Periodical

STATISTICAL REPORT '11 - Floor Covering Institute

STATISTICAL REPORT '11 - Floor Covering Institute

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Vol. 61 No. 14 A Hearst Business Publication July 23/30, 2012 $75<br />

FLOOR COVERING WEEKLY<br />

FCW’s<br />

Statistical Report<br />

20th Anniversary<br />

STATISTICAL REPORT ’11<br />

Chart 1<br />

Flooring’s slow climb: Continued<br />

sluggishness, volatility<br />

The flooring industry showed mixed but<br />

positive results in 2011. Last year mimicked<br />

the year before in many ways, with business<br />

picking up in the first half,<br />

slowing mid-year and<br />

continuing to struggle as<br />

the year came to a close.<br />

Raw materials prices also<br />

continued to be an issue.<br />

Total sales in 2011<br />

reached $17.89 billion, a 2.5<br />

percent increase over 2010’s<br />

$17.45 billion. Square<br />

foot sales — on the other<br />

hand — dipped a slight 1.5<br />

percent from 17.89 billion<br />

square feet in 2010 to 17.62<br />

billion. Square foot wholesale<br />

prices grew from 98<br />

cents per square foot to $1.02 per square foot.<br />

Last year was another in which the traditional<br />

selling seasons seem to have disappeared.<br />

Consumers continued to look for sales, deals<br />

and specials on the residential side. The builder<br />

market remained almost nonexistent. Fortunately<br />

the commercial market held strong.<br />

According to Catalina Research, Floor<br />

Covering Weekly’s partner in the annual<br />

Statistical Report, hard surface sales showed<br />

an upward trend, as did area rugs and carpet<br />

tiles. Wall-to-wall carpet square foot sales<br />

continued to weaken, according to the report.<br />

On the hard surface side, demand strengthened<br />

for ceramic tile, wood and vinyl sheet and<br />

floor tile. According to Catalina, ceramic tile<br />

dollar sales increased by 6 percent and square<br />

foot sales by 4.5 percent. This was the highest<br />

On the inside<br />

News ................................... 3<br />

2011 Industry Statistics ...... 4<br />

marketWise ......................... 5<br />

Imports/Exports .................. 7<br />

Carpet & Area Rugs ............. 8<br />

Wood ................................. 12<br />

Tile & Stone ...................... 16<br />

Laminate ........................... 19<br />

Resilient ............................ 20<br />

The Last Word .................... 26<br />

rate for any flooring material. Vinyl sheet and<br />

floor tile dollar sales rose by 5.8 percent, while<br />

square foot sales increased by 3.2 percent. For<br />

wood flooring, the gains<br />

were 4.3 percent and 4.1<br />

percent, respectively.<br />

On the soft surface<br />

side, carpet tile continued<br />

to show increases in the<br />

commercial sector, but on<br />

the residential side, wall-towall<br />

carpet sales continue<br />

to suffer. One reason could<br />

be the more dramatic<br />

increases in price per<br />

foot of this material type,<br />

which is based on synthetic<br />

chemicals. Two things<br />

helped the area rug market:<br />

the increase in hard surface sales as well as the<br />

sluggish economy. Consumers find area rugs<br />

an inexpensive way to spruce up their homes.<br />

In 2011, the value of carpet and area rug<br />

sales was $9.51 billion — 53.1 percent of total<br />

floor covering dollar sales, down from 53.8<br />

percent in 2010 and 71.9 percent in 1987.<br />

On a square foot basis, soft surface sales were<br />

10.22 billion square feet in 2011 or 58 percent<br />

of total sales, down from 59.7 percent in 2010<br />

and 71.2 percent in 1987.<br />

The industry’s mix continues to change.<br />

Catalina Research estimates that residential<br />

sales accounted for 64.1 percent of total flooring<br />

dollar sales in 2011, down from 67.9 percent<br />

in 2007. Meanwhile, commercial sales<br />

have become approximately 31.5 percent of<br />

Continued on page 4<br />

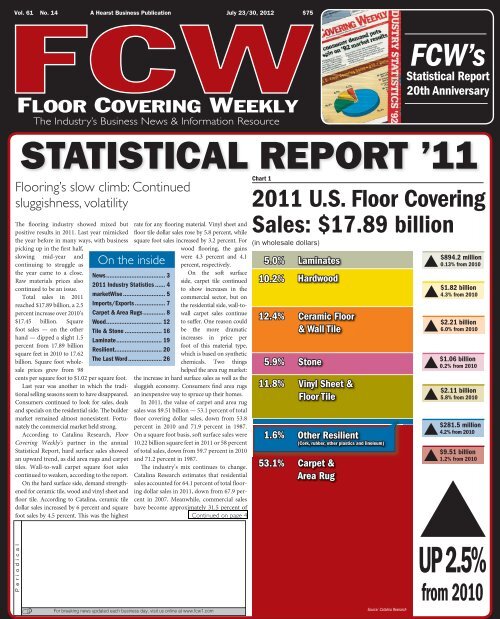

2011 U.S. Floor Covering<br />

Sales: $17.89 billion<br />

(in wholesale dollars)<br />

5.0%<br />

10.2%<br />

12.4%<br />

5.9%<br />

11.8%<br />

1.6%<br />

53.1%<br />

Laminates<br />

Hardwood<br />

Ceramic Floor<br />

& Wall Tile<br />

Stone<br />

Vinyl Sheet &<br />

Floor Tile<br />

Other Resilient<br />

(Cork, rubber, other plastics and linoleum)<br />

Carpet &<br />

Area Rug<br />

$894.2 million<br />

0.13% from 2010<br />

$1.82 billion<br />

4.3% from 2010<br />

$2.21 billion<br />

6.0% from 2010<br />

$1.06 billion<br />

0.2% from 2010<br />

$2.11 billion<br />

5.8% from 2010<br />

$281.5 million<br />

4.2% from 2010<br />

$9.51 billion<br />

1.2% from 2010<br />

<strong>Periodical</strong><br />

For breaking news updated each business day, visit us online at www.fcw1.com<br />

For breaking news updated each business day, visit us online at www.fcw1.com<br />

