azerbaijan: emerging market islamic banking and finance

azerbaijan: emerging market islamic banking and finance

azerbaijan: emerging market islamic banking and finance

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NEWHORIZON Shawwal–Dhu Al Hijjah 1429<br />

INNOVATION SPOTLIGHT<br />

Islamic wealth management industry over<br />

the next several years.<br />

These strategies should be transparent <strong>and</strong><br />

made available in the form of capitalprotected<br />

certificates which, in the event of<br />

a collapse of the issuer or a malfunction of<br />

the strategy, have the ability to offer 100<br />

per cent redemption by adopting a strict<br />

segregation of the Islamic principal via an<br />

Islamic trust, which in turn invests in<br />

Shari’ah-compliant assets only. This<br />

certificate must be offered at competitive<br />

levels in an attempt to rival their<br />

conventional counterparts <strong>and</strong> be made<br />

available in the secondary <strong>market</strong> at<br />

reasonable bid/offer spreads. Target<br />

investors should include retail, private <strong>and</strong><br />

institutional clients.<br />

One such Islamic dynamic strategy is the<br />

‘Islamic Navigator’, which invests in four<br />

Shari’ah-compliant assets based on an<br />

algorithm that identifies medium-term<br />

trends in these assets. The trend is identified<br />

by comparing the prevailing spot price of<br />

the asset to its recent moving average. The<br />

length of the moving average may vary for<br />

each asset <strong>and</strong> can be optimised based on<br />

historical simulations. Should the algorithm<br />

detect a positive trend (i.e. when spot price<br />

is above the moving average) for an asset,<br />

a fixed allocation is provided to that asset.<br />

In the event of a negative trend being<br />

detected, the allocation for the asset is<br />

directed to a commodity-based reserve asset.<br />

The shift in these weightings is conducted<br />

on a monthly basis. The initial result is a<br />

dynamic index linked to a number of<br />

underlying assets.<br />

The strategy is then controlled through a<br />

volatility stabilisation mechanism, which<br />

employs a ‘dynamic participation’ level<br />

based on the volatility of the initial index.<br />

Should the index observe high short-term<br />

volatility, the mechanism reduces exposure<br />

to the index, <strong>and</strong> vice versa. In effect, the<br />

strategy targets a certain st<strong>and</strong>ard deviation<br />

from the average daily returns by decreasing<br />

or increasing the exposure to the index.<br />

Hence, the volatility is ex ante defined <strong>and</strong><br />

is measurable at the outset, which is unusual<br />

for Islamic strategies.<br />

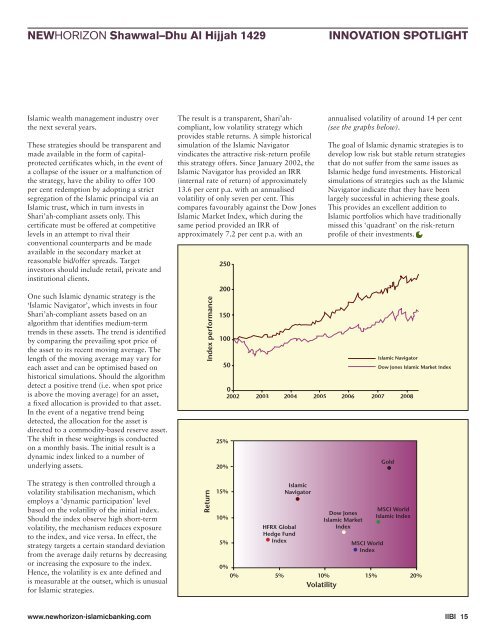

The result is a transparent, Shari’ahcompliant,<br />

low volatility strategy which<br />

provides stable returns. A simple historical<br />

simulation of the Islamic Navigator<br />

vindicates the attractive risk-return profile<br />

this strategy offers. Since January 2002, the<br />

Islamic Navigator has provided an IRR<br />

(internal rate of return) of approximately<br />

13.6 per cent p.a. with an annualised<br />

volatility of only seven per cent. This<br />

compares favourably against the Dow Jones<br />

Islamic Market Index, which during the<br />

same period provided an IRR of<br />

approximately 7.2 per cent p.a. with an<br />

annualised volatility of around 14 per cent<br />

(see the graphs below).<br />

The goal of Islamic dynamic strategies is to<br />

develop low risk but stable return strategies<br />

that do not suffer from the same issues as<br />

Islamic hedge fund investments. Historical<br />

simulations of strategies such as the Islamic<br />

Navigator indicate that they have been<br />

largely successful in achieving these goals.<br />

This provides an excellent addition to<br />

Islamic portfolios which have traditionally<br />

missed this ‘quadrant’ on the risk-return<br />

profile of their investments.<br />

www.newhorizon-<strong>islamic</strong><strong>banking</strong>.com IIBI 15