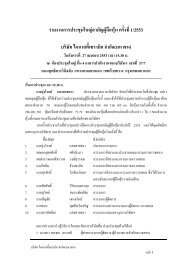

บริษัท ไดนาสตี้เซรามิค จำกัด (มหาชน) - Dynasty TileTop

บริษัท ไดนาสตี้เซรามิค จำกัด (มหาชน) - Dynasty TileTop

บริษัท ไดนาสตี้เซรามิค จำกัด (มหาชน) - Dynasty TileTop

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>บริษัท</strong> ไดนาสตี้ เซรามิค <strong>จำกัด</strong> (<strong>มหาชน</strong>)

Contents<br />

| สารบัญ<br />

ญ<br />

ว ิสัยทัศน์<br />

พันธกิจ<br />

ขององค์กร<br />

3<br />

Vision & Mission<br />

ข ้อมูล<strong>บริษัท</strong><br />

4<br />

Company Profile<br />

สารจากประธานกรรมการ 6<br />

Message from the Chairman<br />

รายงานคณะกรรมการตรวจสอบ 8<br />

Report of the Audit Committee<br />

โ ครงสร้างองค์กร<br />

10<br />

Organization Chart<br />

ค ณะกรรมการบริหาร<strong>บริษัท</strong><br />

12<br />

Board of Directors<br />

การดา<br />

เ นินการด้านความปลอดภัย<br />

สิ่งแวดล้อมและสังค<br />

ม<br />

22<br />

Safety, Environment, and Society<br />

ล ักษณะการประกอบธุรกิจ<br />

36<br />

Nature of Business<br />

ก ารเปลี่ยนแปลงที่ส<br />

า ค ัญในรอบปีที่ผ่านม<br />

า<br />

38<br />

Significant Changes in the Past Year<br />

ส ภาวะอุตสาหกรรมและการแข่งขัน<br />

40<br />

Industrial Conditions and Competition<br />

แ ผนงานและกลยุทธ์ในปี<br />

2554<br />

42<br />

Plans and Strategies for 2011<br />

ป ัจจัยความเสี่ยง<br />

44<br />

Risk Factors<br />

แ ผนภูมิประกอบธุรกิจของ<strong>บริษัท</strong>ฯ<br />

46<br />

Organization Structure<br />

ข ้อมูลส<br />

า ค ัญทางการเงิ<br />

น<br />

47<br />

Financial Hilight<br />

โ ครงสร้างการถือหุ้น<br />

48<br />

Shareholding Structure<br />

ค ่าตอบแทนกรรมการและผู้บริหาร<br />

51<br />

Renumuration for the Directors and Management<br />

โ ครงสร้างการบริหารงาน<br />

54<br />

Management Structure<br />

บ ริษัทย่อยและ<strong>บริษัท</strong>ในเครือ<br />

62<br />

Subsidiaries<br />

การกา<br />

ก ับดูแลกิจกา<br />

ร<br />

63<br />

Corporate Governance<br />

ก ารควบคุมภายใน<br />

67<br />

Internal Controls<br />

น โยบายการจ่ายเงินปันผล<br />

69<br />

Dividend Payment Policy<br />

ร ายการระหว่างกัน<br />

70<br />

Related Transaction<br />

ส รุปผลการด<br />

74<br />

Summary of Operating Results and Financial Analysis<br />

ร ายงานของผู้สอบบัญชีรับอนุญาตและงบการเงิน<br />

78<br />

Auditor’s Report and Financial Statements

3<br />

Vision<br />

“ Leader of Tile Business<br />

with outlets throughout<br />

Thailand ”<br />

Mission<br />

1. To produce tiles with creative production process that meets the international standard at the<br />

lowest cost for quality products at reasonable prices.<br />

2. To serve our customer with wide variety of tiles at reasonable prices, easy access for customers<br />

with our outlets throughout Thailand. Services and continuity of products is guaranteed.<br />

3. To have high dividend payout.<br />

4. To create stability for employees with:<br />

• Total management and creative idea.<br />

• Course training.<br />

• Key capabilities development.<br />

• Cultural development.<br />

• Networking development.<br />

5. To have customers’ products and services satisfaction and supporting majority of customers<br />

who have lower income. To be fair with both customers and suppliers.<br />

6. To have Corporate Social Responsibility.

4<br />

COMPANY PROFILE<br />

Company <strong>Dynasty</strong> Ceramic Public Company Limited (DCC)<br />

Company registration Bor.Mor.Jor. (PCL) 321 (0107537000742)<br />

Established 1 August 1989<br />

Listing on the SET<br />

3 January 1992, trading under the abbreviation “DCC” under the<br />

construction materials group.<br />

Nature of business<br />

Core business<br />

Manufacturer and distributor of ceramic floor and wall tiles under<br />

“<strong>Dynasty</strong>”, “Tomahawk”, “Jaguar”, “Nava” brand. Also, it purchases the<br />

ceramic floor, wall and decorative tiles from Tile Top Industry Public,<br />

Co., Ltd., which is one of the subsidiaries of the Company.<br />

Secondary core<br />

Nationwide distributor through its subsidiaries: Pick & Pay Co., Ltd.,<br />

Muangthong Ceramics business Co., Ltd., and World Wide Ceramics<br />

Co., Ltd. In addition, <strong>Dynasty</strong> Ceramic is order other related products<br />

such as Sanitary wares and other related products such as Tile grout<br />

for sale.<br />

Registered capital 408,000,000 Baht, comprising 408,000,000 shares with a par value of 1<br />

Baht per share, issued and fully paid-up<br />

Subsidiary<br />

The Company has four subsidiaries: Tile Top Industry Co., Ltd., Pick<br />

and Pay Co.Ltd., Muangthong Ceramic Co., Ltd., and World Wide Ce<br />

ramic Co., Ltd, in which it holds an equity stake of 96 percent of the<br />

registered and paid-up capital.<br />

Head Office Of DCC Address 37/7 Suthisarn-Vinijchai Road, Samsen-Nok Sub-district<br />

And Its’ Subsidiaries HuayKwang District, Bangkok10310. Tel. 0-2276-9275-81<br />

Fax. 0-2276-0313-17<br />

Homepage<br />

http://www.dynastyceramic.com

5<br />

DCC Factory Address 54/8 Moo3, Suwannasorn Road, Koke Yae Sub-District, Nong<br />

