Download the booklet on hire purchase - Banking Info

Download the booklet on hire purchase - Banking Info

Download the booklet on hire purchase - Banking Info

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

HIRE PURCHASE<br />

INTRODUCTION<br />

Buying a car under <strong>hire</strong> <strong>purchase</strong> is <strong>on</strong>e of <str<strong>on</strong>g>the</str<strong>on</strong>g> most comm<strong>on</strong> ways to own a car.<br />

This <str<strong>on</strong>g>booklet</str<strong>on</strong>g> provides <str<strong>on</strong>g>the</str<strong>on</strong>g> basics, explains <str<strong>on</strong>g>the</str<strong>on</strong>g> comm<strong>on</strong> terms used in <strong>hire</strong><br />

<strong>purchase</strong> agreement and gives some tips <strong>on</strong> <strong>hire</strong> <strong>purchase</strong> financing.<br />

WHAT IS HIRE PURCHASE (HP)?<br />

HP is <str<strong>on</strong>g>the</str<strong>on</strong>g> hiring of goods with <str<strong>on</strong>g>the</str<strong>on</strong>g> opti<strong>on</strong> to buy <str<strong>on</strong>g>the</str<strong>on</strong>g> goods at <str<strong>on</strong>g>the</str<strong>on</strong>g> end of <str<strong>on</strong>g>the</str<strong>on</strong>g> <strong>hire</strong><br />

<strong>purchase</strong> term. If you take <strong>on</strong> HP financing, you are <str<strong>on</strong>g>the</str<strong>on</strong>g> <strong>hire</strong>r and financier is <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

owner. As a <strong>hire</strong>r, you will have to repay <str<strong>on</strong>g>the</str<strong>on</strong>g> financier based <strong>on</strong> <str<strong>on</strong>g>the</str<strong>on</strong>g> agreed<br />

durati<strong>on</strong> while you have possessi<strong>on</strong> of <str<strong>on</strong>g>the</str<strong>on</strong>g> vehicle. When all <str<strong>on</strong>g>the</str<strong>on</strong>g> instalments are<br />

paid up, ownership is <str<strong>on</strong>g>the</str<strong>on</strong>g>n transferred to you.<br />

GOVERNING LEGISLATION – THE HIRE PURCHASE ACT 1967<br />

HP transacti<strong>on</strong>s are governed by <str<strong>on</strong>g>the</str<strong>on</strong>g> Hire Purchase Act 1967 (HP Act). The HP<br />

Act sets out <str<strong>on</strong>g>the</str<strong>on</strong>g> forms and c<strong>on</strong>tents of HP agreements, <str<strong>on</strong>g>the</str<strong>on</strong>g> legal rights, duties,<br />

obligati<strong>on</strong>s of <strong>hire</strong>rs and financiers. The HP Act is administered by <str<strong>on</strong>g>the</str<strong>on</strong>g> Ministry of<br />

Domestic Trade and C<strong>on</strong>sumer Affairs.<br />

HOW MUCH CAN I AFFORD?<br />

As a guide, your m<strong>on</strong>thly repayment <strong>on</strong> your housing loan and motor vehicle<br />

financing should not exceed 33% of your m<strong>on</strong>thly household income. However,<br />

you should also budget for o<str<strong>on</strong>g>the</str<strong>on</strong>g>r payments associated with owing a motor<br />

vehicle, such as insurance, road tax and expenses for periodical maintenance.<br />

WHERE TO GET FINANCING?<br />

You can apply for HP financing from a banking instituti<strong>on</strong>. You will receive a<br />

financial statement called Sec<strong>on</strong>d Schedule Part I, which states your financial<br />

obligati<strong>on</strong>s under <str<strong>on</strong>g>the</str<strong>on</strong>g> proposed HP Agreement.

2<br />

If you apply for HP financing through a motor vehicle dealer (which will submit<br />

your applicati<strong>on</strong> to a banking instituti<strong>on</strong>), you will receive ano<str<strong>on</strong>g>the</str<strong>on</strong>g>r statement<br />

called <str<strong>on</strong>g>the</str<strong>on</strong>g> Sec<strong>on</strong>d Schedule Part II. This statement states <str<strong>on</strong>g>the</str<strong>on</strong>g> c<strong>on</strong>sent of <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

banking instituti<strong>on</strong> to be a party to <str<strong>on</strong>g>the</str<strong>on</strong>g> agreement.<br />

You need not pay for <str<strong>on</strong>g>the</str<strong>on</strong>g> cost of preparing and obtaining <str<strong>on</strong>g>the</str<strong>on</strong>g> Sec<strong>on</strong>d Schedule, if<br />

you decide not to sign <str<strong>on</strong>g>the</str<strong>on</strong>g> HP agreement. The Sec<strong>on</strong>d Schedule statement is<br />

also not binding <strong>on</strong> you yet. If you agree to take <str<strong>on</strong>g>the</str<strong>on</strong>g> HP financing, you will need<br />

to enter into a HP agreement with your banking instituti<strong>on</strong>.<br />

THE HP AGREEMENT<br />

You should receive <str<strong>on</strong>g>the</str<strong>on</strong>g> HP agreement within 14 days after you have signed it.<br />

The HP agreement must have <str<strong>on</strong>g>the</str<strong>on</strong>g> following informati<strong>on</strong>:<br />

• Descripti<strong>on</strong> of motor vehicle;<br />

• Computati<strong>on</strong> of <str<strong>on</strong>g>the</str<strong>on</strong>g> total sum payable;<br />

