Annual report 2004/05

3.04 MB - SkiStar

3.04 MB - SkiStar

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

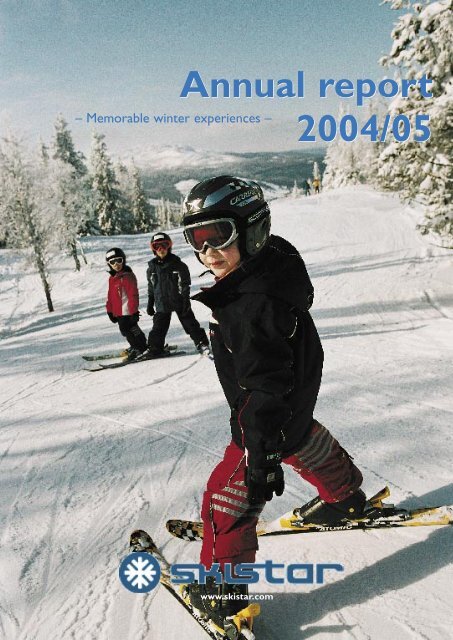

<strong>Annual</strong> <strong>report</strong><br />

– Memorable winter experiences –<br />

<strong>2004</strong>/<strong>05</strong><br />

www.skistar.com

History<br />

1975/78 The brothers, Mats and Erik Paulsson, purchase the<br />

Lindvallen ski resort in Sälen<br />

1994 Lindvallen is listed on Stockholmsbörsen O-List<br />

1997 Tandådalen & Hundfjället AB are acquired<br />

1999 Åre-Vemdalen AB is acquired<br />

2000 Hemsedal Skisenter AS is acquired<br />

2001 The Group takes the new name SkiStar AB<br />

20<strong>05</strong> Acquisition of Trysil, Norway’s largest ski resort, in progress<br />

Summary of the year<br />

Significant events during the financial year<br />

• SkiStar acquires Trysil, Norway’s largest ski resort.<br />

To date, the Norwegian Competition Authority<br />

has not approved the acquisition.<br />

• Net sales declined to MSEK 977 (990), income<br />

before tax increased to MSEK 182 (177), and the<br />

income after tax decreased to MSEK 172(313).<br />

Net earnings per share amounted to 8:83(16:26).<br />

In the previous year, a large, one-off tax rebate was<br />

<strong>report</strong>ed.<br />

• A proposal has been made to increase the dividend<br />

to SEK 6.00(5.00).<br />

Significant events after the end of the financial year<br />

• Decision to propose a 2:1 split of the share to the<br />

<strong>Annual</strong> General Meeting of shareholders.<br />

• Decision on repurchase of a maximum of 60,000<br />

B shares as partial payment for the Trysil<br />

acquisition.<br />

• In the beginning of October, booking volumes were<br />

4% higher than at the corresponding time in the<br />

previous year.<br />

TABLE OF CONTENTS<br />

Operations<br />

History . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2<br />

Summary of the year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3<br />

Comments from the CEO . . . . . . . . . . . . . . . . . . . . . . . . . . . 4<br />

The SkiStar share . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6<br />

The market . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9<br />

Opportunities and risks . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12<br />

The Group’s operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14<br />

Vision, goals and strategies for success . . . . . . . . . . . . . . . . 16<br />

Management and employees . . . . . . . . . . . . . . . . . . . . . . . . . 18<br />

SkiStar Travel . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20<br />

Environmental work . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23<br />

Business Area Destinations . . . . . . . . . . . . . . . . . . . . . . . . . . 24<br />

Sälen . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26<br />

Vemdalen . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28<br />

Åre . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30<br />

Hemsedal . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 32<br />

Business Area Properties . . . . . . . . . . . . . . . . . . . . . . . . . . . 34<br />

<strong>Annual</strong> <strong>report</strong><br />

Administration <strong>report</strong> . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 36<br />

Appropriation of profits . . . . . . . . . . . . . . . . . . . . . . . . . . . . 39<br />

Five-year summary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40<br />

Definitions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40<br />

Income Statement . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 41<br />

Balance Sheet . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42<br />

Change in equity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 44<br />

Cash Flow Statement . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 45<br />

Notes to the financial statements . . . . . . . . . . . . . . . . . . . . . 46<br />

Notes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 49<br />

Audit <strong>report</strong> . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 58<br />

Corporate Governance<br />

Board of Directors . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 59<br />

Financial information and shareholders . . . . . . . . . . . . . . . . 60<br />

Group management . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 62<br />

Articles of Association . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 63<br />

Addresses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 63<br />

The year in figures<br />

<strong>2004</strong>/<strong>05</strong> 2003/04 +/– +/–, %<br />

Net sales, MSEK 977 990 –13 –1<br />

Income before tax, MSEK 182 177 5 3<br />

Income after tax, MSEK 172 313 –141 –45<br />

Cash flow, MSEK 241 250 –9 –4<br />

Earnings per share, SEK 8:83 16:26 –7:43 –46<br />

Dividend, SEK 6:00 5:00 1:00 20<br />

Market value 31 August, SEK 150:00 112:00 38 34<br />

Return, % 4,0 4,5<br />

Price/earnings ratio, times 17,0 6,9<br />

Equity, MSEK 1 075 985 90 9<br />

Equity ratio, % 53 52 1 2<br />

Return on capital employed, % 12 13 –1 –8<br />

Return on equity, % 17 36 –19 –53<br />

Gross margin, % 32 32 0 0<br />

Operating margin, % 20 21 –1 –5<br />

Net margin, % 18 17 1 6<br />

Average number of employees, 871 875 –4 0<br />

Definitions can be found on page 40..<br />

2 3

New market-oriented organisation<br />

Acquisition of Trysil in progress<br />

employees require good management,<br />

In order to be able to meet future<br />

On 19 May 20<strong>05</strong>, SkiStar submitted an<br />

which is why we continue to invest in<br />

demands from our guests, a reorganisa-<br />

offer to acquire the companies that<br />

management development. Our<br />

tion took place and was implemented as<br />

operate Norway’s largest ski resort,<br />

managers go through training in mange-<br />

from 1 January 20<strong>05</strong>. The operations<br />

Trysil. On 23 May this year, the owners<br />

ment and leadership at the SkiStar<br />

have been divided into the business<br />

accepted SkiStar’s offer. The takeover<br />

Academy, our own management school.<br />

areas Destinations and Properties, while<br />

was planned for 1 November, but on 10<br />

In order to find out how well we<br />

at the same time the marketing, sales<br />

October, the Norwegian Competition<br />

succeed, an external market research<br />

and IT staff functions have been mer-<br />

Authority notified its intention to<br />

company annually conducts an ex-<br />

ged into a common area under the name<br />

intervene in the acquisition. In mid-<br />

amnation, the Satisfied Employee Index,<br />

SkiStar Travel. The goal of the Business<br />

November, the Norwegian Competition<br />

among all employees regarding what<br />

Area Destinations, which is comprised<br />

Authority will issue a final decision.<br />

they think of SkiStar as an employer and<br />

of operations at our four alpine<br />

If the decision is negative, SkiStar will<br />

if the employees belive that they get back<br />

destinations: Sälen, Åre, Vemdalen and<br />

appeal to the Norwegian Department<br />

from the compny as much as they give.<br />

Hemsedal, is to offer a memorable<br />

of Modernisation. The Norwegian<br />

The Satisfied Employee Index for the<br />

winter experience for our guests and<br />

Competition Authority believes that a<br />

winter season <strong>2004</strong>/<strong>05</strong> was 81%, which<br />

to maximise the number of returning<br />

relevant market demarcation is the 20<br />

is an improvement of two percentage<br />

guests. The newly formed Business Area<br />

largest ski resorts in Norway and Sweden<br />

points over the previous season.<br />

Properties co-ordinates our property<br />

development projects and will repair<br />

while SkiStar believes that the relevant<br />

market delineation for weekend visits is<br />

The SkiStar share<br />

and sell older housing units in order<br />

ski resorts within 3-5 hours travel<br />

The overall goal for SkiStar is to<br />

to generate profits and make financial<br />

distance and only within Norway. Only<br />

increase the value of the shareholders’<br />

resources available for the development<br />

a few Norwegians travel to ski resorts<br />

capital. During the <strong>2004</strong>/<strong>05</strong> financial<br />

SkiStar improved<br />

its result despite a<br />

weak winter season<br />

Mats Årjes<br />

and construction of new, modern<br />

tourist accommodation. SkiStar Travel<br />

will function as the organiser of travel<br />

to SkiStar’s destinations. This unit’s<br />

primary assignment is to market and<br />

sell the services and products offered<br />

by SkiStar to our guests, that is, accommodation,<br />

ski passes, ski rental and ski<br />

school. SkiStar Travel will also<br />

outside Norway over a weekend. Our<br />

opinion concerning weekly tourism is<br />

that Alps should also be included in<br />

the market delineation. More than half<br />

of Danish skiers travel to the Alps. We<br />

hope and believe that the Norwegian<br />

Competition Authority will listen to our<br />

reasoning and that the acquisition can<br />

be completed shortly. Trysil is the perfect<br />

year, the share price increased by 34%<br />

to SEK 150:00 and it is proposed that<br />

dividends be increased by 20% to SEK<br />

6:00. At the same time, we have 1,816<br />

(32%) more shareholders, making the<br />

current number of shareholders almost<br />

8,000. In order to make it possible for<br />

even more to become SkiStar shareholders,<br />

the Board of Directors is<br />

The winter season’s major cause for joy was Åre, which showed positive development<br />