Kae District, Saraburi Province 18230 Tel. 036-379023-4<br />

Fax. 036-371024<br />

Tile Top Factory<br />

Address 3/2 Moo 8, Paholyothin Road, Nong Khai Nam Sub district,<br />

Nong Khae District, Saraburi Province 18140 Tel. 036-371815<br />

Fax. 036-371111<br />

Subsidiary Outlets<br />

By the end of 2010, there are a total of 177 factory outlets located<br />

nation-wide in forms of factory outlets.<br />

Registrar<br />

Thailand Securities Depository Co. Ltd. The Stock Exchange of<br />

Thailand Building, 62 Ratchadapisek Road, Klongtoey Sub-district,<br />

Klongtoey District, Bangkok 10110 Fax: +66 2 654 5599<br />

Telephone: +66 2 229 2800 ,+66-2-654-5599<br />

Auditors<br />

Mr.Jadesada Hungsapruek Certified Public Accountant No.3759 or<br />

Miss Wimolsri Jongudomsombut Certified Public Accountant No.3899<br />

or Miss Kannika Wipanurat Certified Public Accountant No.7305.<br />

From Karin Audit Co. Ltd.<br />

138 Boonmitr Building 6th Fl. Room B1,Silom Road,<br />

Kwang Suriyawong, Khet Bangrak, Bangkok 10500 Thailand<br />

Legal Counsel<br />

Mr. Payab Khumarj<br />

49/15 Moo 1 Bangratug District Sampran Nakorn-Prathom<br />

Total Capacity<br />

51 Million Squaremetre/Year

6<br />

Message<br />

from the President<br />

During 2010, Thailand had many effects to the<br />

economy, such as the politic unrest which halted the<br />

economy in Bangkok. Many severe weather conditions<br />

throughout the year namely the drought in second<br />

quarter and the flood in third and fourth quarter. Not<br />

to mention the continuous of Baht depreciation. These<br />

effects mentioned above will also continue to affect the<br />

economy in 2011. However, the company has managed<br />

to maintain its growth with a good dividend payout.<br />

2010 Performance<br />

In the first quarter of 2010, the company had<br />

21% growth in revenue from the previous year. Even<br />

with the political crisis, the company had made a new<br />

sales record in March at 722 million Baht. This proved<br />

that political crisis does not affect the company’s<br />

revenue. In the second quarter, with the drought,<br />

the company had 16% growth in revenue from the<br />

previous year. One of the biggest floods in Thailand<br />

occurred during third and fourth quarter which had<br />

halted the company’s growth where the third quarter<br />

resulted in zero growth. In addition to the flood, the<br />

fourth quarter is also the harvest season. From those<br />

events, the company’s growth resulted in 11% from<br />

the target of 15%. However, for the year 2010, the<br />

company’s revenue was 6,513 million Baht with the net<br />

profit of 1,175 million Baht or 18% increase from the<br />

previous year. The gross margin also increased from<br />

42.5% to 44.3% and the company was able to pay out<br />

100% of the net profit or a total of 2.88 Baht per share.<br />

Production investment and development<br />

For the past three years, the company’s<br />

revenue has been steadily growing without any<br />

additional of new kilns. Because of the capacity<br />

expansion can be done easily within three months,<br />

the company’s objective is to expand the point of sale<br />

before expand the capacity. The company’s policy is<br />

to have kilns operating at the most efficient rate with<br />

no idle capacity as we have seen that the capacity<br />

utilization rate is always above 92%.<br />

In the beginning of 2010, the company was<br />

planning to modify and add 4 new kilns, but the<br />

company only modifies and adds 3 kilns because<br />

of the flood. The flood slowed down the market so<br />

we extended the 4th kiln to 2011. In conclusion, our<br />

capacity expansions plan as follows:<br />

• January 2010 1 new kiln at Tile Top<br />

Factory.<br />

• March 2010 modified 1 kiln at Tile Top<br />

Factory.<br />

• July 2010 1 new kiln at <strong>Dynasty</strong> Factory.<br />

• January 2011 1 new kiln at Tile Top<br />

Factory.<br />

• July 2011 1 new kiln at Tile Top Factory.<br />

At the end of 2010, the company has<br />

capacity of 51 million sqm, 58 million sqm in January<br />

2011, then 61 million sqm in July 2011.<br />

In addition to capacity expansion, the company<br />

also researched on producing grout in 4Q10. The<br />

capacity is now at 2,700 boxes per month or 10%<br />

of the sales. In 2011, the company will be expanding<br />

the capacity of grout. The new capacity should<br />

cover at least 40% of the sales. The company also

continuously researches more on cost saving for<br />

producing grout.<br />

The company is still continuously researching<br />

other projects, namely, rectified tiles project, high cost<br />

chemicals replacement, etc.<br />

Marketing<br />

In 2010, the company has a marketing campaign<br />

under “<strong>Dynasty</strong> Tile Top Becomes No. 1” since<br />

April 2010 until April 2011. The company promotes<br />

campaign via radio, local newspaper and also event<br />

cars. Every outlet will have promotion tiles and for<br />

every 1,000 Baht sales, the customer will get a<br />

coupon for chances to win the prize.<br />

Corporate Social Responsibility<br />

During 2010, the company has been participating<br />

in many CSR projects. The company had<br />

begun CSR project since 2009. This year, the<br />

company had given both floor tiles and wall tiles also<br />

managed every construction in 14 upcountry schools<br />

from 3 schools last year. The company also had a<br />

soccer match with the people in the community as<br />

well. The event was filled with happiness for both giver<br />

and receiver which we think it was very successful.<br />

In 2011, the company will also continue to “give” to<br />

upcountry schools as usual.<br />

In addition to building schools, the company<br />

also helped many flood victims. Employees had<br />

prepared dry foods, water bottles, medicines along<br />

with other consumables in a bag for a total of more<br />

than 10,000 bags to give away to the flood victims.<br />

The management team and employees also donated<br />

some money in a total over 6 million baht with the<br />

191 Police.<br />

In 2010, the company has a total net profit<br />

of 1,175 million Baht or 2.88 Baht per share from<br />

1.00 Baht par value. The board of committee<br />

announced 2.88 Baht or 100% for dividend payout and<br />

transactions will be finished by 4th of May 2011. The<br />

company has already paid up 2.30 Baht of the amount<br />

during 2010; therefore, 0.58 Baht is to be paid.<br />

The company has received Forbes: 200 Best<br />

Under a Billion for 2010, which is the third time from<br />

7<br />

Forbes. The company also received 200 Best Public<br />

Company from Financial and Banking Magazine. In<br />

addition to that, the company has been included in<br />

SET 50 starting in January 2011.<br />

The management committee greatly<br />

appreciates every shareholder, supplier, employee and<br />

customer who has been continually supporting the<br />

company. Lacking any part stated will not result in<br />

the successful of the company we are today. As a<br />

representative of the company, I would like to say<br />

thank you to every part of this success and stable<br />

growth of the company. We will continue to improve<br />

our performance and keeping this success as always.<br />

Mr.Roongroj Saengsastra<br />

Chairman

8<br />

REPORT OF THE AUDIT COMMITTEE<br />

To the shareholders of <strong>Dynasty</strong> Ceramic Public Company Limited<br />

The Audit Committee of <strong>Dynasty</strong> Ceramic Public Company Limited was elected by the Board Of<br />

Director. The committee consists of 4 Independent Directors with the Assistant Managing Director – Branch Marketing (In<br />

charge of Internal Audit Office) acted as The Secretary of the Audit Committee. All members of the Audit Committee are<br />

qualified according to the Audit Committee Charter approval by the Board of Director and in accordance with the Stock<br />

Exchange of Thailand’s Best Practice Guidelines 2010. The Audit Committee conducted a total of four meetings in 2010,<br />

and appropriately discussed and shared opinions in one of the meeting with the external auditors. This can be summarized<br />

as follows:<br />

Audit Committee<br />

Position<br />

Attend the Meeting / Total Meeting (Time)<br />

ป 2010 ป 2009<br />

1.General Yuthasak Sasiprapa Chairman 4/4 4/4<br />

2.Pol.Gen.Patcharavat Wongsuwan Committee members 4/4 2/4<br />

3.Mr Surasak Kosiyajinda Committee members 4/4 4/4<br />

4.Mr Yothin Juangbhanich Committee members 4/4 4/4<br />

5.Miss Sonthaya Yaowalee Secretary 4/4 4/4<br />

The Audit Committee No.4 is qualified in both experience and knowledge to review the Financial Statement<br />

of the company.<br />

The Audit Committee sometimes appropriately discussed and shared opinions with senior management and external<br />

auditors on related matters. This can be summarized as follows:<br />

1. Reviewed the Company’s’ audited quarterly and annual financial statements of year 2010, and discussed<br />

with external accounting auditor and management on the righteousness and completion of the financial<br />

statement to ensure that they were prepared in compliance with generally accepted accounting standards<br />

with adequate disclosure of the financial information<br />

2. Reviewed the Internal Control System in its evaluation of the adequacy and effectiveness of the<br />

Company in achieving its goals. The Audit Committee reviewed the Internal Audit Report for accordingly to the<br />

evaluation report committed by the internal control section and the auditor to ensure that the company had<br />

working and operational systems which are effective enough to protect and prevent risks which could happen<br />

to the company, and that the approval of transactions and budget of the operational sector is in agreement<br />

with the approval policy of the company<br />

3. Reviewed the compliance with Securities and Exchange laws, regulations of the Stock Exchange of<br />

Thailand, and other relevant laws; for instance, Securities and Exchange acts, regulations of the Securities and<br />

Exchange Commission, the Public Company Act, and business commitments with third party agreements. The Audit<br />

Committee came to the conclusion that the Company had complied with all applicable regulatory requirements.<br />

4. Considered the nomination and appointment of the external auditor and the annual audit fee for 2011<br />

to seek approval from the Company’s Board of Directors for the 2011 General Shareholders’ Meeting. After considering<br />

the auditors’ performance, independence, and appropriateness of the auditing fee, the Audit Committee appointed<br />

Mr.Jessada Hangsapruck, Certified Public Accountant, Registration Number 3759, or Miss Vimolsri Jongudomsombat<br />

Certified Public Accountant, Registration Number 3899, or Miss Kannikar Vibhanurat Certified Public Accountant, Registration<br />

Number 7305 from Karin Auditing Company Limited the Certified Public Accountant of the Company for 2011. The total annual

9<br />

audit fee for 2011 is 1,945,000 Baht. The Audit Committee had comments on the auditor appointment as followed:<br />

• The auditor independently performed the tasks with knowledge, proficiency, and suggested on<br />

internal control system, and risks<br />

• The proposed fee is at appropriate rate, which is equal to that of 2010. The company does not pay<br />

for other service to the auditor, the auditor’s company, person, or company related to the auditor and the<br />

auditing company which the auditor is working for.<br />

• According to the regulations of Office of the Securities Exchange Commission and the Stock<br />

