei<strong>the</strong>r <strong>on</strong>e of <strong>the</strong> four subagents or <strong>the</strong> random functi<strong>on</strong> of <strong>the</strong> computer.In <strong>the</strong> hope of being able to test for a paradoxical behaviour similar to <strong>the</strong> <strong>on</strong>e of<strong>the</strong> paradoxical games of Parr<strong>on</strong>do et al., I gave <strong>the</strong> subagents S1 and S4 thresholdvalues of winning subagents, and S2 and S3 threshold values of losing subagents.Then I compared <strong>the</strong> performance of this combined trading agent <strong>with</strong> <strong>the</strong> averageperformance of <strong>the</strong> four subagents. I will discuss this fur<strong>the</strong>r below.13