azerbaijan: emerging market islamic banking and finance

azerbaijan: emerging market islamic banking and finance

azerbaijan: emerging market islamic banking and finance

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NEWHORIZON Shawwal–Dhu Al Hijjah 1429<br />

ACADEMIC ARTICLE<br />

depositors. The relationship between the<br />

investment account holder <strong>and</strong> IFI can be<br />

compared to that of a collective investment<br />

scheme, in which participants (the investment<br />

account holders) have authorised their<br />

fund manager (the IFI) to manage their<br />

investments.<br />

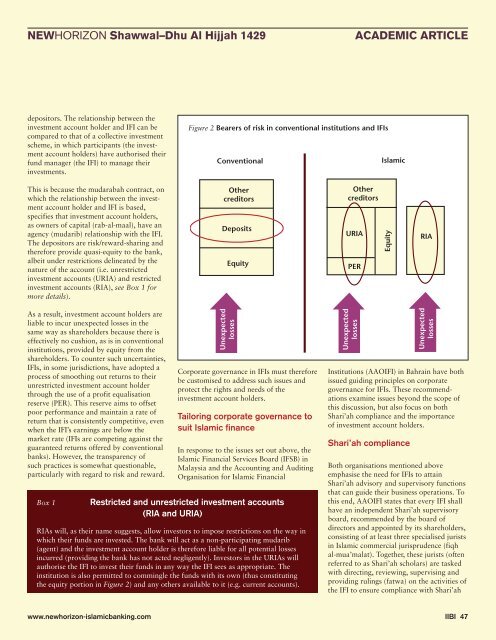

Figure 2 Bearers of risk in conventional institutions <strong>and</strong> IFIs<br />

This is because the mudarabah contract, on<br />

which the relationship between the investment<br />

account holder <strong>and</strong> IFI is based,<br />

specifies that investment account holders,<br />

as owners of capital (rab-al-maal), have an<br />

agency (mudarib) relationship with the IFI.<br />

The depositors are risk/reward-sharing <strong>and</strong><br />

therefore provide quasi-equity to the bank,<br />

albeit under restrictions delineated by the<br />

nature of the account (i.e. unrestricted<br />

investment accounts (URIA) <strong>and</strong> restricted<br />

investment accounts (RIA), see Box 1 for<br />

more details).<br />

As a result, investment account holders are<br />

liable to incur unexpected losses in the<br />

same way as shareholders because there is<br />

effectively no cushion, as is in conventional<br />

institutions, provided by equity from the<br />

shareholders. To counter such uncertainties,<br />

IFIs, in some jurisdictions, have adopted a<br />

process of smoothing out returns to their<br />

unrestricted investment account holder<br />

through the use of a profit equalisation<br />

reserve (PER). This reserve aims to offset<br />

poor performance <strong>and</strong> maintain a rate of<br />

return that is consistently competitive, even<br />

when the IFI’s earnings are below the<br />

<strong>market</strong> rate (IFIs are competing against the<br />

guaranteed returns offered by conventional<br />

banks). However, the transparency of<br />

such practices is somewhat questionable,<br />

particularly with regard to risk <strong>and</strong> reward.<br />

Box 1<br />

Corporate governance in IFIs must therefore<br />

be customised to address such issues <strong>and</strong><br />

protect the rights <strong>and</strong> needs of the<br />

investment account holders.<br />

Tailoring corporate governance to<br />

suit Islamic <strong>finance</strong><br />

In response to the issues set out above, the<br />

Islamic Financial Services Board (IFSB) in<br />

Malaysia <strong>and</strong> the Accounting <strong>and</strong> Auditing<br />

Organisation for Islamic Financial<br />

Restricted <strong>and</strong> unrestricted investment accounts<br />

(RIA <strong>and</strong> URIA)<br />

RIAs will, as their name suggests, allow investors to impose restrictions on the way in<br />

which their funds are invested. The bank will act as a non-participating mudarib<br />

(agent) <strong>and</strong> the investment account holder is therefore liable for all potential losses<br />

incurred (providing the bank has not acted negligently). Investors in the URIAs will<br />

authorise the IFI to invest their funds in any way the IFI sees as appropriate. The<br />

institution is also permitted to commingle the funds with its own (thus constituting<br />

the equity portion in Figure 2) <strong>and</strong> any others available to it (e.g. current accounts).<br />

Institutions (AAOIFI) in Bahrain have both<br />

issued guiding principles on corporate<br />

governance for IFIs. These recommendations<br />

examine issues beyond the scope of<br />

this discussion, but also focus on both<br />

Shari’ah compliance <strong>and</strong> the importance<br />

of investment account holders.<br />

Shari’ah compliance<br />

Both organisations mentioned above<br />

emphasise the need for IFIs to attain<br />

Shari’ah advisory <strong>and</strong> supervisory functions<br />

that can guide their business operations. To<br />

this end, AAOIFI states that every IFI shall<br />

have an independent Shari’ah supervisory<br />

board, recommended by the board of<br />

directors <strong>and</strong> appointed by its shareholders,<br />

consisting of at least three specialised jurists<br />

in Islamic commercial jurisprudence (fiqh<br />

al-mua’malat). Together, these jurists (often<br />

referred to as Shari’ah scholars) are tasked<br />

with directing, reviewing, supervising <strong>and</strong><br />

providing rulings (fatwa) on the activities of<br />

the IFI to ensure compliance with Shari’ah<br />

www.newhorizon-<strong>islamic</strong><strong>banking</strong>.com IIBI 47