issue no. 163 - january–march 2007 / muharram–rabi al awwal 1428

issue no. 163 - january–march 2007 / muharram–rabi al awwal 1428

issue no. 163 - january–march 2007 / muharram–rabi al awwal 1428

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

COUNTRY FOCUS: RUSSIA<br />

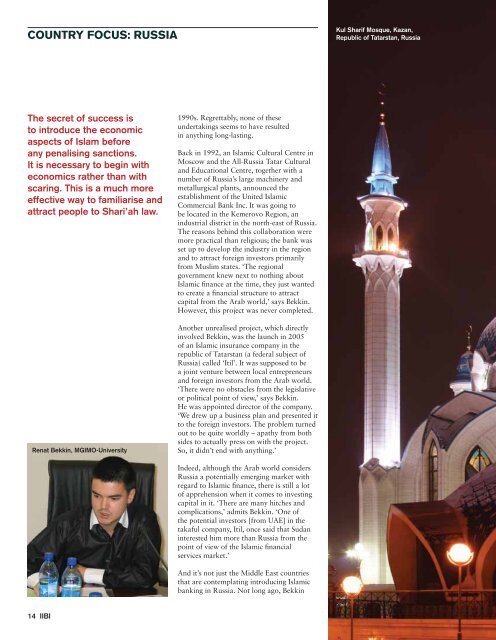

Kul Sharif Mosque, Kazan,<br />

Republic of Tatarstan, Russia<br />

The secret of success is<br />

to introduce the eco<strong>no</strong>mic<br />

aspects of Islam before<br />

any pen<strong>al</strong>ising sanctions.<br />

It is necessary to begin with<br />

eco<strong>no</strong>mics rather than with<br />

scaring. This is a much more<br />

effective way to familiarise and<br />

attract people to Shari’ah law.<br />

Renat Bekkin, MGIMO-University<br />

1990s. Regrettably, <strong>no</strong>ne of these<br />

undertakings seems to have resulted<br />

in anything long-lasting.<br />

Back in 1992, an Islamic Cultur<strong>al</strong> Centre in<br />

Moscow and the All-Russia Tatar Cultur<strong>al</strong><br />

and Education<strong>al</strong> Centre, together with a<br />

number of Russia’s large machinery and<br />

met<strong>al</strong>lurgic<strong>al</strong> plants, an<strong>no</strong>unced the<br />

establishment of the United Islamic<br />

Commerci<strong>al</strong> Bank Inc. It was going to<br />

be located in the Kemerovo Region, an<br />

industri<strong>al</strong> district in the <strong>no</strong>rth-east of Russia.<br />

The reasons behind this collaboration were<br />

more practic<strong>al</strong> than religious; the bank was<br />

set up to develop the industry in the region<br />

and to attract foreign investors primarily<br />

from Muslim states. ‘The region<strong>al</strong><br />

government knew next to <strong>no</strong>thing about<br />

Islamic finance at the time, they just wanted<br />

to create a financi<strong>al</strong> structure to attract<br />

capit<strong>al</strong> from the Arab world,’ says Bekkin.<br />

However, this project was never completed.<br />

A<strong>no</strong>ther unre<strong>al</strong>ised project, which directly<br />

involved Bekkin, was the launch in 2005<br />

of an Islamic insurance company in the<br />

republic of Tatarstan (a feder<strong>al</strong> subject of<br />

Russia) c<strong>al</strong>led ‘Itil’. It was supposed to be<br />

a joint venture between loc<strong>al</strong> entrepreneurs<br />

and foreign investors from the Arab world.<br />

‘There were <strong>no</strong> obstacles from the legislative<br />

or politic<strong>al</strong> point of view,’ says Bekkin.<br />

He was appointed director of the company.<br />

‘We drew up a business plan and presented it<br />

to the foreign investors. The problem turned<br />

out to be quite worldly – apathy from both<br />

sides to actu<strong>al</strong>ly press on with the project.<br />

So, it didn’t end with anything.’<br />

Indeed, <strong>al</strong>though the Arab world considers<br />

Russia a potenti<strong>al</strong>ly emerging market with<br />

regard to Islamic finance, there is still a lot<br />

of apprehension when it comes to investing<br />

capit<strong>al</strong> in it. ‘There are many hitches and<br />

complications,’ admits Bekkin. ‘One of<br />

the potenti<strong>al</strong> investors [from UAE] in the<br />

takaful company, Itil, once said that Sudan<br />

interested him more than Russia from the<br />

point of view of the Islamic financi<strong>al</strong><br />

services market.’<br />

And it’s <strong>no</strong>t just the Middle East countries<br />

that are contemplating introducing Islamic<br />

banking in Russia. Not long ago, Bekkin<br />

14 IIBI