with more guests and a rising profit.<br />

The <strong>2004</strong>/<strong>05</strong> Financial Year<br />

The Group is showing a better result<br />

that income from ski operations on<br />

properties owned by the company in<br />

and Helsinki were quite successful, and<br />

over 7,000 skiers took advantage of the<br />

guarantee effective and affordable transport<br />

solutions to the destinations. A<br />

positive effect of the co-ordination is<br />

that we have distributed 3.6 million<br />

SkiStar catalogues in Sweden, Norway,<br />

Denmark and Finland this autumn<br />

complement to SkiStar’s existing<br />

destinations.<br />

The guests – our product developers<br />

Satisfied and returning guests are the<br />

basis of our profitability. We<br />

proposing a 2:1 split of the share to the<br />

<strong>Annual</strong> General Meeting of shareholders,<br />

that is, shareholders would<br />

receive two new shares for one old.<br />

Prior to the 20<strong>05</strong>/06 season<br />

despite the impact of a number of<br />

Sweden is exempt from income tax.<br />

opportunity to fly at affordable prices.<br />

compared to 0.4 million last autumn.<br />

continuously examine how our guests<br />

The current booking situation at the<br />

negative factors, such as fewer public<br />

After adjustments for these one-off<br />

The development in number of rail<br />

Major investments have been made<br />

feel about their winter holidays. Each<br />

beginning of October showed a 4%<br />

holidays at Christmas and New Year,<br />

effects, net earnings per share in the<br />

passengers to Åre has surpassed<br />

in increased housing capacity in the<br />

week, we measure what the guests think<br />

improvement in volume over the same<br />

weak levels of natural snowfall in Sälen<br />

previous year were SEK 8:08. Increased<br />

expectations - from 9,000 tickets sold<br />

Norwegian and Swedish mountains at<br />

of our various products and services. We<br />

point in time last year. The number of<br />

and Hemsedal preceding the Swedish<br />

activity within the newly started<br />

during winter 2003/04 to over 26,000<br />

the same time that growth in the<br />

also carry out an annual external study<br />

rental units has risen by 2% at our<br />

school holidays in February, and an<br />

Properties Business Area has already<br />

during winter <strong>2004</strong>/<strong>05</strong>. For SkiStar as a<br />

number of new skiers has been limited.<br />

which is compiled into a Customer<br />

destinations since the last season.<br />

early Easter holiday. Net sales during the<br />

resulted in capital gains of MSEK 45(25)<br />

whole, all profitability goals were sur-<br />

In order to create long-term growth,<br />

Satisfaction Index regarding what the<br />

Snow systems have been expanded and<br />

financial year amounted to MSEK 977<br />

from sales of land, tenant-owner’s rights<br />

passed, with the exception of the<br />

it is SkiStar Travel’s responsibility to<br />

guests think of our product and service<br />

strengthened for the winter season in<br />

(990), income before tax rose to MSEK<br />

and apartments, primarily in Sälen. Net<br />

operating margin where the outcome<br />

recruit skiers from other countries such<br />

selection and whether they think that<br />

order to be able to lay snow faster and<br />

182 (177) and the income after tax<br />

financial income has improved due to<br />

was 20% compared to the goal of 22%.<br />

as Denmark, Finland, Great Britain,<br />

they receive value for their money. The<br />

over a larger surface. A totally new<br />

amounted to MSEK 172(313). Net<br />

the fact that all loans have been con-<br />

Return on capital employed amounted<br />

the Netherlands, Russia and the Baltic<br />

Customer Satisfaction Index for the<br />

ski area with new pistes and a high-<br />

earnings per share amounted to SEK<br />

verted to short-term, fixed-interest loans.<br />

to 12%, return on equity increased to<br />

States. Foreign marketing efforts require<br />

<strong>2004</strong>/<strong>05</strong> season was 89% (88).<br />

speed chairlift have been developed in<br />

8:83 (16:26). Profits after tax in the<br />

previous year included a large tax<br />

During the past season, Åre showed a<br />

positive development, with more guests<br />

17% and the equity ratio increased to<br />

53%. Organic growth was negative,<br />

large economic resources and leading<br />

edge competence. This is yet another<br />

Motivated employees<br />

Vemdalen. We look forward with<br />

confidence to the coming winter season.<br />

rebate, as the Swedish Tax Agency reassessed<br />

parts of the Group’s income<br />

and a profit that increased by MSEK 12<br />

to MSEK 32. The efforts made prior<br />

-1%, compared to the goal of growing<br />

annually by at least 3% above inflation.<br />

motivation to co-ordinate the Group’s<br />

total resources within marketing, sales<br />

Motivated employees provide good<br />

service and are a prerequisite for the<br />

Sälen, 30 October 20<strong>05</strong><br />

tax returns from 1997 onward. The reassessment<br />

took place based on the fact<br />

to the season with charter flights to<br />

Östersund from Stockholm, Copenhagen<br />

and IT.<br />

company having satisfied guests who<br />

come back to us. In turn, motivated<br />

Mats Årjes<br />

CEO<br />

4 5

The SkiStar share<br />

During the financial year, the price of the SkiStar share increased by 34% to SEK 150. It<br />

