issue no. 163 - january–march 2007 / muharram–rabi al awwal 1428

issue no. 163 - january–march 2007 / muharram–rabi al awwal 1428

issue no. 163 - january–march 2007 / muharram–rabi al awwal 1428

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NEWHORIZON Muharram–Rabi Al Aww<strong>al</strong> <strong>1428</strong><br />

ANALYSIS: SUKUK<br />

use to manage their short- and mediumterm<br />

investments and to adjust their risk<br />

levels.<br />

Tradition<strong>al</strong>ly (if this word can be used to<br />

describe such a new instrument), investors<br />

bought part of a sukuk <strong>issue</strong> with the<br />

intention of holding that investment to<br />

maturity. There are a number of reasons<br />

for this phe<strong>no</strong>me<strong>no</strong>n, sever<strong>al</strong> of which are<br />

linked to the sm<strong>al</strong>l size and number of<br />

sukuk <strong>issue</strong>s. For example, there have been<br />

so few benchmark <strong>issue</strong>s, that a significant<br />

investor could take part in each new one<br />

without having to liquidate any existing<br />

sukuk holding. Also, should that investor<br />

sell an existing holding, there are few viable<br />

<strong>al</strong>ternative <strong>issue</strong>s with which to replace it.<br />

With sovereign <strong>issue</strong>s offering a premium<br />

return, there is little incentive to sell prior to<br />

maturity. Without investors selling prior to<br />

maturity, there can be <strong>no</strong> secondary market.<br />

There are early signs that selling prior<br />

to maturity may be about to become<br />

more commonplace. In the last few months,<br />

sever<strong>al</strong> sizeable sukuk <strong>issue</strong>s have attracted<br />

internation<strong>al</strong> attention. Abu Dhabi Islamic<br />

Bank’s (ADIB) <strong>issue</strong> in November 2006 of<br />

$800 million sukuk bonds was rated A2 by<br />

Moody’s and A by Fitch. That <strong>issue</strong> was<br />

origin<strong>al</strong>ly planned as a $400–$500 million<br />

<strong>issue</strong> but was increased due to demand. In<br />

March of this year, Dubai Islamic Bank<br />

(DIB) came to market with its first US<br />

dollar de<strong>no</strong>minated sukuk worth $750<br />

million. That <strong>issue</strong> gained an A1 rating<br />

from Moody’s. Both of these <strong>issue</strong>s were<br />

listed on the Dubai Internation<strong>al</strong> Financi<strong>al</strong><br />

Exchange and the London Stock Exchange.<br />

No doubt fuelled by their internation<strong>al</strong><br />

listings and investment grade ratings,<br />

these <strong>issue</strong>s attracted investment, <strong>no</strong>t<br />

only from Islamic investors but from<br />

convention<strong>al</strong> investors around the world.<br />

In the ADIB <strong>issue</strong>, for example, the Middle<br />

East accounted for 50 per cent, Europe<br />

accounted for 37 per cent, Asia accounted<br />

for twelve per cent, and the US one per<br />

cent. There were <strong>al</strong>so different types<br />

of organisations that invested, with<br />

banks accounting for 58 per cent of the<br />

transaction, fund managers 31 per cent,<br />

corporates eight per cent and other investors<br />

(including individu<strong>al</strong>s) three per cent. The<br />

presence of investors from areas other than<br />

the Middle East, as well as fund managers,<br />

suggests that those investments were made<br />

for strategic reasons and <strong>no</strong>t simply to<br />

‘buy-and-hold’. That in turn suggests<br />

that the investments will be sold once their<br />

investment objectives are met. These s<strong>al</strong>es<br />

will add to the size of the secondary market.<br />

Other factors will need to be present before<br />

a secondary market can be considered to<br />

be efficient. These will include regulation,<br />

the presence of standard sized instruments,<br />

standard settlement procedures, and<br />

market-makers who are prepared to step<br />

in and provide liquidity to the market itself.<br />

Over the last 25 years or so, the Islamic<br />

banking community has built infrastructures<br />

when they have been needed and this is<br />

a<strong>no</strong>ther such case in point.<br />

Some Islamic banking centres, including<br />

M<strong>al</strong>aysia and Bahrain, <strong>al</strong>ready have much<br />

of the necessary infrastructure in place<br />

as a result of hosting par<strong>al</strong>lel Islamic and<br />

convention<strong>al</strong> banking markets. Specific<strong>al</strong>ly,<br />