Source: Catalina Research<br />

UP 2.5%<br />

from 2010

July 23/30, 2012<br />

News<br />

3<br />

Sturrus steps down, Babula takes lead<br />

Clarion Industries names new president, CEO<br />

By Raymond Pina<br />

[Shippenville, Pa.] Tony Sturrus announced<br />

he was stepping down as president and CEO<br />

of Clarion Industries, a vertically integrated<br />

manufacturer of particleboard and laminate<br />

flooring, based here, on July 25. The board of<br />

directors at Clarion Industries appointed Mike<br />

Babula, a fellow investor in Clarion Industries<br />

and former vice president of sales and market-<br />

Flooring America: Focus on referral business<br />

By Raymond Pina<br />

[Orlando, Fla.] Nearly 350 Flooring America/Flooring<br />

Canada members gathered here<br />

July 9th for its annual summer convention. The<br />

group focused on its Fast Phase II program that<br />

combines locally aimed TV and radio spots,<br />

web-based technology and training to increase<br />

its referral business through online testimonials<br />

and old-fashioned word of mouth.<br />

“It’s becoming more difficult to win the<br />

hearts and minds of customers with traditional<br />

advertising,” said Keith Spano, president,<br />

Flooring America. “Word of mouth is track<br />

able and inexpensive. Our Buzz Advertizing<br />

campaign is a new way to stay top of mind<br />

with our customers and getting people to talk<br />

about our products and unique services.”<br />

Supporting the strategy is data from Reuters,<br />

highlighting that 70 percent of customers con-<br />

ing, to succeed Sturrus.<br />

“The company is moving into<br />

another stage of development and<br />

it requires a leadership change,”<br />

said Sturrus. “I approached our<br />

board a year ago with a plan to<br />

create a deeper, more technical<br />

managemen t team internally and<br />

Mike was the best prospect based<br />

on experience and knowledge of<br />

Tony Sturrus<br />

Clarion and its customers. That<br />

plan put us in a place where Mike is<br />

now president and CEO. Our business<br />

has a solid foundation and I’m<br />

confident in Mike. I’m leaving my<br />

invested capital in the company.”<br />

Sturrus said the transition will<br />

allow him to focus on other business<br />

interests and his family.<br />

Sturrus and Babula were<br />

sult online reviews or ratings before making a<br />

purchase while 92 percent of consumers value<br />

word-of-mouth testimonials over advertising.<br />

What’s more, the study revealed 75 percent of<br />

consumers mistrust advertising.<br />

Guest speaker Andy Sernovitz, author of<br />

Word of Mouth Marketing, suggested members<br />

send free emails for friends and family<br />

sales instead of spending thousands of dollars<br />

printing out fliers. He also keyed in on<br />

unique services and products, such as flood<br />

proof vinyl floors, that are easy to remember<br />

and discuss. And, Sernovitz stressed the<br />

importance of searching the Internet for any<br />

comments about their stores — thanking<br />

those who commented favorably and apologizing<br />

and seeking solutions for those with<br />

negative comments.<br />

Dealers who sign up for the $87 per month<br />

Fast Phase II program receive a free iPad featuring<br />

an application to help consumers fill out<br />

testimonials as well as a system that automatically<br />

filters testimonials to members homepage,<br />

Facebook, Twitter and other social sites.<br />

The Build the Buzz campaign is also being<br />

supported by TV and radio ads featuring<br />

family and friends referrals to locally-owned<br />

Flooring America or Flooring<br />

Canada locations.<br />

“Our customers know they<br />

want a new floor but not much<br />

more beyond that,” said Marcia<br />

Hewey, direct of marketing,<br />

Flooring America. “Now we<br />

can leverage the words of her<br />

friends and family who have<br />

already been through the process.<br />

We’ve also added more<br />

diversity to our ads with different<br />

ages and ethnicities.”<br />

among a group of investors that purchased<br />

Clarion Industries from Tarkett for $26 million<br />

in 2009. With Tarkett as its original sole<br />

customer, Clarion Industries now supplies<br />

OEM laminate flooring to a number of the<br />

industry’s leading suppliers, distributors and<br />

retailers. Prior to joining Clarion Industries<br />

Babula served as president and CEO of<br />

Franke, a leading international supplier of<br />

kitchen systems.<br />

“I’m going to keep to our strategy of providing<br />

a domestic platform that executes extremely<br />

well and build upon it going forward,” said<br />

Babula. “It’s important that we have this transition<br />

and we expect it to be seamless for our<br />

customers, employees and shareholders.” FCW<br />

Members who are already deeply involved<br />

in their local communities are uniquely<br />

positioned to leverage this modern referral<br />

system, said Sue Barlett, owner of Charlevoix,<br />

Mich.-based Barlett’s Home Interiors. Barlett,<br />

a longtime Flooring America member, sponsors<br />

her local sport teams and donates to the<br />

library and battered women’s organization.<br />

“We already do a lot of referral business but<br />

this program will step it up,” she said. FCW<br />

Flooring America’s summer convention<br />

Carpet One: New wool carpet, click LVT<br />

[Orlando, Fla.] More than 500 Carpet<br />

One Floor & Home members attended the<br />

group’s Team of Champions summer convention,<br />

held here July 11-13, which focused<br />

primarily on new product.<br />

Eric Demaree, Carpet One president, told<br />

dealers that they need to get noticed, get into<br />

the consumer’s consciousness. “The best way<br />

to do that is to drive our combined product<br />

knowledge, selection and service locally,” he<br />

said. “Ultimately, it’s in each individual store<br />

where the battle is won.”<br />

The focus of this year’s convention was on<br />

new product, including Just Shorn, a high-end<br />

collection of New Zealand wool carpeting, and<br />

mechanically locking luxury vinyl tile (LVT).<br />

“Those who seek this type of luxury product<br />

will only increase as consumer confidence<br />

improves,” said Paul Johnson, a Carpet One<br />

owner in Tulsa, Okla. “The Just Shorn collection<br />

has a great green story and it’s beautiful.”<br />

Mike Mostad, general manager of Missoula,<br />

Mont.-based Loren’s Carpet One, said<br />

he was going to pick up the Just Shorn line<br />

at convention. “We have a new upper-end<br />

furniture store in our new building and their<br />

clientele will go towards this new line,” he said.<br />

Mostad said the biggest potential lies with<br />

the group’s recent advent of click LVT. “We’re<br />

pushing big into LVT,” he said. “Nationwide,<br />

that category is coming on like laminate did 20<br />

years ago. And to be competitive, you need a<br />

click LVT at glue down price points.”<br />

Also introduced were coordinated commercial<br />

carpet and carpet tiles to complement the<br />

existing hard surface Core Elements program.<br />

“These products are specifically designed<br />

to target Main Street commercial,” said<br />

Demaree. “We have come to this convention<br />

with products and programs that continue to<br />

help our members differentiate themselves.”<br />

Carpet One also reported that efforts to<br />

attract customers by pairing the strength of its<br />

buying power and product knowledge with<br />

digital and social media has driven 65,000<br />

leads from its website to local stores. FCW<br />

Kitchen of the Year features Shaw’s Epic<br />

[New York] Shaw’s Epic hardwood was<br />

the featured flooring in House Beautiful’s 5th<br />

annual Kitchen of the Year in Rockefeller Plaza.<br />

Poised to be the “new American living<br />

room,” this year’s kitchen was repositioned to<br />

generate more space and reconfigured to look<br />

and feel like a real home, according to Newell<br />

Turner, editor and chief of House Beautiful.<br />

Designed by Mick De Giulio, the con-<br />

struction of the kitchen began in early 2012.<br />

De Giulio said the inspiration behind the<br />

development was his own kitchen.<br />

“It’s all about kitchen centric living, all<br />

living can be done in this space,” said De<br />

Giulio. “I wanted to create a space that I would<br />

want to eat in. This is it, this is my style.”<br />

Shaw’s Epic in gold rush walnut was used in<br />

the kitchen and in the butler’s pantry. Made of<br />

recycled bi-product, Epic utilizes 50 percent less<br />

of the tree, and its handscraped and distressed<br />

look offers a time worn visual. It is also Cradle<br />

to Cradle certified. De Giulio stated that he will<br />

be using Shaw’s floors again and worked with<br />

the company to create his own chevron detailed<br />

pattern in the butler’s pantry.<br />

“People don’t want to compromise on<br />

style but they also want sustainability. I chose<br />

Shaw’s Epic because I wanted something stylish<br />

but organic,” said De Giulio.<br />

Continued on page 23<br />

Shaw’s Epic is the featured flooring<br />

for this year’s Kitchen of the Year.

4<br />

Table 1<br />

U.S. floor covering market sales value<br />

(in millions of dollars)<br />

Product sector 2007 2008 2009 2010 2011 % change<br />

Carpet & area rugs $13,210(R) $11,870(R) $9,287(R) $9,393(R) $9,505 1.2%<br />

Hardwood flooring $2,184(R) $2,102(R) $1,506(R) $1,749(R) $1,824 4.3%<br />

Ceramic floor & wall tile $2,826(R) $2,513(R) $1,909(R) $2,084(R) $2,210 6.0%<br />

Laminate flooring $1,276 $1,047 $901.0(R) $893.0(R) $894.2 0.13%<br />

Vinyl sheet & floor tile $1,926(R) $2,105(R) $1,818(R) $2,000(R) $2,115 5.8%<br />

Other resilient flooring* $282.5(R) $279.8(R) $263.5(R) $270.1(R) $281.5 4.2%<br />