is proposed that dividends be increased by 20% to SEK 6 per share.<br />

History<br />

The B share has been listed on the<br />

Stockholmsbörsen O List since 8 July<br />

1994. At the time of listing, the share<br />

price was SEK 18.<br />

Share structure<br />

On 31 August 20<strong>05</strong>, share capital was SEK<br />

19,528,034 distributed among 19,528,034<br />

shares, of which 912,000 are A shares<br />

carrying 10 votes per share and 18,616,034<br />

are B shares carrying one vote per share.<br />

All shares carry an equal right to dividends.<br />

The nominal value per share is SEK 1. In<br />

July 2003, a convertible debenture loan<br />

amounting to MSEK 25 was issued to<br />

personnel, of which MSEK 13.8 was<br />

subscribed during 2003, MSEK 10.9<br />

during <strong>2004</strong> and MSEK 0.3 during 20<strong>05</strong>.<br />

Up until 31 August 20<strong>05</strong>, debentures<br />

equivalent to 248,388 B shares were<br />

submitted for conversion of which a total<br />

of 183,566 B shares during 2003/04 and<br />

64,822 B shares during <strong>2004</strong>/<strong>05</strong> at an<br />

exchange rate of SEK 79:50. The<br />

convertible loan expires on 1 July 2008<br />

and outstanding debentures can be<br />

converted to an additional 66,077 B shares<br />

during the period, which implies a 0.3%<br />

dilution of existing shares.<br />

Share price development and net sales<br />

The share price increased by 34% to SEK<br />

150 during the <strong>2004</strong>/<strong>05</strong> financial year.<br />

Affärsvärlden’s general index rose by 27%<br />

during the same period. Since the company<br />

became listed in 1994, the market price<br />

has increased SEK 18 to SEK 150. During<br />

the same period, dividends were submitted<br />

for conversion at a rate of SEK 20:35 per<br />

share. During the period 1 September 2002<br />

– 31 August 20<strong>05</strong>, a total of 3,784,3<strong>05</strong><br />

shares (4,585,962) in SkiStar were converted<br />

at Stockholmsbörsen at a value of<br />

MSEK 486 (375). The turnover rate for<br />

shares amounted to 19% (25), compared<br />

to 111% for Stockholmsbörsen as a whole.<br />

The lowest share price was SEK 110:50,<br />

noted on 1 September <strong>2004</strong> and the highest<br />

share price was SEK 161:50 noted on 13<br />

July 20<strong>05</strong>. On 31 August 20<strong>05</strong>, SkiStar’s<br />

market capitalisation amounted to MSEK<br />

2,928 (2,180).<br />

Beta value<br />

The beta value of SkiStar’s B share was<br />

0.3 on 31 August 20<strong>05</strong>. The beta value is<br />

based on the company’s share price during<br />

the past 24 months and indicates<br />

Ownership categories 31 August 20<strong>05</strong><br />

the degree to which the share price has<br />

fluctuated compared to the stock exchange<br />

index. If a share has the same price<br />

fluctuation as the stock exchange index,<br />

then its beta value is equal to 1.0. If a<br />

share’s price fluctuates more than the<br />

index, then its beta value is more than 1<br />

and vice versa. A beta value of 0.3 for the<br />

SkiStar share implies that the share has not<br />

been affected by the same share price<br />

volatility as Stockholmsbörsen, on average.<br />

Category Number of shares Participations, %<br />

Swedish private persons 11 090 836 57<br />

Swedish institutional ownership 7 128 198 36<br />

Foreign ownership 1 309 000 7<br />

Total 19 528 034 100<br />

Share structure 31 August 20<strong>05</strong><br />

Class of shares Number of shares Number of votes Capital, % Votes, %<br />

A 10 votes 912 000 9 120 000 5 33<br />

B 1 vote 18 616 034 18 616 034 95 67<br />

Total 19 528 034 27 736 034 100 100<br />

Number of shares traded<br />

in 1000's (including<br />

aftersubscription)<br />

Shareholder structure<br />

There were 7,454 (5,638) shareholders<br />

on 31 August 20<strong>05</strong>, an increase of 1,816<br />

(32%) in the number of shareholders<br />

during the last year. At the end of the<br />

financial year, the ten largest shareholders<br />

accounted for 67% (67) of<br />

the capital and 77% (77) of the votes.<br />

Foreign owners accounted for 7% (10)<br />

of the capital and institutional owners<br />

for 36% (34) of capital. Significant<br />

changes among the largest owners<br />

during the financial year were the sale of<br />

Thorvald Sverdrup’s holdings, including<br />

company and family, and SEB Funds’<br />

increase of its holdings of SkiStar shares.<br />

Dividend policy<br />

SkiStar’s dividend policy is to annually<br />

distribute at least 50% of its income<br />

after tax. The proposed dividend of SEK<br />

6:00 (5:00) per share corresponds to<br />

Ownership structure 31 August 20<strong>05</strong><br />

68% of income after tax. The proposed<br />

dividend of SEK 6:00 implies a yield of<br />

4.0% (4.5) from the market value on 31<br />

August. The proposed dividend amounts<br />

to a total of MSEK 117 (97). The date of<br />

15 December 20<strong>05</strong> is proposed as date<br />

of record for payment to the Swedish<br />

shareholders. Payments of dividends<br />

will be despatched by VPC (Swedish<br />

Central Securities Depository & Clearing<br />

Organisation) on 20 December 20<strong>05</strong>.<br />

Shareholder benefits<br />

Shareholders owning at least 200 shares<br />

in SkiStar may order a shareholder card<br />

entitling them to discounts at all SkiStar<br />

resorts. A 15% discount is provided on<br />

ski passes, ski rental and ski schools.<br />

SkiStar had 2,873 (2,400) cardholders<br />

as per 31 August 20<strong>05</strong>, which is<br />

equivalent to 39% (43) of the total<br />

number of shareholders.<br />

Proposed split<br />

The Board of Directors has proposed<br />

a 2:1 split of the SkiStar share to the<br />

<strong>Annual</strong> General Meeting of shareholders.<br />

The <strong>Annual</strong> General Meeting<br />

of shareholders will be held on 12<br />

December 20<strong>05</strong> at China Teatern in<br />

Stockholm.<br />

Earnings per share<br />

Class sizes Number of owners % Number of shares % Number of votes %<br />

1-100 1 881 25,90 100 358 0,51 100 358 0,36<br />

101-200 1 717 23,64 348 441 1,78 348 441 1,26<br />

201-1000 2 951 40,64 1 501 236 7,69 1 501 236 5,41<br />

1 001-5 000 550 7,57 1 134 645 5,81 1 134 645 4,09<br />

5 001-10 000 66 0,91 497 753 2,55 497 753 1,79<br />

10 001-20 000 36 0,50 531 728 2,72 531 728 1,92<br />

20 001-50 000 25 0,34 801 912 4,11 801 912 2,89<br />

50 001-100 000 12 0,17 816 094 4,18 816 094 2,94<br />

100 001- 24 0,33 13 795 867 70,65 22 003 867 79,34<br />

Total 7 262 100,00 19 528 034 100,00 27 736 034 100,00<br />

Share capital trend<br />

Year<br />

Changes<br />

Increase in<br />

number of<br />

shares<br />

Nominal<br />

amount<br />

SEK/share<br />

Total<br />

number<br />

of shares<br />

Change in<br />

share capital,<br />

SEK<br />

Total share<br />

capital,<br />

SEK<br />

1992 10 500 000 5 000 000<br />

1994 New share issue 150 000 10 650 000 1 500 000 6 500 000<br />

1994 Conversion 160 4<strong>05</strong> 10 810 4<strong>05</strong> 1 604 <strong>05</strong>0 8 104 <strong>05</strong>0<br />

1995 Split 5:1 3 241 620 2 4 <strong>05</strong>2 025 8 104 <strong>05</strong>0<br />

1997 New share issue 2 337 725 2 6 389 750 4 675 450 12 779 500<br />

1998 New share issue 200 000 2 6 589 750 400 000 13 179 500<br />

1998 Conversion 250 000 2 6 839 750 500 000 13 679 500<br />

1999 Conversion 250 000 2 7 089 750 500 000 14 179 500<br />

1999 New share issue 2 450 000 2 9 539 750 4 900 000 19 079 500<br />

2000 New share issue 100 073 2 9 639 823 200 146 19 279 646<br />

<strong>2004</strong> Split 2:1 9 639 823 1 19 279 646 19 279 646<br />

<strong>2004</strong> Conversion 183 566 1 19 463 212 183 566 19 463 212<br />

20<strong>05</strong> Conversion 64 822 1 19 528 034 64 822 19 528 034<br />

6<br />

7

The market<br />

SkiStar’s competitive situation is much broader than only ski resorts. SkiStar competes for<br />

the guests’ time and disposable income in every area, from rarely-purchased-goods to sun<br />

