TRANSPORT

A4 Application Form Resident.pmd - HDFC Bank

A4 Application Form Resident.pmd - HDFC Bank

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

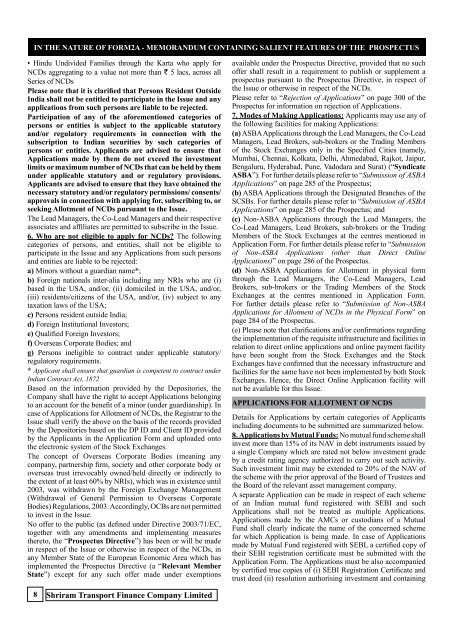

in the nature of FORM2A - MEMORANDUM CONTAINING SALIENT FEATURES OF THE PROSPECTUS• Hindu Undivided Families through the Karta who apply forNCDs aggregating to a value not more than ` 5 lacs, across allSeries of NCDsPlease note that it is clarified that Persons Resident OutsideIndia shall not be entitled to participate in the Issue and anyapplications from such persons are liable to be rejected.Participation of any of the aforementioned categories ofpersons or entities is subject to the applicable statutoryand/or regulatory requirements in connection with thesubscription to Indian securities by such categories ofpersons or entities. Applicants are advised to ensure thatApplications made by them do not exceed the investmentlimits or maximum number of NCDs that can be held by themunder applicable statutory and or regulatory provisions.Applicants are advised to ensure that they have obtained thenecessary statutory and/or regulatory permissions/ consents/approvals in connection with applying for, subscribing to, orseeking Allotment of NCDs pursuant to the Issue.The Lead Managers, the Co-Lead Managers and their respectiveassociates and affiliates are permitted to subscribe in the Issue.6. Who are not eligible to apply for NCDs? The followingcategories of persons, and entities, shall not be eligible toparticipate in the Issue and any Applications from such personsand entities are liable to be rejected:a) Minors without a guardian name*;b) Foreign nationals inter-alia including any NRIs who are (i)based in the USA, and/or, (ii) domiciled in the USA, and/or,(iii) residents/citizens of the USA, and/or, (iv) subject to anytaxation laws of the USA;c) Persons resident outside India;d) Foreign Institutional Investors;e) Qualified Foreign Investors;f) Overseas Corporate Bodies; andg) Persons ineligible to contract under applicable statutory/regulatory requirements.* Applicant shall ensure that guardian is competent to contract underIndian Contract Act, 1872Based on the information provided by the Depositories, theCompany shall have the right to accept Applications belongingto an account for the benefit of a minor (under guardianship). Incase of Applications for Allotment of NCDs, the Registrar to theIssue shall verify the above on the basis of the records providedby the Depositories based on the DP ID and Client ID providedby the Applicants in the Application Form and uploaded ontothe electronic system of the Stock Exchanges.The concept of Overseas Corporate Bodies (meaning anycompany, partnership firm, society and other corporate body oroverseas trust irrevocably owned/held directly or indirectly tothe extent of at least 60% by NRIs), which was in existence until2003, was withdrawn by the Foreign Exchange Management(Withdrawal of General Permission to Overseas CorporateBodies) Regulations, 2003. Accordingly, OCBs are not permittedto invest in the Issue.No offer to the public (as defined under Directive 2003/71/EC,together with any amendments and implementing measuresthereto, the “Prospectus Directive”) has been or will be madein respect of the Issue or otherwise in respect of the NCDs, inany Member State of the European Economic Area which hasimplemented the Prospectus Directive (a “Relevant MemberState”) except for any such offer made under exemptionsavailable under the Prospectus Directive, provided that no suchoffer shall result in a requirement to publish or supplement aprospectus pursuant to the Prospectus Directive, in respect ofthe Issue or otherwise in respect of the NCDs.Please refer to “Rejection of Applications” on page 300 of theProspectus for information on rejection of Applications.7. Modes of Making Applications: Applicants may use any ofthe following facilities for making Applications:(a) ASBA Applications through the Lead Managers, the Co-LeadManagers, Lead Brokers, sub-brokers or the Trading Membersof the Stock Exchanges only in the Specified Cities (namely,Mumbai, Chennai, Kolkata, Delhi, Ahmedabad, Rajkot, Jaipur,Bengaluru, Hyderabad, Pune, Vadodara and Surat) (“SyndicateASBA”). For further details please refer to “Submission of ASBAApplications” on page 285 of the Prospectus;(b) ASBA Applications through the Designated Branches of theSCSBs. For further details please refer to “Submission of ASBAApplications” on page 285 of the Prospectus; and(c) Non-ASBA Applications through the Lead Managers, theCo-Lead Managers, Lead Brokers, sub-brokers or the TradingMembers of the Stock Exchanges at the centres mentioned inApplication Form. For further details please refer to “Submissionof Non-ASBA Applications (other than Direct OnlineApplications)” on page 286 of the Prospectus.(d) Non-ASBA Applications for Allotment in physical formthrough the Lead Managers, the Co-Lead Managers, LeadBrokers, sub-brokers or the Trading Members of the StockExchanges at the centres mentioned in Application Form.For further details please refer to “Submission of Non-ASBAApplications for Allotment of NCDs in the Physical Form” onpage 284 of the Prospectus.(e) Please note that clarifications and/or confirmations regardingthe implementation of the requisite infrastructure and facilities inrelation to direct online applications and online payment facilityhave been sought from the Stock Exchanges and the StockExchanges have confirmed that the necessary infrastructure andfacilities for the same have not been implemented by both StockExchanges. Hence, the Direct Online Application facility willnot be available for this Issue.APPLICATIONS FOR ALLOTMENT OF NCDsDetails for Applications by certain categories of Applicantsincluding documents to be submitted are summarized below.8. Applications by Mutual Funds: No mutual fund scheme shallinvest more than 15% of its NAV in debt instruments issued bya single Company which are rated not below investment gradeby a credit rating agency authorized to carry out such activity.Such investment limit may be extended to 20% of the NAV ofthe scheme with the prior approval of the Board of Trustees andthe Board of the relevant asset management company.A separate Application can be made in respect of each schemeof an Indian mutual fund registered with SEBI and suchApplications shall not be treated as multiple Applications.Applications made by the AMCs or custodians of a MutualFund shall clearly indicate the name of the concerned schemefor which Application is being made. In case of Applicationsmade by Mutual Fund registered with SEBI, a certified copy oftheir SEBI registration certificate must be submitted with theApplication Form. The Applications must be also accompaniedby certified true copies of (i) SEBI Registration Certificate andtrust deed (ii) resolution authorising investment and containing8 Shriram Transport Finance Company Limited