TRANSPORT

A4 Application Form Resident.pmd - HDFC Bank

A4 Application Form Resident.pmd - HDFC Bank

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

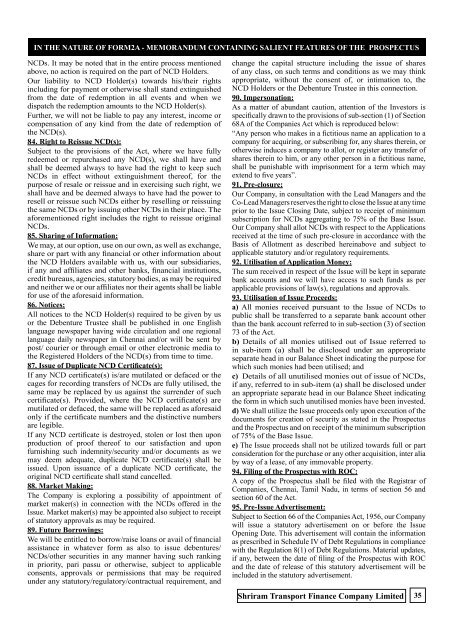

in the nature of FORM2A - MEMORANDUM CONTAINING SALIENT FEATURES OF THE PROSPECTUSNCDs. It may be noted that in the entire process mentionedabove, no action is required on the part of NCD Holders.Our liability to NCD Holder(s) towards his/their rightsincluding for payment or otherwise shall stand extinguishedfrom the date of redemption in all events and when wedispatch the redemption amounts to the NCD Holder(s).Further, we will not be liable to pay any interest, income orcompensation of any kind from the date of redemption ofthe NCD(s).84. Right to Reissue NCD(s):Subject to the provisions of the Act, where we have fullyredeemed or repurchased any NCD(s), we shall have andshall be deemed always to have had the right to keep suchNCDs in effect without extinguishment thereof, for thepurpose of resale or reissue and in exercising such right, weshall have and be deemed always to have had the power toresell or reissue such NCDs either by reselling or reissuingthe same NCDs or by issuing other NCDs in their place. Theaforementioned right includes the right to reissue originalNCDs.85. Sharing of Information:We may, at our option, use on our own, as well as exchange,share or part with any financial or other information aboutthe NCD Holders available with us, with our subsidiaries,if any and affiliates and other banks, financial institutions,credit bureaus, agencies, statutory bodies, as may be requiredand neither we or our affiliates nor their agents shall be liablefor use of the aforesaid information.86. Notices:All notices to the NCD Holder(s) required to be given by usor the Debenture Trustee shall be published in one Englishlanguage newspaper having wide circulation and one regionallanguage daily newspaper in Chennai and/or will be sent bypost/ courier or through email or other electronic media tothe Registered Holders of the NCD(s) from time to time.87. Issue of Duplicate NCD Certificate(s):If any NCD certificate(s) is/are mutilated or defaced or thecages for recording transfers of NCDs are fully utilised, thesame may be replaced by us against the surrender of suchcertificate(s). Provided, where the NCD certificate(s) aremutilated or defaced, the same will be replaced as aforesaidonly if the certificate numbers and the distinctive numbersare legible.If any NCD certificate is destroyed, stolen or lost then uponproduction of proof thereof to our satisfaction and uponfurnishing such indemnity/security and/or documents as wemay deem adequate, duplicate NCD certificate(s) shall beissued. Upon issuance of a duplicate NCD certificate, theoriginal NCD certificate shall stand cancelled.88. Market Making:The Company is exploring a possibility of appointment ofmarket maker(s) in connection with the NCDs offered in theIssue. Market maker(s) may be appointed also subject to receiptof statutory approvals as may be required.89. Future Borrowings:We will be entitled to borrow/raise loans or avail of financialassistance in whatever form as also to issue debentures/NCDs/other securities in any manner having such rankingin priority, pari passu or otherwise, subject to applicableconsents, approvals or permissions that may be requiredunder any statutory/regulatory/contractual requirement, andchange the capital structure including the issue of sharesof any class, on such terms and conditions as we may thinkappropriate, without the consent of, or intimation to, theNCD Holders or the Debenture Trustee in this connection.90. Impersonation:As a matter of abundant caution, attention of the Investors isspecifically drawn to the provisions of sub-section (1) of Section68A of the Companies Act which is reproduced below:“Any person who makes in a fictitious name an application to acompany for acquiring, or subscribing for, any shares therein, orotherwise induces a company to allot, or register any transfer ofshares therein to him, or any other person in a fictitious name,shall be punishable with imprisonment for a term which mayextend to five years”.91. Pre-closure:Our Company, in consultation with the Lead Managers and theCo-Lead Managers reserves the right to close the Issue at any timeprior to the Issue Closing Date, subject to receipt of minimumsubscription for NCDs aggregating to 75% of the Base Issue.Our Company shall allot NCDs with respect to the Applicationsreceived at the time of such pre-closure in accordance with theBasis of Allotment as described hereinabove and subject toapplicable statutory and/or regulatory requirements.92. Utilisation of Application Money:The sum received in respect of the Issue will be kept in separatebank accounts and we will have access to such funds as perapplicable provisions of law(s), regulations and approvals.93. Utilisation of Issue Proceeds:a) All monies received pursuant to the Issue of NCDs topublic shall be transferred to a separate bank account otherthan the bank account referred to in sub-section (3) of section73 of the Act.b) Details of all monies utilised out of Issue referred toin sub-item (a) shall be disclosed under an appropriateseparate head in our Balance Sheet indicating the purpose forwhich such monies had been utilised; andc) Details of all unutilised monies out of issue of NCDs,if any, referred to in sub-item (a) shall be disclosed underan appropriate separate head in our Balance Sheet indicatingthe form in which such unutilised monies have been invested.d) We shall utilize the Issue proceeds only upon execution of thedocuments for creation of security as stated in the Prospectusand the Prospectus and on receipt of the minimum subscriptionof 75% of the Base Issue.e) The Issue proceeds shall not be utilized towards full or partconsideration for the purchase or any other acquisition, inter aliaby way of a lease, of any immovable property.94. Filing of the Prospectus with ROC:A copy of the Prospectus shall be filed with the Registrar ofCompanies, Chennai, Tamil Nadu, in terms of section 56 andsection 60 of the Act.95. Pre-Issue Advertisement:Subject to Section 66 of the Companies Act, 1956, our Companywill issue a statutory advertisement on or before the IssueOpening Date. This advertisement will contain the informationas prescribed in Schedule IV of Debt Regulations in compliancewith the Regulation 8(1) of Debt Regulations. Material updates,if any, between the date of filing of the Prospectus with ROCand the date of release of this statutory advertisement will beincluded in the statutory advertisement.Shriram Transport Finance Company Limited35