and surf holidays.<br />

Competition<br />

increased. Fresh statistics from the<br />

The industry’s leading companies<br />

The tourism industry competes against<br />

Swedish Tourist Authority show that<br />

mainly work locally, but certain<br />

a number of other branches for the<br />

during the last five years, visits to over<br />

international collaborations and<br />

guests’ time and income. The two<br />

2,000 Swedish tourist destinations in<br />

acquisitions have taken place in recent<br />

possibly largest competitors are in-<br />

the survey have increased from 104<br />

years. In Sweden, SkiStar has made<br />

The right equipment enhances your skiing experience.<br />

frequently purchased commodities such<br />

as computers and flat screen televisions,<br />

million in 1998 to 110 million visits<br />

in 2003. The largest increase can be<br />

acquisitions in Norway. In France, CDA<br />

acquired ski resorts in both Switzerland<br />

Largest shareholders as per 31 August 20<strong>05</strong><br />

as well as the building-materials<br />

industry, as many people nowadays<br />

seen in the Activities category, in which<br />

ski resorts are included (see diagram).<br />

and Italy. The ownership of ski resorts<br />

is very fragmented. Many are family-<br />

Owners A shares B shares Capital, % Votes, %<br />

choose to renovate and modernise<br />

Considering the different types of<br />

owned and many companies are small.<br />

Mats Paulsson including company and family 912 000 2 194 046 15,91 40,79<br />

their housing conditions personally.<br />

tourist destinations within the activities<br />

In Austria, ownership is totally<br />

Erik Paulsson including company and family 2 915 330 14,93 10,51<br />

According to Statistics Sweden (SCB),<br />

category, ski resorts and beach resorts<br />

dominated by privately-owned small<br />

Investment AB Öresund 2 280 400 11,68 8,22<br />

the index for trends in net sales in<br />

comprise the largest portions. These two<br />

SEB-Fonder 1 246 <strong>05</strong>0 6,38 4,49<br />

HQ-Fonder 1 043 203 5,34 3,76<br />

Lima Besparingsskog 995 400 5,10 3,59<br />

Per-Uno Sandberg 900 000 4,61 3,24<br />

Robur Fonder 269 800 1,38 0,97<br />

Magnus Sjöholm 140 684 0,72 0,51<br />

Odin Fonder 136 <strong>05</strong>4 0,70 0,49<br />

Handelsbanken Fonder 120 000 0,61 0,43<br />

Astrid Ohlin 120 000 0,61 0,43<br />

Mats Årjes 114 452 0,59 0,41<br />

Other 6 140 615 32,44 22,16<br />

Total 912 000 18 616 034 100,00 100,00<br />

current prices for these industries from<br />

1995 to <strong>2004</strong> has increased by 84% for<br />

the home electronics, radio/television<br />

and other household items category. The<br />

index has also increased by 27% for<br />

wood, construction material and<br />

sanitary items. SCB’s statistics on the<br />

development of household disposable<br />

income show that from 1995 to 2003,<br />

disposable income has increased by<br />

37%.<br />

The Swedish tourist industry<br />

areas are also responsible for a major<br />

portion of the increase.<br />

The global alpine market<br />

People are interested in alpine skiing in<br />

all five continents. The largest market is<br />

in Europe and has an annual<br />

consumption of about 185 million ski<br />

days (a day of alpine skiing with ski<br />

passes is considered a ski day). North<br />

America is the second largest market<br />

with about 75 million ski days per year.<br />

The largest single markets are made up<br />

Changes in the number of<br />

visitors per visiting category<br />

1998-2003<br />

Data per share<br />

Travel to and from Sweden has<br />

increased significantly during the<br />

of the USA, Austria and France, all with<br />

about 57 million ski days per year. The<br />

<strong>2004</strong>/<strong>05</strong> 2003/04 2002/03 2001/02 2000/01<br />

Average number of shares 19 473 464 19 279 646 19 279 646 19 279 646 19 279 646<br />

Number of shares after full conversion 19 594 111 19 487 729 19 308 638 19 279 646 19 279 646<br />

Profit, SEK 8:83 16:26 6:32 5:<strong>05</strong> 2:85<br />

Number of shares after full conversion 8:78 16:09 6:32 5:<strong>05</strong> 2:85<br />