• Minimum deposit;<br />

• Term charges and annual percentage rate for term charges;<br />

• Late payment charges;<br />

• Date <strong>on</strong> which hiring commences;<br />

• Number of instalment repayments;<br />

• Amount of each instalment repayment;<br />

• Pers<strong>on</strong> to whom repayments are to be made, time and place of<br />

repayments; and<br />

• Address where <str<strong>on</strong>g>the</str<strong>on</strong>g> motor vehicle is to be kept.<br />

You do not need to engage a lawyer when entering into a HP agreement.<br />

However, do ensure that <str<strong>on</strong>g>the</str<strong>on</strong>g> particulars in <str<strong>on</strong>g>the</str<strong>on</strong>g> agreement are similar to <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

Sec<strong>on</strong>d Schedule statement received earlier.<br />

MINIMUM DEPOSIT<br />

The minimum deposit is 10% of <str<strong>on</strong>g>the</str<strong>on</strong>g> cash price of <str<strong>on</strong>g>the</str<strong>on</strong>g> motor vehicle. However,<br />

your banking instituti<strong>on</strong> may ask for a higher deposit at its discreti<strong>on</strong>.

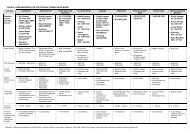

TERM CHARGES AND LATE PAYMENT CHARGES<br />

3<br />

The HP Act sets <str<strong>on</strong>g>the</str<strong>on</strong>g> maximum term charges and late payment charges allowed.<br />

Term charges<br />

(max.)<br />

Late payment<br />

charges (max.)<br />

GUARANTOR<br />

Fixed rate financing Variable rate financing<br />

Not more than 10% flat per<br />

annum. Term charges are<br />

calculated <strong>on</strong> initial amount<br />

financed over <str<strong>on</strong>g>the</str<strong>on</strong>g> entire HP<br />

tenure.<br />

Not more than 8% per annum<br />

calculated <strong>on</strong> a daily basis <strong>on</strong><br />

overdue instalments.<br />

Not more than 17% per annum.<br />

Term charges are calculated at<br />

a margin percentage above <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

base lending rate (BLR) of <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

banking instituti<strong>on</strong>.<br />

A rate of 2% above <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

prevailing rate of term charges<br />

imposed.<br />

The need to have a guarantor for HP financing would depend <strong>on</strong> <str<strong>on</strong>g>the</str<strong>on</strong>g> banking<br />

instituti<strong>on</strong>’s credit assessment of your ability to repay <str<strong>on</strong>g>the</str<strong>on</strong>g> instalments. If you<br />

default <strong>on</strong> your repayment, <str<strong>on</strong>g>the</str<strong>on</strong>g> guarantor is liable for <str<strong>on</strong>g>the</str<strong>on</strong>g> unpaid porti<strong>on</strong> of <str<strong>on</strong>g>the</str<strong>on</strong>g> HP<br />

financing and <str<strong>on</strong>g>the</str<strong>on</strong>g> interest due. A pers<strong>on</strong> who agrees to be a guarantor will need<br />

to sign a letter of guarantee. He will also be given a copy of <str<strong>on</strong>g>the</str<strong>on</strong>g> HP agreement<br />

within 14 days after <str<strong>on</strong>g>the</str<strong>on</strong>g> agreement is signed.<br />

INSURANCE<br />

Your banking instituti<strong>on</strong> will arrange for an insurance cover for <str<strong>on</strong>g>the</str<strong>on</strong>g> motor vehicle<br />

for first year. For subsequent years, you will need to get <str<strong>on</strong>g>the</str<strong>on</strong>g> insurance yourself.<br />

In practice, most banking instituti<strong>on</strong>s would need a comprehensive insurance<br />

policy <strong>on</strong> <str<strong>on</strong>g>the</str<strong>on</strong>g> motor vehicle.<br />

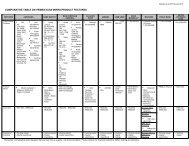

FIXED RATE FINANCING<br />

Calculati<strong>on</strong> of term charge and HP instalments<br />

Term charges <strong>on</strong> a fixed rate HP financing is calculated <strong>on</strong> <str<strong>on</strong>g>the</str<strong>on</strong>g> initial amount<br />

financed. See example:

The m<strong>on</strong>thly instalments is calculated as follows:<br />

4<br />

Since term charges are calculated <strong>on</strong> <str<strong>on</strong>g>the</str<strong>on</strong>g> initial amount financed, you will get a<br />

rebate <strong>on</strong> <str<strong>on</strong>g>the</str<strong>on</strong>g> term charges if you repay in full <str<strong>on</strong>g>the</str<strong>on</strong>g> balance due under <str<strong>on</strong>g>the</str<strong>on</strong>g> HP<br />

agreement.<br />

Using <str<strong>on</strong>g>the</str<strong>on</strong>g> earlier example, where your HP tenure is 5 years (60 m<strong>on</strong>ths) and you<br />

would like to pay off your loan after paying 48 m<strong>on</strong>thly instalments, you will get a<br />

rebate <strong>on</strong> <str<strong>on</strong>g>the</str<strong>on</strong>g> term charges for <str<strong>on</strong>g>the</str<strong>on</strong>g> remaining 12 m<strong>on</strong>ths (i.e. 60 m<strong>on</strong>ths - 48<br />

m<strong>on</strong>ths = 12 m<strong>on</strong>ths). The calculati<strong>on</strong> of rebate is as follows:

