The retailer

1EGEa6G

1EGEa6G

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

1<br />

ABC of GST and the key<br />

business considerations<br />

What is GST?<br />

<strong>The</strong> Goods and Services Tax (GST) is expected to be the most significant tax, or more so, business transformation reform in the<br />

fiscal history of India. It is likely to impact prices, business processes, investments and profitability in all segments of the economy.<br />

GST is a comprehensive tax levied on manufacture, sale and consumption of goods and service at a national level. Under GST there<br />

will be no difference between goods and services. Only the final consumer will bear the tax on value addition at every stage from<br />

producer/service provider to the <strong>retailer</strong>. It tries to eliminate indirect taxes and mitigate cascading or double taxation issues and<br />

leads to a common national market, with elimination of state boundaries.<br />

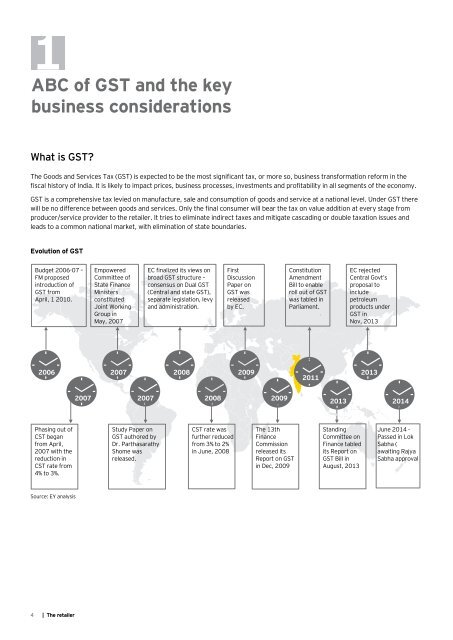

Evolution of GST<br />

Budget 2006-07 –<br />

FM proposed<br />

introduction of<br />

GST from<br />

April, 1 2010.<br />

Empowered<br />

Committee of<br />

State Finance<br />

Ministers<br />

constituted<br />

Joint Working<br />

Group in<br />

May, 2007<br />

EC finalized its views on<br />

broad GST structure –<br />

consensus on Dual GST<br />

(Central and state GST),<br />

separate legislation, levy<br />

and administration.<br />

First<br />

Discussion<br />

Paper on<br />

GST was<br />

released<br />

by EC.<br />

Constitution<br />

Amendment<br />

Bill to enable<br />

roll out of GST<br />

was tabled in<br />

Parliament.<br />

.<br />

EC rejected<br />

Central Govt’s<br />

proposal to<br />

include<br />

petroleum<br />

products under<br />

GST in<br />

Nov, 2013<br />

2006<br />

2007 2008<br />

2009 2013<br />

2011<br />

2007<br />

2007<br />

2008<br />

2009<br />

2013<br />

2014<br />

Phasing out of<br />

CST began<br />

from April,<br />

2007 with the<br />

reduction . in<br />

CST rate from<br />

4% to 3%.<br />

Study Paper on<br />

GST authored by<br />

Dr. Parthasarathy<br />

Shome was<br />

released.<br />

CST rate was<br />

further reduced<br />

from 3% to 2%<br />

in June, 2008<br />

<strong>The</strong> 13th<br />

Finance<br />

Commission<br />

released its<br />

Report on GST<br />

in Dec, 2009<br />

Standing<br />

Committee on<br />

Finance tabled<br />

its Report on<br />

GST Bill in<br />

August, 2013<br />

June 2014 -<br />

Passed in Lok<br />

Sabha (<br />

awaiting Rajya<br />

Sabha approval<br />

Source: EY analysis<br />

4 | <strong>The</strong> <strong>retailer</strong>