Cash flow, SEK 12:35 12:96 14:49 12:34 8:74<br />

Equity, SEK 55:22 51:11 38:13 35:39 31:87<br />

Number of shares after full conversion 55:37 51:42 38:19 35:39 31:87<br />

Market price, SEK 150:00 112:00 82:50 51:50 39:50<br />

Dividends, SEK 6:00 5:00 4:00 3:00 1:75<br />

Price/earnings ratio, times 16,99 6,89 13,<strong>05</strong> 10,20 13,86<br />

Exchange rate/cash flow, times 12,14 8,64 5,69 4,17 4,52<br />

Share price/equity, % 271,64 219,14 216,37 145,52 123,94<br />

Return, % 4,00 4,46 4,85 5,83 4,43<br />

past decade. Statistics from SIKA<br />

(Swedish Institute for Transport and<br />

Communication Analysis) show that<br />

between 1994 and <strong>2004</strong>, the number of<br />

passengers in Swedish airports on<br />

scheduled and charter flights has<br />

increased from just over 16.8 million to<br />

just over 23.4 million (approximately<br />

40%). One of the reasons for this is the<br />

growth of the low-cost flight industry,<br />

which has resulted in increased travel at<br />

the end of the week (city breaks) and an<br />

increase in sun and surf holidays.<br />

Travel within Sweden has also<br />

Nordic region, that is, Sweden, Norway<br />

and Finland, have about 10 million ski<br />

days per year. Historically, the market<br />

growth is a couple of percent per year.<br />

The resorts in all countries are mainly<br />

visited by domestic skiers. In the USA<br />

and Canada, the number of foreign<br />

skiers is barely 5%. In countries such<br />

as Japan, South Africa, Chile and<br />

Argentina, the number of foreign<br />

visitors is very low. The highest number<br />

of foreign visitors can be found in the<br />

Alps, where about a third of all downhill<br />

skiers come from other countries.<br />

Source: The Swedish Tourist Authority<br />

Classification of the number of<br />

visitors per sub-category 2003, %<br />

Source: The Swedish Tourist Authority<br />

8<br />

9

companies. In Italy, there is a strong<br />

element of credit institutions in the<br />

product selection in order to secure<br />

larger percentages of guests’ total<br />

forced to stay closed for up to 50 days<br />

during the season. In general, a large<br />

responsible for the major portion of the<br />

turnover. The 25 largest resorts are esti-<br />

Product development<br />

The new, more flexible carving skis have<br />

resorts. These are Vail Resorts and<br />

Intrawest, listed on the New York<br />

ownership structures. In Switzerland<br />

consumption.<br />

number of ski locations were forced into<br />

mated to be responsible for just over<br />

been a major success and have in-<br />

Stock Exchange, and Compagnie des<br />

and France, there are a few larger<br />

companies with diversified ownership<br />

in limited company form, of which a<br />

couple are public and listed. In Japan,<br />

ski resorts and ski-lift systems are<br />

<strong>2004</strong>/<strong>05</strong> season<br />

Scandinavia<br />

According to SLAO (Swedish Ski Lift<br />

Organisation), ski-pass sales in Sweden<br />

unplanned operation suspensions due to<br />

the weather. However, the locations in<br />

New Mexico, Utah and Colorado had a<br />

good season. For many of them, it was<br />

the best ever. Just over half of the total<br />

60% of the total income for the industry.<br />

Trends<br />

Marketing<br />

Increased resources are being invested<br />

fluenced sales positively in recent years.<br />

The leading companies in the industry<br />

are broadening operations to include ski<br />

schools, ski rental and sales of ski<br />

clothing and equipment as well.<br />

Alpes (CDA), listed on the Paris Stock<br />

Exchange. Vail and Intrawest also<br />

conduct extensive operations within real<br />

estate development. Intrawest also owns<br />

a travel agency. Besides entertainment<br />

usually included in larger privately-<br />

decreased during winter <strong>2004</strong>/<strong>05</strong> by<br />

number of ski days were attributable<br />

in advertising and marketing. The com-<br />

and theme parks, CDA also conducts<br />

owned conglomerates, often with<br />

associated hotel operations. In Sweden,<br />

1.1% to SEK 900 million, excluding<br />

value added tax, compared to the<br />

to the weekends, in line with previous<br />

years. The number of snowboarders was<br />

petition for attention is significant.<br />

There is intense competition for<br />

Population development<br />

Demographic factors such as more<br />

ski operations.<br />

other than SkiStar, there is the Strömma<br />

group, among others, with resorts in<br />

Hemavan-Tärnaby and Riksgränsen.<br />

previous season. The average price<br />

increase was 2.6%, resulting in a<br />

decrease in volume of 3.7%. The<br />

stagnant, amounting to 29%. However,<br />

major local deviations are evident.<br />

Compared to Europe, the number of<br />

attracting attention and gaining<br />

publicity. The Internet, direct advertising<br />

and ”multi-channel ad-<br />

leisure time and an increased interest<br />

in a healthy lifestyle, outdoor activities<br />

and recreation are influencing people’s<br />

The alpine destinations’<br />

ski-pass sales<br />

The North American market does not<br />

number of ski days declined from 6.8<br />

snowboarders in North America is high.<br />

vertising” are being used to a greater<br />

interest in alpine skiing in a favourable<br />

differ from the others. It is also<br />

million to 6.7 million. Weak natural<br />

The number of skiers from the USA<br />

extent.<br />

direction.<br />

significantly fragmented. The listed ski<br />

snow conditions at the beginning of the<br />

on Canadian slopes has decreased in<br />

companies Vail Resorts, Intrawest and<br />

American Skiing Company and Booth<br />

season in parts of the Swedish<br />

mountains, fewer holidays at Christmas<br />

recent years. Instead, travel to Europe<br />

has increased, primarily to ski resorts<br />

The family<br />

More and more ski resorts have families<br />

More and older skiers<br />

For Sweden, skiers in the 55+ age group<br />

Creek represent just over 25% of the<br />

and New Year and an early Easter<br />

in Italy and Switzerland. An increa-<br />

as their target group. This takes place by,<br />

will probably increase as the first large<br />

North American market. A structural<br />

holiday are some of the reasons for this.<br />

sing number of Americans also travel<br />

among others things, wider and<br />

“ski generation” learned to ski in the<br />

transformation towards larger but fewer<br />

In Norway, total ski-pass sales rose by<br />

to ski locations in Colorado such as<br />

flatter ski runs, greater accessibility,<br />

seventies. Many in that group still ski<br />

companies has been continuing for a<br />

3.0% to NOK 747 million, including<br />

Steamboat, Aspen and Vail.<br />

shorter distance between accommodation<br />

and plan to continue doing so for many<br />

number of years now. The driving<br />

7% value added tax. These sales had<br />

and the slopes, child-care facilities, ski<br />

years to come. Assuming that an equal<br />

factors behind this change are the<br />

opportunities for economies of scale<br />

and the requirement for creating critical<br />

mass. The economies of scale are<br />

available in purchase coordination,<br />

operation and maintenance, and within<br />

marketing and sales. The critical mass<br />

previously been exempt from tax. Price<br />

increases in Norway were at an average<br />

of 4.0%, resulting in a decrease of 1.0%<br />

in the volume of passes sold. Weak snow<br />

conditions at the beginning of the season,<br />

negative calendar effects with shorter<br />

Christmas holidays, the school holiday<br />

The Alps<br />

The weather varied rather significantly<br />

in this region during winter <strong>2004</strong>/<strong>05</strong>.<br />

The northern parts of the Alps, where<br />

most of the larger resorts are located,<br />

had a good season. On the other hand,<br />

the southern Alps had significantly<br />

schools, youth activities in the evening<br />

hours, cross-country skiing tracks,<br />

accommodation that is more<br />

comfortable, and the possibility for a<br />

certain degree of self-catering at<br />

accommodations. At the same time, ski<br />

tows are being replaced by ski lifts with<br />

number of children and young people<br />

begin to ski as in previous years, the<br />

total ski market in Sweden will grow.<br />

Industry comparison<br />

The analysis on this page compares<br />

SkiStar with three other listed ski<br />

NOK/SEK recalculated to exchange rate 1.<strong>05</strong> for the<br />

years up to 99/00 and 1.1 for 00/01, 03/04 and 04/<strong>05</strong><br />

and 1.19 for 01/02 and 02/03. FIM/SEK is recalculated<br />

to exchange rate 1.48 for the years up to 99/00<br />

and 1.50 for 00/01. For 01/02 and 02/03 Rukas and<br />

Levis net sales have been calculated to exchange rate<br />

EUR 9.20, 03/04 to EUR 9.10 and 04/<strong>05</strong> to EUR 9.45.<br />

is built up primarily via acquisitions of<br />

period in February being concentrated<br />

worse weather and less snow than the<br />

a higher capacity.<br />

competitors. This is partly about<br />

building up volume and partly about<br />

creating cash flows that are sufficient<br />

into the same week, and a very early<br />

Easter holiday affected the result<br />

negatively. The total number of ski days<br />

previous year. On average, the locations<br />

in the northern Alps could stay open for<br />

about 115 days during the season while<br />

More target groups<br />

In the USA especially, the industry is<br />

Analysis listed ski resorts<br />

SkiStar CDA Vail Intrawest<br />

for balancing the often significant<br />

amounted to 5.4 million, which is<br />

the southern Alps could do so for 100<br />

working to broaden its target groups to<br />

Ski days, million 3 13 6 8<br />

investments in lifts, ski slopes, snow<br />

unchanged compared to the previous<br />

days, signifying a striking decrease<br />

include African-Americans, Americans of<br />

Market value (18 October 20<strong>05</strong>), MSEK 3 083 3 319 9 027 9 342<br />

systems etc. Another driving force in<br />

the structural transformation of the<br />

industry is the companies’ ambition to<br />

conduct operations on several different<br />

geographic areas, thereby decreasing<br />

weather dependency. Both Intrawest and<br />

French CDA have taken further steps<br />

through investments in “warm-weather<br />

services” such as golf resorts and<br />

entertainment and theme parks.<br />

Attempts, at varying degrees of scope,<br />

are also being made to broaden the<br />

year. In Finland, ski-pass sales amounted<br />

to MEUR 46 (46.5) and the number of<br />

ski days was unchanged at 2.7 million.<br />

North America<br />

The number of ski days in the USA<br />

amounted to 56.4 million (57.1) and<br />

18.4 million (19.0) in Canada.<br />

The season was difficult at many<br />

locations from a weather point of view,<br />

especially in the North-West regions<br />

where a number of ski resorts were<br />

compared to the previous year. The<br />

decrease can be explained by the early<br />

spring. During the <strong>2004</strong>/<strong>05</strong> season,<br />

the total number of ski days decreased<br />

somewhat in the Alps, but its reputation<br />

as the world’s largest ski location is not<br />

threatened. On average, ski-pass prices<br />

increased by 2-3%. Therefore, the total<br />

income from ski-pass sales rose slightly<br />

despite a decline in the number of ski<br />

days. Similar to North America and the<br />

Nordic region, the largest ski resorts are<br />

Hispanic descent, ethnic minorities etc.<br />

Snow production<br />

Investments in snow systems are increasing<br />

in order to decrease<br />

dependence on the weather. Ski resorts<br />

in the Alps with the same objectives are<br />

investing in lifts and slopes at high<br />

altitudes.<br />

Net sales, MSEK 1 035 3 517 6 358 13 108<br />

Return on equity, % 17 11 4 4<br />

Operating margin, % 20 17 10 4<br />

Equity ratio, % 53 40 35 32<br />

Earnings per share, SEK 8:83 43:85 5:02 5:34<br />

Stock exchange price (18 October 20<strong>05</strong>), SEK 158 531 247 195<br />

Price/earnings ratio, times 18 12 49 37<br />

Equity per share, SEK 55 453 117 135<br />

Share price/equity, % 287 117 211 144<br />

Earnings per share, SEK 6:00 15:82 0 1:06<br />

Return, % 3,8 3,0 0 0,5<br />

10<br />

11

Opportunities and risks<br />

ment and an incentive programme in<br />

which personnel have been offered the<br />

for ski resorts in Sweden, as the Swedish<br />

Tax Agency has determined that VAT<br />

destinations to well-populated areas,<br />

together with alternative means of travel<br />

The alpine ski branch is influenced by a number of global factors which can be turned<br />

