TRANSPORT

A4 Application Form Resident.pmd - HDFC Bank

A4 Application Form Resident.pmd - HDFC Bank

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

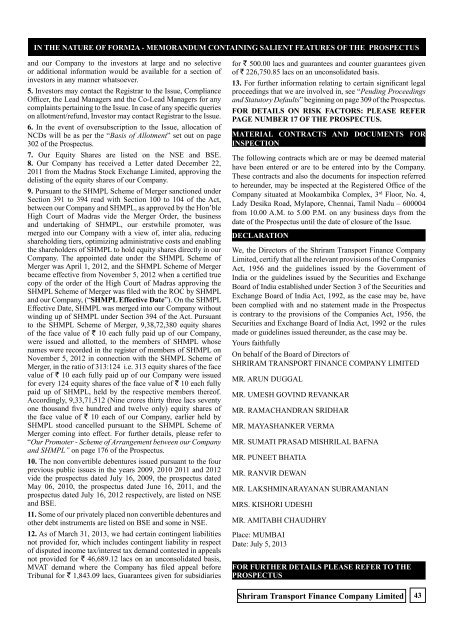

in the nature of FORM2A - MEMORANDUM CONTAINING SALIENT FEATURES OF THE PROSPECTUSand our Company to the investors at large and no selectiveor additional information would be available for a section ofinvestors in any manner whatsoever.5. Investors may contact the Registrar to the Issue, ComplianceOfficer, the Lead Managers and the Co-Lead Managers for anycomplaints pertaining to the Issue. In case of any specific querieson allotment/refund, Investor may contact Registrar to the Issue.6. In the event of oversubscription to the Issue, allocation ofNCDs will be as per the “Basis of Allotment” set out on page302 of the Prospectus.7. Our Equity Shares are listed on the NSE and BSE.8. Our Company has received a Letter dated December 22,2011 from the Madras Stock Exchange Limited, approving thedelisting of the equity shares of our Company.9. Pursuant to the SHMPL Scheme of Merger sanctioned underSection 391 to 394 read with Section 100 to 104 of the Act,between our Company and SHMPL, as approved by the Hon’bleHigh Court of Madras vide the Merger Order, the businessand undertaking of SHMPL, our erstwhile promoter, wasmerged into our Company with a view of, inter alia, reducingshareholding tiers, optimizing administrative costs and enablingthe shareholders of SHMPL to hold equity shares directly in ourCompany. The appointed date under the SHMPL Scheme ofMerger was April 1, 2012, and the SHMPL Scheme of Mergerbecame effective from November 5, 2012 when a certified truecopy of the order of the High Court of Madras approving theSHMPL Scheme of Merger was filed with the ROC by SHMPLand our Company, (“SHMPL Effective Date”). On the SHMPLEffective Date, SHMPL was merged into our Company withoutwinding up of SHMPL under Section 394 of the Act. Pursuantto the SHMPL Scheme of Merger, 9,38,72,380 equity sharesof the face value of ` 10 each fully paid up of our Company,were issued and allotted, to the members of SHMPL whosenames were recorded in the register of members of SHMPL onNovember 5, 2012 in connection with the SHMPL Scheme ofMerger, in the ratio of 313:124 i.e. 313 equity shares of the facevalue of ` 10 each fully paid up of our Company were issuedfor every 124 equity shares of the face value of ` 10 each fullypaid up of SHMPL, held by the respective members thereof.Accordingly, 9,33,71,512 (Nine crores thirty three lacs seventyone thousand five hundred and twelve only) equity shares ofthe face value of ` 10 each of our Company, earlier held bySHMPL stood cancelled pursuant to the SHMPL Scheme ofMerger coming into effect. For further details, please refer to“Our Promoter - Scheme of Arrangement between our Companyand SHMPL” on page 176 of the Prospectus.10. The non convertible debentures issued pursuant to the fourprevious public issues in the years 2009, 2010 2011 and 2012vide the prospectus dated July 16, 2009, the prospectus datedMay 06, 2010, the prospectus dated June 16, 2011, and theprospectus dated July 16, 2012 respectively, are listed on NSEand BSE.11. Some of our privately placed non convertible debentures andother debt instruments are listed on BSE and some in NSE.12. As of March 31, 2013, we had certain contingent liabilitiesnot provided for, which includes contingent liability in respectof disputed income tax/interest tax demand contested in appealsnot provided for ` 46,689.12 lacs on an unconsolidated basis,MVAT demand where the Company has filed appeal beforeTribunal for ` 1,843.09 lacs, Guarantees given for subsidiariesfor ` 500.00 lacs and guarantees and counter guarantees givenof ` 226,750.85 lacs on an unconsolidated basis.13. For further information relating to certain significant legalproceedings that we are involved in, see “Pending Proceedingsand Statutory Defaults” beginning on page 309 of the Prospectus.FOR DETAILS ON RISK FACTORS: PLEASE REFERPAGE NUMBER 17 OF THE PROSPECTUS.MATERIAL CONTRACTS AND DOCUMENTS FORINSPECTIONThe following contracts which are or may be deemed materialhave been entered or are to be entered into by the Company.These contracts and also the documents for inspection referredto hereunder, may be inspected at the Registered Office of theCompany situated at Mookambika Complex, 3 rd Floor, No. 4,Lady Desika Road, Mylapore, Chennai, Tamil Nadu – 600004from 10.00 A.M. to 5.00 P.M. on any business days from thedate of the Prospectus until the date of closure of the Issue.DeclarationWe, the Directors of the Shriram Transport Finance CompanyLimited, certify that all the relevant provisions of the CompaniesAct, 1956 and the guidelines issued by the Government ofIndia or the guidelines issued by the Securities and ExchangeBoard of India established under Section 3 of the Securities andExchange Board of India Act, 1992, as the case may be, havebeen complied with and no statement made in the Prospectusis contrary to the provisions of the Companies Act, 1956, theSecurities and Exchange Board of India Act, 1992 or the rulesmade or guidelines issued thereunder, as the case may be.Yours faithfullyOn behalf of the Board of Directors ofSHRIRAM <strong>TRANSPORT</strong> FINANCE COMPANY LIMITEDMR. ARUN DUGGALMR. UMESH GOVIND REVANKARMR. RAMACHANDRAN SRIDHARMR. MAYASHANKER VERMAMR. SUMATI PRASAD MISHRILAL BAFNAMR. PUNEET BHATIAMR. RANVIR DEWANMR. LAKSHMINARAYANAN SUBRAMANIANMRS. KISHORI UDESHIMR. AMITABH CHAUDHRYPlace: MUMBAIDate: July 5, 2013FOR FURTHER DETAILS PLEASE REFER TO THEPROSPECTUSShriram Transport Finance Company Limited43