Total term charges <strong>on</strong> <str<strong>on</strong>g>the</str<strong>on</strong>g> amount financed is RM25,000.<br />

VARIABLE RATE FINANCING<br />

5<br />

Term charges <strong>on</strong> variable rate financing are calculated <strong>on</strong> <str<strong>on</strong>g>the</str<strong>on</strong>g> outstanding<br />

balance at <str<strong>on</strong>g>the</str<strong>on</strong>g> end of <str<strong>on</strong>g>the</str<strong>on</strong>g> m<strong>on</strong>th.<br />

FIXED OR VARIABLE RATE HP FINANCING?<br />

In variable rate financing, your interest repayments will vary according to <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

movements of <str<strong>on</strong>g>the</str<strong>on</strong>g> BLR. If BLR increases, your term charges will increase,<br />

resulting in a higher m<strong>on</strong>thly instalment. However, if BLR reduces, your<br />

repayments will be lower due to lower term charges. You will have to decide<br />

which mode is more beneficial to you based <strong>on</strong> your expectati<strong>on</strong> of how <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

interest rate will move in <str<strong>on</strong>g>the</str<strong>on</strong>g> future.<br />

REPOSSESSION<br />

Your banking instituti<strong>on</strong> can repossess <str<strong>on</strong>g>the</str<strong>on</strong>g> motor vehicle <strong>hire</strong>d to you when:<br />

• You default in two successive m<strong>on</strong>thly instalments or <str<strong>on</strong>g>the</str<strong>on</strong>g> final instalment;<br />

or<br />

• In <str<strong>on</strong>g>the</str<strong>on</strong>g> case where <str<strong>on</strong>g>the</str<strong>on</strong>g> <strong>hire</strong>r is deceased, defaults in four successive<br />

m<strong>on</strong>thly instalments.

STEPS TO REPOSSESSION<br />

Step 1: Pre-repossessi<strong>on</strong> notice<br />

6<br />

A pre-repossessi<strong>on</strong> notice (Fourth Schedule) will be served <strong>on</strong> you (pers<strong>on</strong>ally<br />

delivered or send by registered mail to your last known address) and your<br />

guarantor. This is a 21 days notice in writing from your banking instituti<strong>on</strong> to<br />

inform you that it intends to repossess <str<strong>on</strong>g>the</str<strong>on</strong>g> vehicle. This will be followed by a<br />

sec<strong>on</strong>d notice, 14 days after <str<strong>on</strong>g>the</str<strong>on</strong>g> Fourth Schedule notice.<br />

What can you do?<br />

You have two choices, both of which must be acted up<strong>on</strong> before <str<strong>on</strong>g>the</str<strong>on</strong>g> expiry of <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

21 days stated in Fourth Schedule notice to avoid repossesi<strong>on</strong>:<br />

• Pay <str<strong>on</strong>g>the</str<strong>on</strong>g> outstanding arrears as stated in <str<strong>on</strong>g>the</str<strong>on</strong>g> Fourth Schedule notice; or<br />

• Return <str<strong>on</strong>g>the</str<strong>on</strong>g> motor vehicle to your banking instituti<strong>on</strong> and pay any<br />

outstanding debt.<br />

Step 2: Repossessi<strong>on</strong> of your vehicle<br />

Up<strong>on</strong> <str<strong>on</strong>g>the</str<strong>on</strong>g> expiry of 21 days stated in <str<strong>on</strong>g>the</str<strong>on</strong>g> Fourth Schedule notice, repossessi<strong>on</strong> is<br />

allowed if you fail to pay <str<strong>on</strong>g>the</str<strong>on</strong>g> outstanding arrears.<br />

Step 3: Post-repossessi<strong>on</strong> notice<br />

Up<strong>on</strong> respossessi<strong>on</strong> of <str<strong>on</strong>g>the</str<strong>on</strong>g> motor vehicle, your banking instituti<strong>on</strong> will send a<br />

notice in writing informing you that it has taken possessi<strong>on</strong> of <str<strong>on</strong>g>the</str<strong>on</strong>g> vehicle. This<br />

will be followed by a Fifth Schedule notice to you and your guarantor within 21<br />

days after <str<strong>on</strong>g>the</str<strong>on</strong>g> repossessi<strong>on</strong> has taken place.<br />

What can you do?<br />

You have three opti<strong>on</strong>s, all of which must be acted up<strong>on</strong> before <str<strong>on</strong>g>the</str<strong>on</strong>g> expiry of <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

21 days as stated in <str<strong>on</strong>g>the</str<strong>on</strong>g> Fifth Schedule notice.

