Periodical

STATISTICAL REPORT '11 - Floor Covering Institute

STATISTICAL REPORT '11 - Floor Covering Institute

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

July 23/30, 2012<br />

Laminate<br />

19<br />

Flatline: 2011 highs, lows<br />

By Raymond Pina<br />

The U.S. laminate floor wholesale market<br />

essentially remained flat in 2011, growing<br />

just 0.13 percent in value due to rising prices<br />

while declining 0.82 percent in volume,<br />

according to Catalina Research.<br />

The category’s wholesale value and average<br />

square foot pricing stopped declining, and<br />

domestic products overtook imports for the<br />

first time since 2008. But sales volume was<br />

dominated by the home center channel and<br />

continues to decline due to pressure from<br />

vinyl and engineered wood flooring. What’s<br />

more, this trend is continuing through 2012,<br />

according to Stuart Hirschhorn, director of<br />

research, Catalina Research.<br />

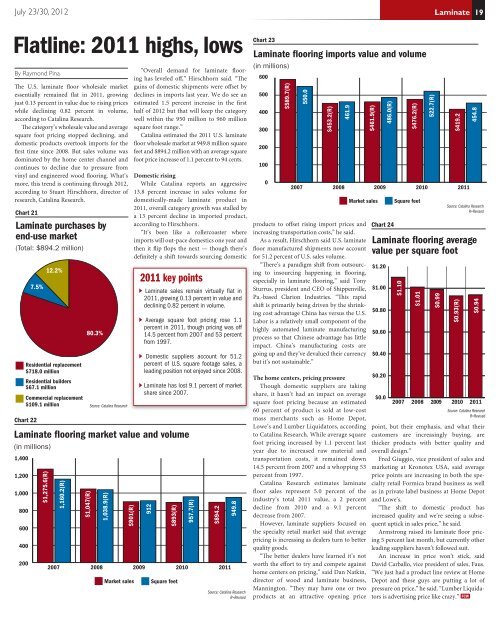

Chart 21<br />

Laminate purchases by<br />

end-use market<br />

(Total: $894.2 million)<br />

Chart 22<br />

Laminate flooring market value and volume<br />

(in millions)<br />

1,400<br />

1,200<br />

1,000<br />

800<br />

600<br />

400<br />

200<br />

7.5%<br />

$1,275.6(R)<br />

12.2%<br />

Residential replacement<br />

$718.0 million<br />

Residential builders<br />

$67.1 million<br />

Commercial replacement<br />

$109.1 million<br />

1,160.2(R)<br />

$1,047(R)<br />

80.3%<br />

Source: Catalina Research<br />

1,038.9(R)<br />

$901(R)<br />

Market sales<br />

“Overall demand for laminate flooring<br />

has leveled off,” Hirschhorn said. “The<br />

gains of domestic shipments were offset by<br />

declines in imports last year. We do see an<br />

estimated 1.5 percent increase in the first<br />

half of 2012 but that will keep the category<br />

well within the 950 million to 960 million<br />

square foot range.”<br />

Catalina estimated the 2011 U.S. laminate<br />

floor wholesale market at 949.8 million square<br />

feet and $894.2 million with an average square<br />

foot price increase of 1.1 percent to 94 cents.<br />

Domestic rising<br />

While Catalina reports an aggressive<br />

13.8 percent increase in sales volume for<br />

domestically-made laminate product in<br />

2011, overall category growth was stalled by<br />

a 13 percent decline in imported product,<br />

according to Hirschhorn.<br />

“It’s been like a rollercoaster where<br />

imports will out-pace domestics one year and<br />

then it flip flops the next — though there’s<br />

definitely a shift towards sourcing domestic<br />

2011 key points<br />

Laminate sales remain virtually flat in<br />

2011, growing 0.13 percent in value and<br />

declining 0.82 percent in volume.<br />

Average square foot pricing rose 1.1<br />

percent in 2011, though pricing was off<br />

14.5 percent from 2007 and 53 percent<br />

from 1997.<br />

Domestic suppliers account for 51.2<br />

percent of U.S. square footage sales, a<br />

leading position not enjoyed since 2008.<br />

Laminate has lost 9.1 percent of market<br />

share since 2007.<br />

912<br />

$893(R)<br />

2007 2008 2009 2010 2011<br />

Square feet<br />

957.7(R)<br />

$894.2<br />

949.8<br />

Source: Catalina Research<br />

R=Revised<br />

Chart 23<br />

Laminate flooring imports value and volume<br />

(in millions)<br />

600<br />

500<br />

400<br />

300<br />

200<br />

100<br />

0<br />

$589.7(R)<br />

550.0<br />

$453.2(R)<br />

461.9<br />

Market sales<br />