Exchange of Thailand, the registered companies have to make the change in the auditor of the company<br />

in every 5 financial statements. If the auditor is appointed the company’s auditor for 2011, it will be<br />

the second time of the auditor.<br />

• The auditor has no connection with the company and its subsidiaries.<br />

5. Reviewed related transactions executed by the Company with related parties which were considered as<br />

having a conflict of interest, and reviewed the sufficiency of the disclosure of these transactions in accordance with the<br />

requirements of the Stock Exchange of Thailand. The Audit committee cameto the conclusion that the aforementioned<br />

transactions were conducted by Management fairly and priced with a view to giving the utmost benefit to the Company at an<br />

arm’s length basis, and that they were accurately and adequately disclosed.<br />

6. Reviewed Risk Management –The Audit Committee had reviewed the operation information and Internal<br />

Control System by interrogating The Accounting Procedure and Reviewed Audit Plan every quarter.<br />

7. The Audit Committee had self- assessment in accordance with Best Practice Guidelines for the audit committee<br />

on its composition, meetings, activities, and dealings with Management and the external auditor. The Audit Committee came to<br />

the conclusion that its scope and performance were consistent with Best Practice Guidelines to effectively aid the fulfillment of<br />

good corporate governance.<br />

8.The minutes of meeting should be written and proposed to the board of director after every meeting, so that<br />

the company’s performance went on accordingly to the Best Practice of the Audit committee.<br />

In conclusion, the Audit committee performed its task entirely as stated in the charter of the audit committee<br />

approved by the company’s board of director in accordance with the act of the Stock Exchange of Thailand.<br />

The Audit committee gave judgment that the company had financial transactions stated, the related transactions<br />

happened during the year disclosed accurately and appropriately. The executive directors operated the company with an<br />

ethical mind, and had the intention of performing duties professionally to achieve the Company’s goals under an effectively<br />

concise and continual Risk Management. The company had an accurate, reliable management system, as well as continually<br />

improved the operational system to be at better quality, and suit the business’ environment.<br />

On Behalf Of Audit Committee<br />

<strong>Dynasty</strong> Ceramic Public Company, Limited<br />

General<br />

(Yuthasak Sasiprapa)<br />

Chairman of the Audit Committee<br />

February 24, 2011

Board of Di<br />

Chairma<br />

Mr.Roongroj Sa<br />

Preside<br />

Mr. Sanchai J<br />

10<br />

ORGANIZATION CHART<br />

Executive Vice Pre<br />

resi sdent<br />

(out<br />

let maketing)<br />

Miss<br />

Sontaya Yaowalee<br />

Exec<br />

ecutive Dire<br />

ctor<br />

(Marketing)<br />

Mr.Chana Suthiwangcharoen<br />

Vice President (Accounting)<br />

Miss Somruethai Boonyarit<br />

VP (Branch Accounting)<br />

Miss Porntip Pengtako<br />

VP (Outlet Marketing)<br />

Miss Sontaya Yaowalee<br />

VP (Admin)<br />

Mr. Monrak Saengsastra<br />

VP (Marketing)<br />

Mr.Jaruj<br />

uate Tritawil<br />

VP-IT Investor<br />

Mr. Marut Sa

11<br />

of Director<br />

airman<br />

j Saengsastra<br />

Company’s Secretary<br />

Miss. Cattleya Saengsastra<br />

Company’s Secretary Assistant<br />

Mr. Marut Saengsastra<br />

sident<br />

hai Janejarat<br />

Seni nor Vice President<br />

(Production)<br />

Mr<br />

.Jaruwat Tritawil<br />

Senior Vice President<br />

(Factory Admin)<br />

Mr. Monrak Saengsastra<br />

Senior Vice President<br />

(Technic)<br />

Mr. Sutee Boonnag<br />

estor Relations<br />

t Saengsastra<br />

VP (Engine<br />

neerin<br />

ering)<br />

DCC / TTOP<br />

Mr. Somnuek Suriyakul<br />

VP (Production)<br />

TTOP<br />

Mr.Jar<br />

uwat Tritawil<br />

VP (Production)<br />

DCC<br />

Mr.Chava<br />

lit Pidthong<br />

VP (Factory Admin)<br />

Mr Arun Natchayangkoon<br />

VP (Technic)<br />

Mr. Sutee Boonnag

12<br />

Board of Directors<br />

Name<br />

Mr.Roongroj Saengsastra<br />

Position<br />

Chairman<br />

Age(Year) 61<br />

Highest Education<br />

Bachelor degree, Accounting, Chulalongkorn University<br />

Training From IOD<br />

None<br />

% Of Share Holding Holding 100,000,000 shares ( 24.51%) at Jan 31 , 2011<br />

Family relationship among executives Miss Cattleya Saengsastra’s brother<br />

Other Current Position<br />

Listed Company<br />

None<br />

Non Listed Company 4 Companies<br />

• Chairman of <strong>TileTop</strong> Industry Company Limited,<br />

• Chairman of Pick and Pay Company Limited,<br />

• Chairmant of Muang Thong Ceramic Co.Ltd.<br />

• Chairman of World Wide Ceramic Company Limited<br />

Previous 5 years experience<br />

2000-2007 - President-<strong>Dynasty</strong> Ceramic PCL<br />

2000-2004 - President of <strong>TileTop</strong> Industry PCL.<br />

2005-Present<br />

- Chairman of Pick and Pay Company Limited,<br />

- Chairman of Muang Thong Ceramic Co.Ltd.<br />

- Chairman of World Wide Ceramic Company Limited<br />

Mr. Roongroj Saengsastra<br />

Chairman

13<br />

Name<br />

Mr. Sanchai Janejarat<br />

Position<br />

President<br />

Age(Year) 61<br />

Highest Education<br />

Bachelor degree, Engineering,Chulalongkorn University<br />

Training From IOD<br />

Directors Accreditation Program (DAP) No.54/2006<br />

% Of Share Holding 342,000 shares ( 0.08 %) at Jan 31 , 2011<br />

Family relationship among executives None<br />

Other Current Position<br />

Listed Company<br />

None<br />

Non Listed Company 4 Companies<br />

• President : <strong>TileTop</strong> Industry PCL.<br />

• Director : Pick and Pay Company Limited,<br />

• Director : Muang Thong Ceramic Co.Ltd.<br />

• Director : World Wide Ceramic Company Limited<br />

Previous 5 years experience<br />

2002-2008 Executive Director (Production) <strong>Dynasty</strong> Ceramic Public Co.,Ltd.<br />

2000-2008 Executive Director (Production) <strong>TileTop</strong> Industry PCL<br />

Mr. Sanchai Janejarat<br />

President

14<br />

Name<br />

General Yutthasak Sasiprapha<br />

Position<br />

Independent Director & Chairman of Audit Committee<br />

Age(Year) 74<br />

Highest Education<br />

Command and General Staff College,<br />

Chulachomklao Royal Military Academy<br />

Chief of Joint Staff School - 48<br />

National Defence College - 33<br />

Training From IOD Directors Accreditation Program (DAP) No. 56/2006<br />

Capital Market Academy Leadership Program ( Class 11 )<br />

% Of Share Holding None<br />

Family relationship among executives None<br />

Other Current Position<br />

Listed Company<br />

1 Company<br />

• PTT Chemical Public Co.,Ltd.-Advisor<br />

Non Listed Company 3 Companies<br />

• Vice President Pan Asia Planner Co.,Ltd.<br />

• Vice President GPP International Co.,Ltd<br />

• President of the Olympic Committee,<br />

Previous 5 years experience<br />

2001-Present : President of the Olympic Committee<br />

2005-2007 Director : PTT Chemical Public Co.,Ltd<br />

General Yutthasak Sasiprapha<br />

Independent Director & Chairman of Audit Committee

15<br />

Name<br />

Pol.Gen. Patcharavat Wongsuwan<br />

Position<br />

Independent Director & Audit Committee<br />

Age(Year) 61<br />

Highest Education<br />

Bachelor Degree Police Academy<br />

Master degree, Art Social, Kasetsart University<br />

Training From IOD<br />

None<br />

% Of Share Holding None<br />

Family relationship among executives None<br />

Other Current Position<br />

Listed Company<br />

None<br />

Non Listed Company 1 Company<br />

• Director : <strong>TileTop</strong> Industry PCL.<br />

Previous 5 years Experience Year 2008-2009 Commissioner General-Royal Thai Police<br />

