Table of Contents

Long Term Council Community Plan 2006-2016 - Waikato District ...

Long Term Council Community Plan 2006-2016 - Waikato District ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

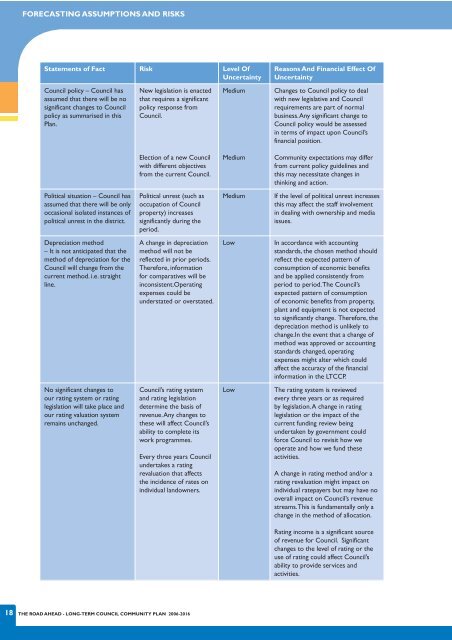

FORECASTING ASSUMPTIONS AND RISKSStatements <strong>of</strong> Fact Risk Level OfUncertaintyCouncil policy – Council hasassumed that there will be nosignificant changes to Councilpolicy as summarised in thisPlan.New legislation is enactedthat requires a significantpolicy response fromCouncil.MediumReasons And Financial Effect OfUncertaintyChanges to Council policy to dealwith new legislative and Councilrequirements are part <strong>of</strong> normalbusiness. Any significant change toCouncil policy would be assessedin terms <strong>of</strong> impact upon Council’sfinancial position.Election <strong>of</strong> a new Councilwith different objectivesfrom the current Council.MediumCommunity expectations may differfrom current policy guidelines andthis may necessitate changes inthinking and action.Political situation – Council hasassumed that there will be onlyoccasional isolated instances <strong>of</strong>political unrest in the district.Political unrest (such asoccupation <strong>of</strong> Councilproperty) increasessignificantly during theperiod.MediumIf the level <strong>of</strong> political unrest increasesthis may affect the staff involvementin dealing with ownership and mediaissues.Depreciation method– It is not anticipated that themethod <strong>of</strong> depreciation for theCouncil will change from thecurrent method. i.e. straightline.A change in depreciationmethod will not bereflected in prior periods.Therefore, informationfor comparatives will beinconsistent.Operatingexpenses could beunderstated or overstated.LowIn accordance with accountingstandards, the chosen method shouldreflect the expected pattern <strong>of</strong>consumption <strong>of</strong> economic benefitsand be applied consistently fromperiod to period. The Council’sexpected pattern <strong>of</strong> consumption<strong>of</strong> economic benefits from property,plant and equipment is not expectedto significantly change. Therefore, thedepreciation method is unlikely tochange.In the event that a change <strong>of</strong>method was approved or accountingstandards changed, operatingexpenses might alter which couldaffect the accuracy <strong>of</strong> the financialinformation in the LTCCP.No significant changes toour rating system or ratinglegislation will take place andour rating valuation systemremains unchanged.Council’s rating systemand rating legislationdetermine the basis <strong>of</strong>revenue. Any changes tothese will affect Council’sability to complete itswork programmes.Every three years Councilundertakes a ratingrevaluation that affectsthe incidence <strong>of</strong> rates onindividual landowners.LowThe rating system is reviewedevery three years or as requiredby legislation. A change in ratinglegislation or the impact <strong>of</strong> thecurrent funding review beingundertaken by government couldforce Council to revisit how weoperate and how we fund theseactivities.A change in rating method and/or arating revaluation might impact onindividual ratepayers but may have nooverall impact on Council’s revenuestreams. This is fundamentally only achange in the method <strong>of</strong> allocation.Rating income is a significant source<strong>of</strong> revenue for Council. Significantchanges to the level <strong>of</strong> rating or theuse <strong>of</strong> rating could affect Council’sability to provide services andactivities.18 THE ROAD AHEAD - LONG-TERM COUNCIL COMMUNITY PLAN 2006-2016