Stone flooring $1,689 $1,408 $1,079 $1,062 $1,064 0.2%<br />

Table 2<br />

U.S. floor covering market sales volume<br />

R=Revised Source: Catalina Research<br />

*Other resilient includes cork, rubber, other plastics and linoleum.<br />

(in millions of square feet)<br />

Product sector 2007 2008 2009 2010 2011 % change<br />

Carpet & area rugs 14,867 12,814 10,601 10,686(R) 10,221 -4.4%<br />

Hardwood flooring 989.0 944.5 803.4 882.8(R) 919.0 4.1%<br />

Ceramic floor & wall tile 2,664 2,258 1,848 1,992 2,078 4.3%<br />

Laminate flooring 1,160 1,039 912.0 957.7 949.8 -0.8%<br />

Vinyl sheet & floor tile 3,272 3,254 2,784 2,860 2,951 3.2%<br />

Other resilient flooring* 352.9(R) 330.8(R) 280.1(R) 250.2(R) 244.0 -2.5%<br />

Stone flooring 436.4 351.6 270.8 260.0 261.5 0.6%<br />

R=Revised Source: Catalina Research<br />

*Other resilient includes cork, rubber, other plastics and linoleum.<br />

Chart 2<br />

2011 U.S. floor covering<br />

sales by volume<br />

Total: 17.63 billion square feet<br />

1.5% 1.4%<br />

16.7%<br />

5.2%<br />

5.4%<br />

11.8%<br />

Carpet &<br />

area rugs<br />

10.22 billion<br />

Ceramic floor &<br />

wall tile<br />

2.08 billion<br />

Vinyl sheet &<br />

floor tile<br />

2.95 billion<br />

July 23/30, 2012<br />

58%<br />

Laminate flooring<br />

949.8 million<br />

Hardwood flooring<br />

919.0 million<br />

Stone flooring<br />

261.5 million<br />

Other resilient*<br />

244.0 million<br />

R= Revised Source: Catalina Research<br />

*Other resilient flooring includes cork,<br />

rubber, other plastics and linoleum.<br />

Slow climb<br />

Continued from page 1<br />

the industry’s total, up from 27.6 percent in<br />

2007. The transportation market remains at<br />

about 4.4 percent of total industry sales.<br />

Just like 2010, commercial sales led dollar<br />

growth in 2011. Corporate, retail and healthcare<br />

are the strongest commercial markets.<br />

Education and government struggled with the<br />

down economy and lower tax bases. Hospitality<br />

is still pulling out of the recession, though<br />

activity there is picking up. Commercial sales<br />

were estimated to be $5.6 billion, rising 4.7 percent;<br />

while sales to transportation equipment<br />

manufacturers were $785 million, a 3.1 percent<br />

increase over the previous year.<br />

Throughout the recession, the residential<br />

market has been the most affected. In 2011,<br />

things improved slightly, but the industry has<br />

a long way to go. In 2011, total residential sales<br />

are estimated to be $11.5 billion (in manufacturers’<br />

dollars), a 1.5 percent increase over the<br />

previous year, according to Catalina Research.<br />

The residential construction market remains<br />

a challenge for the flooring industry, though it<br />

appears to be picking up in 2012. Existing home<br />

sales have been increasing since late summer<br />

2011 and builder starts have been increasing<br />

at double-digit rates during 2012. However, in<br />

2011, home sales remained sluggish and new<br />

home starts were severely depressed.<br />

On the remodel side of the market, which<br />

makes up roughly half of the industry’s sales,<br />

flooring sales continued to struggle. Consumers<br />

in 2011 replaced or repaired essential items.<br />

Flooring is an easy item in the home to postpone<br />

and one of the most expensive. With the<br />

continued decline in home values, consumers<br />

were reluctant to make big expenditures.<br />

Square foot sales increased year over year,<br />

with the average value per square foot going<br />

up 4.1 percent over the previous year. That’s<br />

the sharpest gain since 2006, according to<br />

Catalina. As the overall economy enjoyed<br />

some recovery in 2011, manufacturers<br />

passed along rising raw material, energy and<br />

transportation costs. Carpet and rug prices<br />

increased an average of 5.7 percent, one of<br />

the highest. Hard surface flooring average<br />

selling prices rose by only 0.9 percent in 2011.<br />

According to Catalina, price competitiveness<br />

Methodology<br />

Floor Covering Weekly collaborated with Catalina<br />

Research for this 20th annual statistical<br />

analysis of the U.S. floor covering market. Area<br />

rug numbers come from FCW research.<br />

All figures that have been revised from<br />

previously published numbers are indicated<br />

with (R). All 2011 numbers are estimates at<br />

this time and are subject to revision. The total<br />

Graph 1<br />

Looking back: 20 years of floor covering sales value<br />

(in billions)<br />

$26.0<br />

$24.0<br />

$22.0<br />

$20.0<br />

$18.0<br />

$16.0<br />

$14.0<br />

$12.0<br />

U.S. floor covering sales number posted for<br />

2010 in last year’s issue has been rev ised<br />

from $17.13 billion to $17.45 billion.<br />

Note that in this year’s edition, resilient is<br />

broken down into vinyl sheet and floor tile<br />

and other resilient which includes cork, other<br />

plastics, rubber and linoleum.<br />

U.S. market sales are in manufacturers’<br />

dollars and exclude installation costs. All retail<br />

information is courtesy of Jonathan Trivers’<br />

exclusive marketWise.<br />

improved for ceramic tile and wood flooring.<br />

2012 is shaping up to be an improvement.<br />

Existing home sales increased 7.2 percent in<br />

the first quarter. Industry experts estimate<br />

that will stimulate industry sales since a quarter<br />

of movers will replace a floor in the first<br />

year. Housing starts also increased 19.4 percent<br />

in the same time period. Commercial<br />

sales should also continue to be strong as the<br />

economy slowly improves. FCW<br />

R=Revised Source: Catalina Research<br />

Note: Stone flooring was added as its own category and is reflected in sales<br />

figures starting in 1997. Rubber flooring was removed as its own category<br />

and is reflected in “other resilient flooring” sales figures starting in 2011.<br />

’92 ’93 ’94 ’95 ’96 ’97 ’98 ’99 ’00 ’01 ’02 ’03 ’04 ’05 ’06 ’07 ’08 ’09 ’10 ’11<br />

$12.42(R) $13.30 $14.20 $14.60 $15.20 $15.95(R) $17.40 $18.80 $19.90 $20.20 $20.65(R) $22.12(R) $24.33(R) $25.62(R) $25.89(R) $23.39(R) $21.39(R) $16.76(R) $17.45(R) $17.89