to opportunities if handled properly.<br />

Business related risks<br />

Season dependence<br />

A considerable part of SkiStar’s income<br />

Business cycle<br />

Changes in consumers’ disposable<br />

incomes affect private spending levels.<br />

Growth strategy<br />

SkiStar’s growth strategy is primarily<br />

focussed on expanding and increasing<br />

opportunity to purchase convertible<br />

debentures. As per 31 August 20<strong>05</strong>,<br />

SkiStar’s management owned 546,042<br />

Class B shares in the company. Salary<br />

expenses form the company’s largest<br />

cost item. In order to increase efficiency,<br />

awareness and commitment amongst<br />

should be paid on the basis of lift<br />

transportation. Other sporting<br />

operations in Sweden pay VAT only on<br />

the leasing of sports facilities, and at a<br />

rate of 6%. According to a decision<br />

from the Swedish Administrative Court<br />

of Appeal, alpine skiing should only be<br />

such as rail and air, reduce the negative<br />

consequences of increased petrol prices.<br />

Safety issues<br />

SkiStar works actively with safety issues<br />

by identifying and attending to accident<br />

risks. Risk analyses have been carried<br />

is generated during the December–April<br />

These changes have, in turn, an effect on<br />

the efficiency of the existing destinations<br />

employees, SkiStar emphasises leader-<br />

charged 6% VAT as from <strong>2004</strong>. The<br />

out at all destinations in order to ensure<br />

period. SkiStar’s operations are well<br />

winter holidays. SkiStar’s sales and pro-<br />

and, secondly, on the acquisition or<br />

ship issues. The SkiStar Academy trains<br />

Swedish Tax Agency appealed against<br />

insurance protection and reduce various<br />

adapted to seasonal variations, not the<br />

fit track-record show that the company<br />

lease of other ski resorts. All acquisi-<br />

managers to improve their leadership<br />

the decision, and on 8 June 20<strong>05</strong> the<br />

types of risks. A thorough emergency<br />

least in terms of the company’s<br />

has been able to cope with swings in the<br />

tions made by SkiStar have progressed<br />

skills. The service level offered to the<br />

Swedish Supreme Administrative Court<br />

plan for SkiStar has been drawn up in<br />

personnel. The majority of winter<br />

business cycle in an effective manner. The<br />

well and have contributed, to a great<br />

guests is an important aspect of the<br />

granted SkiStar review dispensation. A<br />

order to ensure that the entire organisa-<br />

bookings take place before the season,<br />

company’s operations in Norway reduce<br />

extent, to the company’s successful<br />

guests’ total experience. Consequently,<br />

ruling from the Swedish Supreme<br />

tion is well prepared in the case of<br />

which reduces operational risk. With an<br />

the dependency on the Swedish economy,<br />

development. SkiStar acquired<br />

there is a risk that the possibility of<br />

Administrative Court is expected in<br />

future possible accidents and events.<br />

increased number of sales in advance<br />

payments, transactions are completed<br />

as does the fact that the Group’s guests<br />

come from a variety of countries. A large<br />

Tandådalen & Hundfjället AB in<br />

1997, Åre-Vemdalen AB in 1999 and<br />

employing qualified seasonal personnel<br />

will decrease in times of general<br />

December 20<strong>05</strong>. Should the Swedish<br />

Supreme Administrative Court rule in<br />

Ongoing disputes<br />

at an early stage, which in turn reduces<br />

number of SkiStar’s guests are families,<br />

Hemsedal Skisenter AS in 2000. The<br />

prosperity, when unemployment is low.<br />

SkiStar’s favour, the Group will recover<br />

Discussions are continuing with the<br />

operational risk.<br />

who generally return to our resorts year<br />

after year, and who highly value their<br />

acquisition of Norway’s largest ski<br />

resort Trysil is currently in progress.<br />

Financial risks<br />

MSEK 180 in previously paid VAT.<br />

Changes in VAT rates in the areas in<br />

Swedish Tax Agency as to whether<br />

employee ski passes should be taxed.<br />

Weather dependency<br />

The number of visitors at SkiStar’s<br />

winter holidays. SkiStar experiences a<br />

higher degree of sensitivity to the b<br />

SkiStar’s developed and well-tested<br />

concept of operating alpine resorts is a<br />

Exchange rate risks<br />

Fluctuations in local currencies against<br />

which SkiStar conducts operations will<br />

impact upon the Group’s income and<br />

SkiStar is not currently involved in any<br />

other disputes which are deemed to have<br />

re-sorts is affected, to a certain extent,<br />

usiness cycle in Åre, whose target group<br />

good pre-condition for continued<br />

other currencies affect holiday habits<br />

results.<br />

any significant effect on the company’s<br />

by weather and snow conditions. A late<br />

is primarily organisers of seminars and<br />

successful future expansion.<br />

and can, consequently, also have an<br />

income and financial position.<br />

winter and a poor supply of natural snow<br />

will decrease demand. However,<br />

operational risk is limited, as<br />

approximately 76% of ski lift capacity at<br />

conferences.<br />

Competition<br />

The Alpine skiing industry is<br />

Bed capacity<br />

The profitability of alpine skiing resorts<br />

is dependent on the availability of beds<br />

im-pact on the number of guests at<br />

SkiStar’s alpine ski resorts. The Group’s<br />

results are also affected by the relation<br />

between the Swedish krona and the<br />

Electricity costs<br />

SkiStar’s business activities consume<br />

large amounts of electricity. Consequently,<br />

changes in electricity rates<br />

Sensitivity analysis<br />

The sensitivity analysis describes the<br />

manner in which the Group’s results<br />

SkiStar’s destinations has a secure supply<br />

characterised by high entry levels, which<br />

and the occupancy rate. It is important<br />

Norwegian krone exchange rates.<br />

have an effect on the Group’s costs and<br />

will be affected by changes in certain<br />

of snow from snow systems. The conse-<br />

restrict competition. Sun and surf<br />

for SkiStar to control the bed capacity at<br />

SkiStar does not hedge its foreign busi-<br />

income. According to an approved poli-<br />

variables important to the Group. The<br />

quences of the greenhouse effect are being<br />

holidays and weekend city breaks, are<br />

the destinations in order to optimise the<br />

ness activities. Ski lifts and piste groming<br />

cy, the main portion of the Group’s elec-<br />

assumptions regarding the effect on<br />

debated. According to studies carried out<br />

considered to be the company’s main<br />

occupancy rate by changes in demand<br />

machines, for example, are purchased<br />

tricity consumption is to be contracted<br />

income of changes in occupancy rates<br />

by the Swedish National Environmental<br />

competitors. Other industries are<br />

and by setting the correct<br />

abroad and these prices are affected by<br />

at a fixed price. Approximately 40% of<br />

are based on all forms of rented tourist<br />

Protection Agency, the expected warmer<br />

significant competitors to SkiStar, such<br />

accommodation prices throughout each<br />

the exchange rate fluctuations.<br />

electricity costs for the <strong>2004</strong>/<strong>05</strong> season<br />

accommodation and refer only to sales<br />

climate will not lead to snow-free winters.<br />

as rarely-purchased goods and invest-<br />

stage of the season. SkiStar is actively<br />

were contracted at a fixed price during<br />

of ski passes. Changes in other types<br />

On the contrary, the amount of snow is<br />

predicted to increase, but there will also<br />

ments in the home. Other competitors<br />

are comprised of other alpine ski resorts<br />

working to increase the number of beds<br />

at its destinations, as well as to increase<br />

Investments and interest rates<br />

The alpine skiing industry requires<br />

winter and autumn 20<strong>05</strong>. Local<br />

electricity producers supply<br />

of income in the sensitivity analysis are<br />

deemed to be offset by increased and<br />

be an additional number of mild periods<br />

in Scandinavia and the Alps. By inves-<br />

the share of beds for which the company<br />

major capital investments in order to<br />

approximately 30% of the Group’s<br />

decreased costs. In calculating the<br />

during the winters. A milder climate may,<br />

ting in service-minded personnel, leader-<br />

acts as an agency. It is also important to<br />

maintain and increase competitiveness.<br />

electricity requirements at a local price,<br />

sensitivity to a change in electricity<br />

in the longterm, lead to shorter winter<br />

ship skills, modern lifts, snow systems,<br />

maintain demand by modernising older<br />

SkiStar has strong cash flows enabling<br />

which is below the market price of the<br />

prices, only the portion of electricity<br />

seasons. If the seasons at SkiStar’s resorts<br />

IT, restaurants, etc., SkiStar maintains<br />

cabins and apartments. New investments<br />

a high and self-financed rate of invest-<br />

Nordic Power Exchange, Nordpool.<br />

consumption that is directly affected<br />

were to start a week later and end a week<br />

the high standards by which our guests’<br />

in cabins and apartments are primarily<br />

ment. If the interest rate were to<br />

This local price is significantly less<br />

by changes in the market price must be<br />

earlier, the impact on results would be<br />

winter holiday experiences and comfort<br />

conducted by external parties or part-<br />

increase, cash flow could be used to<br />

variable than the market price, which is<br />

taken into consideration. All interest<br />

limited. Temperatures are expected to<br />

levels are improved every year. SkiStar’s<br />

owned companies, as well as by SkiStar.<br />

repay loans during a shorter period of<br />

the reason these volumes are not heged.<br />

rates are variable, and a change in<br />

change more in the Alps than in<br />

