The Brazos River Authority Waco Texas

2008 Comprehensive Annual Financial Report - Brazos River ...

2008 Comprehensive Annual Financial Report - Brazos River ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

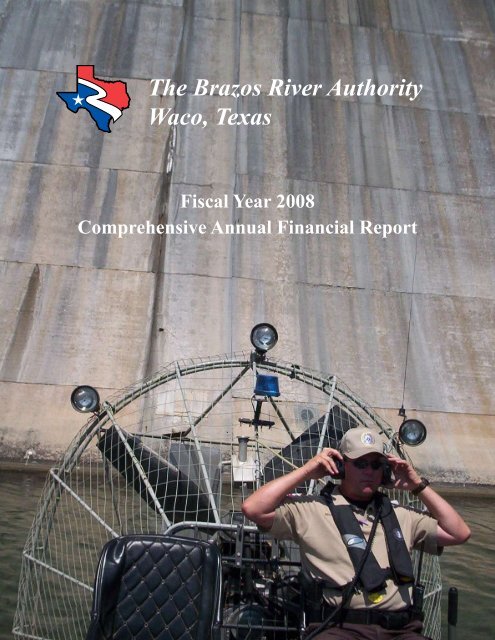

<strong>The</strong> <strong>Brazos</strong> <strong>River</strong> <strong>Authority</strong><strong>Waco</strong>, <strong>Texas</strong>Fiscal Year 2008Comprehensive Annual Financial Report

<strong>Brazos</strong><strong>River</strong><strong>Authority</strong>An agency of the State of <strong>Texas</strong>Comprehensive Annual Financial ReportFiscal Year Ended August 31, 2008Prepared by the Finance and Administration Department

BRAZOS RIVER AUTHORITYCOMPREHENSIVE ANNUAL FINANCIAL REPORTFOR THE FISCAL YEAR ENDED AUGUST 31, 2008TABLE OF CONTENTSPageINTRODUCTORY SECTION:Board of DirectorsManagement TeamOrganizational ChartLetter of TransmittalCertificate of Achievement for Excellence in Financial ReportingviviiiixxixxFINANCIAL SECTION:Independent Auditors’ Report 2Management’s Discussion & Analysis:Financial Highlights 6Overview of the Financial Statements 7Financial Analysis 8Capital Assets and Outstanding Debt 12Requests for Information 14Basic Financial Statements:Statements of Net Assets 16Statements of Revenues, Expenses, and Changes in Net Assets 18Statements of Cash Flows 19Combined Statements of Fiduciary Net Assets 20Notes to the Basic Financial Statements1. Summary of Significant Accounting Policies 212. Deposits and Investments 243. Restricted Assets 274. Capital Assets 295. Unearned Revenues 306. Long-Term Debt 317. Retirement Plan 368. Financing Arrangements 419. Segment Information 4310. Commitments & Contingencies 4611. Risk Management 4712. Board Designated Reserves 4713. Related Party Transactions 4814. Recently Issued GASB Statements 48ii

BRAZOS RIVER AUTHORITYCOMPREHENSIVE ANNUAL FINANCIAL REPORTFOR THE FISCAL YEAR ENDED AUGUST 31, 2008TABLE OF CONTENTSPageSupplemental Information:Combining Statements of Fiduciary Net Assets 50Schedule of Changes in Assets and Liabilities (Agency Funds) 51Comparison of Budgeted Revenues and Expenditures to Actual (Non-GAAP Basis) 52STATISTICAL SECTION (Unaudited):Contents 54Changes in Net Assets 55Net Assets by Component 56Budgeted Long-Term Water Supply Revenues by Contract Type 56Major Customers – All Operations 58Major Customers – Water Supply System (WSS) 59Water Supply Revenue Bond Debt Series 2001A, Series 2001B, Series 2002 AMT, Series 2005AAnd Series 2005B Amortization Schedule 60Water Supply Revenue Bonds Series 2001A, Series 2001B, Series 2002 AMT, Series 2005AAnd Series 2005B Coverage and Account Balances 61Condensed Summary of Operating Results (calculation based on bond resolution requirements) 62Possum Kingdom Electric Power Generation and Lake Elevations 64Miscellaneous Demographic and Economic Information 66Schedule of Insurance 74Full-Time Equivalent 76iii

Introductory Section2008 Comprehensive Annual Financial Reportv

Richard BallDirectorJohn SteinmetzDirectorLubbockUpperRegionZachary S.BradyDirectorAbileneTuscolaGradyBarrDirectorF. LeroyBellDirectorPatriciaBailonDirectorScott D.SmithDirector2008Board of DirectorsJon SloanDirectorSalvatore A.ZaccagninoDirectorvi

<strong>Brazos</strong><strong>River</strong><strong>Authority</strong>Wade ComptonGearSecretaryMary WardDirectorChristopher S.Adams Jr.DirectorMineral WellsPeter BennisDirectorGranburyCleburneChristopher D.DeCluittPresiding OfficerCliftonRobert M.ChristianDirectorCentralRegion<strong>Waco</strong>BeltonJewettCedar ParkLowerRegionRound RockBryanCaldwellSomervilleMark J.CarrabbaDirectorWillisBilly WayneMooreDirectorBrenhamSugar LandNancy PorterDirectorJean KillgoreDirectorJohnBriedenDirectorCarolyn JohnsonAssistantPresiding OfficerFreeportvii

vManagement TeamPhillip J. FordGeneral Manager/CEOLauralee VallonGeneral CounselJohn HawesChief Financial OfficerJohn BakerTechnical ServicesMgr./AssistantGeneral ManagerJim FortePlanning &Development Mgr.Pat GillInformationTechnology Mgr.John HofmannCentral & LowerBasin ManagerTerry LopasSpecial ProjectsManagerMatt PhillipsGov. & CustomerRelations ManagerKent RindyUpper BasinManagerDavid WheelockWater ServicesManagerMonica WheelisHuman Resource Mgr.Don WoodsInternal Auditorviii

<strong>Brazos</strong> <strong>River</strong> <strong>Authority</strong>Organizational ChartCONSTITUENCY/CUSTOMERS OF THE BRAAdvisory Boards, Water Customers, Elected Officials, Bond Rating Companies, Citizens of the <strong>Brazos</strong> <strong>River</strong> BasinGovernor of<strong>Texas</strong>Chief Financial OfficerInformation TechnologyPlanning and DevelopmentStrategic Planning/Special ProjectsBoard of DirectorsGeneral Manager& CEOInternal AuditorGov’t & Customer RelationsHuman ResourcesGeneral CounselTechnicalServicesMgr./Asst.General Mgr.Upper BasinManagerCentral/Lower Basin ManagerConstructionand PropertyServicesWater PlantSuperintendentRegionalSuperintendentRegional WaterPlantsSuperintendentWater Services,FederalReservoirs &Purchased WaterRegional LakeProject Mgr.Lake ProjectManagerEnvironmentalServicesRegionalEnvironmentalServicesRegionalEnvironmentalServicesRegionalEnvironmentalServicesEmergency,Safety &ComplianceProgramsRegionalBusinessDevelopmentRegionalBusinessDevelopmentRegionalBusinessDevelopmentEngineeringRegional Gov.& CustomerRelationsRegional Gov.& CustomerRelationsviix

PROFILE OF THE AUTHORITY<strong>The</strong> <strong>Authority</strong> was created by the <strong>Texas</strong> Legislature in 1929 as the first state agency in the UnitedStates specifically created for the purpose of developing and managing the water resources of an entireriver basin. Although the <strong>Authority</strong> is an agency of the State of <strong>Texas</strong>, it does not levy or collect taxes.With the exception of a relatively small number of governmental grants, the <strong>Authority</strong> is entirely selfsupporting,maintaining and operating reservoirs, transmission facilities, and treatment systems throughrevenues from the customers it serves.<strong>The</strong> <strong>Authority</strong>’s Board of Directors consists of 21 members appointed by the Governor and subjectto confirmation by the <strong>Texas</strong> Senate. Directors serve a six-year, staggered term, with one-third beingeither replaced or reappointed each odd-numbered year.<strong>The</strong> <strong>Authority</strong> functions under the direction of a General Manager/CEO. <strong>The</strong> more than 42,000 squaremiles that make up the <strong>Brazos</strong> <strong>River</strong> Basin are divided into geographic regions – each with distinctiveclimate, topography and water needs. Each region falls under the direction of a Regional BasinManager.Water Supply<strong>The</strong> <strong>Authority</strong> built, owns, and operates three reservoirs for water supply – Possum Kingdom Lake,Lake Granbury, and Lake Limestone. <strong>The</strong> <strong>Authority</strong> also contracts with the U.S. Army Corps ofEngineers (USACE) for storage space in nine multi-purpose Federal reservoirs – Lakes Whitney,Belton, Proctor, <strong>Waco</strong>, Somerville, Stillhouse Hollow, Granger, Georgetown and Aquilla. <strong>The</strong>se lakes,owned and operated by the USACE, provide flood control to the <strong>Brazos</strong> <strong>River</strong> basin as well as beingsources for water supply.Together, the twelve reservoirs have conservation storage of more than 800 billion gallons of water. <strong>The</strong><strong>Authority</strong> contracts to supply water from these reservoirs on a wholesale basis to municipal, industrialand agricultural water customers from West <strong>Texas</strong> to the Gulf Coast.Water and Wastewater Treatment<strong>The</strong> <strong>Authority</strong> operates potable (drinking) water treatment systems for Lee County Fresh Water Districtand the City of Leander and two regional water treatment systems, one at Lake Granbury and one atLake Granger. <strong>The</strong> plants have won numerous awards for operations, maintenance and design fromState and Federal governmental agencies.Wastewater treated and released by the <strong>Authority</strong> at its eight sewerage systems in Temple-Belton, SugarLand, Brushy Creek (in Williamson County), Lee County Fresh Water District, Clute, Hutto, LibertyHill and Georgetown is returned to the <strong>Brazos</strong> <strong>River</strong> cleaner than the water in the river flowing bythe plants. At the wastewater plants, waste separated from liquids in the treatment process are usedfor beneficial purposes. Wastes at the Temple-Belton plant is composted with wood chips and sold asfertilizers and soil enhancers. Waste from the Sugar Land plant is applied to farmland.xi