July 23/30, 2012 marketWise 5<br />

Sales velocity: So little and so slow<br />

By Jonathan Trivers<br />

If you were a runner and had to run on a road<br />

that increased in elevation so you could get<br />

real aerobic exercise, the upward slant of the<br />

road needs to get you panting and wishing for<br />

the end of the hill. If our industry’s 2011 sales<br />

(including labor) increase (3.0 percent) were<br />

the upward slant, you would not be winded<br />

and you sure would not have done much to<br />

burn calories. Forget aerobic exercise.<br />

So it is with our industry. Yes, it wasn’t<br />

down but no it wasn’t up much.<br />

As always, what happens to housing happens<br />

to the floor covering industry.<br />

New home sales for single families continue<br />

to amaze — in a bad way. New home sales<br />

have declined for six years in a row. In 2005,<br />

new home sales were 1,283,000. For 2011, new<br />

home sales were 302,000, almost one million<br />

fewer new home sales than in 2005!<br />

In 2011, new home sales dropped 10<br />

percent from pitiful sales in 2010. An average<br />

of 6,000 new homes was sold per state.<br />

That might be fine for South Dakota, but that<br />

barely shows up as an economic impact for<br />

California, Florida, New York, etc. (If the<br />

builder business increases by 13 percent a<br />

year for nine years, it will be close to the good<br />

years. It might well take that long.)<br />

Existing home sales are off 25 percent<br />

from the best year ever but they are nonetheless<br />

still pretty robust. The problem for<br />

Table 3<br />

2011 floor covering industry sales<br />

(in billions) $48.1B<br />

Product Labor Total<br />

$ Sell GP % $ Sell GP % $ Sales GP %<br />

Carpet $12.5 30.4% $3.1 17.5% $15.6 28.2%<br />

Vinyl $3.9 33.0% $1.8 26.0% $5.7 31.5%<br />

Ceramic tile $4.6 32.0% $6.3 26.0% $10.9 28.6%<br />

Stone/marble $1.1 36.0% $1.6 25.0% $2.7 29.6%<br />

Wood $3.5 28.6% $2.1 22.0% $5.6 26.9%<br />

Laminate $1.7 26.0% $1.0 20.0% $2.7 22.2%<br />

Carpet cushion $.0 9 26.0% N/A N/A $.09 26.0%<br />

Installation<br />

materials<br />

$1.0 26.0% N/A N/A $1.0 26.0%<br />

Total installed<br />

products<br />

$29.2 30.6% $15.9 23.9% $45.1 28.2%<br />

Area rugs $3.0 33.0% N/A N/A $3.0 33.0%<br />

Total floor covering $32.2 30.9% $15.9 23.9% $48.1 28.5%<br />

homeowners is that the average price of those<br />

houses sold is 30 percent less than what it<br />

was six years ago. If you are underwater you<br />

certainly won’t make investments in flooring;<br />

if you are wanting to upgrade your floors<br />

but know that the house has lost 30 percent<br />

Source: marketWise<br />

in value, you will become a much harder sell<br />

— it becomes, “should we really do this” as<br />

opposed to “which one is best for us.”<br />

Even with those headwinds, pent up<br />

demand for new flooring in existing homes<br />

continues to drive business for the residential<br />

replacement sector. Pent up demand is far<br />

greater than the negatives and will continue<br />

to push this sector with sales increases for<br />

years to come.<br />

Commercial, blessed commercial, has<br />

done better than the other sectors. That is<br />

true for large class buildings, refurbishment<br />

of existing commercial properties and Main<br />

Street commercial.<br />

The real news for 2011 is the accelerated rate<br />

of the “market splintering” at retail. Small niche<br />

markets are growing faster than traditional full<br />

service flooring stores and one niche segment<br />

has underperformed. Narrowcasting is in full<br />

bloom — specialty hard surface stores are<br />

popping up all over. The highest profile chains<br />

are Lumber Liquidators and Floor Décor and<br />

More, but there are independent hard surface<br />

stores in many towns by another name. Shop<br />

at home continues to grow as a part of full<br />

service flooring store’s marketing effort and<br />

Empire showed new vigor after consolidating<br />

and cutting back on underperforming markets.<br />

(Empire bought Luna, a direct competitor in<br />

Chicago at the beginning of 2012.)<br />

Key chapters of 2011 marketWise are:<br />

The four legged stool collapses<br />

New home’s size stabilize<br />

Narrowcasting<br />

Selling to the trade — a faltering business<br />

model?<br />

When ceramic looks like wood<br />

The vinyl revolution<br />

Baby boomers buy better and more expensive<br />

goods again FCW<br />

What we sell<br />

Our very own Ray Pina, senior editor, FCW,<br />

has been writing about the vinyl revolution;<br />

most were disbelieving. Myself included.<br />

Believe it. The vinyl industry bemoaned the<br />

fact that their product was called vinyl. Consumers<br />

thought of the vinyl in grandma’s house<br />

and didn’t even want to look at the product.<br />

The product got so much better in quality and<br />

looks but the name hurt the category.<br />

Along comes glass-backed vinyl, luxury<br />

vinyl tile and VCT all gussied up and we have<br />

a revolution. Used to be that luxury vinyl<br />

tile was sold by two companies — Amtico<br />

and NAFCO. It was a specialty product for<br />

commercial sector and they sold 10 yards<br />

into residential replacement. That might<br />

be high. VCT was purely commercial and<br />

glass-backed was some idea first advanced in<br />

Europe. So what?<br />

These three types of vinyl products are red,<br />

red hot residential replacement products. If<br />

retailers do not have large displays for these<br />

products, they are missing the revolution. I<br />

don’t mean a nice little display next to the<br />

gigantic sheet vinyl rack; I mean a large display<br />

of these products next to a small rack of<br />

sheet vinyl. Many joined the revolution but<br />

it’s not too late in 2012.<br />

The new vinyl is helping this category to<br />

regain lost market share. For 2011, vinyl had<br />

the second highest increase of any product<br />

category plus 5.7 percent (product plus labor).<br />

(See Table 4.)<br />

When ceramic tile looks like wood<br />

Carmen Chilelli, the very creative product<br />

Continued on page 7<br />

Table 4<br />

2011 product sales growth<br />

(sales in billions; product + labor)<br />

2006 2007 2008 2009 2010 2011<br />

% increase<br />

over last year<br />

Carpet $21.8 $20.1 $18.3 $15.0 $15.3 $15.6 +2.0%<br />

Vinyl $5.5 $5.5 $5.5 $5.0 $5.4 $5.7 +5.7%<br />

Ceramic tile $15.9 $13.5 $11.4 $9.5 $10.3 $10.9 +6.0%<br />

Stone/marble $3.5 $4.2 $3.4 $2.7 $2.7 $2.7 Even<br />

Wood $7.7 $6.7 $5.8 $5.0 $5.4 $5.6 +4.3%<br />

Laminate $4.5 $4.0 $3.4 $2.8 $2.7 $2.7 Even<br />

Table 5<br />

2011 market share installed products<br />

2006 2007 2008 2009 2010 2011<br />

Carpet 37.6% 37.9% 38.8% 38.2% 37.1% 36.6%<br />

Vinyl 9.0% 9.9% 11.2% 12.1% 12.6% 12.9%<br />

Ceramic tile 27.4% 25.5% 24.3% 24.0% 24.9% 25.5%<br />

Stone/marble 5.8% 7.5% 7.0% 6.7% 6.4% 6.2%<br />

Installation<br />

supplies<br />

$3.1 $2.8 $2.4 $2.0 $1.9 $1.9 Even<br />

Wood 12.6% 12.0% 11.7% 12.1% 12.6% 12.6%<br />

Rugs $5.0 $4.6 $4.0 $3.0 $3.0 $3.0 Even<br />

Total $67.0 $61.4 $54.2 $45.0 $46.7 $48.1 +3.0%<br />

Source: marketWise<br />

Laminate 7.6% 7.2% 7.0% 6.9% 6.4% 6.2%<br />

Note: These market share numbers were computed from the sales of product, labor and the installation materials used for that product category.<br />

Source: marketWise

6<br />

marketWise<br />

July 23/30, 2012<br />

Who sells it<br />

There is some very good news hidden under<br />

the massive amount of bad news about single<br />

family new home construction. The number<br />

of new homes sold has declined to an abysmal<br />

low 302,000. At the same time, the average<br />

size of the new home was dropping from<br />

a high in 2006 of 2,561 square feet to right<br />

around 2,300 square feet in 2010. Talk about<br />

adding insult to injury — new home units<br />

drop 72 percent from the best year (2005)<br />

and then the average amount of square feet<br />

drops another 10 percent! That’s what flooring<br />

contractors were looking at in dismay.<br />

However, in 2011, the average size of new<br />

single family homes went up almost 100<br />

square feet to 2,480. We see the size settling at<br />

the range of the best year (2006); gone will be<br />

the over-sized and useless foyer; there will be a<br />

home office space that is not a bedroom, spacious<br />

kitchens and some creative builders will<br />

give up on the never-used living room and add<br />

a play room along with a family room.<br />

So when 2012 new home construction is<br />

reported, the actual increase in number of<br />

homes built over 2011 will not have to have<br />

an asterisk noting that the home is smaller<br />

therefore there is no gain in flooring needs.<br />

The interest rates for mortgages were<br />

at an all-time low and that will help the<br />

sales of new homes and it allows the buyer<br />

to make a modest monthly payment for a<br />

good sized homes.<br />

The four legged stool collapses<br />

For a very long time our industry has been<br />

easily broken down into four equal parts:<br />

Builder 25 percent<br />

Commercial 25 percent<br />

Residential replacement (new owner older<br />

home) 25 percent<br />

Residential replacement (existing owner<br />

improving home) 25 percent<br />

Table 6<br />

Who sells to the three end-user markets<br />

(in billions)<br />

These numbers always fluctuated as one<br />

segment got stronger but a rolling average<br />

pretty much had these segments equal. But<br />

with the collapse of the builder business,<br />

there are really only three legs to the stool and<br />

(this is a very big and) because Americans<br />

are moving far less than in the last 40 years,<br />

the flooring sales generated by a household<br />

moving into an existing home has declined<br />

dramatically. (About 17 percent of households<br />

moved every year; now that number is<br />

right around 11 percent.)<br />

This is how we think the sales by end user<br />

market looks for 2011:<br />

Commercial: 31 percent<br />

Builder: 11 percent<br />

Residential replacement (new owner older<br />

home): 18 percent<br />

Residential replacement (existing owner<br />

improving home): 40 percent<br />

The most important areas for flooring<br />

retailers are commercial and residential<br />

replacement of existing homes (owner<br />

improvement). Sales for these two sectors<br />

will come largely from word of mouth and a<br />

compelling website.<br />

The builder business should improve<br />

about plus 13 percent each year for the next<br />

nine years or so (that’s how long it will take<br />

to get back to “normal” new home construction.)<br />

These numbers (end-user balance of<br />

sale) will slowly go back to how they were<br />

and we will have four equal components;<br />

however, for some years, the key components<br />

for sales will come from commercial<br />

and sales to customers in your town who are<br />

now willing to improve their flooring.<br />

Selling to the trade — a faltering business<br />

model?<br />

Many industries that serve the home<br />

improvement sector have distributors who<br />

sell to the trade. Their distribution facilities<br />

have a showroom and contractors can<br />

bring in their customers and decide on<br />

Residential<br />

Replacement<br />

Builder Commercial Total<br />

Floor covering stores $13.4 $1.7 $7.7 $22.8<br />

Home improvement $7.5 $0.4 $0.4 $8.3<br />

Hard surface stores; $4.3 $0.4 $0.4 $5.1<br />

Internet, non-store $0.9 N/A N/A $0.9<br />

Furniture, department,<br />

discounters,home<br />

furnishing stores<br />

$1.9 N/A N/A $1.9<br />

Contractors N/A $2.6 $6.5 $9.1<br />

Total $28.0 $5.1 $15.0 $48.1<br />

% to total 58.1% 10.7% 31.2% N/A<br />

Source: marketWise<br />

Table 7<br />

Who sells it: Who the customer pays<br />

(in billions)<br />

2006<br />

(%)<br />

2007*<br />

(%)<br />

2008<br />

(%)<br />

2009<br />

(%)<br />

2010<br />

(%)<br />

2011<br />

(%)<br />

2011<br />

($)<br />

Floor covering stores 57.8 53.8 54.2 53.6 49.7 46.4 $22.8<br />

Home improvement 16.1 14.3 14.4 16.0 16.7 17.3 $8.3*<br />

- Home Depot 8.7 7.1 7.5 8.8 9.9 8.7 $4.2<br />

- Lowe’s<br />

4.8 5.2 5.5 7.2 7.5 7.0 $3.4<br />

Hard surface stores 2.6 6.2 6.5 6.9** 10.1 10.6 $5.1<br />

Internet, non-store N/A N/A N/A N/A 2.1 1.9 $0.9<br />

Furniture, department,<br />

discount, home 0.5 5.5 5.0 4.4 4.3 3.9 $1.9<br />

furnishing stores<br />

Contractor 23.0 20.2 19.9 19.0 17.1 19.9 $9.1<br />

*This number reflects better valuation of Menards and other regional home improvement retailers’ selling flooring.<br />