7<br />

• Pay all outstanding arrears and out of pocket expenses (includes cost of<br />

storage, repair or maintenance, cost of repossessi<strong>on</strong> and re-delivery)<br />

incurred by <str<strong>on</strong>g>the</str<strong>on</strong>g> banking instituti<strong>on</strong> to take back possessi<strong>on</strong> of <str<strong>on</strong>g>the</str<strong>on</strong>g> motor<br />

vehicle; or<br />

• Repay in full, <str<strong>on</strong>g>the</str<strong>on</strong>g> balance due and settle all out of pocket expenses<br />

(includes cost of repossessi<strong>on</strong>, storage, repair or maintenance); or<br />

• Introduce a buyer to <strong>purchase</strong> <str<strong>on</strong>g>the</str<strong>on</strong>g> motor vehicle at <str<strong>on</strong>g>the</str<strong>on</strong>g> price indicated <strong>on</strong><br />

<str<strong>on</strong>g>the</str<strong>on</strong>g> notice.<br />

Step 4: Notice <strong>on</strong> disposal of motor vehicle<br />

If <str<strong>on</strong>g>the</str<strong>on</strong>g> amount due under <str<strong>on</strong>g>the</str<strong>on</strong>g> Fifth Schedule notice is not paid within 21 days after<br />

<str<strong>on</strong>g>the</str<strong>on</strong>g> Fifth Schedule notice, your banking instituti<strong>on</strong> can sell <str<strong>on</strong>g>the</str<strong>on</strong>g> motor vehicle<br />

through a public aucti<strong>on</strong> by giving you a notice 14 days before <str<strong>on</strong>g>the</str<strong>on</strong>g> date of <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

aucti<strong>on</strong> or c<strong>on</strong>duct a private sale to sell <str<strong>on</strong>g>the</str<strong>on</strong>g> motor vehicle.<br />

Step 5: Selling <str<strong>on</strong>g>the</str<strong>on</strong>g> motor vehicle<br />

Sale of <str<strong>on</strong>g>the</str<strong>on</strong>g> motor vehicle can take place after <str<strong>on</strong>g>the</str<strong>on</strong>g> 14 days given in <str<strong>on</strong>g>the</str<strong>on</strong>g> notice in<br />

Step 4. As aucti<strong>on</strong> prices are based <strong>on</strong> forced sale value, it will be lower than <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

prevailing market value. The aucti<strong>on</strong> price may also reduce at each subsequent<br />

aucti<strong>on</strong> carried out. If proceeds from <str<strong>on</strong>g>the</str<strong>on</strong>g> sale of <str<strong>on</strong>g>the</str<strong>on</strong>g> motor vehicle are<br />

inadequate to pay <str<strong>on</strong>g>the</str<strong>on</strong>g> outstanding amount due, your banking instituti<strong>on</strong> will<br />

recover <str<strong>on</strong>g>the</str<strong>on</strong>g> shortfall from you. You will also need to bear <str<strong>on</strong>g>the</str<strong>on</strong>g> aucti<strong>on</strong> expenses.<br />

REPOSSESSION PROCEDURES IN SUMMARY<br />

See Appendix 1.

WHO CAN REPOSSESS?<br />

8<br />

Repossessi<strong>on</strong> of motor vehicles are generally carried out by repossessors who<br />

are registered members of <str<strong>on</strong>g>the</str<strong>on</strong>g> Associati<strong>on</strong> of Hire Purchase Companies<br />

Malaysia (AHPCM). All repossessors must comply with <str<strong>on</strong>g>the</str<strong>on</strong>g> rules set by<br />

AHPCM when carrying out <str<strong>on</strong>g>the</str<strong>on</strong>g>ir duties. Am<strong>on</strong>g o<str<strong>on</strong>g>the</str<strong>on</strong>g>rs, <str<strong>on</strong>g>the</str<strong>on</strong>g> rules required a<br />

repossessor to:<br />

• Show <strong>hire</strong>r <str<strong>on</strong>g>the</str<strong>on</strong>g> Repossessi<strong>on</strong> Order and his authority card issued by <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

banking instituti<strong>on</strong> before he repossesses <str<strong>on</strong>g>the</str<strong>on</strong>g> motor vehicle;<br />

• Obtain permissi<strong>on</strong> of <str<strong>on</strong>g>the</str<strong>on</strong>g> resident/<strong>hire</strong>r before he enters into <str<strong>on</strong>g>the</str<strong>on</strong>g> premises<br />

to repossess <str<strong>on</strong>g>the</str<strong>on</strong>g> motor vehicle;<br />

• At all times appear and act in a professi<strong>on</strong>al manner;<br />

• Not use str<strong>on</strong>g arm tactics and force when carrying out his duties;<br />

• Give <strong>hire</strong>r enough time to clear his pers<strong>on</strong>al bel<strong>on</strong>gings from <str<strong>on</strong>g>the</str<strong>on</strong>g> motor<br />

vehicle to be repossessed;<br />

• Immediately make a police report after he has repossessed <str<strong>on</strong>g>the</str<strong>on</strong>g> motor<br />

vehicle and bring it to <str<strong>on</strong>g>the</str<strong>on</strong>g> place indicated by <str<strong>on</strong>g>the</str<strong>on</strong>g> banking instituti<strong>on</strong>.<br />

ADVICE TO HIRERS<br />

Your rights<br />

• To receive a copy of <str<strong>on</strong>g>the</str<strong>on</strong>g> HP agreement.<br />

• To obtain any informati<strong>on</strong> regarding <str<strong>on</strong>g>the</str<strong>on</strong>g> account.<br />

• To request a statement of outstanding balance (<strong>on</strong>ce every 3 m<strong>on</strong>ths).<br />

• To settle early <str<strong>on</strong>g>the</str<strong>on</strong>g> full outstanding amount.<br />

• To terminate <str<strong>on</strong>g>the</str<strong>on</strong>g> agreement at any time.<br />

YOUR RESPONSIBILITES<br />

• Read all <str<strong>on</strong>g>the</str<strong>on</strong>g> fine print in <str<strong>on</strong>g>the</str<strong>on</strong>g> written agreement.<br />

• Check that <str<strong>on</strong>g>the</str<strong>on</strong>g> <strong>purchase</strong> price and HP terms in <str<strong>on</strong>g>the</str<strong>on</strong>g> agreement are as<br />

agreed. Do not sign blank or incomplete agreement/ forms.