Year 2002-2007 Deputy Commissioner General,Royal Thai Police<br />

Pol.Gen. Patcharavat Wongsuwan<br />

Independent Director & Audit Committee

16<br />

Name<br />

Mr. Chaiyasith Viriyametakul<br />

Position<br />

Director<br />

Age(Year) 62<br />

Highest Education<br />

Bachelor degree, Engineering, Chulalongkorn University<br />

National Defence College (NDC.4414)<br />

Training From IOD Director Accreditation Program (DAP) 20/2004<br />

- Increasing Your Corporate Value Through Effective<br />

Communication Year 2003<br />

- Risk Management From IOD<br />

% Of Share Holding 17,545,000 shares or 4.30 % at Jan 31 ,2011<br />

Family relationship among executives<br />

Other Current Position<br />

Listed Company<br />

None<br />

1 Companies<br />

• President of Vibhavadee Hospital<br />

Non Listed Company<br />

8 Companies<br />

• Vice Chairman of BOD Chao Paya Hospital Public Co.,Ltd<br />

• President of Thai Rim Tower Associated Co,,Ltd<br />

• Executive Director Vibharam Co.,Ltd<br />

• Executive Director Patanakarn Vejchakit Co.,Ltd.<br />

• Director-Sereerak Hospital Co.,Ltd.<br />

• Managing Director Thepharak Pattanakarn Co.,Ltd.<br />

• Director-Princeton Park Suite Co.,Ltd<br />

• Director-Pitakdham Development Co.,Ltd<br />

Mr. Chaiyasith Viriyametakul<br />

Director

17<br />

Name<br />

Mr. Suvit Smarnpanchai<br />

Position<br />

Director<br />

Age(Year) 63<br />

Highest Education<br />

High-School,Charnvit Wittaya School<br />

Training From IOD Director Accreditation Program (DAP) 54/2006<br />

% Of Share Holding 12,892,000 shares or 3.16 % at Jan 31 ,2011<br />

Family relationship among executives None<br />

Other Current Position<br />

Listed Company<br />

None<br />

Non Listed Company 1 Company<br />

• Managing Director-Ekasithpun Co.,Ltd.<br />

Previous 5 years Experience<br />

Present : Advisor of The Audit Committee and Monitoring<br />

The Police Adminisration of Ratchburana police Station<br />

2000-Present : Managing Director-Ekasithpun Co.,Ltd.<br />

Mr. Suvit Smarnpanchai<br />

Director

18<br />

Name<br />

Mr.Yothin Juangbhanich<br />

Position<br />

Independent Director & Audit Committee<br />

Age(Year) 62<br />

Highest Education<br />

Master Degree(MBA) from University of Santa Clara,USA<br />

Training From IOD Director Accreditation Program (DAP) 79/2009<br />

% Of Share Holding None<br />

Family relationship among executives None<br />

Other Current Position<br />

Listed Company<br />

1 Company<br />

• Independent Director & Chairman of Audit Commitee-Tanasiri Group PCL<br />

Non Listed Company None<br />

Previous 5 years Experience<br />

Head of Management System Development - Revenue Department<br />

Regional 12 Revenue Chief<br />

Mr. Yothin Juangbhanich<br />

Independent Director & Audit Committee

19<br />

Name<br />

Mr. Surasak Kosiyajinda<br />

Position<br />

Independent Director & Audit Committee<br />

Age(Year) 68<br />

Highest Education<br />

Bachelor degree in Law, Tammasart University<br />

Training From IOD Director Accreditation Program (DAP) 48/2005<br />

% Of Share Holding None<br />

Family relationship among executives None<br />

Other Current Position:<br />

Listed Company<br />

1 Company<br />

• Director / AJ PLAST Public.Co.Ltd.<br />

Non Listed Company 1 Company<br />

• Director / UNITED FOOD Public.Co.Ltd.<br />

Previous 5 years Experience<br />

2000-2010 Jutturatham Law Office<br />

Mr. Surasak Kosiyajinda<br />

Independent Director & Audit Committee

20<br />

Name<br />

Mr. Chana Suthiwangcharoen<br />

Position<br />

Director<br />

Age(Year) 63<br />

Highest Education<br />

Bachelor degree,Communication Arts, Chulalongkorn University<br />

Training From IOD<br />

Directors Accreditation Program (DAP) No.63/2007<br />

% Of Share Holding None<br />

Family relationship among executives None<br />

Other Current Position<br />

Listed Company<br />

None<br />

Non Listed Company 4 Companies<br />

• Executive Director (Marketing) <strong>TileTop</strong> Industry PCL.<br />

• Director : Pick and Pay Company Limited,<br />

• Director : Muang Thong Ceramic Co.Ltd.<br />

• Director : World Wide Ceramic Company Limited<br />

Previous 5 year Experience<br />

Director & Vice President (Marketing) <strong>Dynasty</strong> Ceramic Public Co.,Ltd.<br />

<strong>TileTop</strong> Industry PCL<br />

• Director : Pick and Pay Company Limited,<br />

• Director : Muang Thong Ceramic Co.Ltd.<br />

• Director : World Wide Ceramic Company Limited<br />

Mr. Chana Suthiwangcharoen<br />

Director

21<br />

Name<br />

Miss. Cattleya Saengsastra<br />

Position<br />

Executive Director and Company’s Secretary<br />

Age(Year) 63<br />

Highest Education<br />

Bachelor degree Accounting, Chulalongkorn University<br />

Management Development Program<br />

J.J Kellogg , North Western University<br />

Training From IOD<br />

Directors Accreditation Program (DAP) No.47/2005<br />

% Of Share Holding 11,000,000 shares(2.7%) at Jan 31 ,2011<br />

Family relationship among executives Mr.Roongroj Saengsastra’s Sister<br />

Other Current Position<br />

Listed Company<br />

1 Companies<br />

• Independent Director & Chairman of Audit Committee<br />

S&P Syndicated Public Co.,Ltd.<br />

Non Listed Company 4 Companies<br />

• Executive Director and Company’s Secretary,<strong>TileTop</strong> Industry PCL<br />

• Director : Pick and Pay Company Limited,<br />

• Director : Muang Thong Ceramic Co.Ltd.<br />

• Director : World Wide Ceramic Company Limited<br />

Previous 5 year Experience<br />

• Director : Pick and Pay Company Limited,<br />

• Director : Muang Thong Ceramic Co.Ltd.<br />

• Director : World Wide Ceramic Company Limited<br />

Miss Cattleya Saengsastra<br />

Executive Director and Company’s Secretary

22<br />

Operations<br />

in Safety, Environment, and Society

Safety<br />

In 2010, the company has been focusing on<br />

developing many aspects of the staff’s knowledge. Safety<br />

is one of the company’s developments; improving the<br />

working condition and ambience to be safe for the staff<br />

of the company with the belief that any accident, injury<br />

or illness caused by the job can be prevented by the<br />

cooperation from all of the organization’s members. The<br />

company has encouraged many activities concerning<br />

safety in the organization to motivate the staff’s<br />

consciousness such as<br />

1. The fire drill training program<br />

2. Organizing Safety Week to reduce the<br />

accident<br />

3. Acknowledging the staffs to protect<br />

themselves and their family from HIV, TB, as<br />

well as other contagious diseases<br />

4. The White Factory Campaign<br />

5. The Watch Out Project which takes care of<br />

the staffs encountered any accident<br />

6. Six Zero Project<br />

• Zero Accident<br />

• Zero Break-Down<br />

• Zero Complaint<br />

• Zero Loss<br />

• Zero Mistake<br />

• Zero Waiting Time.<br />

These projects were organized not only to<br />

reduce the accident but also to develop and improve<br />

the staffs’ quality of lives. The result of the company’s<br />

endeavor to lower the accident happened while working<br />

is that the accident statistic continually reduces. Every<br />

employee does play a vital role to create good working<br />

ambience, which also generates safety and consciousness<br />

in increasing efficiency in working as well as quality<br />

of life.<br />

23<br />

Environment<br />

We have taken environment and human resource development<br />

as ones of the company’s responsibilities. So, the company<br />

has been emphasizing on the environmental control in the<br />

manufacturing system since last year in many aspects.<br />

1. Evaluating the quality of the air of the surrounding area<br />

of the plant to ensure that the air released from the factory cannot<br />

affect the environment and the community around the factory<br />

2. Evaluating noise pollution, dust, and chemical which are<br />

all standardized<br />

3. Building the waste-water treatment system to treat and<br />

recycle the water which help reduce the water resource<br />

4. Recycling the waste materials and the fragmented tiles,<br />

and keeping those which are not recyclable in the specifically safe<br />

place in the factory.<br />

Additionally, the company has sympathized the<br />

victims of inundations and provided them dried food,<br />

drink, medical supply, consumer goods, and more<br />

than 10,000 relief bags to distribute to the suffered<br />

community. Moreover, the company executives and<br />

employees have contributed their own money of about 6<br />

million in total in cooperation with the patrol 191.