Water QualityWater quality is a high priority with the <strong>Brazos</strong> <strong>River</strong> <strong>Authority</strong>. Staff charged with environmentalconcerns work to protect and improve the quality of water resources in the <strong>Brazos</strong> <strong>River</strong> basin throughsampling and analysis. Since 1991, the <strong>Authority</strong> has contracted with the <strong>Texas</strong> Commission onEnvironmental Quality (TCEQ) to conduct the Clean <strong>River</strong>s Program for the basin. <strong>The</strong> <strong>Authority</strong>,working with other agencies and basin residents, identifies and evaluates water quality and watershedmanagement issues, establishes priorities for corrective actions, and works to implement those solutions.As part of a Basin Monitoring Program, the staff collects water quality samples at strategic locationsthroughout the <strong>Brazos</strong> <strong>River</strong> basin.Regional Water Planning<strong>The</strong> <strong>Authority</strong> supports and participates in ongoing regional water planning processes, including waterconservation, to meet water supply needs in the basin. <strong>The</strong> <strong>Authority</strong> participates in development ofregional water plans authorized by the <strong>Texas</strong> Legislature in 1997 with the passage of Senate Bill 1including Regions O (High Plains) and H (Houston-area), and serves as the administrative agency forRegion G (Central <strong>Texas</strong>).<strong>Brazos</strong>-Colorado Water AllianceIn 1995, the <strong>Authority</strong> and the Lower Colorado <strong>River</strong> <strong>Authority</strong> (LCRA) formed an Alliance to cooperatein the conservation, planning and development of regional water resources. <strong>The</strong> Alliance brings theresources of both river authorities to address immediate and long-term water and wastewater needs ofcustomers in Williamson County. In 1996, the Alliance signed a contract to purchase the City of RoundRock’s wastewater treatment facilities, now called the Brushy Creek Regional Wastewater System. In2002, the Alliance launched its first water treatment plant in Williamson County. Built by the LCRA andoperated by the <strong>Authority</strong>, the plant provides potable water to more than 16,000 residents of Leander. In2007, the Alliance completed the start-up of the Liberty Hill Wastewater System. Owned by the LCRAand operated by the <strong>Authority</strong>, the treatment facility will have an ultimate permit capacity of 1.2 milliongallons per day (MGD).ECONOMIC CONDITION AND OUTLOOK<strong>The</strong> information presented in the financial statements is perhaps best understood when it is consideredfrom the broader perspective of the specific environment within which the <strong>Authority</strong> operates.<strong>The</strong> economic events of the fiscal year ended August 31, 2008 set the stage for significant deteriorationin the financial markets. <strong>The</strong> sub-prime housing debacle began to heat up late in 2007 and has become adramatic financial crisis for the global economies. <strong>The</strong> U.S. Federal Open Markets Committee (FOMC)began adjusting to the threat of economic downturn in October 2007 as they lowered the Federal FundsRate by .25%, from 4.75% to 4.50%. Another move to lower rates by .25% was executed in December2007 as the FOMC continued to forecast economic distress, leaving the Funds rate at 4.25%.As the new year of 2008 began, the floor collapsed for many financial institutions that had participatedheavily in the sub-prime mortgage speculation. Over one weekend in January, the FOMC tookunprecedented action to call an emergency meeting to address the impending collapse of a majormarket player, Bear Stearns. <strong>The</strong> FOMC, working with the Federal Treasury Department, determinedxii

that the failure of Bear Stearns would cause severe economic damage and worked to orchestrate aFederally subsidized buyout of the firm by JPMorgan Chase. Immediately following this action, theFOMC announced that they were lowering the Federal Funds rate by an additional .75%, from 4.25%to 3.50%. <strong>The</strong> list of troubled institutions continued to grow and firms such as Lehman Brothers failed,while others such as AIG received Federal support. <strong>The</strong> U.S. Agencies, Federal National MortgageAssociation (Fannie Mae)and Federal Home Loan Mortgage Corporation (Freddie Mac), were takenunder the conservatorship of the U.S. Government to avoid their financial failure. <strong>The</strong> list of casualtiesfrom this downturn continues, includes name brand institutions, and has prompted the FOMC to slashrates four more times before making their latest cut on October 29, 2008. <strong>The</strong> current Federal FundsRate stands at 1.00%.Congress has done their part to keep the economy breathing. During September, Congress took emergencyaction to provide $700 billion in funding for the program entitled the “Troubled Asset Relief Program”.<strong>The</strong> Federal Reserve, the Treasury Department and Congress will use these funds as necessary to keepessential markets above water and avoid more widespread economic collapse. It is anticipated that thesefunds will be essential to bring the credit markets, which have grinded to a halt in recent months, backto life.While the national and global economies have experienced severe deterioration, the <strong>Texas</strong> economyhas been surprisingly expansive. During the past year, <strong>Texas</strong> gained almost 248,000 jobs, more thanthe next 14 top job-growth states combined. <strong>The</strong> <strong>Texas</strong> unemployment rate in September 2008 was5.1% compared with the 6.1% national rate. <strong>The</strong> housing market in <strong>Texas</strong> has experienced some recentvaluation decreases, but is far below the rate of decrease in other states. <strong>Texas</strong> foreclosure rates inAugust 2008 indicated only one in every 1,003 homes faced foreclosure. This compares very favorablyagainst Nevada’s one in 82, California’s one in 189 and Arizona’s one in 178. As gasoline prices havedecreased more recently, the <strong>Texas</strong> sales tax receipts have increased. During September 2008, sales taxreceipts increased 3.7% when compared to the same period last year. Whether <strong>Texas</strong>’ experience beginsto reflect the national trend depends upon the length and severity of the national/global recession.LONG-TERM FINANCIAL PLANNINGIn July 2008, the <strong>Authority</strong>’s Board of Directors reviewed the Fiscal Year 2009 Long Range FinancialPlan. This fifty year look into the future is both an inventory of projects anticipated to be undertakenby the <strong>Authority</strong> to satisfy its mission, as well as an analysis of the implications of those projects onthe <strong>Authority</strong>’s System Water Rate. <strong>The</strong> inventory of projects is a mixture of water development,transportation, and treatment initiatives and range from those that are anticipated to be fully supportedby the System Water Rate to those which will have a specific customer base (such as a regional treatmentplant), for which a cost of service-based fee will be calculated. Initial indications based on this analysisare that the <strong>Authority</strong>’s System Water Rate over the next several decades will continue to be among thelowest in the State of <strong>Texas</strong>; while maintaining a level of service sufficient to address the obligationsplaced upon it by both our enabling legislation, our strategic plan, and the vision of our Directors andmanagement. Future rate-making will be based upon a combination of both debt-funded initiatives,as well as those in which a cash infusion will be made, through the use of the Board-mandated seriesof Reserve Funds to balance and stabilize rates. Additional information on the <strong>Authority</strong>’s BoardDesignated Reserves can be found in Note 12, of the Notes to the Basic Financial Statements.xiii

RELEVANT FINANCIAL POLICIESCash ManagementDuring the year, funds were invested in demand deposits, obligations of the U.S. Treasury, obligationsof U.S. Government Agencies, and State investment pools as authorized by the Public Funds InvestmentAct. As of August 31, 2008 approximately 13.6% of the <strong>Authority</strong>’s funds were invested in collateralizeddemand accounts, 72.2% invested in U.S. Government Agencies, 9.7% invested in State InvestmentPool, and 4.5% invested in U.S. Treasury Obligations. <strong>The</strong> portfolio yield for the year averaged 4.0%.Additional information on the <strong>Authority</strong>’s cash management activity can be found in Note 2, of theNotes to the Basic Financial Statements.Risk Management<strong>The</strong> <strong>Authority</strong> has continued its emphasis on a loss control program to minimize risk exposures.Employees are well trained in safety practices and maintain a constant vigil to correct safety hazards.Third-party insurance coverage is currently maintained to reduce risk exposures. Additional informationon the <strong>Authority</strong>’s risk management activity can be found in Note 11, of the Notes to the Basic FinancialStatements.Retirement Plan<strong>The</strong> <strong>Authority</strong> makes an annual contribution to a non-traditional defined benefit plan in the <strong>Texas</strong> Countyand District Retirement System (TCDRS), and <strong>Authority</strong> employees make periodic contributions to theplan as well. TCDRS is a multiple-employer public employer retirement system governed by a Board ofTrustees appointed by the Governor of <strong>Texas</strong>.In addition, the <strong>Authority</strong> continues to administer the Retirement Plan for Employees of the <strong>Brazos</strong> <strong>River</strong><strong>Authority</strong> (Plan), which, effective September 2007, was closed to new entrants, and benefit accrual andcontributions were frozen. This Plan’s policies and performance are monitored closely by the RetirementCommittee which consists of four (4) Directors and three (3) <strong>Authority</strong> employee representativesappointed by the <strong>Authority</strong>’s Board of Directors. Additional information on the <strong>Authority</strong>’s retirementplans can be found in Note 7, of the Notes to the Basic Financial Statements.Internal Accounting ControlsInternal accounting controls are designed to provide reasonable assurance regarding safeguarding ofassets against loss from unauthorized use or disposition, and the reliability of financial records forpreparing financial statements and maintaining accountability for assets. We believe that the <strong>Authority</strong>’sinternal accounting controls adequately safeguard assets and provide reasonable assurance of properrecording of all financial transactions.As a recipient of Federal and State loans and grants, the <strong>Authority</strong> is also responsible for ensuring thatadequate internal controls are in place to document compliance with applicable laws and regulationsrelated to these programs. <strong>The</strong>se internal controls are subject to periodic evaluation by management.As part of the <strong>Authority</strong>’s audit, tests were made of the internal controls and of its compliance withlaws and regulations that could have a material effect on the <strong>Authority</strong>’s financial statements. Althoughthis testing was not sufficient to support an opinion on the <strong>Authority</strong>’s internal control system or itscompliance with laws and regulations, no material instance of noncompliance related to the audit for theyear ended August 31, 2008 are disclosed.xiv