**Up to 2009, this number was hard surface stores and Internet and non-store. For 2010 and 2011, we have broken out Internet and non-store as a<br />

separate category.<br />

Source: marketWise<br />

what she wants. The contractor buys the<br />

merchandise from the distributor. It’s not<br />

surprising ceramic tile distributors had and<br />

have beautiful showrooms for the “trade.”<br />

Lumber yards have always marketed to the<br />

trade and Home Depot and Lowe’s are very<br />

aggressive marketing to the trade. If the<br />

percentage of pro sales (their phrase for the<br />

trade) that Home Depot and Lowe’s generate<br />

for the entire store is applied to their<br />

flooring sales, they well could be selling $1<br />

billion in flooring to the “trade.” In that<br />

way, they are competing with distributors<br />

not retailers.<br />

Contract Furnishings Mart (CFM) sells<br />

only to the trade. They have been in Portland,<br />

Ore. for 30 years. But they are not a distributor.<br />

They are a flooring/counter top hybrid<br />

selling to the trade. They have nine “stores”<br />

in the Portland/Seattle corridor.<br />

They promise excellent service and excellent<br />

pricing; CFM is a one price house for customers<br />

whether you are an architect or builder. Service<br />

and product knowledge are an important part<br />

of their brand. They have a design staff; sales<br />

people are paid salary — guarantee no pressure.<br />

If you buy more and CFM gets a price break,<br />

that is passed on to the customer.<br />

Contract Furnishings Mart has thrived in<br />

these very tough times. (The Pacific Northwest<br />

has not been hit as hard as other parts<br />

of the country but new home construction is<br />

down in this area also.)<br />

Pro-Source, a division of CCA Global,<br />

is the largest type (in number of outlets)<br />

of this form of marketing. Unlike Contract<br />

Furnishing Mart, Pro Source was<br />

established as a do-it-yourself marketing<br />

company — the designer was given a key<br />

and could come in any time of day, find a<br />

product and place the order; 2 a.m. if they<br />

wanted. Nice displays, wide assortment of<br />

all flooring products but no sales help. Pro<br />

Source is a franchise and as such pays 3<br />

percent of their gross sales to the franchisor<br />

— CCA Global.<br />

They took a tremendous hit during the<br />

downturn. The Pro Source business model<br />

was bludgeoned.<br />

According to the most recent Franchise<br />

Disclosure Document from 2007 to beginning<br />

of 2011, Pro Source had a 37 percent<br />

sales decrease; they had a 27 percent<br />

decline in number of franchise outlets; and<br />

to protect the brand they owned (at the<br />

end of 2010) 19 outlets, of which they were<br />

looking to sell 15 of them to new franchise<br />

owners; the average sale of the existing outlets<br />

went from $3.4 million to $2.7 million<br />

per outlet. (Three Pro Source outlets were<br />

closed in Oregon/Washington.)<br />

The Pro Source model is built on high<br />

volume, lower gross margins than conventional<br />

retail stores and commensurate<br />

lower cost of operations — they don’t give<br />

the same kind of personal customer service<br />

as retail stores and their outlets are in business<br />

districts or those areas with much lower<br />

occupancy cost. As long as the sales were<br />

roaring, this was a great business but with the<br />

downturn, its flaws were too apparent.<br />

Over time, it became apparent that there<br />

was a need for sales people. The fact is their<br />

“customers” knew precious little about flooring<br />

and so the self-serve system became a<br />

selling system with sales force ever present.<br />

Did the gross margin increase to pay for these<br />

additional costs?<br />

Pro Source has decided to test kitchen<br />

cabinets to expand their product mix and<br />

attract new “professional” customers. (We<br />

are not sure the allure of kitchen cabinets to<br />

a flooring outlet, but Floor and Décor just<br />

added kitchen cabinets to its assortment.)<br />

Ultimately, a business model built on<br />

high volume and fairly low margin works<br />

only in the best of times. Our industry is<br />

littered with retailers and contract houses

July 23/30, 2012<br />

2011 Import/Export<br />

Table 8<br />

U.S. floor covering imports value<br />

(in millions)<br />

Industry Sector 2007 2008 2009 2010 2011<br />

Carpet & area rugs 1 $2,257.7(R) $2,039.8(R) $1,580.8(R) $1,859.3(R) $2,032.8<br />

