APPLICANT'S UNDERTAKING HOUSING AND URBAN DEVELOPMENT CORPORATION LIMITED

housing and urban development corporation limited - HDFC Bank

housing and urban development corporation limited - HDFC Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

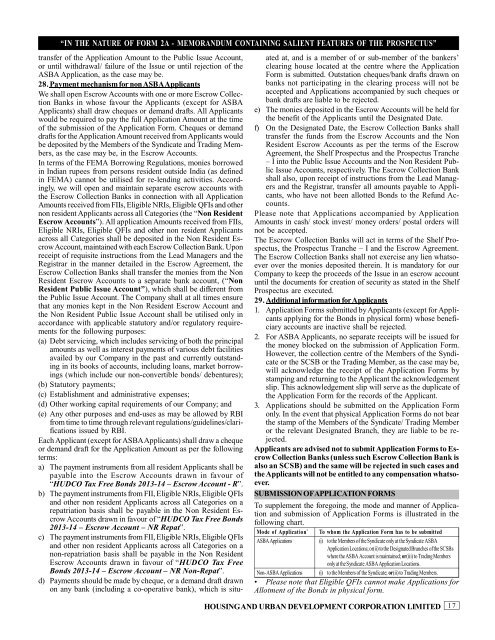

“IN THE NATURE OF FORM 2A - MEMOR<strong>AND</strong>UM CONTAINING SALIENT FEATURES OF THE PROSPECTUS”transfer of the Application Amount to the Public Issue Account,or until withdrawal/ failure of the Issue or until rejection of theASBA Application, as the case may be.28. Payment mechanism for non ASBA ApplicantsWe shall open Escrow Accounts with one or more Escrow CollectionBanks in whose favour the Applicants (except for ASBAApplicants) shall draw cheques or demand drafts. All Applicantswould be required to pay the full Application Amount at the timeof the submission of the Application Form. Cheques or demanddrafts for the Application Amount received from Applicants wouldbe deposited by the Members of the Syndicate and Trading Members,as the case may be, in the Escrow Accounts.In terms of the FEMA Borrowing Regulations, monies borrowedin Indian rupees from persons resident outside India (as definedin FEMA) cannot be utilised for re-lending activities. Accordingly,we will open and maintain separate escrow accounts withthe Escrow Collection Banks in connection with all ApplicationAmounts received from FIIs, Eligible NRIs, Eligible QFIs and othernon resident Applicants across all Categories (the “Non ResidentEscrow Accounts”). All application Amounts received from FIIs,Eligible NRIs, Eligible QFIs and other non resident Applicantsacross all Categories shall be deposited in the Non Resident EscrowAccount, maintained with each Escrow Collection Bank. Uponreceipt of requisite instructions from the Lead Managers and theRegistrar in the manner detailed in the Escrow Agreement, theEscrow Collection Banks shall transfer the monies from the NonResident Escrow Accounts to a separate bank account, (“NonResident Public Issue Account”), which shall be different fromthe Public Issue Account. The Company shall at all times ensurethat any monies kept in the Non Resident Escrow Account andthe Non Resident Public Issue Account shall be utilised only inaccordance with applicable statutory and/or regulatory requirementsfor the following purposes:(a) Debt servicing, which includes servicing of both the principalamounts as well as interest payments of various debt facilitiesavailed by our Company in the past and currently outstandingin its books of accounts, including loans, market borrowings(which include our non-convertible bonds/ debentures);(b) Statutory payments;(c) Establishment and administrative expenses;(d) Other working capital requirements of our Company; and(e) Any other purposes and end-uses as may be allowed by RBIfrom time to time through relevant regulations/guidelines/clarificationsissued by RBI.Each Applicant (except for ASBA Applicants) shall draw a chequeor demand draft for the Application Amount as per the followingterms:a) The payment instruments from all resident Applicants shall bepayable into the Escrow Accounts drawn in favour of“HUDCO Tax Free Bonds 2013-14 – Escrow Account - R”.b) The payment instruments from FII, Eligible NRIs, Eligible QFIsand other non resident Applicants across all Categories on arepatriation basis shall be payable in the Non Resident EscrowAccounts drawn in favour of “HUDCO Tax Free Bonds2013-14 – Escrow Account – NR Repat”.c) The payment instruments from FII, Eligible NRIs, Eligible QFIsand other non resident Applicants across all Categories on anon-repatriation basis shall be payable in the Non ResidentEscrow Accounts