Budgetary Controls<strong>The</strong> annual budget serves as the basis for the <strong>Authority</strong>’s financial planning and control. Budgetarycontrols are maintained to ensure the proper management of resources, and are required pursuant tocertain contracts for service. Although there are no legal requirements to include comparative budget-toactualexpense statements in this report, such information is included in the Supplemental Informationsection. In addition, it is provided to the Board of Directors on a quarterly basis throughout the fiscalyear.Charges for services are based on budgeted operating expenses, including debt service requirements andcapital expenditures, but excluding depreciation and amortization. In the cost reimbursable operations,charges for services are adjusted accordingly at the end of each year to a break-even basis. <strong>The</strong>se yearendadjustments are recorded as either accounts receivable or unearned revenue.MAJOR INITIATIVESDuring Fiscal Year 2008, the <strong>Authority</strong> managed many new and ongoing water quality and water supplyprojects. Water supply remains the priority for the <strong>Authority</strong> as we continue to work to obtain a majornew water right and to develop groundwater. <strong>The</strong> following is a synopsis of select programs and projectsmanaged by the <strong>Authority</strong> in Fiscal Year 2008:East Williamson County Regional Water SystemConstruction was completed in March 2008 on the expansion of the East Williamson County RegionalWater System. Retrofit of the older portions of the plant began immediately, and were completed inJune 2008. <strong>The</strong> expansion increases the plant’s capacity from 5.3 million gallons per day (mgd) to12.8 mgd, and is part of the development of a long-term regional treated water system for WilliamsonCounty.Fort Bend County<strong>The</strong> <strong>Authority</strong> continued work with the cities of Richmond and Rosenberg, municipal utility districts andother entities in West Fort Bend County on a regional surface water treatment project. A preliminaryengineering report was completed and recommendations were made on implementing a “treatabilitymonitoring” program.Grant InitiativesDuring FY2008, the <strong>Authority</strong> submitted applications for seven grants primarily related to HomelandSecurity projects. Three grants have been approved for $183,651, three are pending for $149,250, andone was not awarded. In addition, there was one proposal submitted for inclusion in the StatewideInteroperability Communication Plan that the <strong>Authority</strong> participated, in order to be eligible for futureHomeland Security funding. In addition to the above grants, other funding programs are being researchedand will be applied for as the project qualifies.Possum Kingdom Lake – Hydroelectric GenerationOn November 1, 2007, the <strong>Authority</strong> and <strong>Brazos</strong> Electric Power Cooperative (BEPC) signed a FacilityUse Agreement for the lease of the Possum Kingdom Lake hydroelectric generation facility. <strong>The</strong>terms of the agreement will take effect when all approvals are received from both the Federal EnergyRegulatory Commission (FERC) and the Rural Utility Services (RUS).xv

Simultaneously, the <strong>Authority</strong> and BEPC entered into a Facility Cost Agreement (FCA). <strong>The</strong> FCAestablishes BEPC’s responsibility to reimburse the <strong>Authority</strong> for all costs associated with the hydroelectricplant while we wait for the final approval from the regulatory agencies. <strong>The</strong>se two agreements are theresult of more than two years of difficult negotiations.Joint Lake Somerville StudyAs part of the passage of Senate Bill 3, the State’s omnibus water bill, the LCRA and the <strong>Authority</strong>launched a joint baseline study of the role of Lake Somerville in the economic development of thesurrounding area. <strong>The</strong> LCRA and the <strong>Authority</strong> hosted town hall meetings to inform Lake Somervillecitizens of the baseline analysis and the current tourism strategy for Lake Somerville. A final report wasdelivered to the Legislature in June.Lake Granbury Debris CleanupFollowing flooding events in July 2007, the <strong>Authority</strong> began an unprecedented debris cleanup ofthe lake. <strong>The</strong> large-scale project was completed in FY 2008 at a cost of $147,792. <strong>The</strong> <strong>Authority</strong>received reimbursement of 75 percent of these funds from the Federal Emergency Management Agency(FEMA).Lake Granbury Watershed Protection PlanE.coli monitoring continued during the last twelve months and was integrated into the LakeGranbury Watershed Protection Plan. Water quality monitoring was added in FY 1007 whichincluded the addition of ten new sites in previously unmonitored areas and six tributary creeksites. Bacterial source tracking samples are now being analyzed and watershed modeling isunderway to help in identifying bacterial sources. Source identification activities are anticipatedto be completed in October 2008. <strong>The</strong> project is expected to be completed in August 2009.Lake Granbury Surface Water And Treatment System (SWATS)<strong>The</strong> <strong>Authority</strong> is currently upgrading the potable water treatment systems at the SWATS plant.Modifications and additions to both the Ultra-filtration (UF) and Reverse Osmosis (RO) systems areunderway. <strong>The</strong> UF system is nearing completion while the RO system is scheduled to be completed bythe summer of 2009, and will provide a finished water capacity of 13.0 mgd. In addition to the currentsystem modifications taking place at the plant, engineers are also evaluating expanding the plant (UF/RO system) by an additional 2.54 mgd. This work, if determined to be necessary, will be scheduled tobe completed by the end of 2011, and will provide a total finished water capacity of 15.54 mgd.Lawson Accounting Software 9.0 Upgrade<strong>The</strong> Lawson Software upgrade was completed in March of 2008. <strong>The</strong> upgrade allows the <strong>Authority</strong>’sfinancial services and human resources departments to use enhanced functionalities, including bettersecurity.Possum Kingdom DivestitureA major topic of discussion for FY 2008 was the potential sale of <strong>Authority</strong>-owned land at PossumKingdom Lake. Continued research into the logistics of divestiture, including the potential for a 3 rdparty sale, is ongoing.xvi

Reallocation of Flood Storage – USACEPhase I of a feasibility study on the potential to increase water supply in USACE lakes was completed in FY2008 with three lakes identified as potential projects. <strong>The</strong> reallocation of existing flood storage space toconservation storage could potentially provide the <strong>Brazos</strong> basin with additional water supplies to meet the State WaterPlan.Salt Creek, Graham, <strong>Texas</strong> Floodplain Project<strong>The</strong> <strong>Authority</strong> and the USACE continue the property acquisition phase of the Salt Creek, Graham,<strong>Texas</strong>, project. <strong>The</strong> objective of the project is to provide flood protection for residents of Graham thatlive within the 10-year floodplain near Salt Creek. To date, approximately 60 residential property tractshave been acquired by USACE and transferred to the <strong>Authority</strong>.San Gabriel Wastewater Master Plan<strong>The</strong> San Gabriel Wastewater Master Plan is an effort to protect local water resources through thedevelopment of a regionalized sewerage system in the San Gabriel <strong>River</strong> watershed. In FY 2008, the<strong>Authority</strong> worked closely with City of Georgetown to determine the cost for using existing infrastructureto provide regional benefits. <strong>The</strong> cost of developing a sewerage system over such a large watershed willbe in excess of $100 million over a 20-year time frame.Alternative Future Water Supply Strategies<strong>The</strong> development of a new water supply source can be a decades-long process. In October 2007, the<strong>Authority</strong> initiated a study of the variety of future water supply strategies available, involving bothstewardship of current resources as well as infrastructure required to create new sources. <strong>The</strong> preliminaryreport completed in January 2008 found that conservation ranked highest among the projects identifiedin the report. As a result, the <strong>Authority</strong> has begun research into potential partnerships with our watersupply customers to encourage conservation.Strategic PlanAn update to the <strong>Authority</strong>’s Strategic Plan continued in FY 2008 to more closely align the practices andcore business of the <strong>Authority</strong> with the strategic direction set by the Board of Directors. <strong>The</strong> StrategicPlan is implemented through a project process and will assist in determining the direction the <strong>Authority</strong>will take in allocating its resources in order to meet the future needs of the basin.System Operations PermitIn the spring of 2003, the <strong>Authority</strong> initiated the System Operations Permit project with the goal ofmaximizing utilization of existing reservoir storage. If approved as submitted, the System OperationsPermit will add approximately 421,000 acre-feet to the <strong>Authority</strong>’s currently permitted available watersupply.During FY 2008, the <strong>Authority</strong> continued negotiations with interested parties including <strong>Texas</strong> Parks andWildlife Department, the Dow Chemical Company, <strong>Texas</strong> Municipal Power Agency (TMPA), <strong>Texas</strong>Municipal Water District, the Cities of Lubbock, Bryan, and College Station, and Luminant (successorto TXU).xvii