products to offset rising import prices and<br />

increasing transportation costs,” he said.<br />

As a result, Hirschhorn said U.S. laminate<br />

floor manufactured shipments now account<br />

for 51.2 percent of U.S. sales volume.<br />

“There’s a paradigm shift from outsourcing<br />

to insourcing happening in flooring,<br />

especially in laminate flooring,” said Tony<br />

Sturrus, president and CEO of Shippenville,<br />

Pa.-based Clarion Industries. “This rapid<br />

shift is primarily being driven by the shrinking<br />

cost advantage China has versus the U.S.<br />

Labor is a relatively small component of the<br />

highly automated laminate manufacturing<br />

process so that Chinese advantage has little<br />

impact. China’s manufacturing costs are<br />

going up and they’ve devalued their currency<br />

but it’s not sustainable.”<br />

The home centers, pricing pressure<br />

Though domestic suppliers are taking<br />

share, it hasn’t had an impact on average<br />

square foot pricing because an estimated<br />

60 percent of product is sold at low-cost<br />

mass merchants such as Home Depot,<br />

Lowe’s and Lumber Liquidators, according<br />

to Catalina Research. While average square<br />

foot pricing increased by 1.1 percent last<br />

year due to increased raw material and<br />

transportation costs, it remained down<br />

14.5 percent from 2007 and a whopping 53<br />

percent from 1997.<br />

Catalina Research estimates laminate<br />

floor sales represent 5.0 percent of the<br />

industry’s total 2011 value, a 2 percent<br />

decline from 2010 and a 9.1 percent<br />

decrease from 2007.<br />

However, laminate suppliers focused on<br />

the specialty retail market said that average<br />

pricing is increasing as dealers turn to better<br />

quality goods.<br />

“The better dealers have learned it’s not<br />

worth the effort to try and compete against<br />

home centers on pricing,” said Dan Natkin,<br />

director of wood and laminate business,<br />

Mannington. “They may have one or two<br />

products at an attractive opening price<br />

$461.9(R)<br />

486.0(R)<br />

$476.2(R)<br />

Square feet<br />

522.7(R)<br />

$419.2<br />

2007 2008 2009 2010 2011<br />

Chart 24<br />

454.8<br />

Source: Catalina Research<br />

R=Revised<br />

Laminate flooring average<br />

value per square foot<br />

$1.20<br />

$1.00<br />

$0.80<br />

$0.60<br />

$0.40<br />

$0.20<br />

$0.0<br />

$1.10<br />

$1.01<br />

$0.99<br />

$0.93(R)<br />

$0.94<br />

2007 2008 2009 2010 2011<br />

Source: Catalina Research<br />

R=Revised<br />

point, but their emphasis, and what their<br />

customers are increasingly buying, are<br />

thicker products with better quality and<br />

overall design.”<br />

Fred Giuggio, vice president of sales and<br />

marketing at Kronotex USA, said average<br />

price points are increasing in both the specialty<br />

retail Formica brand business as well<br />

as in private label business at Home Depot<br />

and Lowe’s.<br />

“The shift to domestic product has<br />

increased quality and we’re seeing a subsequent<br />

uptick in sales price,” he said.<br />

Armstrong raised its laminate floor pricing<br />

5 percent last month, but currently other<br />

leading suppliers haven’t followed suit.<br />

An increase in price wo n’t stick, said<br />

David Carballo, vice president of sales, Faus.<br />

“We just had a product line review at Home<br />

Depot and these guys are putting a lot of<br />

pressure on price,” he said. “Lumber Liquidators<br />

is advertising price like crazy.” FCW