24<br />

<strong>Dynasty</strong> Ceramic Public Company, Limited<br />

Operations in Safety, Occupational Health, and Working Ambience 2010<br />

Objectives: 1. To create the means of operations in safety, occupational health, and working ambience.<br />

2. To create the directions in the development of sustainable safety in working according to all the laws concerning safety at work.<br />

By: The committee of safety, occupational health, and working ambiences<br />

targeted length of operations (Quarter)<br />

No. Plans and Activities<br />

1 2 3 4<br />

Operators Responsible Sectors<br />

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec<br />

1 Personnel Development<br />

1.1 New staff Orientations<br />

• Safety regulations and duties<br />

• Basic knowledge of fire extinguishing and PPE usage<br />

• Occupational illnesses, illnesses and drugs<br />

1.2 Occupational health committee's development and field trip<br />

• National safety-at-work week /<br />

• Plant and company visits<br />

1.3 Potential development seminar on safety<br />

• Supervisors / operational staffs / committees<br />

• Seminar on HIV, and TB / /<br />

• Department of Skill Development's seminar<br />

Occupational health<br />

officers<br />

Occupational health<br />

officers, and the<br />

committee<br />

Occupational health<br />

officers<br />

Human resources<br />

department, head of each<br />

department, and<br />

operational staffs<br />

Head of each department,<br />

and operational staffs<br />

Human resources<br />

department, head of each<br />

department, and<br />

operational staffs<br />

2 Inspection, Control, Improvement, and Protection<br />

2.1 Installation of basic fire extinguishers /<br />

Occupational health<br />

officers, and the<br />

2.22 Inspection on electricity system, electrical appliances, and<br />

Electricians and<br />

/<br />

transformers<br />

occupational health<br />

2.3 Inspection on buildings and signboards /<br />

Human resources<br />

department and<br />

2.4 Inspection on working ambiences (noise, light, temperature,<br />

Occupational health<br />

/<br />

chemical), and improvement<br />

officers, and the<br />

2.5 Examination, inspection, and improvement of PPE<br />

Occupational health<br />

officers, and the<br />

2.6 Suggestion, and improvement of security system<br />

Occupational health<br />

officers, and the<br />

2.7 Improvement of safety signs according to legal standard<br />

Occupational health<br />

officers, and the<br />

2.8 Suggestion of additional safety equipment at work (cards,<br />

Occupational health<br />

tools, safety equipments)<br />

officers, and the<br />

3 Safety Campaign<br />

3.1 Campaign on encouraging the use of PPE<br />

Occupational health<br />

officers and the<br />

3.2 Promoting on board exhibition:<br />

• Information on social security, workers' compensation fund, etc.<br />

Occupational health<br />

officers, and the<br />

• Safety policies<br />

committee<br />

Head of each department<br />

Committee<br />

Committee<br />

Head of each department,<br />

and officers of Saraburi's<br />

Head of each department,<br />

and operational staffs<br />

Administrative and human<br />

resources departments<br />

Head of each department,<br />

and operational staffs<br />

Head of inventory<br />

department<br />

Head of each department<br />

Head of each department,<br />

and operational staffs<br />

• Accidents' statistics<br />

3.3 Activities and projects<br />

• "Rewarding Creativity" campaign<br />

• "365 days 0 accident" campaign<br />

• "White Factory" campaign<br />

3.4 Organizing safety week at work of 2010 (16-18/9/10) /<br />

3.5 Making handbook concerning safety at work<br />

3.6 Campaign on safety out of work such as driving safely, etc.<br />

Occupational health<br />

officers, and the<br />

committee<br />

Occupational health<br />

officers, and the<br />

Occupational health<br />

officers, and the<br />

Occupational health<br />

officers, and the<br />

Administrative and human<br />

resources departments<br />

Head of each department,<br />

and operational staffs<br />

Head of each department<br />

Administrative and human<br />

resources departments

25<br />

4 Routine Working<br />

, p<br />

4.1 Monthly occupational health committee meeting<br />

• Safety tour on first Thursdays of every month 9-12am 14 4 4 1 6 3 1 5 2 7 4 2<br />

• Occupational health committee meeting 1.30-4.00pm 14 4 4 1 6 3 1 5 2 7 4 2<br />

4.2 Monthly Divisional safety inspection by head of each<br />

department<br />

4.3 Implementation of safety laws every 3 month (Occupational<br />

health reports)<br />

Jan-Mar Apr-Jun Jul-Sep Oct-Dec<br />

4.4 Safety analysis to evaluate the risks<br />

4.5 Inspection, analysis, and report of accidents caused by working<br />

4.6 Report summary on accident statistics (on every 7th)<br />

4.7 Inspection on emergency alarms and automatic water pumpers 23 20 22 24 26 21<br />

4.8 Inspection on basic fire extinguisher<br />

5 Conflagration's Protection and Prevention<br />

5.1 Improving emergency extinguishing plan<br />

5.2 "Extinguishing and Fire Escaping" seminar /<br />

5.3 Basic fire extinguishing training<br />

• Emergency fire alarm system / / / / / /<br />

• Automatic stand pipe system and portable stand pipe / / / / / /<br />

• Basic extinguishers<br />

• Safety signs, and signboards<br />

5.4 Conflagration's prevention during dry season<br />

Occupational health<br />

officers, and the<br />

committee<br />

Head of each department<br />

t<br />

Occupational health<br />

officers<br />

Occupational health<br />

officers<br />

Occupational health<br />

officers<br />

Occupational health<br />

officers, and the<br />

Occupational health<br />

officers, and the<br />

Occupational health<br />

officers, and the<br />

Occupational health<br />

officers, and the<br />

Occupational health<br />

officers, and the<br />

Occupational health<br />

officers<br />

Occupational health<br />

officers, and the<br />

Head of each department,<br />

and operational staffs<br />

Occupational health<br />

officers, and the<br />

Head of each department<br />

Head of each department<br />

Committee, and head of<br />

each department<br />

Head of each department<br />

Head of each department<br />

Head of each department<br />

Head of each department<br />

Head of each department,<br />

and operational staffs<br />

Head of each department,<br />

supervisors, and<br />

operational staffs<br />

Administrative and human<br />

resources departments

26<br />

Society<br />

The company has organized the Corporate Social Responsibility<br />

or CSR since 2009 under the theme of “<strong>Dynasty</strong> Tile-Top<br />

Ceramic Market Returning Profit to Society”. In 2009, the<br />

company supported and helped build the floor of a classroom<br />

and improve the landscape of 3 schools in Thailand’s rural<br />

area. In 2010, we have continually organized this campaign<br />

and raised the number of schools chosen to be 14.<br />

Baan Saidaeng School, Mueng District, Ranong<br />

1<br />

1 Classroom before tiling 2 Classroom after tiling 3 Teacher’s common room before Tiling 4 Teacher’s common room

27<br />

• โรงเรียนเลาวิทยาคาร อ.เมือง จ.ชัยภูมิ<br />

• โรงเรียนหนองปลามันหนองไร อ.แกงครอ จ.ชัยภูมิ<br />

• โรงเรียนบานหลุบโพธิ์ อ.บานเขวา จ.ชัยภูมิ<br />

• โรงเรียนเมืองนอยราษฎรสงเคราะห อ.เมือง จ.ชัยภูมิ<br />

• โรงเรียนอนุบาลภูซาง อ.ภูซาง จ.พะเยา<br />

• โรงเรียนบานสบบง อ.ภูซาง จ.พะเยา<br />

• โรงเรียนบานปาสัก อ.ภูซาง จ.พะเยา<br />

• โรงเรียนตระเวนชายแดนฯ อ.ละหานทราย จ.บุรีรัมย<br />

• โรงเรียนบานหนองหวา อ.ละหานทราย จ.บุรีรัมย<br />

• โรงเรียนบานหนองกราด อ.ละหานทราย จ.บุรีรัมย<br />

• โรงเรียนทุงนาตาปน อ.ดานชาง จ.สุพรรณบุรี<br />

• โรงเรียนบานหนองกระดี่ อ.ดานชาง จ.สุพรรณบุรี<br />

• โรงเรียนบานทับละคร อ.ดานชาง จ.สุพรรณบุรี<br />

*รวมเปนจํานวนเงินทั้งสิ้น 3.8 ลานบาท*<br />

09.01.2553<br />

2 3 4<br />

oom after Tiling

28<br />

Baan Laowittaya School, Mueng District, Chaiyapoom<br />

Baan Lhumpho School, Baankhaow District, Chaiyapoom<br />

Baan Muengnoiratchasongkror School, Mueng District, Chaiyapoom<br />

Baan Nongplamunnongrai School, Kaengkro District, Chaiyapoom<br />

1<br />

2<br />

3<br />

4<br />

1,3 Versatile Building before tiling 2,4 Versatile Building afte tiling 5 Teacher’s common room before Tiling 6 Teacher’s common room a

29<br />

5 7<br />

29.06.2553<br />

6<br />

8<br />

om after Tiling 7 Acticity Court before tiling 8 Acticity Court after tiling

30<br />

Baan Pasuk School, Phusarng District, Phayao<br />

Baan Sob Bong School, Phusarng District, Phayao<br />

Phusarng Kindergarten, Phusarng District, Phayao<br />

14.08.2553<br />

1<br />

2<br />

1 Classroom’s corridor before tiling 2 Classroom’s corridor after tiling 3 Academic room before tiling 4 Academic room after tiling