Williamson County Regional Raw Water Line<strong>The</strong> <strong>Authority</strong> continued work on Phase II pump upgrades for the Williamson County Regional RawWater Line including planning for design and installation of Phase II pumps. Water usage indicatesthat additional pumping capacity may be needed by 2011. <strong>The</strong> goal for the Phase II pump upgrade isto deliver up to 64,600 acre-feet of water annually to Lake Georgetown to meet the needs of the Citiesof Round Rock and Georgetown, as well as Brushy Creek Municipal Utility District, Chisholm TrailSpecial Utility District and Jonah Water Special Utility District.AWARDS AND ACKNOWLEDGEMENTS<strong>The</strong> Government Finance Officers Association of the United States and Canada (GFOA) awarded aCertificate of Achievement for Excellence in Financial Reporting to the <strong>Authority</strong> for its CAFR for thefiscal year ended August 31, 2007. This was the twenty second consecutive year that the <strong>Authority</strong> hasreceived this prestigious award. In order to be awarded a Certificate of Achievement, the <strong>Authority</strong>published an easily readable and efficiently organized CAFR. <strong>The</strong> 2007 report satisfied both GAAP andapplicable legal requirements.A Certificate of Achievement is valid for a period of one year only. We believe that our current CAFRcontinues to meet the Certificate of Achievement Program’s requirements and we are submitting it tothe GFOA to determine its eligibility for another certificate.In addition, the <strong>Authority</strong> also received its first GFOA’s Distinguished Budget Presentation Award forits annual budget document for Fiscal Year beginning September 1, 2007. In order to qualify for theDistinguished Budget Presentation Award, the <strong>Authority</strong>’s budget document had to be judged proficientas a policy document, a financial plan, an operations guide, and a communication device.<strong>The</strong> preparation of this report would not have been possible without the efficient and dedicated endeavorsof the entire staff of the Finance and Administration Department. I would like to express my sincereappreciation to Matt Wheelis, Melissa Anthony, Janie Crowder, Judy Wallace, Michele Giroir, PaulaThamez, Lupe Diaz, Sandy Dominguez, Cheryl Hoelscher, Kim Goolsby, Kim Tosh, Gina Romano, andall other employees who contributed to the preparation of this report.Our appreciation is also extended to the members of the Board of Directors for their support in planningand conducting the financial operations of the <strong>Authority</strong> in a responsible and professional manner, andfor providing us the tools and resources to ensure the integrity of the assets of the <strong>Authority</strong>.Respectfully submitted,Phillip J. FordGeneral Manager/CEOJohn Hawes, CPAChief Financial Officerxviii

xix

From the <strong>River</strong>......to the LabKeeping our environment safexx

Financial Section2008 Comprehensive Annual Financial Report1

Management’sDiscussion & Analysis2008 Comprehensive Annual Financial Report5

BRAZOS RIVER AUTHORITYMANAGEMENT’S DISCUSSION AND ANALYSISAUGUST 31, 2008, 2007 AND 2006 (in thousands)As management of the <strong>Brazos</strong> <strong>River</strong> <strong>Authority</strong>, we offer readers of the <strong>Authority</strong>’s financial statements thisnarrative overview and analysis of the financial activities of the <strong>Authority</strong> for the fiscal year ended August 31,2008 in comparison with the two prior year financial results. We encourage readers to consider theinformation presented here in conjunction with additional information that we have furnished in our letter oftransmittal, which can be found on Pages x to xviii of the Introductory Section of this report.Financial Highlights Total assets at the end of Fiscal Year 2008, 2007 and 2006 were $338,673, $336,249 and $312,030,respectively. Total assets exceeded liabilities at the end of Fiscal Year 2008, 2007 and 2006 by $141,754,$131,291 and $126,263, respectively.Total assets for Fiscal Year 2008 increased $2,424 over prior year primarily as a result of improvedoperations.Total assets for Fiscal Year 2007 increased $24,219 over prior year primarily as a result of unspent bondproceeds and additional construction activities attributable to the issuance of the series 2006 revenuebonds and the improved results of operations.<strong>The</strong> <strong>Authority</strong> ended Fiscal Year 2008 with an increase in net assets of $10,463, an increase in net assetsof $5,028 for Fiscal Year 2007 and a decrease in net assets of $5,855 in Fiscal Year 2006.<strong>The</strong> increases and decreases in capital assets for the past three years and the events causing these changesare noted below:2008 2007 2006Net additions to land and land rights $ - $ 41 $ 350Additions to construction-in-progress 13,943 23,673 8,408Transfers from construction-in-progress to capital assetsbeing depreciated (33,556) (3,269) (5,688)Additions and transfers to capital assets being depreciated 34,431 2,475 2,946Deletions and transfers (544) (84) (4,710)Normal annual depreciation (8,692) (8,384) (8,550)TOTAL $ 5,582 $ 14,452 $ (7,244)For Fiscal Year 2008, total outstanding debt decreased by $5,749. This decrease is a result of requiredannual principal payments on revenue bonds, contracts payable and accretion on capital appreciationbonds of $4,795, $1,061 and $107, respectively.6

BRAZOS RIVER AUTHORITYMANAGEMENT’S DISCUSSION AND ANALYSISAUGUST 31, 2008, 2007 AND 2006 (in thousands) For Fiscal Year 2007, total outstanding debt increased by $13,073. This net increase is a result of $17,805in new bonds being issued for the costs of the continued expansion of the East Williamson CountyRegional Water System and $550 of new contracts payable debt issued to acquire water rights from the<strong>Brazos</strong> Electric Power Cooperative, Inc. In addition, required annual principal payments on revenuebonds, contracts payable and accretion on capital appreciation bonds of $4,365, $1,019 and $102,respectively. For Fiscal Year 2006, total outstanding debt increased by $13,169. This net increase is a result of $23,210in new bonds being issued of which $10,335 was issued for the costs of acquisition and expansion of theEast Williamson County Regional Water System and $12,875 was issued for the costs of repairs at MorrisSheppard Dam on Possum Kingdom Lake. Excess construction funds were returned to the <strong>Texas</strong> WaterDevelopment Board to reduce the obligation on the Series 1999 bonds by $5,045. In addition, requiredannual principal payments on revenue bonds, contracts payable and accretion on capital appreciationbonds of $4,070, $1,022 and $96, respectively.Overview of the Financial Statements<strong>The</strong> Management’s Discussion and Analysis is intended to serve as an introduction to the <strong>Authority</strong>’s basicfinancial statements. <strong>The</strong> <strong>Authority</strong>’s basic financial statements are composed of Statements of Net Assets,Statements of Revenues, Expenses and Changes in Net Assets, Statements of Cash Flows, CombinedStatements of Fiduciary Net Assets, and Notes to the Basic Financial Statements. This report also containsother supplementary information and statistical information in addition to the basic financial statementsthemselves.Basic financial statements. <strong>The</strong> financial statements are designed to provide readers with an overview of the<strong>Authority</strong>’s finances, in a manner similar to private-sector business.<strong>The</strong> Statement of Net Assets presents information on all of the <strong>Authority</strong>’s assets and liabilities, with thedifference between the two reported as net assets. Over time, increases or decreases in net assets may serveas a useful indicator of whether the financial position of the <strong>Authority</strong> is improving or deteriorating. <strong>The</strong>Statement of Net Assets can be found on Page 16 of this report.<strong>The</strong> Statement of Revenues, Expenses and Changes in Net Assets presents information showing how the<strong>Authority</strong>’s net assets changed during the most recent fiscal year. All changes in net assets are reported assoon as the underlying event giving rise to the change occurs, regardless of the timing of related cash flows.Thus revenues and expenses are reported in this statement for some items that will only result in cash flows infuture fiscal periods. <strong>The</strong> increase or decrease in net assets may serve as an indicator of the effect of the<strong>Authority</strong>’s current year operations on its financial position. <strong>The</strong> Statement of Revenues, Expenses andChanges in Net Assets can be found on Page 18 of this report.<strong>The</strong> Statement of Cash Flows summarizes all of the <strong>Authority</strong>’s cash flows into three categories, asapplicable: 1) cash flows from operating activities, 2) cash flows from capital and related financing activities,and 3) cash flows from investing activities. <strong>The</strong> Statement of Cash Flows can be found on Page 19 of thisreport. <strong>The</strong> Statement of Cash Flows, along with the related notes and information in other financialstatements, can be useful in assessing the following:7

BRAZOS RIVER AUTHORITYMANAGEMENT’S DISCUSSION AND ANALYSISAUGUST 31, 2008, 2007 AND 2006 (in thousands)<strong>The</strong> <strong>Authority</strong>’s ability to generate future cash flows<strong>The</strong> <strong>Authority</strong>’s ability to pay its debt as the debt maturesReasons for the difference between the <strong>Authority</strong>’s operating cash flows and operating income<strong>The</strong> effect on the <strong>Authority</strong>’s financial position of cash and non-cash transactions from investing,capital and financing activities<strong>The</strong> Combined Statement of Fiduciary Net Assets summarizes all of the <strong>Authority</strong>’s agency fund transactions.Generally, an agency fund is created to act as a custodian for other funds, governmental entities, or privateentities. Assets are recorded by the agency fund, held for a period of time as determined by a legal contract orcircumstance and then returned to their owners. Generally, only assets and a liability representing the partiesthat are entitled to the assets are presented in the Combined Statement of Fiduciary Net Assets. <strong>The</strong>Combined Statement of Fiduciary Net Assets can be found on Page 20.<strong>The</strong> Notes to the Basic Financial Statement provides additional information that is essential to a fullunderstanding of the data provided in the basic financial statements. <strong>The</strong> Notes to the Financial Statementscan be found starting on Page 21 of this report.Financial AnalysisStatement of Net Assets - As noted earlier, net assets may serve over time as a useful indicator of the<strong>Authority</strong>’s financial position. In the case of the <strong>Authority</strong>, assets exceeded liabilities for Fiscal Year 2008,2007 and 2006 by $141,754, $131,291 and $126,263, respectively.<strong>The</strong> largest portion of the <strong>Authority</strong>’s net assets, 59%, in Fiscal Year 2008, reflects its investment in capitalassets (e.g., land, reservoirs, water treatment and sewerage facilities, and buildings and equipment) less anyrelated debt used to acquire those assets that is still outstanding. Although the <strong>Authority</strong>’s investment in itscapital assets is reported net of related debt, it should be noted that the resources needed to repay this debtmust be provided from other resources, since the capital assets themselves cannot be used to liquidate theseliabilities.8

