BABCOCK & BROWN

bbsn supplementary prospectus.pdf - Astrojapanproperty.com

bbsn supplementary prospectus.pdf - Astrojapanproperty.com

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

can be obtained free of charge by any person who requests it<br />

during the Offer Period, by contacting the BBSN InfoLine<br />

on 1800 818 562.<br />

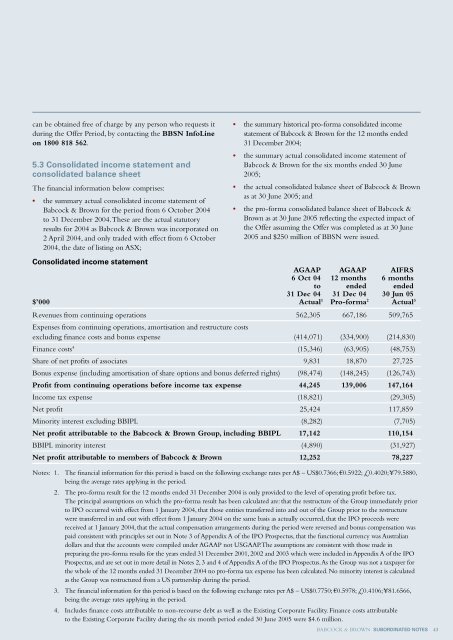

5.3 Consolidated income statement and<br />

consolidated balance sheet<br />

The financial information below comprises:<br />

• the summary actual consolidated income statement of<br />

Babcock & Brown for the period from 6 October 2004<br />

to 31 December 2004. These are the actual statutory<br />

results for 2004 as Babcock & Brown was incorporated on<br />

2 April 2004, and only traded with effect from 6 October<br />

2004, the date of listing on ASX;<br />

• the summary historical pro-forma consolidated income<br />

statement of Babcock & Brown for the 12 months ended<br />

31 December 2004;<br />

• the summary actual consolidated income statement of<br />

Babcock & Brown for the six months ended 30 June<br />

2005;<br />

• the actual consolidated balance sheet of Babcock & Brown<br />

as at 30 June 2005; and<br />

• the pro-forma consolidated balance sheet of Babcock &<br />

Brown as at 30 June 2005 reflecting the expected impact of<br />

the Offer assuming the Offer was completed as at 30 June<br />

2005 and $250 million of BBSN were issued.<br />

Consolidated income statement<br />

AGAAP AGAAP AIFRS<br />

6 Oct 04 12 months 6 months<br />

to ended ended<br />

31 Dec 04 31 Dec 04 30 Jun 05<br />

$’000 Actual 1 Pro-forma 2 Actual 3<br />

Revenues from continuing operations 562,305 667,186 509,765<br />

Expenses from continuing operations, amortisation and restructure costs<br />

excluding finance costs and bonus expense (414,071) (334,900) (214,830)<br />

Finance costs 4 (15,346) (63,905) (48,753)<br />

Share of net profits of associates 9,831 18,870 27,725<br />

Bonus expense (including amortisation of share options and bonus deferred rights) (98,474) (148,245) (126,743)<br />

Profit from continuing operations before income tax expense 44,245 139,006 147,164<br />

Income tax expense (18,821) (29,305)<br />

Net profit 25,424 117,859<br />

Minority interest excluding BBIPL (8,282) (7,705)<br />

Net profit attributable to the Babcock & Brown Group, including BBIPL 17,142 110,154<br />

BBIPL minority interest (4,890) (31,927)<br />

Net profit attributable to members of Babcock & Brown 12,252 78,227<br />

Notes: 1. The financial information for this period is based on the following exchange rates per A$ – US$0.7366; €0.5922; £0.4020; ¥79.5880,<br />

being the average rates applying in the period.<br />

2. The pro-forma result for the 12 months ended 31 December 2004 is only provided to the level of operating profit before tax.<br />

The principal assumptions on which the pro-forma result has been calculated are: that the restructure of the Group immediately prior<br />

to IPO occurred with effect from 1 January 2004, that those entities transferred into and out of the Group prior to the restructure<br />

were transferred in and out with effect from 1 January 2004 on the same basis as actually occurred, that the IPO proceeds were<br />

received at 1 January 2004, that the actual compensation arrangements during the period were reversed and bonus compensation was<br />

paid consistent with principles set out in Note 3 of Appendix A of the IPO Prospectus, that the functional currency was Australian<br />

dollars and that the accounts were compiled under AGAAP not USGAAP. The assumptions are consistent with those made in<br />

preparing the pro-forma results for the years ended 31 December 2001, 2002 and 2003 which were included in Appendix A of the IPO<br />

Prospectus, and are set out in more detail in Notes 2, 3 and 4 of Appendix A of the IPO Prospectus. As the Group was not a taxpayer for<br />

the whole of the 12 months ended 31 December 2004 no pro-forma tax expense has been calculated. No minority interest is calculated<br />

as the Group was restructured from a US partnership during the period.<br />

3. The financial information for this period is based on the following exchange rates per A$ – US$0.7750; €0.5978; £0.4106; ¥81.6566,<br />

being the average rates applying in the period.<br />

4. Includes finance costs attributable to non-recourse debt as well as the Existing Corporate Facility. Finance costs attributable<br />

to the Existing Corporate Facility during the six month period ended 30 June 2005 were $4.6 million.<br />

<strong>BABCOCK</strong> & <strong>BROWN</strong> SUBORDINATED NOTES 43