31<br />

3 5 7<br />

5,7 Classroom before tiling 6,8 Classroom after tiling<br />

4 6 8

32<br />

Baan Nonggrard School, Laharnsai District, Burirum<br />

Baan Noinongwha School, Laharnsai District, Burirum<br />

Patrol Police’s School, Laharnsai District, Burirum<br />

1<br />

3<br />

1 Classroom before tiling 2-5 Classroom after tiling 6 Administrative room before tiling 7 Administrative room after tiling<br />

2

33<br />

18.09.2553<br />

3 6<br />

7<br />

4 5

34<br />

Baan Tublakorn School, Daancharng, Suphanburi<br />

Baan Tungnatapin School, Daancharng, Suphanburi<br />

Baan Nongkradi School, Daancharng, Suphanburi<br />

1<br />

1-2 Kindergarten’s classroom after tiling 3,6 sidewalks after tiling 4 Administrative room after tiling 5 Canteen after tiling<br />

2

35<br />

3 5<br />

20.11.2553<br />

4 6

Nature Of Business<br />

<strong>Dynasty</strong> Ceramic Public Company Limited was<br />

formerly known as Royal Floor Tiles Co. Ltd. Its core<br />

business is the manufacture and distributionof ceramic<br />

tiles. The Company was founded on 1 August 1989,<br />

listed on the Stock Exchange of Thailand on 3 January<br />

1992, and registered as a Public Company on 9 March<br />

1994. Its registered capital was increased to 280 million<br />

baht, with capital paid-up at a par value of 10 baht per<br />

share at 272 million baht, in January, 1995.<br />

At the end of 1997, the Shareholders and Directors<br />

of Tile Top Industry Public Co. Ltd, also a manufacturer<br />

of ceramic tiles with a factory located close to<br />

the <strong>Dynasty</strong> Ceramic Plant, bought 14.9 million ordinary<br />

shares of the company, or 54.82% of the paid-up<br />

capital, from the major shareholder which is a securities<br />

company. It has invested in more efficient machinery<br />

37<br />

and developed quality and more colorful products. It has also adjusted<br />

marketing strategies to focus more on distribution to consumers.<br />

Towards the end of 2000, the Company increased its registered<br />

capital to 408 million Baht, comprising 40.8 million shares with<br />

a par value of 10 Baht per share. The funds were to be utilized for<br />

the expansion of production capacity through the purchase of the<br />

entire ordinary shareholding in Tile Top Industry PCL from the original<br />

shareholders. As a result, the Company acquired the factory of Tile<br />

Top Industry Public Co. Ltd. The Company is currently the major<br />

shareholder in Tile Top Industry Public Co. Ltd., with an equity stake<br />

of 96.83%, of which 81.86 % is held by Thai nationals and 18.14 %<br />

by foreigners. (Register closed 31 January, 2011)<br />

<strong>Dynasty</strong> Ceramic Public Company Limited’s core business<br />

is the manufacture and distribution of ceramic tiles. It buys all products<br />

produced by Tile Top Industry Public Co. Ltd. at a wholesale<br />

price for sale. The Company also purchases sanitaryware and<br />

products related to ceramic tiles such as stair components and tile<br />

grout for sale through its three subsidiaries, namely Pick and Pay<br />

Co. Ltd.,Muangthong Ceramic Co. Ltd. and Worldwide Ceramic Co.<br />

Ltd, in which the Company invested an equity stake of over 96% in<br />

2005, to operate a retail business in the form of factory outlets. This<br />

enables the Company to get closer to its customers, know what they<br />

want and understand their ceramic tile purchasing trends. The Company<br />

used such information to improve its products and services,<br />

resulting in a rise in sales.<br />

As at the end of 2010, the Company had 177 branch<br />

warehouses nationwide and 116 local distributors. Its products are<br />

exported overseas to countries and regions including South Africa,<br />

Brunei, the Maldives, Indochina, Sri Lanka, Myanmar, Australia, New<br />

Zealand, Korea, Japan, Canada, Fiji, Loas, Kambodia etc . The ceramic<br />

tiles produced by the Company and its subsidiaries comprise<br />

• Floor and wall ceramic tiles under the “<strong>Dynasty</strong>” trademark<br />

• Floor and wall ceramic tiles under the “Tile Top” trademark<br />

• Floor and wall ceramic tiles under the “Tomahawk” trademark<br />

• Floor and wall ceramic tiles under the “Jaguar” trademark<br />

• Floor and wall ceramic tiles under the “Anna” trademark<br />

• Floor and wall ceramic tiles under the “Value” trademark<br />

• Floor and wall ceramic tiles under the “Mustang” trademark<br />

The Company and its subsidiary have extended their<br />

capacity thoroughly the year,until now,all capacity of both factory are<br />

51million square meters per year, that’s made The Company,currently<br />

holds the biggest share in the domestic ceramic tile market.

38<br />

Real estate business has grown<br />

considerably, considering more constructions<br />

in both city and provincial<br />

area; especially the first half of the year<br />

during which the overall tile market had<br />

grown up about 18-20%. For the second<br />

half of the year, La Nina phenomenon<br />

causing heavy rain made every region of<br />

Thailand encounter most severe inundation<br />

ever happened in 20 years’ time.<br />

However, the company has managed to<br />

maintain the sales growth rate of 11%<br />

and gain more than 18% of last year’s<br />

net profit due to the development in the<br />

many sections of the company.<br />

Factory<br />

• The company increased production<br />

capacity in January and July to ameliorate<br />

the manufacture’s potential, reduce<br />

fixed cost, and add more flexibility to<br />

inventory.<br />

• mprovement on the old kiln’s efficiency<br />

in March allows the company to<br />

increase the production capacity<br />

• The continuing research on the raw<br />

Significant Changes in the Past Year<br />

materials to find new materials and use<br />

them as the substitute of the old ones<br />

which are getting more expensive by<br />

taking the product’s quality as priority.<br />

• Improvement on the manufacturing<br />

plan’s calculating method to be in accordance<br />

with the production capacity itself<br />

to reduce the turnover of the inventory.<br />

• The company has carried on the Creative<br />

Idea Project which allows every<br />

employee to participate in creating new<br />

efficient economical manufacturing<br />

method. This project has been cooperated<br />

by so many employees that the<br />

company has saved not less than 10<br />

million Baht in expense.<br />

Although, the raw materials’<br />

prices have been continually increasing<br />

during 2010; natural gas, which has<br />

raised approximately more than 17%, in<br />

particular, there has been no increase in<br />

production cost of the company. This<br />

is evidence proving that <strong>Dynasty</strong> does<br />

process potential and efficiency in the<br />

manufacturing procedures.

Headquarters<br />

• Improvement on computer system; increasing the server’s<br />

efficiency, resulted in faster and more effective calculations<br />

and processing.<br />

• The company has improved the reports to be more concise.<br />

The goal of doing so is to make it easier in analyzing<br />

to set the right strategies and directions for the company.<br />

• We have used the software called Documentum in dealing<br />

with the documents to be able to work more easily and<br />

flexibly.<br />

• An additional transportation cost’s calculation system created<br />

and programmed by the executives made the cost<br />

more satisfactory and fair to the other parties. The system<br />

also makes it faster and more correct.<br />

• The company has held training course for all staff in each<br />

section as well as the branches.<br />

•We have held the Corporate Social Responsibility (CSR)<br />

since 2009 under the theme of “<strong>Dynasty</strong> Tile-Top Ceramic<br />

Market Returning Profit to Society”. The companies supported<br />

in building the floor of classrooms and improved the<br />

landscape of 3 schools in rural area in 2009. Continually in<br />

2010, we organized this campaign and raised the number<br />

of schools chosen to be 14 under the budget of more than<br />

4 million Baht.<br />

In addition, both the executives and the employees<br />

39<br />

have cooperated in reducing the lead time as well as the<br />

working process. This made the quality of the company’s<br />

personnel higher and allowed the company to maintain the<br />

number of staff to be the same while having more quantity<br />

in work.<br />

Branches and Subsidiaries<br />

• Higher selling price; from 125 Baht to 129 Baht<br />

• New branches and improved old branches are 11 in number<br />

• There is sales promotion campaign under the theme of<br />

“<strong>Dynasty</strong> Tile Top Becomes No.1” held from April 2010 to<br />

April 2011 while having the campaign promoted on radio,<br />

in local newspapers, on the event cars running in every<br />

province. Moreover, in this campaign, 8 pick-ups and more<br />

than 144 motorcycles are rewarded to lucky persons.<br />

• Improvement on the in-store selling system to be<br />

connected to the headquarters and the factories, so that<br />

the system becomes more efficient.<br />

All of the above are the main elements for<br />

the company’s ceaseless forwarding steps. However,<br />

these could not have happened without the cooperation<br />

of the executives and all of the staffs. The company’s<br />

important goal are the lowest cost of goods sold with the<br />

standardized product’s quality, the working system which<br />

can penetrate to the work site in harmony, the flexible<br />

manufacturing procedures, and proactive sales.<br />

Revenue, Gross Profit & Net Profit (MB)