BRAZOS RIVER AUTHORITYMANAGEMENT’S DISCUSSION AND ANALYSISAUGUST 31, 2008, 2007 AND 2006 (in thousands)Condensed Statement of Net AssetsAugust 31, 2008, 2007 and 20062008 2007 2006ASSETSCurrent assets - unrestricted $ 55,853 $ 47,930 $ 42,113Current assets - restricted 21,110 30,235 25,859Capital assets, net 227,850 222,268 207,816Noncurrent assets 33,860 35,816 36,242TOTAL ASSETS 338,673 336,249 312,030LIABILITIESCurrent liabilities (payable from current assets) 13,236 13,090 9,286Current liabilities (payable from restricted assets) 14,729 15,518 11,565Noncurrent liabilities 168,954 176,350 164,916TOTAL LIABILITIES 196,919 204,958 185,767NET ASSETSInvested in capital assets, net of related debt 83,408 71,750 72,514Restricted 13,774 22,634 18,678Unrestricted 44,572 36,907 35,071TOTAL NET ASSETS $ 141,754 $ 131,291 $ 126,263For Fiscal Year 2008, about 10% ($13,774) of the <strong>Authority</strong>’s net assets represent resources that arerestricted. <strong>The</strong> remaining balance of unrestricted net assets ($44,572) may be used to meet the <strong>Authority</strong>’songoing obligations.9

BRAZOS RIVER AUTHORITYMANAGEMENT’S DISCUSSION AND ANALYSISAUGUST 31, 2008, 2007 AND 2006 (in thousands)Condensed Statement of Revenues, Expenses and Changes in Net AssetsFiscal Years Ended August 31, 2008, 2007 and 20062008 2007 2006OPERATING REVENUESWater supply system $ 36,536 $ 32,698 $ 30,052Cost reimbursable operations 18,347 17,448 17,025TOTAL OPERATING REVENUES 54,883 50,146 47,077OPERATING EXPENSESOperating and maintenance 34,738 33,404 33,045Depreciation and amortization 10,124 9,819 9,965TOTAL OPERATING EXPENSES 44,862 43,223 43,010OPERATING INCOME 10,021 6,923 4,067Total net non-operating expenses 219 3,828 11,048GAIN/(LOSS) BEFORE CONTRIBUTIONS 9,802 3,095 (6,981)Capital contributions 661 1,933 1,126CHANGE IN NET ASSETS 10,463 5,028 (5,855)NET ASSETS, BEGINNING 131,291 126,263 132,118NET ASSETS, ENDING $ 141,754 $ 131,291 $ 126,26310

BRAZOS RIVER AUTHORITYMANAGEMENT’S DISCUSSION AND ANALYSISAUGUST 31, 2008, 2007 AND 2006 (in thousands)Operating IncomeOperating income increased by $3,098, or 44% after increasing in the prior year by 70%. <strong>The</strong>se increases area result of an increase in the sale of raw water, a 3.81% and 5.74% increase in the price charged to customersfor an acre foot of water sold for 2008 and 2007 respectively and a control in spending representing a lessthan 5% increase in operating expenses over the past two years.Total operating revenues consist primarily of raw water sales, cost reimbursable operations, and lakeoperations. Other operating revenues include the sale of treated water, operation of a wastewater treatmentfacility, grants and hydroelectric operations. Total operating expenses consist primarily of personnel services,materials and supplies, utilities, depreciation and amortization and outside services.$60,000$50,000$40,000$30,000$20,000Operating RevenuesOperating Expenses$10,000$-2008 2007 200611

BRAZOS RIVER AUTHORITYMANAGEMENT’S DISCUSSION AND ANALYSISAUGUST 31, 2008, 2007 AND 2006 (in thousands)Capital Assets and Outstanding DebtCapital Assets - <strong>The</strong> <strong>Authority</strong>’s capital assets, as of August 31, 2008, 2007 and 2006, amounted to $227,850,$222,268 and $207,816, respectively (net of accumulated depreciation). <strong>The</strong> increase in capital assets for2008 is primarily due to the completion of the plant expansion at the <strong>Authority</strong>’s East Williamson CountyWater Treatment Facility. <strong>The</strong> following table summarizes capital assets, net of depreciation.Capital Assets(net of accumulated depreciation) August 31, 2008, 2007 and 20062008 2007 2006Land and land rights $ 28,587 $ 28,587 $ 28,546Reservoirs, water and sewerage facilities 98,864 95,192 99,343Buildings, structures and improvements 73,438 52,175 53,331Vehicles, furniture and equipment 4,788 4,528 5,214Construction in progress 22,173 41,786 21,382TOTAL $ 227,850 $ 222,268 $ 207,816Additional information on the <strong>Authority</strong>'s capital assets can be found in Note 4, of this report.$100,000$90,000$80,000$70,000$60,000$50,000$40,000$30,000$20,000$10,000$-2008 2007 2006Land and land rightsReservoirs, water andsewerage facilitiesBuildings, structuresand improvementsVehicles, furniture andequipmentConstruction in progress12

BRAZOS RIVER AUTHORITYMANAGEMENT’S DISCUSSION AND ANALYSISAUGUST 31, 2008, 2007 AND 2006 (in thousands)Outstanding Debt – At the end of Fiscal Year 2008, 2007 and 2006, the <strong>Authority</strong> had total outstanding debtof $166,944, $172,693 and $159,619, respectively. Of the 2008 amount, 62% and 38% is reflected in WaterSupply System and Cost Reimbursable Operations, respectively.$70,000$60,000$50,000$40,000$30,000$20,000$10,000Cost ReimbursableBondsWater Supply BondsU.S. GovernmentContracts$02008 2007 2006<strong>The</strong> changes in the <strong>Authority</strong>’s debt for Fiscal Year 2008, 2007 and 2006 are shown in the following table:2008 2007 2006Accretion of interest on capital appreciation bonds $ 107 $ 102 $ 96Principal payments made in current year (5,856) (5,384) (5,092)New Series 2005A and 2005B Revenue Bonds - - 23,210New Series 2006 Revenue Bonds - 17,805 -New contracts payable debt - 550 -Excess construction funds returned to TWDB - - (5,045)INCREASE (DECREASE) IN DEBT $ (5,749) $ 13,073 $ 13,169Additional information on the <strong>Authority</strong>'s long-term debt can be found in Note 6, of this report.13

BRAZOS RIVER AUTHORITYMANAGEMENT’S DISCUSSION AND ANALYSISAUGUST 31, 2008, 2007 AND 2006 (in thousands)Requests for InformationThis financial report is designed to provide a general overview of the <strong>Authority</strong>’s finances and to demonstratethe <strong>Authority</strong>’s accountability for the funds it receives. Questions concerning any of the information providedin this report or requests for additional financial information should be addressed to the office of the ChiefFinancial Officer, 4600 Cobbs Drive, P.O. Box 7555, <strong>Waco</strong>, TX 76714-7555.14

Basic Financial Statements2008 Comprehensive Annual Financial Report15

BRAZOS RIVER AUTHORITYSTATEMENTS OF NET ASSETSAUGUST 31, 2008AND 2007 (in thousands)ASSETSCURRENT ASSETS:2008 2007UNRESTRICTED:Cash and cash equivalents $ 4,008 $ 3,974Investments 46,297 36,543Receivables:Accounts 3,000 3,919Accrued interest 327 250Current portion of contracts receivables 158 152Other current assets 2,063 3,092TOTAL UNRESTRICTED 55,853 47,930RESTRICTED:Cash and cash equivalents 10,281 17,244Investments 10,792 12,931Interest 37 60TOTAL RESTRICTED 21,110 30,235TOTAL CURRENT ASSETS 76,963 78,165NONCURRENT ASSETS:CAPITAL ASSETS:Land and land rights 28,587 28,587Reservoirs, water treatment and sewerage facilities 167,349 159,514Building, structures and improvements 87,918 63,468Vehicles, furniture and equipment 16,926 15,859Construction in progress 22,173 41,786TOTAL CAPITAL ASSETS 322,953 309,214Less accumulated depreciation (95,103) (86,946)NET CAPITAL ASSETS 227,850 222,268OTHER NONCURRENT ASSETS:Storage rights, net 27,463 28,783Contract receivable, net of current portion 1,038 1,196Bond related costs 2,688 3,106Other assets, net 2,671 2,731TOTAL OTHER NONCURRENT ASSETS 33,860 35,816TOTAL NONCURRENT ASSETS 261,710 258,084TOTAL ASSETS $ 338,673 $ 336,249<strong>The</strong> accompanying notes are an integral part of these statements.16