destinations are within easy reach of<br />

The attractiveness of SkiStar’s<br />

time, thereby decreasing financing costs.<br />

This implies that approximately 30% of<br />

interest rate levels, therefore, has a<br />

Scandinavia, which is the reason the<br />

well populated areas via its geographical<br />

destinations generates investor interest in<br />

SkiStar has gradually decreased its level<br />

the winter’s expected electricity<br />

direct effect on interest charges.<br />

effects of global warming could provide<br />

SkiStar with new business opportunities.<br />

proximity and affordable transport<br />

solutions in the form of trains, planes,<br />

providing capital, which leads to stable,<br />

long-term growth in the number of<br />

of net debt during recent years. External<br />

borrowing currently takes place only in<br />

consumption will be directly influenced<br />

by fluctuations in the market price.<br />

Sensitivity analysis<br />

The Group’s exposure to weather changes<br />

has also reduced due to the fact that the<br />

destinations are in a variety of geographic<br />

locations and, therefore, involve differing<br />

weather conditions.<br />

buses and hire cars. Other important<br />

competitive strengths are the company’s<br />

market position, its strong financial<br />

position, its well-known and attractive<br />

brand names and high cash flow.<br />

tourist beds.<br />

Personnel<br />

SkiStar’s continued success is dependent<br />

on motivated and committed employees.<br />

In order to retain key personnel, SkiStar<br />

is working with management develop-<br />

the local currencies of SEK and NOK.<br />

The loan portfolio includes only shortterm,<br />

fixed interest rate loans.<br />

Other risks<br />

VAT<br />

VAT on alpine skiing is currently 12%<br />

Petrol prices<br />

Many of SkiStar’s guests travel in their<br />

own cars to the destinations. These<br />

travel habits are affected by the level of<br />

petrol prices and taxation of company<br />

cars. The proximity of alpine<br />

Occupancy<br />

Ski pass prices<br />

Interest<br />

Payroll expenses<br />

Change<br />

Effect<br />

on income<br />

+/-10% +/-25 MSEK<br />

+/-10% +/-54 MSEK<br />

-/+1% -/+7 MSEK<br />

-/+10% -/+30 MSEK<br />

Market price of electricity -/+10 öre -/+2 MSEK<br />

12<br />

13

The Group’s operations<br />

Profits before tax increased to MSEK 182 (177), the best result in SkiStar’s history. A weak<br />

winter season has been compensated by higher capital gains and lower net financial income.<br />

Key points for the year<br />

• Acquisition of Trysil, Norway’s<br />

largest ski resort.<br />

• Net sales and profit:<br />

- Net sales reduced to MSEK 977 (990).<br />

- Income before tax amounted to<br />

MSEK 182 (177).<br />

- Income after tax decreased to MSEK<br />

172 (313).<br />

- Net earnings per share amounted to<br />

SEK 8:83 (16:26) during the period.<br />

In the previous year a large one-off<br />

tax revenue amount was <strong>report</strong>ed.<br />

• An increased dividend of SEK 6:00<br />

(5:00) per share is proposed.<br />

• The current booking situation for<br />

the 20<strong>05</strong>/06 season showed a 4%<br />

improvement at the beginning of<br />

October than at the same point in<br />

time in the previous year.<br />

Organisation and legal structure<br />

All operations in Sweden are<br />

conducted in the Parent Company,<br />

SkiStar AB (publ).<br />

Property<br />

Operations in Norway are conducted<br />

in the wholly-owned subsidiary,<br />

Accounting/Finance<br />

/IR/Purchases<br />

HR/Guest Service<br />

Hemsedal Skisenter AS and the 65%<br />

owned subsidiary Hemsedal Booking<br />

AS. Hemsedal Skisenter AS has an<br />

option to purchase the outstanding<br />

shares in Hemsedal Booking AS in<br />

CEO<br />

2008. The Group’s managerial group<br />

was comprised of twelve individuals<br />

during the year: CEO, CFO,<br />

Market and Sales Manager, Human<br />

Resources Manager, Market Manager,<br />

Sales Co-ordinator, IT Manager,<br />

Property Manager and four Heads of<br />

Destinations, one for Åre, Vemdalen,<br />

Sälen and Hemsedal.<br />

Operational structure<br />

SkiStar’s operations are divided into two<br />

business areas and three staff<br />

functions. Business Area Destinations is<br />

comprised of four areas of operations:<br />

Sälen, Åre, Vemdalen and Hemsedal.<br />

The second business area is the recently<br />

formed Business Area Property. The<br />

staff functions are divided into SkiStar<br />

Travel (comprising Marketing/Sales/IT),<br />

Accounting/Finance/IR/Purchases and<br />

HR/Guest Service.<br />

Staff functions<br />

Accounting, Finance, Purchasing, IR<br />

Accounting, finance, purchasing and<br />

IT are co-ordinated under the CFO.<br />

SkiStar Travel<br />

Accounting principles and <strong>report</strong>ing<br />

routines are, amongst other things, coordinated<br />

under Accounting in order to<br />

achieve standardised <strong>report</strong>ing for the<br />

Group. In addition, work with<br />

standardised models for financial<br />

control, such a follow-up of<br />

effectiveness and profitability, is<br />

conducted here. All credit risk<br />

management and interest rate hedging is<br />

handled centrally and follows adopted<br />

policies. The Investor Relations function,<br />

IR, handles information to the stock<br />

market in the form of annual <strong>report</strong>s,<br />

interim <strong>report</strong>s, press releases, analyst<br />

meetings, capital market days and<br />

financial information via the website.<br />

Certain purchases are handled centrally<br />

in order to generate purchase synergy<br />

effects.<br />

Human Resources, Guest Service<br />

To ensure that all of the functions and<br />

departments of the Group prioritise and<br />

work with leadership and guest service<br />

in a standardised manner, the overall<br />

human resources function for the Group<br />

has been centralised under a Human<br />

Resources Manager. See also<br />

pages 18–19.<br />

SkiStar Travel<br />

The Group’s marketing, sales and IT<br />

has been co-ordinated under the name<br />

SkiStar Travel since January 20<strong>05</strong>.<br />

This co-ordination has taken place in<br />

order to the take full advantage of and<br />

gain the greatest possible effect from<br />

SkiStar’s total resources in these three<br />

areas. See also pages 20–22.<br />

Business Area Properties<br />

Business Area Properties has been<br />

operational since January 20<strong>05</strong>. The<br />

responsibilities of this business area<br />

include generating profits and making<br />

financial resources available via sales<br />

of older properties and utilising these<br />

resources to develop and build modern<br />

properties at SkiStar’s destinations.<br />

More information on Business Area<br />

Properties can be found on page 34.<br />

Business Area Destinations<br />

Business Area Destinations is divided<br />

into four areas of operation: Åre,<br />

Vemdalen, Sälen and Hemsedal. This<br />

business area is presented on pages<br />

24–33.<br />

Acquisition of Trysil in progress<br />

On 19 May SkiStar submitted an offer<br />

to Trysilfjell BA, the owners of the ski<br />

resort in Trysil, Norway, for acquiring<br />

the companies which together conduct<br />

alpine skiing activities in Trysil.<br />

Trysilfjell BA accepted SkiStar’s offer on<br />

23 May. The offer entails that SkiStar<br />

offer a cash payment of a maximum<br />

of MNOK 190 or a maximum of<br />

1,672,000 B shares, or, alternatively,<br />

a combination of cash and shares.<br />

Thereafter, the seller informed SkiStar<br />

that the purchase price would be<br />

comprised of a maximum of 60,000<br />

B shares. These shares will be acquired<br />

on the basis of a repurchase of shares.<br />

The date of taking possession was<br />

agreed at 1 November 20<strong>05</strong>. The<br />

Norwegian Competition Authority has<br />

not, to date, approved this transaction.<br />

It is the Competition Authority’s<br />

opinion that after the acquisition of<br />

Trysil, SkiStar will have a dominating<br />

position in the operation of alpine ski<br />

resorts in Scandinavia. A final ruling<br />

from the Norwegian Competition<br />

Authority is expected in mid-November<br />

20<strong>05</strong>, and therefore the acquisition<br />

has been slightly delayed. If the<br />

Competition Authority’s decision is<br />

negative for SkiStar, the company will<br />

lodge an appeal with a superior<br />

body, the Norwegian Ministry of<br />

Modernisation. In the event of such an<br />

appeal, the acquisition will be further<br />

delayed by a few months. In <strong>2004</strong> Trysil<br />

generated total net sales of MNOK 230<br />

and <strong>report</strong>ed profits before tax<br />

amounting to MNOK 24. Trysil is<br />

Norway’s largest ski resort with a<br />

market share of 15% of ski passes in<br />

Norway. The company conducts skiing,<br />

ski hire and accommodation agency<br />

activities. Ski school activities are<br />

conducted by one of the associated<br />

companies. Trysil is a high-standard,<br />

modern ski resort. There is ski lift<br />

capacity for 32,400 skiers per hour,<br />

with 22 ski lifts and 5 chairlifts. There<br />

are 64 slopes. The companies<br />

administer 3,300 of a total of<br />

approximately 8,000 commercial beds<br />

in the area. The occupancy rate for the<br />

cabins and apartments, provided on an<br />

agency basis, was 67% in the <strong>2004</strong>/<strong>05</strong><br />

season. After the completion of the<br />

acquisition, SkiStar’s market share of ski<br />

passes in Scandinavia will increase from<br />

32% to 42%. With the acquisition of<br />

Trysil, SkiStar provides a<br />

comprehensive offering in the Nordic<br />

markets, with Hemsedal in Norway and<br />

Åre in Sweden having more advanced<br />

profiles, and Trysil in Norway as well as<br />

Sälen and Vemdalen in Sweden<br />

focusing on families. The acquisition<br />

provides synergies primarily within<br />

Marketing, Sales and IT.<br />

Division of operating income and costs, MSEK<br />

Operating income <strong>2004</strong>/<strong>05</strong> 2003/04 +/– +/–, %<br />