Hardwood flooring $313.6(R) $572.8(R) $489.9(R) $632.0(R) $702.3<br />

Ceramic floor & $2,083.6(R) $1,720.7(R) $1,203.4(R) $1,275.8(R) $1,325.2<br />

wall tile<br />

Resilient<br />

Vinyl sheet & floor tile $605.8(R) $687.6(R) $613.8(R) $728.8(R) $764.4<br />

Other resilient 2 $106.1(R) $107.6(R) $95.4(R) $109.6(R) $117.2<br />

Laminates 3 $589.7(R) $453.2(R) $461.9(R) $476.2(R) $419.20<br />

Total imports $5,956.5(R) $5,581.7(R) $4,445.3 (R) $5,081.7(R) $5,361.1<br />

Year-to-year change -4.9%(R) -6.3%(R) -20.4%(R) 14.3% 5.5%<br />

Table 10<br />

U.S. floor covering exports value<br />

(in millions)<br />

Industry Sector 2007 2008 2009 2010 2011<br />

Carpet & area rugs 1 $1,029.9 $1,102.9 $850.5 $999.2 1,066.6<br />

Hardwood flooring $137.8 $142.7 $102.7 $130.7(R) $136.9<br />

Ceramic floor &<br />

wall tile<br />

$52.3 $56.2 $50.3 $50.3 $52.5<br />

Resilient<br />

Vinyl sheet & floor tile $138.0 $160.9 $141.6 $163.8 $176.8<br />

Other resilient 2 $27.6 $43.3 $34.3 $40.9 $40.4<br />

Total exports $1,385.6 $1,506.0 $1,179.4 $1,384.9(R) $1,473.2<br />

Year-to-year change 4.8% 8.7% -21.7% 17.4% 6.4%<br />

Table 9 Table 11<br />

U.S. floor covering imports volume<br />

(in millions of square feet)<br />

Industry Sector 2007 2008 2009 2010 2011<br />

Carpet & area rugs 1 2,060.6 1,824.6 1,654.7 1,960.7 1,956.5<br />

Hardwood flooring 152.2 258.3 282.4 330.9(R) 371.4<br />

Ceramic floor & 2,175.9 1,684.4 1,331.8 1,393.2 1,408.7<br />

wall tile<br />

Resilient<br />

Vinyl sheet & floor tile 1503.7 1,481.8 1,247.4 1,335.2 1,251.8<br />

Other resilient 2 196.7(R) 230.3 227.7 213.5 161.9<br />

Laminates 3 550.0 461.9 486.0(R) 522.7(R) 454.8<br />

Total imports 6,639.1 5,941.3 5,230.0(R) 5,756.2(R) 5,605.1<br />

Year-to-year change -8.3% -10.5% -12.0%(R) 10.1%(R) -2.6%<br />

Import Key<br />

1 Includes imports of roll goods, bath mats, area rugs, auto and aircraft carpeting and artificial grass.<br />

2 Includes imports of flooring made of other plastics, cork, linoleum, rubber and other materials.<br />

3 Estimated by Catalina Research, Inc.<br />

R=Revised<br />

U.S. floor covering exports volume<br />

(in millions of square feet)<br />

Industry Sector 2007 2008 2009 2010 2011<br />

Carpet & area rugs 1 1,050.6 1,091.4 785.3 947.3(R) 1,009.4<br />

Hardwood flooring 62.9 64.5 48.3 56.8(R) 59.1<br />

Ceramic floor & 56.6 61.3 55.6 50.8(R) 53.7<br />

wall tile<br />

Resilient<br />

Vinyl sheet & floor tile 301.2 331.7 310.5 377.6 363.3<br />

Other resilient 2 51.4 91.2 70.9 76.7(R) 74.7<br />

Total exports 1,522.7 1,640.1 1,270.6 1,509.2(R) 1,560.2<br />

Year-to-year change 1.2% 7.7%% -22.5% 18.8%(R) 3.4%<br />

Export Key<br />

1 Includes exports of roll goods, bath mats, area rugs, auto and aircraft carpeting and artificial grass.<br />

2 Includes exports of flooring made of other plastics, linoleum, rubber and other materials.<br />

R=Revised<br />

going gangbusters only to be tripped up by<br />

low margins and sales decreases.<br />

Narrowcasting<br />

Think of the traditional broadcasting networks<br />

in TV — NBC, CBS and ABC. Then<br />

along came cable and satellite and now we<br />

have more cooking channels than broadcast<br />

networks. That’s narrowcasting — a narrow<br />

but more compelling focus. Happened in<br />

magazines, radio and in retail.<br />

Flooring has a small, fairly narrow array<br />

of goods. But narrowcasting has come to our<br />

industry and it is thriving. Lumber Liquidators<br />

(wood and laminate) with 270 stores<br />

and Floor & Décor (ceramic tile, stone, porcelain,<br />

etc.) with 30 stores are the two best<br />

known national multi-store narrowcasters.<br />

The downturn slowed them down but they<br />

are gaining market share in all markets they<br />

serve. In 2011, these two flooring retailers<br />

with very narrow product offerings generated<br />

more than $900 million in sales. (They<br />

both have a very narrow product focus but<br />

otherwise they market differently. Lumber<br />

Liquidators has 1,000 square foot showrooms<br />

with stock in the back; Floor & Décor has<br />

60,000 square foot stores and all inventory is<br />

on the floor.)<br />

The customer’s logic goes like this: The<br />

fewer product types a store carries the better<br />

they know these products as opposed to<br />

the general retailer (Home Depot) or even<br />

the specialty retailer (full-service flooring<br />

store). She gives up one stop shopping (she<br />

wants carpet and wood) for the belief that<br />

she will get the most knowledgeable person<br />

and the best value.<br />

Both of these narrowcasters started out<br />

as product-only retailers. Customers have<br />

pushed them into offering installation.<br />

Both now offer installation done by a third<br />

party (Home Service Store). The pressure<br />

for them to expand their assortment to<br />

carpet will be great. Remember Color Tile?<br />

We suspect that won’t happen very soon<br />

but for some reason Floor and Décor is<br />

now offering kitchen cabinets to its flooring<br />

assortment.<br />

— Jonathan Trivers<br />

What we sell<br />

Continued from page 5<br />

development manager at Canada’s Shnier<br />

(second largest flooring distributor in North<br />

America) was talking about the crosstransfer<br />

(my words, not his) of design from<br />

one substrate to the next. Laminate looks so<br />

much like wood that wood manufacturers<br />

buy laminate samples so their wood can be<br />

more wood like; ceramic tile now has really<br />

cool looking wood plank looks; luxury vinyl<br />

tile looks like ceramic, even with faux grout;<br />

ceramic tile looks like stone; and vinyl looks<br />

like all the above. And with new and different<br />

printing technologies, the crossovers will<br />

continue and expand.<br />

Chilelli is convinced that this is great<br />

news for the flooring retailer. Superior<br />

knowledge of what product is perfect for<br />

what place in the home will become very,<br />

very important. And, with setting materials<br />

products that now have a moisture barrier,<br />

products never before installed in basements<br />

can now be installed without fear of<br />

basements and or slabs.<br />

Never before has training and product<br />

knowledge been so valuable. Now she has<br />

three different product types all with the same<br />

visuals and she doesn’t want to make the<br />

wrong decision. The best trained sales person<br />

wins. Every time. Now more than ever.<br />

Baby boomers buy better and more expensive<br />

goods again.<br />

They are back. And now that they are retiring<br />

they want to buy something really cool<br />

and creative. Just ask Pinterest.com.<br />

She has been frugal long enough. For her,<br />

it’s now or never.<br />

Flooring retailers had best reduce all those<br />

value products and start adding better and<br />

better and better goods to all product categories.<br />

All.<br />

This is true for all retail categories —<br />

clothes to washing machines to roofing<br />

materials to flooring.<br />

Enough said.<br />

— Jonathan Trivers

8<br />

Carpet & Area Rugs<br />

July 23/30, 2012<br />

Uneven recovery haunts carpet industry<br />

By Janet Herlihy<br />

The carpet industry continued to take one<br />

step forward, half a step back in 2011, but<br />

managed to eke out a slight increase in manufacturers’<br />

sales in the U.S. — sales for 2011<br />

(shipments minus exports plus imports) are<br />

posted at $9.51 billion, compared to $9.39 bil-<br />

Chart 3<br />

Carpet & area rugs market* value and volume<br />

(in billions)<br />

20<br />

15<br />

10<br />

5<br />

0<br />

$13.21(R)<br />

14.87<br />

$11.87(R)<br />

12.81<br />

$9.29(R)<br />

2007 2008 2009 2010 2011<br />

Market sales<br />

lion in 2010, according to Catalina research.<br />

Beset by necessary price increases and a shift<br />

in consumer preference, carpet lost market<br />

share, going from 59.7 percent of all flooring<br />

volume sales in 2010 to 58 percent in 2011.<br />

Residential market<br />

The residential carpet market continues to<br />

10.60<br />

$9.39(R)<br />

Square feet<br />

10.69(R)<br />

$9.51<br />

10.22<br />

*Includes roll goods, carpet tile, bathmats, area rugs, auto and aircraft carpeting and artificial grass.<br />

Source: Catalina Research<br />

R=Revised<br />

struggle. “For the residential carpet business,<br />

the first half was weaker and the second half<br />

was a bit stronger than anticipated,” said Tom<br />

Lape, president of Mohawk’s residential and<br />

commercial businesses. “Overall, the residential<br />

carpet industry had a puny positive increase in<br />

dollars and was down slightly (one and a half to<br />

three percent) in units,” Lape stated.<br />

“The higher end of residential carpet performed<br />

better because the luxury consumer<br />

was ready to remodel and the low end of carpet<br />

was driven by multi-family construction. The<br />

middle was still very tough,” he continued.<br />

According to Ralph Boe, CEO of Beaulieu of<br />

America, “Total demand in residential carpet<br />

stayed fairly weak because of a slow housing<br />

market that is weakened by foreclosures and<br />

short sales, was further depressed as people put<br />

off buying because the price might go lower and<br />

financing is hard to find,” Boe explained.<br />

For carpet manufacturers, slow demand<br />

is further aggravated by continued volatility<br />

of raw materials costs. Boe added, “Lately, we<br />

have seen reduction in cost of the oil, which<br />

has helped for awhile, but it is too hard to<br />

predict the future.”<br />

Randy Merritt, president of Shaw Industries,<br />

agreed, saying, “The residential side of business<br />

in 2011 was still quite a challenge. Consumers<br />

were still sitting on the sidelines. The consumer<br />

pattern was to complete necessary renovation<br />

projects but projects that were considered<br />

improvements to the home were delayed,”<br />

Merritt said, adding, “Unemployment and<br />

consumer confidence continue to be issues.”<br />

The Dixie Group’s high-end Fabrica and<br />

Masland brands performed ahead of the<br />

industry in 2011, contributing to a Dixie<br />

sales increase of 15 percent, according to<br />

the company. “Residentially, the upper end,<br />

design business was much healthier than the<br />

overall retail carpet business,” Kennedy Frierson,<br />

COO of The Dixie Group, said. “Our<br />

wool business continued to grow. In 2010<br />

and 2011, people realized that there was not<br />

going to be a total collapse, so, the upper end<br />

market started coming back.”<br />

Polyester filament increases share<br />

Polyester continued its surge in the residential<br />

carpet industry. “The fiber dynamic<br />

continued to change with filament polyester<br />

growing at the expense of staple yarns of<br />

nylon, polypropylene and polyester,” Boe said.<br />

Merritt added, “Just as we saw in nylon, polyester<br />

staple is giving way to filament replacements.<br />

Without question, the predominant<br />

face fibers in carpet today are nylon filament<br />

“Oh, don’t<br />

worry sweetie ...<br />

momma’s got<br />

TM<br />

EverClean<br />

carpet!”<br />

Visit AccessBeaulieu.com or call 800-227-7211<br />

TM<br />

There’s no need to worry with Beaulieu’s<br />

Bliss EverClean , the solution-dyed<br />

polyester carpet that can be cleaned with a<br />

50% solution of bleach and water.* It also<br />

has Magic Fresh ® so odors are history, too.<br />

Over 115 million U.S. households have<br />

at least one pet. Chances are you have<br />

a potential EverClean customer in your<br />

showroom right now!