40<br />

Industrial Conditions<br />

and Competitions<br />

In 2010, the sales in the first<br />

and second quarter have broken the<br />

record of the company. The main factor<br />

is the rising price of the agricultural<br />

product; in March, sugar was at its<br />

highest price in 25 years’ time. Although,<br />

the rice’s price has decreased about<br />

10%, agricultural people could sell<br />

rice in number because of the natural<br />

disasters in the producers’ country<br />

resulted in much higher demand abroad.<br />

Due to the higher demand in tiles in the<br />

first quarter, the company’s production<br />

capacity was insufficient. This was<br />

identification that the company can raise<br />

the selling price from the average 125<br />

Baht/m2 to 129 Baht/m2 which also<br />

makes the company’s gross margin<br />

higher.<br />

Problems caused by the natural<br />

disasters abroad had an effect on<br />

Thailand in the second half of the year.<br />

The La Nina phenomenon happened<br />

in August resulted in heavy rain all<br />

over Thailand’s regions; the north, the<br />

northeast, and the central regions were<br />

affected by the rain first and gradually<br />

made some areas flooded with the<br />

height of over 5 meters.<br />

Thailand has encountered the<br />

natural disaster problems for several<br />

times, but Thai agriculturers always take<br />

only a short period of time to recovery.<br />

However, the inundation in 2010 has<br />

been the most severe in Thai history,<br />

the agriculture section, then, took time<br />

to recovery. Due to this problem, the<br />

company had to close 6 branches and<br />

got 100,000 m2 of wet defected tiles<br />

which were set on sales to distribute.<br />

The flood made the company’s<br />

target sales growth of 15% lowered to<br />

only 11% from the first half of the year’s<br />

growth rate of more than 19%. Nevertheless,<br />

the company has managed<br />

to increase the gross profit rate from<br />

42.5% to 44.3%, which made the total<br />

revenue 18% higher, or equal to 1,175<br />

million Baht.<br />

Quarterly Sales Performance by Region

Market Share<br />

41<br />

RCI, 10%<br />

TGCI, 17%<br />

UMI, 21%<br />

DCC, 53%<br />

DCC<br />

UMI<br />

TGCI<br />

RCI<br />

Generally, the tile market condition has been<br />

growing really well in the fourth quarter of 2009, and this<br />

trend is carried on to the second quarter of 2010. The<br />

main factors were the gradually-increasing price of crops<br />

and the overall of Thailand’s economic which has been<br />

extending. People had more liquidity, less unemployment<br />

problems which we could see that Thai labors become<br />

rarer and rarer. The overall of Thailand’s tile market of 2011<br />

has 9% higher in selling quantity; most of them have rose<br />

in the first half of the year and slowed down in the second<br />

half. For the company, there has been about 2% higher<br />

in growth than the market itself, which shows that the<br />

company has taken more market share.<br />

The chart above shows the market share of each<br />

public company in the Stock Exchange of Thailand. This<br />

shows that the company has held 53% of market share, but,<br />

actually, there are 7 tile producers in Thailand, the other 3<br />

companies are not in SET. Considering this fact, <strong>Dynasty</strong><br />

has about 32% of market share, and 40% if we consider only<br />

domestic market of all 7 producers because <strong>Dynasty</strong> has only 4%<br />

market share in the tile export due to the high domestic demand<br />

and better gross profit rate, the company then keeps focusing on<br />

domestic market.<br />

The company increased the production capacity to two<br />

kilns and improved the efficiency of one kiln in 2010 to produce<br />

more and to have enough products to response to the increasing<br />

demand. The increased capacity also reduces manufacturing<br />

cost because of the Economy of Scales. This also allows the<br />

company to make more profit and have more potential in higher<br />

competition.<br />

As for the yearly selling price, the competitors have also<br />

lowered the prices; especially in the second half of the year, but<br />

the company has emphasized mostly on activities concerning<br />

sales promotion, which permitted the company to gain 4 Baht/m2<br />

in profit more than last year.

42<br />

Plans<br />

and Strategies in 2011

43<br />

In 2011, we have predicted that costs will<br />

increase; especially in energy. So the company will focus<br />

on developing to fix the cost, to increase the potential<br />

of all selling points and the value-added to the products<br />

by considering the gross profit as the priority. The overall<br />

targets are:<br />

• Maintaining the gross profit to be from 44% to<br />

45%<br />

• The sales growth rate of 10% from 2010<br />

• Opening 10-15 more branches by 2011<br />

• Increasing the production capacity to 2 kilns<br />

• Decreasing waste to be lower than 1%<br />

Because of the quiet condition of market in the<br />

second half of 2010 due to the flood in many provinces,<br />

constructions had to be slowed down in many areas. The<br />

manufacturers, then, had to lower the prices, although,<br />

the other costs; especially the energy cost, will start to<br />

increase in 2011.<br />

As for <strong>Dynasty</strong>, we slowed down the 2 projects<br />

concerning the new kilns; one of them was opened in<br />

January 2011. This new kiln can manufacture about<br />

250,000 m2 per month. The company will start using<br />

the second kiln in July 2011; this has taken the<br />

investment of about 280 million Baht and will have capacity to<br />

manufacture about 285,000 m2 per month. After using<br />

both kilns, the company will be able to take advantage<br />

from Economy of Scales and lower the production costs.<br />

For the sales growth rate, the company has<br />

targeted at 10%, less than the last year’s target because<br />

the company had the sales of 6.5 billion which is pretty<br />

high and this year’s house repairs and house construction<br />

are still affected by last year’s floods. Most of people<br />

encountered the flood still have to wait for their own<br />

revenue from their next manufacture to repair their places.<br />

The company has evaluated that the overall market will<br />

grow up about 6%-7%, but the reason why we have<br />

targeted higher is to gain more market share.<br />

The company has projected to maintain the gross<br />

profit rate to be from 44% to 45%. The methods to be<br />

carried out depend on both cost and marketing elements.<br />

Marketing<br />

• The current market trend is bigger tile. The<br />

company’s kilns can change the size of the tiles on demand.<br />

Moreover, the bigger tiles will allow the company to raise the<br />

average selling price per m2 as well as higher gross profit.<br />

• The opening of new 10-15 branches will increase<br />

the company’s channels and take more market share in the<br />

same time.<br />

• The policy of targeting on the constructors as a<br />

target market which will have the subscription for this special<br />

group of customers will stimulate continuing of purchases.<br />

Cost<br />

Since the company has predicted that the energy cost;<br />

especially the natural gas which is the main composition in<br />

manufacturing, as well as the cost of the chemicals, affected by<br />

the rising gas price, will increase. The company has policies to<br />

control the cost as below.<br />

• Increasing the production capacity which will make<br />

the company take advantage of the Economy of Scale to reduce<br />

the production cost<br />

• Research and development in the tile’s compositions<br />

to lower the temperature in the incineration which will result in<br />

less usage of the natural gas<br />

• Research and development in the tile color’s compositions<br />

and other chemicals to find cheaper substitute<br />

• Creating new technology to reduce the use of chemicals<br />

• Decreasing waste from last year’s 1.13% to be lower<br />

than 1%<br />

Considering the fact that we have to be qualified for<br />

many countries’ industrial standards, the cost control mentioned<br />

above will be employed with the primary concerns of the tile’s<br />

quality. If any policy reduces the tile’s quality, the company will<br />

not bring them into action.<br />

Transportation<br />

The Company has also planned to improve transportation<br />

system by using bigger trucks, and routing in considering<br />

the shortest and cheapest distance, which will be able to control<br />

the company’s transportation cost in a way.