Alpine skiing/Lift 545 560 –15 –3<br />

Accommodation 162 162 0 0<br />

Ski rental 91 85 6 7<br />

Ski school 37 38 –1 –3<br />

Sports outlets * 24 42 –18 –43<br />

Properties 59 57 2 4<br />

Capital gains 45 25 20 80<br />

Other ** 72 49 23 47<br />

Total 1 035 1 018 17 2<br />

Operating expenses<br />

Operating income and results per business area, MSEK<br />

Cost of materials –56 –62 6 –10<br />

Personnel costs –313 –3<strong>05</strong> –8 3<br />

Other costs –336 –324 –12 4<br />

Total –7<strong>05</strong> –691 –14 2<br />

* Leased sports outlets generated net sales of MSEK 20 in 2003/04.<br />

**Other income includes, amongst other things, recently-started charter flight operations.<br />

Åre Vemdalen Hemsedal Sälen Property<br />

<strong>2004</strong>/<strong>05</strong> 2003/04 <strong>2004</strong>/<strong>05</strong> 2003/04 <strong>2004</strong>/<strong>05</strong> 2003/04 <strong>2004</strong>/<strong>05</strong> 2003/04 <strong>2004</strong>/<strong>05</strong> 2003/04<br />

Net sales 265 238 70 74 170 163 472 515 0 0<br />

Other income 3 0 1 0 0 0 9 2 45 25<br />

Operating income 268 238 71 74 170 163 481 517 45 25<br />

Operating expenses –2<strong>05</strong> –187 –52 –51 –128 –111 –320 –341 0 0<br />

Depreciation –31 –31 –8 –7 –30 –24 –53 –54 0 0<br />

Operating income 32 20 11 16 12 28 108 122 45 25<br />

Operating margin, % 12 8 15 22 7 17 22 24 100 100<br />

14 15

Vision, goals and<br />

strategies for success<br />

The value of the shareholders’ invested capital shall be increased by creating value for SkiStar’s<br />

guests, employees and other interested parties.<br />

Vision<br />

year amounted to 0.9% and the organic<br />

area should preferably be run by<br />

SkiStar’s vision is to create memorable<br />

growth for similar business operations<br />

external, professional parties.<br />

winter experiences as the leading<br />

was negative at -0.6%.<br />

• SkiStar will work to ensure that all<br />

operator of European alpine skiing<br />

destinations SkiStar shall take a leading<br />

Fulfilment of goals<br />

companies providing services at alpine<br />

destinations achieve high quality and<br />

position in the conceptualisation,<br />

The overall goal is to increase the value<br />

a high level of service in order to<br />

integration and development of these<br />

of the shareholders’ capital. During the<br />

strengthen the destinations’ brand and<br />

types of services.<br />

<strong>2004</strong>/<strong>05</strong> financial year, the share price<br />

offer the guests a better experience.<br />

Goals<br />

increased by 34% to SEK 150:00 and it<br />

is proposed that dividends be increased<br />

• SkiStar Travel is the Group’s travel<br />

organisation and is responsible for<br />

A fantastic view over the “The Scandinavian Alps” in Hemsedal<br />

Overall goals<br />

The value of the shareholders’ invested<br />

by 20% to SEK 6:00. The fulfilment of<br />

financial targets and organic growth can<br />

creating holiday packages, conducting<br />

administering and selling<br />

creates a lack of dependency on cars<br />

for transportation during guests’<br />

ously be improved. The strategy is to<br />

use professional selection processes<br />

secured at an early stage, entailing<br />

lower risk and a more even cash flow.<br />

capital shall be increased by creating<br />

value for SkiStar’s guests, employees and<br />

be seen in the tables. The goals that<br />

have not been achieved are the targets<br />

accommodation, transportation and<br />

SkiStar’s own products and services.<br />

holidays.<br />

• Development of the Group’s snow<br />

for recruitment, and to train and<br />

perform continual follow-ups.<br />

Acquisition strategy<br />

other interested parties. This focus has<br />

for the operating margin and organic<br />

• The Business Area Properties shall<br />

systems is a high priority. The snow<br />

• The alpine destinations will be<br />

• The acquisition strategy is to acquire<br />

been a significant factor in SkiStar’s success<br />

growth. Negative calendar effects of an<br />

make financial resources available<br />

systems are being continuously<br />

continuously improved in consulta-<br />

selected alpine destinations having<br />

and its leading position in the market.<br />

early Easter holiday and fewer public<br />

and generate profits by refurbishing<br />

expanded in order to offer good<br />

tion with the guests and their wishes,<br />

high potential, later developing them<br />

Financial goals<br />

holidays at Christmas and New Year<br />

combined with a poor level of natural<br />

and selling older properties and<br />

utilising available resources to<br />

skiing facilities, regardless of the<br />

natural snow conditions.<br />

which will result in more satisfied<br />

guests who will return to SkiStar year<br />

at a high level of profitability.<br />

• The acquired alpine destinations<br />

In order to make possible an offensive<br />

snowfall at three of SkiStar’s four<br />

construct new, modern tourist<br />

• The destinations have differing<br />

after year.<br />

should be of a size greater than<br />

strategy while simultaneously balancing<br />

destinations have negatively impacted<br />

accommodation at SkiStar’s<br />

profiles and can thereby combine to<br />

• The improvement of accessibility,<br />

critical mass and shall only to a<br />

operational risks, SkiStar stresses the<br />

organic growth and the operating<br />

destinations.<br />

attract large customer groups.<br />

simplicity and comfort for our guests<br />

limited extent compete with SkiStar’s<br />

importance of a strong financial foundation.<br />

The goal is an equity ratio above<br />

35%. At the current interest rate level,<br />

margin.<br />

Strategies<br />

Operational strategies<br />

• Well-managed products and services<br />

• SkiStar shall ensure that there is a<br />

wide range of affordable transport<br />

alternatives to the respective<br />

will be continual.<br />

Market and sales strategies<br />

existing destinations for the same<br />

guests.<br />

• In order for an alpine destination to<br />

the return on equity should amount<br />

to 13.9% and the return on capital<br />

Concept and business model<br />

• The core business is alpine skiing,<br />

result in a higher number of returning<br />

guests, who are the best advertise-<br />

destinations, firstly via agreements<br />

with external companies and secondly<br />

• All IT, marketing and sales resources<br />

will be co-ordinated in order to<br />

be an interesting potential object of<br />

acquisition, it should be possible to<br />

employed should amount to 10.9%.<br />

with the focus on the guest’s skiing<br />

ment for the company.<br />

by SkiStar offering its own transport<br />

obtain the greatest possible effects for<br />

structure the destination in<br />

These targets are established on the<br />

experience.<br />

• Thanks to a well-planned infra-<br />

solutions.<br />

SkiStar as a whole.<br />

accordance with SkiStar’s concept.<br />

basis of three-month treasury bills for<br />

which the average interest rate during<br />

• Profitable and strategic activities within<br />

lifts/alpine skiing, ski school and ski<br />

structure, the guests will find<br />

everything within walking distance.<br />

Management and service strategies<br />

• The primary purpose of the<br />

marketing and sales strategies is to<br />

Cross-training and benchmarking<br />

the <strong>2004</strong>/<strong>05</strong> financial year was 1.87%.<br />

rental will, in the long-term, be con-<br />

• The accommodation and skiing areas<br />

• Through a process-controlled<br />

increase the number and maximise the<br />

SkiStar’s employees have extensive<br />

The operating margin should, in the<br />

ducted within the company’s own<br />

are located close together in order to<br />

organisation and strategic<br />

percentage of alpine skiers at SkiStar’s<br />

experience and knowledge in operating<br />

long-term, exceed 22%. All financial<br />

organisation at its respective<br />