9<br />

• Ensure that you can afford <str<strong>on</strong>g>the</str<strong>on</strong>g> instalment payments for <str<strong>on</strong>g>the</str<strong>on</strong>g> durati<strong>on</strong> of <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

HP financing and pay your instalments <strong>on</strong> time.<br />

• Know your rights and obligati<strong>on</strong>s under <str<strong>on</strong>g>the</str<strong>on</strong>g> HP c<strong>on</strong>tract so that you do not<br />

commit any acti<strong>on</strong>s leading to a breach.<br />

• Keep all documents pertaining to <str<strong>on</strong>g>the</str<strong>on</strong>g> HP financing such as agreement,<br />

receipts, etc. in a safe place.<br />

• Not to remove, sell or dispose off <str<strong>on</strong>g>the</str<strong>on</strong>g> motor vehicle without <str<strong>on</strong>g>the</str<strong>on</strong>g> c<strong>on</strong>sent of<br />

your banking instituti<strong>on</strong>.<br />

• <strong>Info</strong>rm your banking instituti<strong>on</strong> of any change of address.<br />

• Insure <str<strong>on</strong>g>the</str<strong>on</strong>g> motor vehicle after <str<strong>on</strong>g>the</str<strong>on</strong>g> first year and to update your banking<br />

instituti<strong>on</strong> within 14 days before <str<strong>on</strong>g>the</str<strong>on</strong>g> current policy expires.<br />

RIGHTS OF YOUR BANKING INSTITTUTION<br />

The rights of your banking instituti<strong>on</strong> include:<br />

• To repossess <str<strong>on</strong>g>the</str<strong>on</strong>g> motor vehicle when you default in payment.<br />

• To ask you to insure <str<strong>on</strong>g>the</str<strong>on</strong>g> motor vehicle.<br />

• To charge you any fees relating to <str<strong>on</strong>g>the</str<strong>on</strong>g> enforcement of <str<strong>on</strong>g>the</str<strong>on</strong>g> HP agreement.<br />

RIGHTS OF A GUARANTOR<br />

A guarantor under a HP agreement would have <str<strong>on</strong>g>the</str<strong>on</strong>g> following rights:<br />

• To receive a copy of <str<strong>on</strong>g>the</str<strong>on</strong>g> HP agreement.<br />

• To be discharged from liability <strong>on</strong>ce <str<strong>on</strong>g>the</str<strong>on</strong>g> amount due is fully paid.<br />

• To take legal acti<strong>on</strong> against <str<strong>on</strong>g>the</str<strong>on</strong>g> <strong>hire</strong>r for breach of obligati<strong>on</strong>.<br />

• To be indemnified by <str<strong>on</strong>g>the</str<strong>on</strong>g> <strong>hire</strong>r against claims by <str<strong>on</strong>g>the</str<strong>on</strong>g> banking instituti<strong>on</strong><br />

after he has paid <str<strong>on</strong>g>the</str<strong>on</strong>g> amount due.

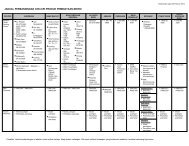

REPOSSESSION PROCEDURES IN SUMMARY<br />

Days<br />

<strong>Banking</strong> instituti<strong>on</strong><br />

gives 4 th<br />

Schedule notice<br />

(21 days to inform<br />

you that its intends<br />

to repossess <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

vehicle).<br />

Appendix 1<br />

1 14 21 22 X 42 X + 21 days<br />

<strong>Banking</strong> instituti<strong>on</strong><br />

gives sec<strong>on</strong>d<br />

notice to inform<br />

you its intenti<strong>on</strong> to<br />

repossess <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

motor vehicle.<br />

<strong>Banking</strong> instituti<strong>on</strong><br />

repossesses <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

motor vehicle<br />

up<strong>on</strong> expiry of 4 th<br />

Schedule notice.<br />

<strong>Banking</strong> instituti<strong>on</strong><br />

gives 5 th<br />

Schedule notice.<br />

Hirer to exercise<br />

rights within 21<br />

days.<br />

<strong>Banking</strong> instituti<strong>on</strong><br />

sells motor vehicle<br />

up<strong>on</strong> expiry of 5 th<br />

Schedule notice.<br />

Note: X is <str<strong>on</strong>g>the</str<strong>on</strong>g> day <str<strong>on</strong>g>the</str<strong>on</strong>g> banking instituti<strong>on</strong> sends <str<strong>on</strong>g>the</str<strong>on</strong>g> Fifth Schedule notice which must be within 21 days from <str<strong>on</strong>g>the</str<strong>on</strong>g> date <str<strong>on</strong>g>the</str<strong>on</strong>g> motor vehicle<br />

was repossessed.

