TRANSPORT

A4 Application Form Resident.pmd - HDFC Bank

A4 Application Form Resident.pmd - HDFC Bank

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

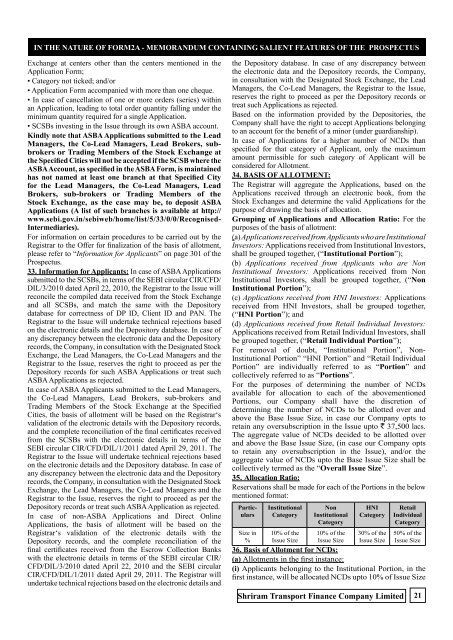

in the nature of FORM2A - MEMORANDUM CONTAINING SALIENT FEATURES OF THE PROSPECTUSExchange at centers other than the centers mentioned in theApplication Form;• Category not ticked; and/or• Application Form accompanied with more than one cheque.• In case of cancellation of one or more orders (series) withinan Application, leading to total order quantity falling under theminimum quantity required for a single Application.• SCSBs investing in the Issue through its own ASBA account.Kindly note that ASBA Applications submitted to the LeadManagers, the Co-Lead Managers, Lead Brokers, subbrokersor Trading Members of the Stock Exchange atthe Specified Cities will not be accepted if the SCSB where theASBA Account, as specified in the ASBA Form, is maintainedhas not named at least one branch at that Specified Cityfor the Lead Managers, the Co-Lead Managers, LeadBrokers, sub-brokers or Trading Members of theStock Exchange, as the case may be, to deposit ASBAApplications (A list of such branches is available at http://www.sebi.gov.in/sebiweb/home/list/5/33/0/0/Recognised-Intermediaries).For information on certain procedures to be carried out by theRegistrar to the Offer for finalization of the basis of allotment,please refer to “Information for Applicants” on page 301 of theProspectus.33. Information for Applicants: In case of ASBA Applicationssubmitted to the SCSBs, in terms of the SEBI circular CIR/CFD/DIL/3/2010 dated April 22, 2010, the Registrar to the Issue willreconcile the compiled data received from the Stock Exchangeand all SCSBs, and match the same with the Depositorydatabase for correctness of DP ID, Client ID and PAN. TheRegistrar to the Issue will undertake technical rejections basedon the electronic details and the Depository database. In case ofany discrepancy between the electronic data and the Depositoryrecords, the Company, in consultation with the Designated StockExchange, the Lead Managers, the Co-Lead Managers and theRegistrar to the Issue, reserves the right to proceed as per theDepository records for such ASBA Applications or treat suchASBA Applications as rejected.In case of ASBA Applicants submitted to the Lead Managers,the Co-Lead Managers, Lead Brokers, sub-brokers andTrading Members of the Stock Exchange at the SpecifiedCities, the basis of allotment will be based on the Registrar‘svalidation of the electronic details with the Depository records,and the complete reconciliation of the final certificates receivedfrom the SCSBs with the electronic details in terms of theSEBI circular CIR/CFD/DIL/1/2011 dated April 29, 2011. TheRegistrar to the Issue will undertake technical rejections basedon the electronic details and the Depository database. In case ofany discrepancy between the electronic data and the Depositoryrecords, the Company, in consultation with the Designated StockExchange, the Lead Managers, the Co-Lead Managers and theRegistrar to the Issue, reserves the right to proceed as per theDepository records or treat such ASBA Application as rejected.In case of non-ASBA Applications and Direct OnlineApplications, the basis of allotment will be based on theRegistrar‘s validation of the electronic details with theDepository records, and the complete reconciliation of thefinal certificates received from the Escrow Collection Bankswith the electronic details in terms of the SEBI circular CIR/CFD/DIL/3/2010 dated April 22, 2010 and the SEBI circularCIR/CFD/DIL/1/2011 dated April 29, 2011. The Registrar willundertake technical rejections based on the electronic details andthe Depository database. In case of any discrepancy betweenthe electronic data and the Depository records, the Company,in consultation with the Designated Stock Exchange, the LeadManagers, the Co-Lead Managers, the Registrar to the Issue,reserves the right to proceed as per the Depository records ortreat such Applications as rejected.Based on the information provided by the Depositories, theCompany shall have the right to accept Applications belongingto an account for the benefit of a minor (under guardianship).In case of Applications for a higher number of NCDs thanspecified for that category of Applicant, only the maximumamount permissible for such category of Applicant will beconsidered for Allotment.34. BASIS OF ALLOTMENT:The Registrar will aggregate the Applications, based on theApplications received through an electronic book, from theStock Exchanges and determine the valid Applications for thepurpose of drawing the basis of allocation.Grouping of Applications and Allocation Ratio: For thepurposes of the basis of allotment:(a) Applications received from Applicants who are InstitutionalInvestors: Applications received from Institutional Investors,shall be grouped together, (“Institutional Portion”);(b) Applications received from Applicants who are NonInstitutional Investors: Applications received from NonInstitutional Investors, shall be grouped together, (“NonInstitutional Portion”);(c) Applications received from HNI Investors: Applicationsreceived from HNI Investors, shall be grouped together,(“HNI Portion”); and(d) Applications received from Retail Individual Investors:Applications received from Retail Individual Investors, shallbe grouped together, (“Retail Individual Portion”);For removal of doubt, “Institutional Portion”, Non-Institutional Portion” “HNI Portion” and “Retail IndividualPortion” are individually referred to as “Portion” andcollectively referred to as “Portions”.For the purposes of determining the number of NCDsavailable for allocation to each of the abovementionedPortions, our Company shall have the discretion ofdetermining the number of NCDs to be allotted over andabove the Base Issue Size, in case our Company opts toretain any oversubscription in the Issue upto ` 37,500 lacs.The aggregate value of NCDs decided to be allotted overand above the Base Issue Size, (in case our Company optsto retain any oversubscription in the Issue), and/or theaggregate value of NCDs upto the Base Issue Size shall becollectively termed as the “Overall Issue Size”.35. Allocation Ratio:Reservations shall be made for each of the Portions in the belowmentioned format:ParticularsSize in%InstitutionalCategory10% of theIssue SizeNonInstitutionalCategory10% of theIssue SizeHNICategory30% of theIssue SizeShriram Transport Finance Company LimitedRetailIndividualCategory50% of theIssue Size36. Basis of Allotment for NCDs:(a) Allotments in the first instance:(i) Applicants belonging to the Institutional Portion, in thefirst instance, will be allocated NCDs upto 10% of Issue Size21