July 23/30, 2012 Carpet & Area Rugs 9<br />

Chart 4<br />

Carpet & area rugs imports* value and volume<br />

(in billions)<br />

3.0<br />

2.4<br />

1.8<br />

1.2<br />

0.6<br />

0<br />

$2.26(R)<br />

2.06<br />

$2.04(R)<br />

1.82<br />

$1.58(R)<br />

2007 2008 2009 2010 2011<br />

Market sales Square feet<br />

1.65<br />

$1.86(R)<br />

1.96<br />

$2.03<br />

1.96<br />

*Includes imports of roll goods, bathmats, area rugs, auto and aircraft carpeting and artificial grass.<br />

Source: Catalina Research<br />

R=Revised<br />

and polyester filament. At some point in the<br />

future, these two fibers could near equilibrium.<br />

The result may be 60 percent nylon, 40 percent<br />

polyester or vice versa, but both fibers will play<br />

important roles in the future of carpeting.”<br />

While PET has moved into the residential<br />

market, it doesn’t seem likely to be accepted<br />

in the specified commercial business. “We’ve<br />

built Interface on durable materials for<br />

performance purposes,” stated John Wells,<br />

president and CEO of Interface Americas.<br />

“In our testing, polyester doesn’t fit commercial<br />

applications because it’s more suited to<br />

residential and light traffic applications.”<br />

But according to Frierson, PET dominates<br />

the under $10 per square yard segment and<br />

continues to grow in 2012. “As long as the cost<br />

difference between nylon and PET stays as great<br />

as it is, PET will continue to grow,” he said.<br />

Lape added that Mohawk research shows<br />

that “three out of four RSA’s (retail sales associates)<br />

who sell PET filament carpet would not<br />

put it in their own homes. We need to know<br />

how the consumer sees it (PET filament carpet)<br />

and be sure they know what they are getting, or<br />

it could backlash on the industry.”<br />

Commercial market<br />

Although, Catalina reports that soft surface<br />

flooring declined from 42.8 percent in 2010 to<br />

41.6 percent of total commercial market dollar<br />

sales in 2011, commercial was the saving grace<br />

for many carpet manufacturers.<br />

Merritt of Shaw, said, “Led by strength<br />

in the carpet tile business, the commercial<br />

carpet market remained robust in 2011.<br />

On the commercial side, we saw continued<br />

strength in corporate and healthcare segments,<br />

and retail store and hospitality began<br />

to show signs of recovery that have definitely<br />

carried over into 2012.”<br />

Interface Americas posted record sales in<br />

2011, according to John Wells, president and<br />

CEO of the leading modular manufacturer.<br />

“The corporate and education markets were<br />

especially strong for Interface in 2011,” Wells<br />

noted, adding, “The greatest challenges, for<br />

the past few years, have been anticipating<br />

customer needs in an unpredictable macroeconomic<br />

downturn.”<br />

Lape reported, “Specified was stronger<br />

in the front half and weaker in the second<br />

half. For the year, commercial outperformed<br />

residential, mainly because projects on the<br />

drawing board since 2008, 2009 and 2010<br />

were finally funded. The global market was<br />

reasonably robust, mainly with the export of<br />

2011 key points<br />

The carpet and rug industry gained slightly<br />

in dollars but lost slightly in volume in<br />

2011, compared to 2010. Sales were up<br />

to $9.51 billion compared to $9.39 billion<br />

in 2010, but square feet slid from 2010’s<br />

10.69 billion to 10.22 billion in 2011.<br />

Filament fi ber — primarily nylon and<br />

polyester — continue to replace staple<br />

fi ber yarns used in the carpet and rug<br />

industry. PET fi lament continues to grow<br />

its share of the residential market, but<br />

nylon continues to hold its own in the<br />

commercial industry. The new and improved<br />

PET fi lament has allowed carpet<br />

manufacturers to hit a more popular<br />

price point in residential but some in<br />

the industry fear a backlash if some PET<br />

products are not made well enough to<br />

meet consumer satisfaction.<br />

carpet tile, and that continues in 2012. Carpet<br />

tile is fast approaching 50 percent of the commercial<br />

carpet market.”<br />

Frierson added, “On the commercial side<br />

of Dixie’s business, we saw the corporate<br />

segment break loose a bit. We attributed<br />

that to the federal 100 percent tax deduction<br />

for capital expenditures in 2011 that<br />

accelerated spending.”<br />

Continued on page 10<br />

“The<br />

Carpet<br />

Pet Lovers<br />

Love!”<br />

Call your Beaulieu Territory Manager today!<br />

*If the stain remains after initially cleaning your carpet using the recommended methods, as found in our Bliss Care and Cleaning brochure, a 50% solution of bleach and water may be used to<br />

further clean the carpet without damaging the carpet fibers. See our Bliss Care & Cleaning brochure for complete carpet cleaning and maintenance instructions.