FREQUENTLY ASKED QUESTIONS<br />

How much can I borrow from <str<strong>on</strong>g>the</str<strong>on</strong>g> banking instituti<strong>on</strong>?<br />

The margin of financing will depend <strong>on</strong> your credit standing subject to a<br />

maximum of 90% of <strong>purchase</strong> price or any o<str<strong>on</strong>g>the</str<strong>on</strong>g>r lower margin of financing fixed<br />

by <str<strong>on</strong>g>the</str<strong>on</strong>g> banking instituti<strong>on</strong>.<br />

What is <str<strong>on</strong>g>the</str<strong>on</strong>g> minimum deposit required?<br />

The minimum deposit is 10% of <strong>purchase</strong> price. However, a banking instituti<strong>on</strong><br />

may fix a higher amount.<br />

What are <str<strong>on</strong>g>the</str<strong>on</strong>g> term charges for a HP facility?<br />

The maximum term charges for a HP facility under fixed rate financing is 10% flat<br />

per annum while term charges for variable rate financing will be quoted at a<br />

margin above <str<strong>on</strong>g>the</str<strong>on</strong>g> base lending rate of <str<strong>on</strong>g>the</str<strong>on</strong>g> lending banking instituti<strong>on</strong>.<br />

Do I require a guarantor for my HP facility?<br />

The need for a guarantor depends <strong>on</strong> <str<strong>on</strong>g>the</str<strong>on</strong>g> credit assessment of <str<strong>on</strong>g>the</str<strong>on</strong>g> banking<br />

instituti<strong>on</strong>. The guarantor should be <strong>on</strong>e who is acceptable to <str<strong>on</strong>g>the</str<strong>on</strong>g> banking<br />

instituti<strong>on</strong>.<br />

What should I do if <str<strong>on</strong>g>the</str<strong>on</strong>g> guarantor or I did not get a copy of <str<strong>on</strong>g>the</str<strong>on</strong>g> HP<br />

agreement 14 days after entering into <str<strong>on</strong>g>the</str<strong>on</strong>g> agreement?<br />

You should c<strong>on</strong>tact your banking instituti<strong>on</strong> to get a copy of <str<strong>on</strong>g>the</str<strong>on</strong>g> agreement.<br />

Can my banking instituti<strong>on</strong> insist that I insure with an insurance company<br />

<strong>on</strong> its panel?<br />

You can ei<str<strong>on</strong>g>the</str<strong>on</strong>g>r insure with an insurance company <strong>on</strong> <str<strong>on</strong>g>the</str<strong>on</strong>g> panel of your banking<br />

instituti<strong>on</strong> or an insurance company of your choice. Normally, a banking<br />

instituti<strong>on</strong> has at least four insurance companies <strong>on</strong> its panel for <str<strong>on</strong>g>the</str<strong>on</strong>g> c<strong>on</strong>venience<br />

of its <strong>hire</strong>rs.<br />

Can I keep <str<strong>on</strong>g>the</str<strong>on</strong>g> motor vehicle registrati<strong>on</strong> card to enable me to renew my<br />

road tax up<strong>on</strong> expiry?<br />

Generally, banking instituti<strong>on</strong>s will keep <str<strong>on</strong>g>the</str<strong>on</strong>g> registrati<strong>on</strong> card until <str<strong>on</strong>g>the</str<strong>on</strong>g> HP<br />

financing has been fully settled in order to prevent any inc<strong>on</strong>veniences that may<br />

arise due to damage, misplacement or <str<strong>on</strong>g>the</str<strong>on</strong>g>ft of card. As such for <str<strong>on</strong>g>the</str<strong>on</strong>g> c<strong>on</strong>venience<br />

of <str<strong>on</strong>g>the</str<strong>on</strong>g>ir <strong>hire</strong>rs, most banking instituti<strong>on</strong>s will provide insurance and road tax<br />

renewal services to <str<strong>on</strong>g>the</str<strong>on</strong>g>ir <strong>hire</strong>rs.

12<br />

Can I modify <str<strong>on</strong>g>the</str<strong>on</strong>g> m<strong>on</strong>thly repayment amount if I have financial difficulties?<br />

This is subject to your banking instituti<strong>on</strong>’s discreti<strong>on</strong> and you are advised to<br />

discuss <str<strong>on</strong>g>the</str<strong>on</strong>g> matter with your banking instituti<strong>on</strong>.<br />

What happens if I settle my fixed rate HP financing earlier than <str<strong>on</strong>g>the</str<strong>on</strong>g> date<br />

originally agreed up<strong>on</strong>?<br />

If you settle your outstanding balance earlier, you are entitled to a rebate <strong>on</strong> <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

term charges.<br />

When can my banking instituti<strong>on</strong> repossess my motor vehicle?<br />

Under a HP agreement, a banking instituti<strong>on</strong> can repossess a motor vehicle after<br />

<str<strong>on</strong>g>the</str<strong>on</strong>g> <strong>hire</strong>r had defaulted two successive instalments or <str<strong>on</strong>g>the</str<strong>on</strong>g> final instalment.<br />

What is <str<strong>on</strong>g>the</str<strong>on</strong>g> time limit for banking instituti<strong>on</strong>s to repossess <str<strong>on</strong>g>the</str<strong>on</strong>g> motor<br />

vehicles after serving <str<strong>on</strong>g>the</str<strong>on</strong>g> Fourth Schedule notice?<br />

<strong>Banking</strong> instituti<strong>on</strong>s can repossess <str<strong>on</strong>g>the</str<strong>on</strong>g> motor vehicles anytime after 21 days from<br />

<str<strong>on</strong>g>the</str<strong>on</strong>g> date <str<strong>on</strong>g>the</str<strong>on</strong>g> Fourth Schedule notices were served if <str<strong>on</strong>g>the</str<strong>on</strong>g> overdue instalments are<br />

not paid.<br />

How do I determine <str<strong>on</strong>g>the</str<strong>on</strong>g> identity of <str<strong>on</strong>g>the</str<strong>on</strong>g> repossessor?<br />