BRAZOS RIVER AUTHORITYSTATEMENTS OF NET ASSETSAUGUST 31, 2008AND 2007(in thousands)LIABILITIES2008 2007CURRENT LIABILITIES:PAYABLE FROM CURRENT ASSETS:Accounts payable $ 5,793 $ 6,204Contracts payable 1,103 1,061Accrued interest 733 764Unearned revenues 5,607 5,061TOTAL PAYABLE FROM CURRENT ASSETS 13,236 13,090PAYABLE FROM RESTRICTED ASSETS:Accrued interest 1,875 1,803Revenue bonds payable 5,375 4,795Construction contracts payable 2,018 3,122Unearned revenues 2,923 3,644Other 2,538 2,154TOTAL PAYABLE FROM RESTRICTED ASSETS 14,729 15,518TOTAL CURRENT LIABILITIES 27,965 28,608NONCURRENT LIABILITIES:Revenue bonds payable, net of current portion 124,369 129,637Discount on revenue bonds payable (1,280) (1,412)Contracts payable, net of current portion 36,097 37,199Unearned revenues 9,052 10,262Other liabilities 716 664TOTAL NONCURRENT LIABILITIES 168,954 176,350TOTAL LIABILITIES $ 196,919 $ 204,958NET ASSETS:Invested in capital assets, net of related debt $ 83,408 $ 71,750Restricted for construction and debt service 13,774 22,634Unrestricted 44,572 36,907TOTAL NET ASSETS $ 141,754 $ 131,291<strong>The</strong> accompanying notes are an integral part of these statements.17

BRAZOS RIVER AUTHORITYSTATEMENTS OF REVENUES, EXPENSES AND CHANGES IN NET ASSETSFISCAL YEARS ENDED AUGUST 31, 2008AND 2007 (in thousands)2008 2007OPERATING REVENUES:Water Supply System:Raw water sales $ 26,093 $ 23,010Treated water 1,022 1,062Wastewater treatment 2,989 2,572Lake operations 3,181 3,121Hydroelectric 631 603Grants 1,264 1,101Other 1,356 1,229Cost Reimbursable Operations:Water conveyance/supply 2,346 2,247Water treatment 8,174 7,880Wastewater treatment 7,827 7,321TOTAL OPERATING REVENUES 54,883 50,146OPERATING EXPENSES:Personnel services 15,271 14,744Materials and supplies 2,613 2,501Utilities 4,836 4,545Depreciation and amortization 10,124 9,819Outside services 4,993 4,959Other 7,025 6,655TOTAL OPERATING EXPENSES 44,862 43,223OPERATING INCOME 10,021 6,923NON-OPERATING REVENUES (EXPENSES):Investment income 2,187 2,832Interest expense (5,848) (5,928)Other income 4,125 -Other expenses (292) (765)Gain/(Loss) on sale of capital assets (391) 33TOTAL NET NON-OPERATING EXPENSES (219) (3,828)GAIN BEFORE CONTRIBUTIONS 9,802 3,095Capital contributions 661 1,933CHANGE IN NET ASSETS 10,463 5,028NET ASSETS, BEGINNING 131,291 126,263NET ASSETS, ENDING $ 141,754 $ 131,291<strong>The</strong> accompanying notes are an integral part of these statements.18

BRAZOS RIVER AUTHORITYSTATEMENTS OF CASH FLOWSFISCAL YEARS ENDED AUGUST 31, 2008AND 2007(in thousands)2008 2007CASH FLOWS FROM OPERATING ACTIVITIES:Cash received from customers $ 55,989 $ 50,804Cash received from others 22 1,255Cash paid to suppliers for goods and services (23,759) (24,876)Cash paid to employees for services (11,878) (10,945)Net cash provided by operating activities 20,374 16,238CASH FLOWS FROM CAPITAL AND RELATED FINANCING ACTIVITIES:Bond proceeds - 17,805Payment of debt issuance costs - (462)Cash paid for capital assets (15,370) (20,110)Interest paid (5,734) (5,663)Principal payments on long-term debt (5,796) (5,381)Proceeds from disposal of capital assets 142 15Capital contributions 661 1,933Proceeds from litigation settlement of capital assets 4,125 -Other 153 -Net cash used in capital and related financing activities (21,819) (11,863)CASH FLOWS FROM INVESTING ACTIVITIES:Sales of investments 91,235 69,336Purchases of investments (98,893) (65,098)Interest received 2,174 1,747Net cash provided by/(used in) investing activities (5,484) 5,985NET INCREASE/(DECREASE) IN CASH AND CASH EQUIVALENTS (6,929) 10,360CASH AND CASH EQUIVALENTS, BEGINNING OF YEAR(including $17,244 and $7,841, respectively, reported in restricted accounts) 21,218 10,858CASH AND CASH EQUIVALENTS, END OF YEAR(including $10,281 and $17,244, respectively, reported in restricted accounts) $ 14,289 $ 21,218RECONCILIATION OF OPERATING INCOME TONET CASH PROVIDED BY OPERATING ACTIVITIES:Operating income $ 10,021 $ 6,923Adjustments to reconcile operating income to net cash provided by operating activities:Depreciation 8,684 8,384Amortization 1,440 1,435Change in current assets and liabilities:Decrease in accounts receivable 919 332(Increase) decrease in other current assets 1,029 (2,645)Increase (decrease) in accounts payable (411) 2,452Decrease in unearned revenue and other liabilities (1,308) (643)Total adjustments 10,353 9,315NET CASH PROVIDED BY OPERATING ACTIVITIES $ 20,374 $ 16,238NONCASH INVESTING ACTIVITY:Net increase/(decrease) in fair value of investments $ (53) $ 7Amounts recorded for accretion on WCRRWL Series 2000 Capital Appreciation Bonds $ 107 $ 102<strong>The</strong> accompanying notes are an integral part of these statements.19

BRAZOS RIVER AUTHORITYCOMBINED STATEMENTS OF FIDUCIARY NET ASSETSAUGUST 31, 2008AND 2007(in thousands)2008 2007ASSETSCash $ 3,855$ 3,738Investments 2,917 -Receivables - 8Accrued Interest 13 -TOTAL ASSETS $ 6,785$ 3,746LIABILITIESHeld for future debt service $ 3,268$ 3,226Held for future construction cost 3,517 520TOTAL LIABILITIES $ 6,785$ 3,746<strong>The</strong> accompanying notes are an integral part of these statements.20

BRAZOS RIVER AUTHORITYNOTES TO THE BASIC FINANCIAL STATEMENTSAUGUST 31, 2008AND 2007(in thousands)1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIESReporting Entity - <strong>The</strong> <strong>Brazos</strong> <strong>River</strong> <strong>Authority</strong> (the “<strong>Authority</strong>”) was created by the <strong>Texas</strong> Legislaturein 1929, pursuant to constitutional Provision Section 59, Article 16, as a governmental agency of theState of <strong>Texas</strong>. <strong>The</strong> <strong>Authority</strong> is governed by a board of 21 directors appointed by the Governor for sixyearterms, subject to approval by the <strong>Texas</strong> Senate. <strong>The</strong> <strong>Authority</strong> is not financially accountable to theState of <strong>Texas</strong>. <strong>The</strong> <strong>Authority</strong> is responsible for conservation, control, and development of the surfacewater resources of the <strong>Brazos</strong> <strong>River</strong> Basin. <strong>The</strong> <strong>Authority</strong> cooperates with cities and other local agenciesin the construction and operation of water treatment and regional sewerage systems to improve andmaintain the quality of water in the <strong>Brazos</strong> <strong>River</strong> and its tributaries. <strong>The</strong> <strong>Authority</strong> also plans anddevelops water supply projects and commits the water it can supply under contracts to cities, towns,industries, and other water users throughout the <strong>Brazos</strong> <strong>River</strong> Basin and adjacent areas.Principles of Accounting - <strong>The</strong> accompanying basic financial statements have been prepared on the fullaccrual basis of accounting as prescribed by the Governmental Accounting Standards Board (“GASB”).<strong>The</strong> <strong>Authority</strong> consists of a single enterprise fund through which all financial activities are recorded, andfour agency funds that report assets and liabilities held by the <strong>Authority</strong> in a custodial capacity forothers. Under GASB Statement 20, the <strong>Authority</strong> has elected not to apply Financial AccountingStandards Board (“FASB”) Statements and Interpretations issued after November 30, 1989.Basis of Presentation - <strong>The</strong> <strong>Authority</strong> presents its financial statements in accordance with GASB 34guidance for governments engaged in business type activities. Accordingly, the basic financialstatements of the <strong>Authority</strong> consist of Statement of Net Assets, Statement of Revenues, Expenses andChanges in Net Assets, Statement of Cash Flows, Combined Statement of Fiduciary Net Assets andNotes to the Basic Financial Statements.Enterprise Funds – Enterprise Funds are required to be used to account for operations for which a fee ischarged to external users for goods or services and the activity (a) is financed with debt that is solelysecured by a pledge of the net revenues, (b) has third-party requirements that the cost of providingservices include capital cost, be recovered with fees and charges, or (c) has a pricing policy designed forthe fees and charges to record similar cost.Agency Funds - <strong>The</strong> <strong>Authority</strong>’s Agency Funds are created to act as a custodian for the City ofRobinson, the City of Temple, the City of Keene and Jonah Water Special Utility District for thefacilitating of bond proceeds in accordance with the <strong>Texas</strong> Water Development Board Rules and InterlocalAgreements relating to financial programs. <strong>The</strong> Agency Funds only report assets and liabilities in astatement of fiduciary net assets.Revenue Recognition - Revenues are recorded when earned. Unearned revenues are reflected in theaccompanying statement of net assets as unearned revenues. Nonrefundable charges to contractingparties relating to the acquisition of capital assets or project development costs are initially recorded asnoncurrent unearned revenues and are amortized to income over periods equal to the lives of the assetspurchased from such charges on a straight-line basis. Refundable charges to contracting parties relatingto the acquisition of capital assets or project development costs are recorded as other noncurrentliabilities.21