10<br />

Carpet & Area Rugs<br />

July 23/30, 2012<br />

Rugs continue slow recovery<br />

By Janet Herlihy<br />

While far from a banner year, 2011 saw<br />

some recovery in the area rug market. Total<br />

market sales, calculated from a compilation<br />

of estimates, indicates an increase in area<br />

rug manufacturers’ sales for 2011 of about 6<br />

percent to $2.01 billion overall compared to<br />

2010’s $1.90 billion.<br />

Because rugs are manufactured in every<br />

material from silk, wool, cotton, natural<br />

grasses and leather to every synthetic fiber<br />

known and are available in hand made and<br />

machine made constructions, it is a difficult<br />

category to quantify. In addition, most rugs<br />

are imported and tracked in a myriad of<br />

ways. Statistics from the U.S. Department<br />

of Commerce combine carpets and rugs,<br />

Chart 5<br />

Area rugs market value<br />

(sales in billions)<br />

$3.0<br />

$2.5<br />

$2.0<br />

$1.5<br />

$1.0<br />

$0.5<br />

$0.0<br />

$2.25<br />

$2.05<br />

$1.80<br />

$1.90(E)<br />

$2.01(E)<br />

2007 2008 2009 2010 2011<br />

Source: U.S. Customs Bureau and FCW research<br />

E-Estimated<br />

including roll goods, bath mats, area rugs,<br />

auto and aircraft carpeting and artificial grass<br />

all in one statistic. Distribution for rugs is as<br />

diverse as its product lines.<br />

Catalina Research reported that while battling<br />

the same volatile raw materials costs and<br />

weak demand as broadloom, area rugs got a<br />

boost from the trend to hard surface flooring as<br />

consumers often added a rug to their new hard<br />

surface floor. Rugs also benefited by being a low<br />

cost way to refresh the look of a room.<br />

Most of the increase was estimated to<br />

come from sales of imported products, which,<br />

including carpet, were up from $1.86 billion<br />

in 2010 to $2.03 billion in 2011, according to<br />

Catalina. Rugs are estimated to account for<br />

60 to 70 percent of that total.<br />

In many ways, the area rug business is the<br />

opposite of the wall-to-wall carpet business.<br />

Most broadloom sold in the U.S., is made in<br />

the U.S., while most area rugs sold here are<br />

imported. While wool accounts for a low<br />

single digit percent of all U.S. broadloom,<br />

industry sources estimated that more than 90<br />

percent of imported hand knotted and hand<br />

tufted rugs are made of wool.<br />

Challenges<br />

The greatest challenge in 2011 continued<br />

to be price pressure brought about by a combination<br />

of forces, according to Bill Kilbride,<br />

president of Mohawk Home. “First, the U.S.<br />

economy is not fully recovered, so getting the<br />

consumer to spend disposable income on rugs<br />

is an issue,” Kilbride explained. “Those consumers,<br />

who are shopping, are on a quest for<br />

value,” he said. The second issue is the price of<br />

raw materials, whether up or down. “If those<br />

prices increase, it is virtually impossible to reprice<br />

your product, but, if they go down, customers<br />

expect our prices to go down,” he noted.<br />

For importers, conditions in countries<br />

where rugs are made and the cost of shipping<br />

added to the challenge. “Last year was a perfect<br />

storm, where the housing market, as well<br />

as the overall economy, did not show any<br />

signs of relief, while our industry in general<br />

was hit with price increases due to higher cost<br />

of raw materials and labor,” said Alex Peykar,<br />

principal of Nourison.<br />

Aaron Gray, director of marketing for<br />

Oriental Weavers/Sphinx, agreed that the<br />

ever-increasing cost of raw materials is the<br />

greatest challenge as it “obviously eats at our<br />

overall margins.”<br />

Ron Couri, president and CEO of Couristan,<br />

noted, “The greatest challenge was to drive<br />

sales. We introduced 67 new rugs in January,<br />

but the tough part is getting stores to commit.<br />

Our residential area rugs and broadloom businesses<br />

are seeing up ticks, but not as great as our<br />

hospitality business. In our rug business, hand<br />

knotted rugs are the slowest, while outdoor<br />

rugs are growing fastest,” Couri stated.<br />

In terms of channels of distribution, Couri<br />

added, “Department stores, internet retail and<br />

catalogs are performing the best for us. Macy<br />

has reset 180 stores with fresh rugs this year.”<br />

Couristan is looking to broaden distribution<br />

even more, according to Couri. “In rugs,<br />

we are looking at new distribution in home<br />

centers and are considering big boxes too.”<br />

Signs of a better 2012?<br />

Continuing the pattern of the past few years,<br />

the start of 2012 is looking better. Virtually all<br />

2011 key points<br />

Area rugs continued to contend with price<br />

pressure at all levels of the market, but<br />

managed to increase sales by about 6<br />

percent, generated by consumers choosing<br />

a value-priced rug to freshen a room<br />

or accent a new hard surface fl oor.<br />

Competition from imports may be lessening<br />

as labor costs in China and India rise<br />

as well as shipping costs. Currency rates<br />

are also favoring domestic production.<br />

Fashion and innovation are critical as rug<br />

manufacturers win sales with new kinds<br />

of products such as outdoor rugs and explore<br />

new channels of distribution.<br />

the rug suppliers FCW spoke with reported<br />

sales in the first quarter running ahead of the<br />

same period a year ago. Nourison’s first quarter<br />

sales are up 5 percent, according to Peykar<br />

and the company is striving for a double-digit<br />

increase for the year.<br />

In the first quarter, OW was slightly<br />

ahead compared to 2011, as Gray sees more<br />

optimism in the marketplace and expects<br />

that momentum to carry on the rest of the<br />

year. “We are being aggressive in introducing<br />

new products and bringing them to<br />

market,” he added.<br />

Despite escalating raw materials costs<br />

and soft demand, Jeff Brown, division vice<br />

president for Shaw Living, noted a few<br />

bright spots, saying, “New collections and<br />

constructions were well received by customer<br />

base,” and “Comps were better in<br />

the first quarter of 2012 than the previous<br />

year.” Still, Brown cautioned the industry<br />

to “Expect to see slowdown and more<br />

worry about consumer demand,” in the<br />

second half. FCW<br />

Uneven<br />

Continued from page 9<br />

Balancing cost increases, lower demand<br />

During the recession and into an anemic,<br />

uneven recovery, the carpet industry has done<br />

everything possible to serve its customers and<br />

survive. Mills shuttered excess capacity and<br />

cut back labor forces, but all the cost cutting<br />

could not make up for increases in the cost of<br />

raw materials.<br />

“There is no question that over the last five<br />

years, even in this recessionary environment,<br />

manufacturers have experienced a rise in raw<br />

material costs,” Merritt explained. “Certainly<br />

these prices rise and fall over time but the<br />

overall trend has been up. As costs rise, we have<br />

to also consider the first rule of marketing —<br />

supply and demand.”<br />

Even with a highly specialized product,<br />

Interface experienced the same situation.<br />

“We’ve had to pass along cost increases,<br />

where appropriate, to our customers. To<br />

balance raw materials costs, we’re also<br />

constantly driving product innovation and<br />

Chart 6<br />

Carpet & area rugs exports* value and volume<br />

(in billions)<br />

1.5<br />

1.2<br />

0.9<br />

0.6<br />

0.3<br />

0<br />

$1.03<br />

1.05<br />

design.” said Wells.<br />

$1.10<br />

1.09(R)<br />

2007 2008 2009 2010 2011<br />

Market sales<br />

$0.85<br />

2012 and beyond<br />

The carpet industry sees reasons for<br />

optimism in 2012. “Retail sales continue<br />

0.79<br />

$1.00<br />

Square feet<br />

0.95<br />

$1.07<br />

1.01<br />

*Includes exports of roll goods, bathmats, area rugs, auto and aircraft carpeting and artificial grass.<br />

Source: Catalina Research<br />

R=Revised<br />

to be a challenge through every channel,”<br />

Merritt noted. Still, “The new single family<br />

home business has shown some signs of life<br />

and they now believe we will see roughly<br />

369,000 new homes sold in 2012. This<br />

would be nominally a 20 percent increase<br />

over last year, still far from healthy but<br />

better. As we look to the fall, we of course<br />

have the election issues to deal with. Historically,<br />

this has a dampening effect on<br />

the fall business, but once we are past that<br />

event, I look for better things in 2013.”<br />

Lape at Mohawk added, “So far, 2012 has<br />

not been as robust for the residential carpet<br />

market as expected,” he said. “Still there are<br />

positive signs — gas prices were going down,<br />

there is credit available and the builder<br />

market is growing, although nowhere near<br />

the numbers before the recession.”<br />

Boe said that so far in 2012, business<br />

has been start and stop. “We had a surge<br />

in April, May and slowed down again in<br />

June,” he noted.<br />

Dixie is looking to a stronger second half<br />

in 2012. Frierson said, “So far in 2012, residential<br />

started out great in January, then each<br />

month since has been disappointing. We still<br />

have had some growth, but it’s at the upper<br />

end of the business and not as good as it was<br />

in 2011. We think the second half will be<br />

better, but not until after the election.” FCW

July 23/30, 2012 Carpet & Area Rugs 11<br />

Chart 7<br />

Carpet & area rug purchases by end-use market<br />

(Total: $9.51 billion)<br />

21.0%<br />

7.4%<br />

2.2%<br />

3.7%<br />

0.3%<br />

65.4%<br />

Residential replacement<br />

$6.22 billion<br />

Commerical replacement<br />

$2.00 billion<br />

Transportation<br />

$0.70 billion<br />

Commerical new construction<br />

$0.35 billion<br />

Residential contract<br />

$0.21 billion<br />

Manufactured housing<br />

$0.02 billion<br />

Source: Catalina Research<br />

Wells: In trying to balance increased costs<br />

and raising prices, we also place emphasis on<br />

our ReEntry Recycling Process where we’re<br />

taking back more used carpet and recycling<br />

— turning backing into new backing plus<br />

face fi ber into new face fi ber. Using more<br />

recycled materials helps us minimize the<br />

dependency on virgin, petrochemical based,<br />

raw materials for the short and long term.<br />

Frierson: Balancing increased costs with<br />

declining sales is a juggling act. It’s a very hard<br />

issue to solve — much lower volume with<br />

higher raw materials and other costs — and<br />

get back to a normal return.<br />

Merritt: I think there are some segments<br />

where this trend may be continuing, such as<br />

in new construction in apartments, where<br />

more living space is being converted to<br />

laminate or LVT while the bedrooms remain<br />

carpeted. This trend may be occurring in<br />

certain segments of the fl ooring market but<br />

it’s certainly not an overall market trend.<br />

In commercial, carpet continues to hold its<br />

own or grow share. And while we’re seeing<br />

a trend toward smaller homes, people still<br />

want three or four bedrooms and these are<br />

still carpet in the majority of spaces. I just am<br />

not sure carpet is continuing to lose square<br />

foot share.<br />

Perspective<br />

Carpet industry leaders Tom Lape, president<br />

of Mohawk’s residential and commercial<br />

businesses; Randy Merritt, president of Shaw<br />

Industries; Ralph Boe, CEO of Beaulieu of<br />

America; John Wells, president and CEO of<br />

Interface Americas; and Kennedy Frierson,<br />

COO of The Dixie Group, share views on<br />

challenges and strategies.<br />

What can manufacturers do to answer<br />

today’s greatest challenges?<br />

Lape: Carpet manufacturers are faced with the<br />

challenge of how to reverse the trend away<br />

from carpet. Carpet price increases in 2011<br />

are thought to have pushed some consumers<br />

to choose hard surface because, while still less<br />

expensive than most hard surface fl ooring,<br />

the cost difference was less than in the past.<br />

We have got to excite the consumer with<br />

innovation and exceed their expectations.<br />

Boe: The decreased market share of carpet<br />

versus hard surface fl ooring for the past fi ve<br />

years comes down to fashion. Consumers will<br />

have to become passionate about soft surface<br />

fl ooring again. Carpet is clearly preferred for<br />

bedrooms, where consumers want softness<br />

under foot. Carpet is also the value leader.<br />

Chart 8<br />

Carpet & area rugs market<br />

average value per square foot<br />

$1.0<br />

$0.8<br />

$0.6<br />

$0.4<br />

$0.2<br />

$0.0<br />

$.89<br />

$.93(R)<br />

$.88(R)<br />

$.88<br />

$.93<br />

2007 2008 2009 2010 2011<br />

Source: Catalina Research<br />

R-Revised<br />

When<br />

Less<br />

is<br />

More!<br />

Use your QR tag reader<br />

to go directly to our<br />

dealer website and read<br />

more about this topic.<br />

If you are not familiar with a certain product category, a buying choice can<br />

be dificult any option can be painful hin about the laundry detergent<br />

, egular, i-ctie, Free lear, etc If you can not memorie the<br />

pacage at home in your laundry room, youre doomed<br />

How many products do you have in your store?<br />

elling ha to be a guided proce, with your big election more a a bacdrop,<br />

not a a warehoue full of choice nce you narrowed down color and<br />

tyle, dont offer more than choice If the cutomer can not mae a deci-<br />

ion, replace one after the other ont leae the product that were reected<br />

around - eep them out of ight Find more tip on tuftexdealer.com<br />

Tuftex, Shaw Floors premier brand, is a California carpet<br />

manufacturer known for its innovative color, design, quality<br />

and care for the environment.<br />

<br />

<br />