APPLICANT'S UNDERTAKING HOUSING AND URBAN DEVELOPMENT CORPORATION LIMITED

housing and urban development corporation limited - HDFC Bank

housing and urban development corporation limited - HDFC Bank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

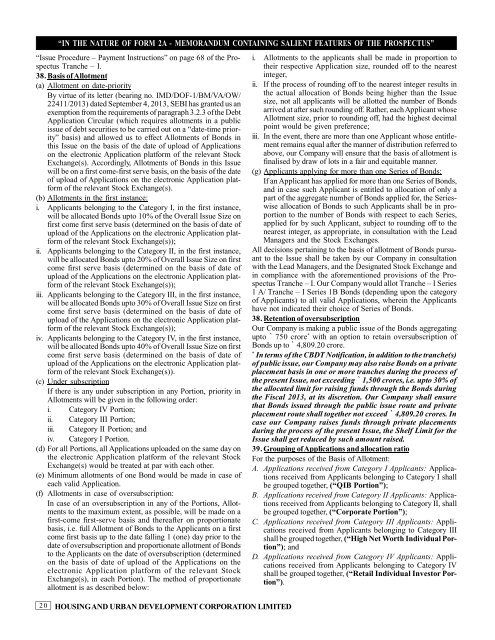

“IN THE NATURE OF FORM 2A - MEMOR<strong>AND</strong>UM CONTAINING SALIENT FEATURES OF THE PROSPECTUS”“Issue Procedure – Payment Instructions” on page 68 of the ProspectusTranche – I.38. Basis of Allotment(a) Allotment on date-priorityBy virtue of its letter (bearing no. IMD/DOF-1/BM/VA/OW/22411/2013) dated September 4, 2013, SEBI has granted us anexemption from the requirements of paragraph 3.2.3 of the DebtApplication Circular (which requires allotments in a publicissue of debt securities to be carried out on a “date-time priority”basis) and allowed us to effect Allotments of Bonds inthis Issue on the basis of the date of upload of Applicationson the electronic Application platform of the relevant StockExchange(s). Accordingly, Allotments of Bonds in this Issuewill be on a first come-first serve basis, on the basis of the dateof upload of Applications on the electronic Application platformof the relevant Stock Exchange(s).(b) Allotments in the first instance:i. Applicants belonging to the Category I, in the first instance,will be allocated Bonds upto 10% of the Overall Issue Size onfirst come first serve basis (determined on the basis of date ofupload of the Applications on the electronic Application platformof the relevant Stock Exchange(s));ii.Applicants belonging to the Category II, in the first instance,will be allocated Bonds upto 20% of Overall Issue Size on firstcome first serve basis (determined on the basis of date ofupload of the Applications on the electronic Application platformof the relevant Stock Exchange(s));iii. Applicants belonging to the Category III, in the first instance,will be allocated Bonds upto 30% of Overall Issue Size on firstcome first serve basis (determined on the basis of date ofupload of the Applications on the electronic Application platformof the relevant Stock Exchange(s));iv. Applicants belonging to the Category IV, in the first instance,will be allocated Bonds upto 40% of Overall Issue Size on firstcome first serve basis (determined on the basis of date ofupload of the Applications on the electronic Application platformof the relevant Stock Exchange(s)).(c) Under subscriptionIf there is any under subscription in any Portion, priority inAllotments will be given in the following order:i. Category IV Portion;ii. Category III Portion;iii. Category II Portion; andiv. Category I Portion.(d) For all Portions, all Applications uploaded on the same day onthe electronic Application platform of the relevant StockExchange(s) would be treated at par with each other.(e) Minimum allotments of one Bond would be made in case ofeach valid Application.(f) Allotments in case of oversubscription:In case of an oversubscription in any of the Portions, Allotmentsto the maximum extent, as possible, will be made on afirst-come first-serve basis and thereafter on proportionatebasis, i.e. full Allotment of Bonds to the Applicants on a firstcome first basis up to the date falling 1 (one) day prior to thedate of oversubscription and proportionate allotment of Bondsto the Applicants on the date of oversubscription (determinedon the basis of date of upload of the Applications on theelectronic Application platform of the relevant StockExchange(s), in each Portion). The method of proportionateallotment is as described below:20 <strong>HOUSING</strong> <strong>AND</strong> <strong>URBAN</strong> <strong>DEVELOPMENT</strong> <strong>CORPORATION</strong> <strong>LIMITED</strong>i. Allotments to the applicants shall be made in proportion totheir respective Application size, rounded off to the nearestinteger,ii.If the process of rounding off to the nearest integer results inthe actual allocation of Bonds being higher than the Issuesize, not all applicants will be allotted the number of Bondsarrived at after such rounding off. Rather, each Applicant whoseAllotment size, prior to rounding off, had the highest decimalpoint would be given preference;iii. In the event, there are more than one Applicant whose entitlementremains equal after the manner of distribution referred toabove, our Company will ensure that the basis of allotment isfinalised by draw of lots in a fair and equitable manner.(g) Applicants applying for more than one Series of Bonds:If an Applicant has applied for more than one Series of Bonds,and in case such Applicant is entitled to allocation of only apart of the aggregate number of Bonds applied for, the Serieswiseallocation of Bonds to such Applicants shall be in proportionto the number of Bonds with respect to each Series,applied for by such Applicant, subject to rounding off to thenearest integer, as appropriate, in consultation with the LeadManagers and the Stock Exchanges.All decisions pertaining to the basis of allotment of Bonds pursuantto the Issue shall be taken by our Company in consultationwith the Lead Managers, and the Designated Stock Exchange andin compliance with the aforementioned provisions of the ProspectusTranche – I. Our Company would allot Tranche – I Series1 A/ Tranche – I Series 1B Bonds (depending upon the categoryof Applicants) to all valid Applications, wherein the Applicantshave not indicated their choice of Series of Bonds.38. Retention of oversubscriptionOur Company is making a public issue of the Bonds aggregatingupto ` 750 crore * with an option to retain oversubscription ofBonds up to ` 4,809.20 crore.*In terms of the CBDT Notification, in addition to the tranche(s)of public issue, our Company may also raise Bonds on a privateplacement basis in one or more tranches during the process ofthe present Issue, not exceeding ` 1,500 crores, i.e. upto 30% ofthe allocated limit for raising funds through the Bonds duringthe Fiscal 2013, at its discretion. Our Company shall ensurethat Bonds issued through the public issue route and privateplacement route shall together not exceed ` 4,809.20 crores. Incase our Company raises funds through private placementsduring the process of the present Issue, the Shelf Limit for theIssue shall get reduced by such amount raised.39. Grouping of Applications and allocation ratioFor the purposes of the Basis of Allotment:A. Applications received from Category I Applicants: Applicationsreceived from Applicants belonging to Category I shallbe grouped together, (“QIB Portion”);B. Applications received from Category II Applicants: Applicationsreceived from Applicants belonging to Category II, shallbe grouped together, (“Corporate Portion”);C. Applications received from Category III Applicants: Applicationsreceived from Applicants belonging to Category IIIshall be grouped together, (“High Net Worth Individual Portion”);andD. Applications received from Category IV Applicants: Applicationsreceived from Applicants belonging to Category IVshall be grouped together, (“Retail Individual Investor Portion”).