BRAZOS RIVER AUTHORITYNOTES TO THE BASIC FINANCIAL STATEMENTSAUGUST 31, 2008AND 2007(in thousands)<strong>The</strong> <strong>Authority</strong> has constructed reservoir, water treatment and sewerage system facilities which werefinanced primarily by the issuance of revenue bonds and/or federal grants. <strong>The</strong> recipients of the servicesprovided by these facilities generally contract to pay the <strong>Authority</strong> amounts equivalent to operating andmaintenance expenses and the debt service requirements of the related revenue bonds. Revenue bonddebt service is predominantly applicable to interest in the early years, with the portion applicable toprincipal retirements increasing in later years. Depreciation expense, provided on the straight-linemethod, usually exceeds the portion of revenues applicable to the principal portion of bond retirementswhich partially results in reporting operating losses in early years which will reverse in later years.Cash and Cash Equivalents - All highly liquid investments (including restricted assets) with originalmaturities of three months or less when purchased are considered to be cash equivalents.Deposits - <strong>The</strong> <strong>Authority</strong>’s collateral agreement requires that all deposits be fully collateralized bygovernment securities or <strong>Texas</strong> municipal bonds rated A or better that have a market value exceedingthe total amount of cash and investments held at all times.Accounts Receivable - Accounts receivable are considered to be fully collectible; accordingly, noallowance for doubtful accounts is required. If amounts become uncollectible, they will be charged tooperating expenses when that determination is made.Capital Assets - All purchased capital assets are stated at historical cost. Donated assets are stated attheir estimated fair values on the date donated. Newly acquired assets with a cost of five thousanddollars or more and a useful life greater than three years will be capitalized. Repairs and maintenanceare recorded as expenses; renewals and betterments are capitalized. Depreciation is calculated on eachclass of depreciable property using the straight-line method. Estimated useful lives are as follows:Reservoir facilitiesWater and sewerage system facilitiesBuildings, structures, and improvementsVehicles, furniture, and equipment30 to 85 years25 to 50 years20 to 70 years3 to 35 years<strong>The</strong> <strong>Authority</strong> capitalizes net interest costs, as applicable, as a component cost of construction inprogress. <strong>The</strong> two projects that meet the capitalization rule are the Morris Sheppard Dam project atPossum Kingdom Lake and the East Williamson County Regional Water System expansion. For theyears ended August 31, 2008 and 2007, the <strong>Authority</strong> had $1,491 and $639 in net capitalized interest,respectively for these two projects.Compensated Absences – Prior to May 1, 2002 the <strong>Authority</strong>’s employees were granted vacation andsick leave in specified amounts. Effective May 1, 2002 vacation and sick leave were superseded byPersonal Time Off (PTO). <strong>The</strong> <strong>Authority</strong>’s current policy states that upon termination an employee willbe paid for 100% of unused vacation time and 50% of their PTO balance up to a maximum of 160 hours(20 days) combined. In addition, for employees eligible to retire only, unused sick leave is paid out at arate of 50% of their balance or 144 hours (18 days) whichever is less. <strong>The</strong> total recorded liability forcompensated absences, as of August 31, 2008 and 2007, was $690 and $681 respectively.22

BRAZOS RIVER AUTHORITYNOTES TO THE BASIC FINANCIAL STATEMENTSAUGUST 31, 2008 AND 2007 (in thousands)Budgets and Budgetary Accounting - <strong>The</strong> <strong>Authority</strong> is not required under its enabling act to adopt abudget; therefore, comparative statements of actual expenses compared to budgeted expenses are notpart of the basic financial statements.Use of Estimates - <strong>The</strong> preparation of financial statements in conformity with accounting principlesgenerally accepted in the United States of America requires management to make estimates andassumptions that affect the amounts reported in the basic financial statements and accompanying notes.Actual results could differ from those estimates.Operating Revenues and Expenses – Operating revenues and expenses for Proprietary Funds are thosethat result from providing services and producing and delivering goods and/or services. It also includesall revenue and expenses not related to capital and related financing, non-capital financing or investingactivities. All revenues and expenses not meeting this definition are reported as non-operating revenuesand expenses.Other Assets – <strong>The</strong> <strong>Authority</strong> capitalizes bond and loan issuance costs and amortizes such costs over theterm of the related bonds and loan using the straight-line method. At August 31, 2008 and 2007, bondand loan issuance costs, net of accumulated amortization, of approximately $1,885 and $2,006,respectively, were included in bond related cost in the accompanying statement of net assets.By agreement in 1988, the <strong>Authority</strong> amended a water contract with a utility company which providedfor the sale of 162,000 acre feet of water per year through the year 2030. <strong>The</strong> amendment reduced theutility company’s right to purchase water to 83,000 acre feet per year beginning January 1, 1989. Asconsideration for the 79,000 acre-feet reduction, the <strong>Authority</strong> (1) paid the utility company $3,823 in1988 and (2) reduced charges to the utility company by approximately $350 per year beginning January1, 1989. <strong>The</strong> <strong>Authority</strong> has sold the 79,000 acre-feet to various third parties under long-term watercontracts. <strong>The</strong> balance of $2,437 and $2,522 at August 31, 2008 and 2007, respectively, is included inother assets and will be amortized against related revenues from such contracts over the contract lives.Storage Rights – Rights in the Federal Reservoirs are purchased through long-term contracts from theFederal government. <strong>The</strong>y are recorded at cost and amortized using the straight-line method. Inaccordance with Accounting Principles Board Opinion No. 17, storage rights acquired prior toNovember 1, 1970, are amortized over the contract terms while storage rights acquired after October 31,1970, are amortized over a certain period, not to exceed 40 years.Storage rights at August 31, 2008 and 2007, consist of the following:2008 2007Storage rights purchased prior to November 1, 1970 - amortizedover the initial term of contract ranging from 50 to 65 years, net ofaccumulated amortization $ 4,840 $ 5,123Storage rights purchased after October 31, 1970 - amortized over 40-years (50-year contract terms), net of accumulated amortization 22,623 23,660TOTAL $ 27,463 $ 28,78323

BRAZOS RIVER AUTHORITYNOTES TO THE BASIC FINANCIAL STATEMENTSAUGUST 31, 2008 AND 2007 (in thousands)Reclassification - Storage rights and its related debt have been reclassified from unrestricted net assetsto invested in capital assets, net of related debt. <strong>The</strong> reclassified amount totaled $4,784.2. DEPOSITS AND INVESTMENTSAs of August 31, 2008, the <strong>Authority</strong> had the following investments:Investment TypeFair ValueWeighted AverageMaturity (Years)US Treasury Notes and Bills $ 3,6750.99US Agencies:FHLB 33,372 1.47FHLMC 14,094 0.85FNMA 5,924 1.21Total Value $ 57,065Portfolio weighted average maturity 1.27Credit RiskCertificates of Deposit - <strong>The</strong> <strong>Authority</strong>'s adopted Investment Policy and State law restrict certificates ofdeposit to those which are fully collateralized or insured by the FDIC or its successor. <strong>The</strong> certificates ofdeposit must be from banks doing business within the State of <strong>Texas</strong> and must have a written depositoryagreement executed under the terms of FIRREA, i.e. approved by the bank board or loan committee. ByPolicy, the certificates of deposit must be collateralized to 102% of principal and interest byobligations of the US Government, its agencies and instrumentalities including mortgage backedsecurities which pass the bank test or obligations of municipal entities of any state rated as to investmentquality by a nationally recognized rating agency as "A" or its equivalent. <strong>The</strong> bank party is heldcontractually liable for maintaining the margin daily. All pledged collateral is held by an independentcustodian in the <strong>Authority</strong>'s name. All certificates of deposit are restricted to a maximum of twelve (12)months to its stated maturity.Repurchase Agreements - State law and the <strong>Authority</strong>'s adopted Policy require repurchase agreementsdefined as a buy-and-sell transaction. <strong>The</strong> transactions must have a defined termination date and beplaced through a primary government securities dealer, as defined by the Federal Reserve, or a bank doingbusiness in <strong>Texas</strong>. <strong>The</strong>y must be secured by obligations of the US Government, its agencies orinstrumentalities, to include mortgage backed securities. Collateral is held with a third party selected orapproved by the <strong>Authority</strong> and held in the <strong>Authority</strong>'s name. <strong>The</strong> custodian or counter-party is heldcontractually liable for maintaining a margin of 102% of principal and interest. Repurchase agreements24