Risk Factors<br />

The company had the executive committee evaluated the<br />

business risks and set the measures to manage the possible risks<br />

as followed.<br />

1 Risks from the natural disasters<br />

Due to Thailand’s climate changes in the recent years, the<br />

first half of the year was in drought, and there were floods in the<br />

second half. This made the agricultural products and crops have<br />

variation. So, the company set the policy to expand the market to<br />

reduce the risks from the natural disasters as well as to protect the<br />

company’s assets of every branch.<br />

45<br />

2 Risks from the energy cost<br />

The fluctuation of natural gas, which is the<br />

main fuel of the ceramic tiles’ manufacture, depending<br />

on the fuel oil’s and the world gas’ prices makes<br />

the production cost change from the company’s<br />

prediction. However, the company has policy to<br />

improve the manufacturing process; the raw materials<br />

in particular, to gradually reduce the energy cost, the<br />

quantity of the natural gas and the electricity used.<br />

3 Risks from the imported tiles<br />

In 2009, the tiles imported from China were<br />

worth more than 1.5 billion Baht, and in 2010, they<br />

were worth more than 3.7 billion Baht. The expansion<br />

was caused by the real estate companies which have<br />

doubled the condominium constructions in the city.<br />

This made the city’s tile market risky. The company<br />

has planned to sell 2 more styles of ceramic tiles.<br />

• Manufacturing cut-edge tiles which are like<br />

the imported tiles or granito which can be tiled close<br />

to each other, but, due to the high manufacturing cost,<br />

the company has to, keep developing to reach the<br />

desirably low cost first.<br />

• Manufacturing bigger tiles. In the present,<br />

there are 4 sizes of tiles, 8x8”, 8x10”, 12x12”, and<br />

16x16”, but there is demand on bigger tiles in the<br />

current market trend. The company has done<br />

researches in preparation of manufacturing 24x24”<br />

tiles, which is the same size as the imported tiles, to<br />

be better to response to the demand of the city’s tile<br />

market.<br />

4 Risks from the increasing transportation<br />

cost<br />

Since the company’s products are heavy<br />

goods; the higher transportation cost is likely. Due<br />

to the chaotic situation in Libya, the company has<br />

set policy to improve the transportation system by<br />

planning the transportation routing to have shortest,<br />

and cheapest distance, and using bigger vehicles.<br />

We expected that the policy can help control the<br />

transportation cost.

46<br />

<strong>Dynasty</strong> Ceramic PCL<br />

Produced Ceramic Floor Tiles , Gruut<br />

And Distributed all Products<br />

Organization Structure<br />

DCC Subsidiary which DCC hold 96.83% of Total Shares<br />

TILETOP INDUSTRY PCL.<br />

Produced CeramicFloor & Wall Tiles<br />

Sold To DYNASTY PCL.<br />

Purchased Sanitary ware<br />

and other related Products<br />

from local factory for Sales<br />

Sold to<br />

FACTORY OUTLETS<br />

Wholesales-local<br />

EXPORT<br />

Muang Thong Ceramic<br />

DCC HOLD 99.98 %<br />

PICK & PAY CO.LTD<br />

DCC HOLD 97.99 %<br />

WORLD WIDE CERAMIC CO.LTD<br />

DCC HOLD 99.93 %

47<br />

Financial Hilight<br />

(Consolidated Income Statement)<br />

2553<br />

2552<br />

2551<br />

2550<br />

2549<br />

2010<br />

2009<br />

2008<br />

2007<br />

2006<br />

Total Revenues<br />

6,531<br />

5,905<br />

5,095<br />

4,475<br />

4,460<br />

Net Sales<br />

6,513<br />

5,884<br />

5,089<br />

4,458<br />

4,452<br />

Gross Profit<br />

2,883<br />

2,500<br />

1,964<br />

1,716<br />

1,623<br />

%Gross Profit)<br />

44.3<br />

42.5<br />

38.6<br />

38.5<br />

36.5<br />

Selling & Admin. Expenses<br />

(1,206)<br />

(1,081)<br />

(984)<br />

(800)<br />

(746)<br />

Net Profit Before Interest & Depreciation<br />

1,988<br />

1,705<br />

1,280<br />

1,284<br />

1,252<br />

Net Profit<br />

1,175<br />

994<br />

664<br />

543<br />

567<br />

Consolidated Balance Sheet<br />

Total Assets<br />

3,715<br />

3,632<br />

3,893<br />

4,054<br />

4,349<br />

Total Liabilities<br />

989<br />

922<br />

1,443<br />

1,777<br />

2,306<br />

Total Shareholders' Equity<br />

2,726<br />

2,710<br />

2,449<br />

2,228<br />

2,044<br />

Financial Ratio<br />

Earning Per Share - Baht<br />

2.88<br />

2.44<br />

1.63<br />

1.33<br />

1.39<br />

Net Profit / Total Revenues - %<br />

17.99<br />

16.83<br />

13.03<br />

12.13<br />

12.71<br />

Debt Equity Ratio<br />

0.36<br />

0.34<br />

0.59<br />

0.80<br />

1.13<br />

(Return on Total Assets - %<br />

31.63<br />

27.37<br />

17.06<br />

13.39<br />

13.04<br />

Return on Equity - %<br />

43.10<br />

36.68<br />

27.11<br />

24.37<br />

27.74<br />

Booked Value - Baht<br />

6.68<br />

6.64<br />

6.00<br />

5.46<br />

5.01<br />

Dividend Per Share - Baht<br />

2.88<br />

2.08<br />

1.25<br />

1.00<br />

0.97<br />

Dividend Yield - %<br />

100<br />

85<br />

77<br />

75<br />

70

48<br />

Shareholding Structure<br />

Securities of <strong>Dynasty</strong> Ceramic Public Co. Ltd. Consist of;<br />

• Registered, issued and paid-up capital comprising 408 million shares<br />

• Par value of 1 Baht per share, representing a total value of 408 million Baht.<br />

• No debentures or warrants have been issued whatsoever.<br />

• No obligations with regard to the issue of future securities to Thai Trust Fund<br />

• No Major Shareholding Agreement on any company’s business<br />

As of 31 December 2010, the Company’s investments in ordinary shares of subsidiaries are as follows:<br />

1. Investment in ordinary shares of Tile Top Industry PCL, which under the Cost method at 109.5 million baht.<br />

The Company holds an equity stake of 96.83 % in this subsidiary.<br />

2. Investment in ordinary shares of Pick and Pay Co. Ltd., which under the Cost method at 12.5 million baht. The<br />

Company holds an equity stake of 97.99% in this subsidiary.<br />

3. Investment in ordinary shares of Muangthong Ceramic Co. Ltd., which under the Cost method at 4.8 million<br />

baht. The Company holds an equity stake of 99.98 % in this business.<br />

4. Investment in ordinary shares of Worldwide Ceramic Co. Ltd., which under the Cost method at 1.1 million baht.<br />

The Company holds an equity stake of 99.93 % in this firm.<br />

There are four subsidiaries as follows:<br />

1. Tile Top Industry PCL has registered capital of 300 million baht. Issued and paid-up capital as of 31 December,<br />

2010 comprised 22.2 million shares with a par value of 10 baht per share,amounting to 222 million baht in total. Tile Top<br />

Industry PLC has no subsidiary or affiliated company in which it has shareholdings or investments.<br />

2. Pick and Pay Co. Ltd. has registered capital of 12 million baht. Issued and paid-up capital as of 31 December<br />

2010 comprised 120,000 shares with a par value of 100 baht per share at 12.0 million baht. Pick and Pay Co. Ltd. has no<br />

subsidiary of affiliated company in which it has shareholdings or investments.<br />

3. Muangthong Ceramic Co. Ltd. has registered capital of 4.5 million baht. Issued and paid-up capital as of 31 December<br />

2010 comprised 45,000 shares with a par value of 100 baht per share at 4.5 million baht. Muangthong Ceramic Co. Ltd. has an<br />

equity stake in a ceramic tile retailer, Acapulco Co. Ltd., at 16.65% of registered capital, representinga value of 249,750 baht.<br />

4. Worldwide Ceramic Co. Ltd. has registered capital of 1.0 million baht. Issued and paid-up capital as of 31 December<br />

2010 comprised 10,000 shares with a par value of 100 baht per share, totaling 1 million baht. Worldwide Ceramic Co. Ltd. has<br />

no subsidiary of affiliated company in which it has shareholdings or investments.

49<br />

Shareholders<br />

Shareholders Shareholding structure (10 major shareholders) as of 31 January 2011<br />

RankingNo. Shareholder name<br />

No. of Share<br />

1 Mr. Roongroj Saengsastra<br />

100,000,000<br />

2 Mr. Vibul Vadcharasurang<br />

34,811,010<br />

3 THAI NVDR CO.,LTD<br />

21,730,000<br />

4 NORTRUST NOMINEES LTD<br />

20,263,800<br />

5 Mr. Monrak Saengsastra<br />

20,000,000<br />

6 Mr. Marut Saengsastra<br />

20,000,000<br />

7 Mr. Chaiyasith Viriyamettakul<br />

17,545,000<br />

8 Mr. Suvit Smarnphanchai<br />

12,892,000<br />

9 Miss Cattleya Saengsastra<br />

11,000,000<br />

10 AMERICAN INTERNATIONAL ASSURANCE<br />

CO., LTD - APEX<br />

6,567,000<br />

Total 10 major shareholders<br />

Total number of shares<br />

264,809,110<br />

408,000,000<br />

% of shareholding<br />

24.51 %<br />

8.53 %<br />

5.33 %<br />

4.97 %<br />

4.90 %<br />

4.90 %<br />

4.30 %<br />

3.16 %<br />