azerbaijan: emerging market islamic banking and finance

azerbaijan: emerging market islamic banking and finance

azerbaijan: emerging market islamic banking and finance

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NEWHORIZON Shawwal–Dhu Al Hijjah 1429<br />

IIBI LECTURES<br />

reducing balance basis, so the cost of the<br />

machine can only be amortised over a<br />

number of years.<br />

With the Islamic transaction, the customer<br />

claims capital allowances on a machine<br />

costing £1100. As the capital allowances<br />

are given over an extended period of time,<br />

the customer’s tax relief with the Islamic<br />

transaction would be deferred further into<br />

the future than with a conventional<br />

purchase where the <strong>finance</strong> cost of £100 is<br />

deducted over the first two years. Overall,<br />

the Islamic transaction would be treated less<br />

favourably than the conventional<br />

transaction.<br />

Having illustrated the problem, Amin then<br />

went on to explain how UK tax law has<br />

been modified with the goal of equalising<br />

the tax treatment. He explained that, strictly<br />

speaking, the UK has no tax law for Islamic<br />

<strong>finance</strong>. Instead, the legislation reveals a<br />

fundamental principle that the same tax law<br />

should apply to all citizens, regardless of<br />

religion, <strong>and</strong> that the tax treatment of a<br />

transaction cannot be allowed to depend on<br />

whether or not it is Shari’ah-compliant.<br />

Instead, UK law now defines certain types<br />

of transactions, carefully using language<br />

that is completely neutral regarding religion.<br />

Amin illustrated this with the text of<br />

Finance Act (FA) 2005 s.47, which defines a<br />

transaction called ‘purchase <strong>and</strong> resale’ that<br />

happens to correspond to murabaha. The<br />

legislation then separates the mark-up in the<br />

transaction (£100 in the example above)<br />

<strong>and</strong> treats it in the same way as interest is<br />

treated for tax purposes.<br />

The table below sets out the UK tax law<br />

concepts Amin covered, <strong>and</strong> the Islamic<br />

transactions to which they correspond:<br />

Tax law<br />

Purchase <strong>and</strong> resale<br />

Deposit<br />

Profit share agency<br />

Diminishing shared ownership<br />

Alternative <strong>finance</strong> investment bond<br />

After covering the tax rules in more detail,<br />

especially those for alternative <strong>finance</strong><br />

investment bonds (sukuk), Amin addressed<br />

some of the remaining problem areas. He<br />

illustrated one problem with the Diagram 3<br />

below:<br />

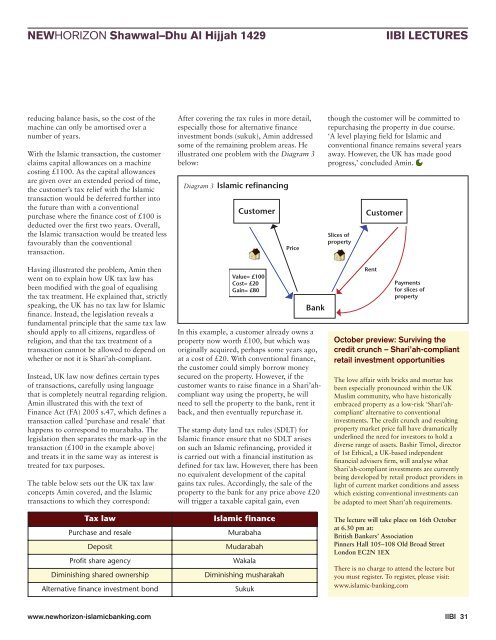

Diagram 3 Islamic refinancing<br />

In this example, a customer already owns a<br />

property now worth £100, but which was<br />

originally acquired, perhaps some years ago,<br />

at a cost of £20. With conventional <strong>finance</strong>,<br />

the customer could simply borrow money<br />

secured on the property. However, if the<br />

customer wants to raise <strong>finance</strong> in a Shari’ahcompliant<br />

way using the property, he will<br />

need to sell the property to the bank, rent it<br />

back, <strong>and</strong> then eventually repurchase it.<br />

The stamp duty l<strong>and</strong> tax rules (SDLT) for<br />

Islamic <strong>finance</strong> ensure that no SDLT arises<br />

on such an Islamic refinancing, provided it<br />

is carried out with a financial institution as<br />

defined for tax law. However, there has been<br />

no equivalent development of the capital<br />

gains tax rules. Accordingly, the sale of the<br />

property to the bank for any price above £20<br />

will trigger a taxable capital gain, even<br />

Islamic <strong>finance</strong><br />

Murabaha<br />

Mudarabah<br />

Wakala<br />

Diminishing musharakah<br />

Sukuk<br />

though the customer will be committed to<br />

repurchasing the property in due course.<br />

‘A level playing field for Islamic <strong>and</strong><br />

conventional <strong>finance</strong> remains several years<br />

away. However, the UK has made good<br />

progress,’ concluded Amin.<br />

October preview: Surviving the<br />

credit crunch – Shari’ah-compliant<br />

retail investment opportunities<br />

The love affair with bricks <strong>and</strong> mortar has<br />

been especially pronounced within the UK<br />

Muslim community, who have historically<br />

embraced property as a low-risk ‘Shari’ahcompliant’<br />

alternative to conventional<br />

investments. The credit crunch <strong>and</strong> resulting<br />

property <strong>market</strong> price fall have dramatically<br />

underlined the need for investors to hold a<br />

diverse range of assets. Bashir Timol, director<br />

of 1st Ethical, a UK-based independent<br />

financial advisers firm, will analyse what<br />

Shari’ah-compliant investments are currently<br />

being developed by retail product providers in<br />

light of current <strong>market</strong> conditions <strong>and</strong> assess<br />

which existing conventional investments can<br />

be adapted to meet Shari’ah requirements.<br />

The lecture will take place on 16th October<br />

at 6.30 pm at:<br />

British Bankers’ Association<br />

Pinners Hall 105–108 Old Broad Street<br />

London EC2N 1EX<br />

There is no charge to attend the lecture but<br />

you must register. To register, please visit:<br />

www.<strong>islamic</strong>-<strong>banking</strong>.com<br />

www.newhorizon-<strong>islamic</strong><strong>banking</strong>.com IIBI 31