BRAZOS RIVER AUTHORITYNOTES TO THE BASIC FINANCIAL STATEMENTSAUGUST 31, 2008 AND 2007 (in thousands)includes reverse repurchase agreements in which the reinvestment security shall not mature later than thereverse. All <strong>Authority</strong> repurchase agreement transactions are governed by an executed Master RepurchaseAgreement. <strong>The</strong> maximum stated maturity is 90 days except for flex repurchase agreements used only forbond funds which are matched to the expenditure plan of the bonds. A flex requires additional approval bythe General Manager/CEO and the Chief Financial Officer on an issue-by-issue basis.Money Market Mutual Funds - <strong>The</strong> <strong>Authority</strong>'s adopted Policy does not require that SEC registeredmoney market mutual funds be rated as to investment quality. However, the Policy restricts <strong>Authority</strong>participation in these funds to 10% of the fund assets and restricts use of funds for any bond proceeds,debt service, or reserves.<strong>The</strong> <strong>Authority</strong>'s adopted Policy does not require that SEC registered mutual funds be rated as toinvestment quality. However, the <strong>Authority</strong>'s Policy restricts <strong>Authority</strong> participation in these funds to5% of <strong>Authority</strong> assets. State law prohibits investment in mutual funds for any bond proceeds or debtservice funds. Participation in such funds is dependent upon specific Board review and approval.Local Government Investment Pools - <strong>The</strong> local government investment pools in <strong>Texas</strong> are required bystate statute to be rated no lower than AAA or AAA-m or an equivalent rating by at least one nationallyrecognized rating service. Pools must comply with the restrictions of state statute (Local GovernmentCode 2256.016).Portfolio disclosure as of August 31, 2008:- the portfolio contained no certificates of deposits,- investment in the State Comptroller's local government investment pool (Texpool) represented 9.7%of the total portfolio rated AAAM,- fully collateralized demand deposits represented 13.6 % of the total portfolio, and- the remainder of the portfolio ( 76.7 %) was in US Government securities rated AAA.Concentration of Credit Risk<strong>The</strong> <strong>Authority</strong>'s adopted Investment Policy requires diversification on all investments and diversificationis monitored on at least a monthly basis. Diversification by investment type is established by Policy withthe following maximum percentages of investment type to the total <strong>Authority</strong> investment portfolio:Maximum %a. U.S. Treasury Bills/Notes/Bonds…………………………………90%b. U. S. Agencies & Instrumentalities………………………………80%c. States, Agencies, Counties, Cities, & Other………………………20%d. Certificates of Deposit……………………………………………20%e. Money Market Mutual Funds………………………….…………75%f. Repurchase Agreements……………………………….…………50% (excluding bond proceeds)g. Authorized Local government Investments………………………75%Portfolio disclosure as of August 31, 2008:- all portfolio sectors were under the maximum percentages allowed by the Policy.25

BRAZOS RIVER AUTHORITYNOTES TO THE BASIC FINANCIAL STATEMENTSAUGUST 31, 2008 AND 2007 (in thousands)Interest Rate RiskIn order to limit interest and market rate risk from changes in interest rates, the <strong>Authority</strong>'s adoptedInvestment Policy sets a maximum maturity on any investment of three (3) years in operating funds,repair and replacement funds and five (5) years in reserve funds. Bond proceeds are to be matched tothe planned expenditures of the funds. <strong>The</strong> Policy restricts the dollar weighted average maturity ofoperating funds to less than 365 days. <strong>The</strong> maximum dollar weighted average maturity for repair andreplacement bond reserve funds are restricted to two years. Operating reserve funds maximum weightedaverage maturity is restricted to three years.Portfolio disclosure as of August 31, 2008:- holdings maturing beyond two years totaled $8,033 or 21.52 % of the Operating Reserve Fundrepresented 10.28 % of the total portfolio- one mortgage backed security holdings had stated maturities of three years and an estimated life ofone year and represented 0.11 % of the Operating Reserves and 0.05 % of the total portfolio- the dollar weighted average maturity of the total portfolio was 351 daysAs of August 31, 2008, the portfolio contained fourteen structured securities and one mortgage backedsecurity as follows:SecurityNote Par Coupon Purchase DateMaturityDate Call Date Structure CusipFairValueStructured Securities Past the Call Date:FHLB $4,000 2.750% 05/07/08 05/07/09 08/07/08 one time call 3133XR2H2 $3,996FHLMC 915 3.000% 07/16/08 07/16/09 10/16/08 one time call 3128X7Q56 913FHLMC 3,000 3.000% 06/16/08 09/16/09 09/16/08 one time call 3128X7ZM9 2,995FHLB 5,000 3.400% 03/12/08 03/12/10 09/12/08 one time call 3133XQ3N0 5,002Discretely Callable Securities:FHLMC 2,000 2.500% 04/21/08 05/15/09 01/21/09 quarterly call 3128X7LD4 1,991FHLB 2,000 2.750% 06/24/08 06/24/09 12/24/08 one time call 3133XRH78 1,996FHLB 1,625 3.050% 08/28/08 08/28/09 11/28/08 quarterly call 3133XS2L1 1,618FHLB 4,550 3.050% 06/23/08 12/23/09 12/23/08 one time call 3133XRGA2 4,547FHLB 2,450 3.000% 05/05/08 02/05/10 02/05/09 one time call 3133XQZ54 2,447FHLB 5,000 3.150% 02/19/08 02/19/10 11/19/08 quarterly call 3133XPKT0 4,995FHLMC 3,000 3.050% 04/28/08 04/28/10 10/28/08 quarterly call 3128X7HZ0 3,002FHLB 5,000 3.000% 03/25/08 03/25/11 12/25/08 quarterly call 3133XQF72 4,988FHLB 3,000 3.000% 05/27/08 05/27/10 11/27/08 quarterly call 3136F9QK2 2,998FHLB 3,000 3.500% 02/14/08 02/14/11 11/14/08 quarterly call 3133XPHZ0 3,003Mortgage Backed Securities:FNMA 40 7.00% 9/1/2005 06/01/11 NA 31371FKA9 42$44,580 $44,53326

BRAZOS RIVER AUTHORITYNOTES TO THE BASIC FINANCIAL STATEMENTSAUGUST 31, 2008 AND 2007 (in thousands)Custodial Credit RiskTo control custody risk State law and the <strong>Authority</strong>'s adopted Investment Policy require all <strong>Authority</strong>owned securities and all collateral pledged for time and demand deposits as well as repurchase agreementcollateral be transferred delivery versus payment and held by an independent party approved by the<strong>Authority</strong> in the <strong>Authority</strong>'s name. <strong>The</strong> custodian is required to provide original safekeeping receipts.Repurchase agreements and deposits must be collateralized to 102% by Policy and contract.Portfolio disclosure as of August 31, 2008:- the portfolio contained no certificates of deposit- the portfolio contained no repurchase agreements- all bank demand deposits were fully insured and collateralized. All pledged bank collateral for demanddeposits was held by an independent institution outside the bank’s holding company.3. RESTRICTED ASSETSCertain proceeds of revenue bonds, as well as certain resources set aside for their repayment, areclassified as restricted assets because their use is limited by applicable bond covenants.Net assets have been restricted for the excess of restricted assets over related liabilities to the extent suchrestricted assets were accumulated from revenues (i.e., in some cases, restricted assets were obtained intotal or in part from the proceeds of bond sales or grants).Restricted assets represent:- Bond Proceeds funds - Construction of facilities, restricted by purpose of the debt issuance.- Debt Service funds - Current interest and principal of bonded indebtedness.- Bond Reserve funds - Payment of final serial maturity on bonded indebtedness or payment of interestand principal of bonded indebtedness when and to the extent the amount in the debt service funds isinsufficient.- Repair And Replacement funds – unexpected or extraordinary expenditures for which funds are nototherwise available or for debt service to the extent of debt service funds deficiencies as required bybond covenants.- Other funds – Future health benefit payments.27

BRAZOS RIVER AUTHORITYNOTES TO THE BASIC FINANCIAL STATEMENTSAUGUST 31, 2008 AND 2007 (in thousands)<strong>The</strong> cash and cash equivalents, investments, and accrued interest components of each fund represented byrestricted assets at August 31, 2008 and 2007 were as follows:2008 2007Lines of BusinessCash and CashEquivalentsAccruedInterestCash and CashEquivalentsInvestmentsInvestmentsAccruedInterestWater Supply System:Bond proceeds funds $ 2,950 $ 3,981 $ 13 $ 4,428 $ 11,747 $ 31Debt service funds 3 280 - 637 - -Bond reserve funds - - - 294 - -Repair and replacement funds 37 449 1 1 475 21Other funds 1,188 2,419 6 2,230 - -Water Supply System Total 4,178 7,129 20 7,590 12,222 52Cost Reimbursable Operations:Bond proceeds funds 1,449 - - 1,264 - -Debt service funds 4,252 439 - 4,886 - -Bond reserve funds 275 2,549 15 3,392 - -Repair and replacement funds 127 675 2 112 709 8Cost Reimbursable Operations Total 6,103 3,663 17 9,654 709 8TOTAL $ 10,281 $ 10,792 $ 37 $ 17,244 $ 12,931 $ 6028

BRAZOS RIVER AUTHORITYNOTES TO THE BASIC FINANCIAL STATEMENTSAUGUST 31, 2008 AND 2007 (in thousands)4. CAPITAL ASSETSA summary of changes in capital assets follows:Balance at Additions Deletions Balance atAugust 31, and and August 31,2007 Transfers Transfers 2008Capital assets, not being depreciated:Land and land rights $ 28,587 $ - $ - $ 28,587Construction in progress 41,786 13,943 (33,556) 22,173Total capital assets, not being depreciated 70,373 13,943 (33,556) 50,760Capital assets, being depreciated:Reservoirs, water treatment and sewerage facilities 159,514 7,835 - 167,349Buildings, structures and improvements 63,468 24,819 (369) 87,918Vehicles 2,830 262 (182) 2,910Furniture 779 - ( 9) 770Computers 3,279 1,124 (21) 4,382Tools and heavy equipment 8,971 391 (498) 8,864Total capital assets, being depreciated 238,841 34,431 (1,079) 272,193TOTAL $ 309,214 $ 48,374 $ (34,635) $ 322,953Less accumulated depreciation for:Reservoirs, water treatment and sewerage facilities $ 64,322 $ 4,163 $ - $ 68,485Buildings, structures and improvements 11,293 3,247 (60) 14,480Vehicles 2,060 328 (168) 2,220Furniture 659 32 ( 9) 682Computers 3,035 300 (21) 3,314Tools and heavy equipment 5,577 622 (277) 5,922Total accumulated depreciation $ 86,946 $ 8,692 $ (535) $ 95,103TOTAL CAPITAL ASSETS, NET $ 222,268 $ 39,682 $ (34,100) $ 227,85029