The repossessor will have to show you an authority card, which has <str<strong>on</strong>g>the</str<strong>on</strong>g> name<br />

and address of <str<strong>on</strong>g>the</str<strong>on</strong>g> repossessor and your banking instituti<strong>on</strong>, nature of<br />

appointment of <str<strong>on</strong>g>the</str<strong>on</strong>g> repossessor and <str<strong>on</strong>g>the</str<strong>on</strong>g> signature of an authorised<br />

representative of your banking instituti<strong>on</strong>.<br />

How do I get my motor vehicle back after it was repossessed by my<br />

banking instituti<strong>on</strong>?<br />

After <str<strong>on</strong>g>the</str<strong>on</strong>g> repossessi<strong>on</strong>, your banking instituti<strong>on</strong> will issue you a Fifth Schedule<br />

notice. This notice gives you a chance to settle <str<strong>on</strong>g>the</str<strong>on</strong>g> amount outstanding within 21<br />

days. You can get <str<strong>on</strong>g>the</str<strong>on</strong>g> motor vehicle back provided that, before <str<strong>on</strong>g>the</str<strong>on</strong>g> expiry of 21<br />

days, you:<br />

• pay all outstanding arrears with interest due and <str<strong>on</strong>g>the</str<strong>on</strong>g> costs incurred by <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

banking instituti<strong>on</strong> (costs of storage, repair or maintenance, repossessi<strong>on</strong><br />

and re-delivery); or<br />

• settle <str<strong>on</strong>g>the</str<strong>on</strong>g> balance in full including <str<strong>on</strong>g>the</str<strong>on</strong>g> costs of repossessi<strong>on</strong>, storage,<br />

repair or maintenance.<br />

When can <str<strong>on</strong>g>the</str<strong>on</strong>g> banking instituti<strong>on</strong> sell <str<strong>on</strong>g>the</str<strong>on</strong>g> repossessed motor vehicle?<br />

The banking instituti<strong>on</strong> can sell <str<strong>on</strong>g>the</str<strong>on</strong>g> repossessed motor vehicle when <str<strong>on</strong>g>the</str<strong>on</strong>g> <strong>hire</strong>r<br />

does not make any payment after <str<strong>on</strong>g>the</str<strong>on</strong>g> 21 days stated in <str<strong>on</strong>g>the</str<strong>on</strong>g> Fifth Schedule notice.

13<br />

Can I introduce a prospective buyer to buy <str<strong>on</strong>g>the</str<strong>on</strong>g> repossessed motor vehicle?<br />

Yes. Before <str<strong>on</strong>g>the</str<strong>on</strong>g> expirati<strong>on</strong> of <str<strong>on</strong>g>the</str<strong>on</strong>g> Fifth Schedule notice, you can introduce a buyer<br />

to buy <str<strong>on</strong>g>the</str<strong>on</strong>g> repossessed motor vehicle at <str<strong>on</strong>g>the</str<strong>on</strong>g> price indicated in <str<strong>on</strong>g>the</str<strong>on</strong>g> Fifth Schedule<br />

notice.<br />

Whom and where can I complain if I am not satisfied with <str<strong>on</strong>g>the</str<strong>on</strong>g> manner in<br />

which my motor vehicle was repossessed?<br />

You may lodge your complaint with <str<strong>on</strong>g>the</str<strong>on</strong>g> banking instituti<strong>on</strong>. Alternatively, you may<br />

also lodge your complaint with <str<strong>on</strong>g>the</str<strong>on</strong>g> Associati<strong>on</strong> of Hire Purchase Companies<br />

Malaysia at <str<strong>on</strong>g>the</str<strong>on</strong>g> address below:<br />

Unit 605 Block C,<br />

Phileo Damansara 1,<br />

No. 9 Jalan 16/11,<br />

Off Jalan Damansara,<br />

46350 Petaling Jaya, Selangor<br />

If I have defaulted <strong>on</strong> <str<strong>on</strong>g>the</str<strong>on</strong>g> m<strong>on</strong>thly instalments, can my banking instituti<strong>on</strong><br />

claim from <str<strong>on</strong>g>the</str<strong>on</strong>g> guarantor?<br />

Yes. Your banking instituti<strong>on</strong> can claim <str<strong>on</strong>g>the</str<strong>on</strong>g> payment from <str<strong>on</strong>g>the</str<strong>on</strong>g> guarantor because<br />

<str<strong>on</strong>g>the</str<strong>on</strong>g> guarantor has agreed to undertake <str<strong>on</strong>g>the</str<strong>on</strong>g> liability to repay your debt in <str<strong>on</strong>g>the</str<strong>on</strong>g> event<br />

of your default.<br />

What are <str<strong>on</strong>g>the</str<strong>on</strong>g> rights and resp<strong>on</strong>sibilities of a guarantor under <str<strong>on</strong>g>the</str<strong>on</strong>g> HP Act?<br />

A guarantor has <str<strong>on</strong>g>the</str<strong>on</strong>g> following rights under a HP agreement:<br />

• To receive a copy of <str<strong>on</strong>g>the</str<strong>on</strong>g> HP agreement.<br />

• To receive all notices <strong>on</strong> payment issued by <str<strong>on</strong>g>the</str<strong>on</strong>g> banking instituti<strong>on</strong> to <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