drawn in favour of “HUDCO Tax FreeBonds 2013-14 – Escrow Account – NR Non-Repat”.d) Payments should be made by cheque, or a demand draft drawnon any bank (including a co-operative bank), which is situatedat, and is a member of or sub-member of the bankers’clearing house located at the centre where the ApplicationForm is submitted. Outstation cheques/bank drafts drawn onbanks not participating in the clearing process will not beaccepted and Applications accompanied by such cheques orbank drafts are liable to be rejected.e) The monies deposited in the Escrow Accounts will be held forthe benefit of the Applicants until the Designated Date.f) On the Designated Date, the Escrow Collection Banks shalltransfer the funds from the Escrow Accounts and the NonResident Escrow Accounts as per the terms of the EscrowAgreement, the Shelf Prospectus and the Prospectus Tranche– I into the Public Issue Accounts and the Non Resident PublicIssue Accounts, respectively. The Escrow Collection Bankshall also, upon receipt of instructions from the Lead Managersand the Registrar, transfer all amounts payable to Applicants,who have not been allotted Bonds to the Refund Accounts.Please note that Applications accompanied by ApplicationAmounts in cash/ stock invest/ money orders/ postal orders willnot be accepted.The Escrow Collection Banks will act in terms of the Shelf Prospectus,the Prospectus Tranche – I and the Escrow Agreement.The Escrow Collection Banks shall not exercise any lien whatsoeverover the monies deposited therein. It is mandatory for ourCompany to keep the proceeds of the Issue in an escrow accountuntil the documents for creation of security as stated in the ShelfProspectus are executed.29. Additional information for Applicants1. Application Forms submitted by Applicants (except for Applicantsapplying for the Bonds in physical form) whose beneficiaryaccounts are inactive shall be rejected.2. For ASBA Applicants, no separate receipts will be issued forthe money blocked on the submission of Application Form.However, the collection centre of the Members of the Syndicateor the SCSB or the Trading Member, as the case may be,will acknowledge the receipt of the Application Forms bystamping and returning to the Applicant the acknowledgementslip. This acknowledgement slip will serve as the duplicate ofthe Application Form for the records of the Applicant.3. Applications should be submitted on the Application Formonly. In the event that physical Application Forms do not bearthe stamp of the Members of the Syndicate/ Trading Memberor the relevant Designated Branch, they are liable to be rejected.Applicants are advised not to submit Application Forms to EscrowCollection Banks (unless such Escrow Collection Bank isalso an SCSB) and the same will be rejected in such cases andthe Applicants will not be entitled to any compensation whatsoever.SUBMISSION OF APPLICATION FORMSTo supplement the foregoing, the mode and manner of Applicationand submission of Application Forms is illustrated in thefollowing chart.Mode of Application * To whom the Application Form has to be submittedASBA Applications (i) to the Members of the Syndicate only at the Syndicate ASBAApplication Locations; or(ii) to the Designated Branches of the SCSBswhere the ASBA Account is maintained; or(iii) to Trading Membersonly at the Syndicate ASBA Application Locations.Non- ASBA Applications (i) to the Members of the Syndicate; or(ii) to Trading Members.• Please note that Eligible QFIs cannot make Applications forAllotment of the Bonds in physical form.<strong>HOUSING</strong> <strong>AND</strong> <strong>URBAN</strong> <strong>DEVELOPMENT</strong> <strong>CORPORATION</strong> <strong>LIMITED</strong>17