APPLICANT'S UNDERTAKING HOUSING AND URBAN DEVELOPMENT CORPORATION LIMITED

housing and urban development corporation limited - HDFC Bank

housing and urban development corporation limited - HDFC Bank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

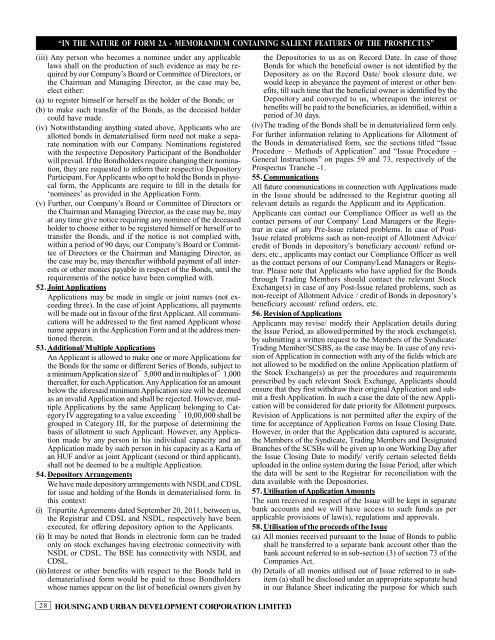

“IN THE NATURE OF FORM 2A - MEMOR<strong>AND</strong>UM CONTAINING SALIENT FEATURES OF THE PROSPECTUS”(iii) Any person who becomes a nominee under any applicablelaws shall on the production of such evidence as may be requiredby our Company’s Board or Committee of Directors, orthe Chairman and Managing Director, as the case may be,elect either:(a) to register himself or herself as the holder of the Bonds; or(b) to make such transfer of the Bonds, as the deceased holdercould have made.(iv) Notwithstanding anything stated above, Applicants who areallotted bonds in dematerialised form need not make a separatenomination with our Company. Nominations registeredwith the respective Depository Participant of the Bondholderwill prevail. If the Bondholders require changing their nomination,they are requested to inform their respective DepositoryParticipant. For Applicants who opt to hold the Bonds in physicalform, the Applicants are require to fill in the details for‘nominees’ as provided in the Application Form.(v) Further, our Company’s Board or Committee of Directors orthe Chairman and Managing Director, as the case may be, mayat any time give notice requiring any nominee of the deceasedholder to choose either to be registered himself or herself or totransfer the Bonds, and if the notice is not complied with,within a period of 90 days, our Company’s Board or Committeeof Directors or the Chairman and Managing Director, asthe case may be, may thereafter withhold payment of all interestsor other monies payable in respect of the Bonds, until therequirements of the notice have been complied with.52. Joint ApplicationsApplications may be made in single or joint names (not exceedingthree). In the case of joint Applications, all paymentswill be made out in favour of the first Applicant. All communicationswill be addressed to the first named Applicant whosename appears in the Application Form and at the address mentionedtherein.53. Additional/ Multiple ApplicationsAn Applicant is allowed to make one or more Applications forthe Bonds for the same or different Series of Bonds, subject toa minimum Application size of ` 5,000 and in multiples of ` 1,000thereafter, for each Application. Any Application for an amountbelow the aforesaid minimum Application size will be deemedas an invalid Application and shall be rejected. However, multipleApplications by the same Applicant belonging to CategoryIV aggregating to a value exceeding ` 10,00,000 shall begrouped in Category III, for the purpose of determining thebasis of allotment to such Applicant. However, any Applicationmade by any person in his individual capacity and anApplication made by such person in his capacity as a Karta ofan HUF and/or as joint Applicant (second or third applicant),shall not be deemed to be a multiple Application.54. Depository ArrangementsWe have made depository arrangements with NSDL and CDSLfor issue and holding of the Bonds in dematerialised form. Inthis context:(i) Tripartite Agreements dated September 20, 2011, between us,the Registrar and CDSL and NSDL, respectively have beenexecuted, for offering depository option to the Applicants.(ii) It may be noted that Bonds in electronic form can be tradedonly on stock exchanges having electronic connectivity withNSDL or CDSL. The BSE has connectivity with NSDL andCDSL.(iii) Interest or other benefits with respect to the Bonds held indematerialised form would be paid to those Bondholderswhose names appear on the list of beneficial owners given by28 <strong>HOUSING</strong> <strong>AND</strong> <strong>URBAN</strong> <strong>DEVELOPMENT</strong> <strong>CORPORATION</strong> <strong>LIMITED</strong>the Depositories to us as on Record Date. In case of thoseBonds for which the beneficial owner is not identified by theDepository as on the Record Date/ book closure date, wewould keep in abeyance the payment of interest or other benefits,till such time that the beneficial owner is identified by theDepository and conveyed to us, whereupon the interest orbenefits will be paid to the beneficiaries, as identified, within aperiod of 30 days.(iv)The trading of the Bonds shall be in dematerialized form only.For further information relating to Applications for Allotment ofthe Bonds in dematerialised form, see the sections titled “IssueProcedure – Methods of Application” and “Issue Procedure –General Instructions” on pages 59 and 73, respectively of theProspectus Tranche -1.55. CommunicationsAll future communications in connection with Applications madein the Issue should be addressed to the Registrar quoting allrelevant details as regards the Applicant and its Application.Applicants can contact our Compliance Officer as well as thecontact persons of our Company/ Lead Managers or the Registrarin case of any Pre-Issue related problems. In case of Post-Issue related problems such as non-receipt of Allotment Advice/credit of Bonds in depository’s beneficiary account/ refund orders,etc., applicants may contact our Compliance Officer as wellas the contact persons of our Company/Lead Managers or Registrar.Please note that Applicants who have applied for the Bondsthrough Trading Members should contact the relevant StockExchange(s) in case of any Post-Issue related problems, such asnon-receipt of Allotment Advice / credit of Bonds in depository’sbeneficiary account/ refund orders, etc.56. Revision of ApplicationsApplicants may revise/ modify their Application details duringthe Issue Period, as allowed/permitted by the stock exchange(s),by submitting a written request to the Members of the Syndicate/Trading Member/SCSBS, as the case may be. In case of any revisionof Application in connection with any of the fields which arenot allowed to be modified on the online Application platform ofthe Stock Exchange(s) as per the procedures and requirementsprescribed by each relevant Stock Exchange, Applicants shouldensure that they first withdraw their original Application and submita fresh Application. In such a case the date of the new Applicationwill be considered for date priority for Allotment purposes.Revision of Applications is not permitted after the expiry of thetime for acceptance of Application Forms on Issue Closing Date.However, in order that the Application data captured is accurate,the Members of the Syndicate, Trading Members and DesignatedBranches of the SCSBs will be given up to one Working Day afterthe Issue Closing Date to modify/ verify certain selected fieldsuploaded in the online system during the Issue Period, after whichthe data will be sent to the Registrar for reconciliation with thedata available with the Depositories.57. Utilisation of Application AmountsThe sum received in respect of the Issue will be kept in separatebank accounts and we will have access to such funds as perapplicable provisions of law(s), regulations and approvals.58. Utilisation of the proceeds of the Issue(a) All monies received pursuant to the Issue of Bonds to publicshall be transferred to a separate bank account other than thebank account referred to in sub-section (3) of section 73 of theCompanies Act.(b) Details of all monies utilised out of Issue referred to in subitem(a) shall be disclosed under an appropriate separate headin our Balance Sheet indicating the purpose for which such