<strong>hire</strong>r.<br />

• To be discharged from liability <strong>on</strong>ce <str<strong>on</strong>g>the</str<strong>on</strong>g> amount due to <str<strong>on</strong>g>the</str<strong>on</strong>g> banking<br />

instituti<strong>on</strong> is fully paid.<br />

• To take legal acti<strong>on</strong> against <str<strong>on</strong>g>the</str<strong>on</strong>g> <strong>hire</strong>r for breach of obligati<strong>on</strong>.<br />

• To be indemnified by <str<strong>on</strong>g>the</str<strong>on</strong>g> <strong>hire</strong>r against claims by <str<strong>on</strong>g>the</str<strong>on</strong>g> banking instituti<strong>on</strong><br />

after paying <str<strong>on</strong>g>the</str<strong>on</strong>g> amount due.<br />

Can my banking instituti<strong>on</strong> claim any amount from me after <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

repossessed motor vehicle is sold?<br />

Yes. If <str<strong>on</strong>g>the</str<strong>on</strong>g> proceeds from <str<strong>on</strong>g>the</str<strong>on</strong>g> sale of <str<strong>on</strong>g>the</str<strong>on</strong>g> repossessed motor vehicle are not<br />

enough to cover your liabilities, your banking instituti<strong>on</strong> can claim <str<strong>on</strong>g>the</str<strong>on</strong>g> amount<br />

outstanding from you.

14<br />

Do I still have to pay my m<strong>on</strong>thly instalments if my motor vehicle is stolen?<br />

Yes. This is because your liability to pay <str<strong>on</strong>g>the</str<strong>on</strong>g> m<strong>on</strong>thly instalment does not cease<br />

with <str<strong>on</strong>g>the</str<strong>on</strong>g> loss of your motor vehicle. However, you may claim from <str<strong>on</strong>g>the</str<strong>on</strong>g> insurance<br />

company, <str<strong>on</strong>g>the</str<strong>on</strong>g> market value of <str<strong>on</strong>g>the</str<strong>on</strong>g> insured motor vehicle or <str<strong>on</strong>g>the</str<strong>on</strong>g> sum insured,<br />

whichever is lower.<br />

What happens to <str<strong>on</strong>g>the</str<strong>on</strong>g> HP agreement in <str<strong>on</strong>g>the</str<strong>on</strong>g> event of <str<strong>on</strong>g>the</str<strong>on</strong>g> death of <str<strong>on</strong>g>the</str<strong>on</strong>g> <strong>hire</strong>r?<br />

If <str<strong>on</strong>g>the</str<strong>on</strong>g> pers<strong>on</strong>al representative has obtained a Letter of Administrati<strong>on</strong> or Grant of<br />

Probate, <str<strong>on</strong>g>the</str<strong>on</strong>g> rights, title and interest will be transferred to <str<strong>on</strong>g>the</str<strong>on</strong>g> pers<strong>on</strong>al<br />

representative who will take over <str<strong>on</strong>g>the</str<strong>on</strong>g> resp<strong>on</strong>sibilities of <str<strong>on</strong>g>the</str<strong>on</strong>g> <strong>hire</strong>r. O<str<strong>on</strong>g>the</str<strong>on</strong>g>rwise, <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

banking instituti<strong>on</strong> will repossess <str<strong>on</strong>g>the</str<strong>on</strong>g> motor vehicle after defaults in four<br />

successive m<strong>on</strong>thly instalments.<br />

How can I transfer/sell/part possessi<strong>on</strong> of <str<strong>on</strong>g>the</str<strong>on</strong>g> motor vehicle to a third party<br />

even though <str<strong>on</strong>g>the</str<strong>on</strong>g> motor vehicle is still financed under my name?<br />

It is illegal to transfer/sell/part possessi<strong>on</strong> of <str<strong>on</strong>g>the</str<strong>on</strong>g> motor vehicle without <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

permissi<strong>on</strong> of your banking instituti<strong>on</strong>, who is <str<strong>on</strong>g>the</str<strong>on</strong>g> legal owner. If you do so, you<br />

may incur substantial losses and penalties as you are still fully resp<strong>on</strong>sible for <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

liability and losses incurred. Ensure that you have fully settled your HP debt<br />

before you sell your motor vehicle. If you wish to use <str<strong>on</strong>g>the</str<strong>on</strong>g> proceeds of <str<strong>on</strong>g>the</str<strong>on</strong>g> sale of<br />

your motor vehicle to pay <str<strong>on</strong>g>the</str<strong>on</strong>g> outstanding balance of your HP financing, get <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

c<strong>on</strong>sent of your banking instituti<strong>on</strong> to sell <str<strong>on</strong>g>the</str<strong>on</strong>g> motor vehicle and arrange for <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

proceeds of <str<strong>on</strong>g>the</str<strong>on</strong>g> sale to be paid directly to <str<strong>on</strong>g>the</str<strong>on</strong>g> banking instituti<strong>on</strong> to settle your<br />

outstanding balance. If <str<strong>on</strong>g>the</str<strong>on</strong>g>re is any shortfall, you will be resp<strong>on</strong>sible for repaying<br />

<str<strong>on</strong>g>the</str<strong>on</strong>g> balance. If <str<strong>on</strong>g>the</str<strong>on</strong>g>re is a surplus, it will be refunded to you by <str<strong>on</strong>g>the</str<strong>on</strong>g> banking<br />

instituti<strong>on</strong>.