azerbaijan: emerging market islamic banking and finance

azerbaijan: emerging market islamic banking and finance

azerbaijan: emerging market islamic banking and finance

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NEWHORIZON Shawwal–Dhu Al Hijjah 1429<br />

RATINGS & INDICES<br />

prudential foundations to accommodate<br />

Islamic <strong>finance</strong> side-by-side with the<br />

conventional financial system. Many of<br />

the largest western banks, through their<br />

Islamic windows, have become active<br />

<strong>and</strong> sometimes leading players in financial<br />

innovation, through new Shari’ah-compliant<br />

financial instruments that attempt to<br />

alleviate many of the current constraints<br />

such as a weak systemic liquidity infrastructure.<br />

More conventional banks are<br />

expected to offer Islamic products, enticed<br />

by enormous profit opportunities <strong>and</strong> also<br />

ample liquidity, especially across the Middle<br />

East.<br />

New product innovation is also driven<br />

by domestic banks’ interest in risk<br />

diversification. With a large number of new<br />

Islamic banks across the Middle East <strong>and</strong><br />

Asia especially, diversification of products<br />

enables banks to offer the right product mix<br />

to more sophisticated clients. A few banks<br />

are already active across different<br />

jurisdictions, <strong>and</strong> this trend is certainly<br />

going to continue in the near future,<br />

possibly with some consolidation.<br />

On the regulatory front, the Islamic<br />

Financial Services Board (IFSB), an international<br />

st<strong>and</strong>ard-setting organisation<br />

based in Malaysia, has moved ahead with<br />

its efforts aimed at fostering of the<br />

soundness <strong>and</strong> stability of the Islamic<br />

financial services industry through more<br />

st<strong>and</strong>ardised regulation. Globally accepted<br />

prudential st<strong>and</strong>ards have been adopted by<br />

the IFSB that smoothly integrate Islamic<br />

<strong>finance</strong> with the conventional financial<br />

system. For instance, the adoption of the<br />

IFSB st<strong>and</strong>ards (somewhat akin to Basel II),<br />

which take into account the specificities of<br />

Islamic <strong>finance</strong>, ensures a level playing field<br />

between Islamic <strong>and</strong> conventional banks.<br />

Many challenges still lie ahead, as is<br />

clear from the discussion above. However,<br />

the ongoing improvements in banks’ risk<br />

management techniques <strong>and</strong> prudential<br />

frameworks for Shari’ah-compliant<br />

<strong>banking</strong> give reasonable hope that the<br />

Islamic financial industry’s growth will<br />

contribute positively to broader financial<br />

<strong>and</strong> economic stability.<br />

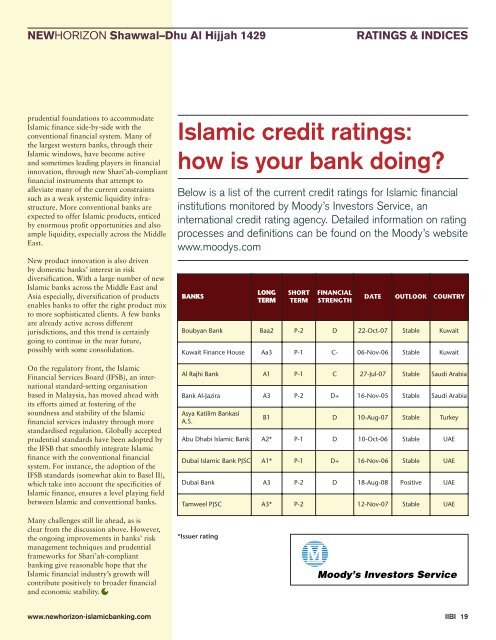

Islamic credit ratings:<br />

how is your bank doing?<br />

Below is a list of the current credit ratings for Islamic financial<br />

institutions monitored by Moody’s Investors Service, an<br />

international credit rating agency. Detailed information on rating<br />

processes <strong>and</strong> definitions can be found on the Moody’s website<br />

www.moodys.com<br />

BANKS<br />

LONG<br />

TERM<br />

SHORT<br />

TERM<br />

FINANCIAL<br />

STRENGTH<br />

DATE OUTLOOK COUNTRY<br />

Boubyan Bank Baa2 P-2 D 22-Oct-07 Stable Kuwait<br />

Kuwait Finance House Aa3 P-1 C- 06-Nov-06 Stable Kuwait<br />

Al Rajhi Bank A1 P-1 C 27-Jul-07 Stable Saudi Arabia<br />

Bank Al-Jazira A3 P-2 D+ 16-Nov-05 Stable Saudi Arabia<br />

Asya Katilim Bankasi<br />

A.S.<br />

B1 D 10-Aug-07 Stable Turkey<br />

Abu Dhabi Islamic Bank A2* P-1 D 10-Oct-06 Stable UAE<br />

Dubai Islamic Bank PJSC A1* P-1 D+ 16-Nov-06 Stable UAE<br />

Dubai Bank A3 P-2 D 18-Aug-08 Positive UAE<br />

Tamweel PJSC A3* P-2 12-Nov-07 Stable UAE<br />

*Issuer rating<br />

www.newhorizon-<strong>islamic</strong><strong>banking</strong>.com IIBI 19