in the capit<strong>al</strong> markets space, Dubai and<br />

London are keen to promote their depth of<br />

market expertise, regulators, ready-made<br />

pool of investors and market support<br />

profession<strong>al</strong>s.<br />

It will take time to build up a deep<br />

secondary sukuk market. More sukuk<br />

<strong>issue</strong>s, made more frequently, would help<br />

that growth. Until <strong>no</strong>w, many of the sukuk<br />

<strong>issue</strong>s have been ‘one-off’ events, introduced<br />

to raise money for a specific purpose.<br />

Regular and frequent <strong>issue</strong>s with different<br />

maturity dates – <strong>al</strong>ong the lines of Gilt<br />

<strong>issue</strong>s in the UK or T-Bills in the US – would<br />

add depth to the market. That depth would<br />

facilitate banks buying and selling sukukbased<br />

instruments ‘on demand’. Once that<br />

is in place then Islamic banks will be able<br />

to use the sukuk to invest excess cash and<br />

manage liquidity to suit their needs.<br />

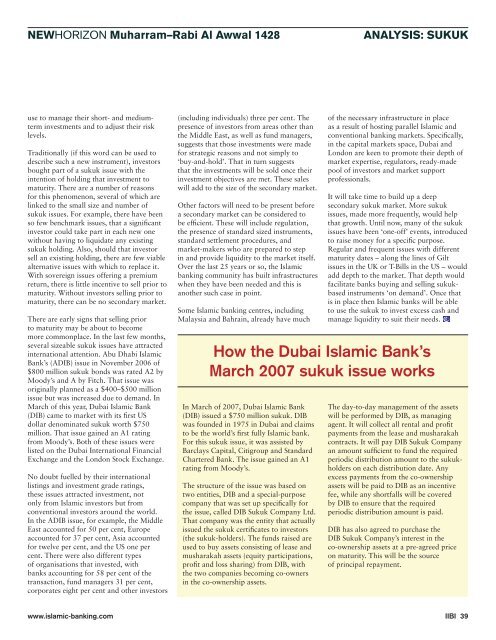

How the Dubai Islamic Bank’s<br />

March <strong>2007</strong> sukuk <strong>issue</strong> works<br />

In March of <strong>2007</strong>, Dubai Islamic Bank<br />

(DIB) <strong>issue</strong>d a $750 million sukuk. DIB<br />

was founded in 1975 in Dubai and claims<br />

to be the world’s first fully Islamic bank.<br />

For this sukuk <strong>issue</strong>, it was assisted by<br />

Barclays Capit<strong>al</strong>, Citigroup and Standard<br />

Chartered Bank. The <strong>issue</strong> gained an A1<br />

rating from Moody’s.<br />

The structure of the <strong>issue</strong> was based on<br />

two entities, DIB and a speci<strong>al</strong>-purpose<br />

company that was set up specific<strong>al</strong>ly for<br />

the <strong>issue</strong>, c<strong>al</strong>led DIB Sukuk Company Ltd.<br />

That company was the entity that actu<strong>al</strong>ly<br />

<strong>issue</strong>d the sukuk certificates to investors<br />

(the sukuk-holders). The funds raised are<br />

used to buy assets consisting of lease and<br />

musharakah assets (equity participations,<br />

profit and loss sharing) from DIB, with<br />

the two companies becoming co-owners<br />

in the co-ownership assets.<br />

The day-to-day management of the assets<br />

will be performed by DIB, as managing<br />

agent. It will collect <strong>al</strong>l rent<strong>al</strong> and profit<br />

payments from the lease and musharakah<br />

contracts. It will pay DIB Sukuk Company<br />

an amount sufficient to fund the required<br />

periodic distribution amount to the sukukholders<br />

on each distribution date. Any<br />

excess payments from the co-ownership<br />

assets will be paid to DIB as an incentive<br />

fee, while any shortf<strong>al</strong>ls will be covered<br />

by DIB to ensure that the required<br />

periodic distribution amount is paid.<br />

DIB has <strong>al</strong>so agreed to purchase the<br />

DIB Sukuk Company’s interest in the<br />

co-ownership assets at a pre-agreed price<br />

on maturity. This will be the source<br />

of princip<strong>al</strong> repayment.<br />

www.islamic-banking.com IIBI 39