Periodical

STATISTICAL REPORT '11 - Floor Covering Institute

STATISTICAL REPORT '11 - Floor Covering Institute

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

10<br />

Carpet & Area Rugs<br />

July 23/30, 2012<br />

Rugs continue slow recovery<br />

By Janet Herlihy<br />

While far from a banner year, 2011 saw<br />

some recovery in the area rug market. Total<br />

market sales, calculated from a compilation<br />

of estimates, indicates an increase in area<br />

rug manufacturers’ sales for 2011 of about 6<br />

percent to $2.01 billion overall compared to<br />

2010’s $1.90 billion.<br />

Because rugs are manufactured in every<br />

material from silk, wool, cotton, natural<br />

grasses and leather to every synthetic fiber<br />

known and are available in hand made and<br />

machine made constructions, it is a difficult<br />

category to quantify. In addition, most rugs<br />

are imported and tracked in a myriad of<br />

ways. Statistics from the U.S. Department<br />

of Commerce combine carpets and rugs,<br />

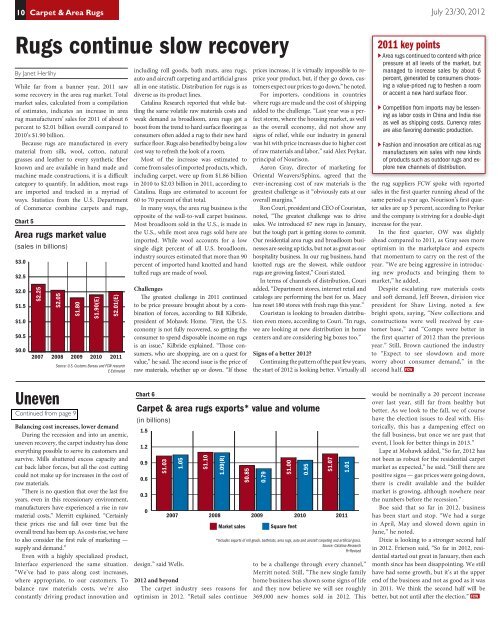

Chart 5<br />

Area rugs market value<br />

(sales in billions)<br />

$3.0<br />

$2.5<br />

$2.0<br />

$1.5<br />

$1.0<br />

$0.5<br />

$0.0<br />

$2.25<br />

$2.05<br />

$1.80<br />

$1.90(E)<br />

$2.01(E)<br />

2007 2008 2009 2010 2011<br />

Source: U.S. Customs Bureau and FCW research<br />

E-Estimated<br />

including roll goods, bath mats, area rugs,<br />

auto and aircraft carpeting and artificial grass<br />

all in one statistic. Distribution for rugs is as<br />

diverse as its product lines.<br />

Catalina Research reported that while battling<br />

the same volatile raw materials costs and<br />

weak demand as broadloom, area rugs got a<br />

boost from the trend to hard surface flooring as<br />

consumers often added a rug to their new hard<br />

surface floor. Rugs also benefited by being a low<br />

cost way to refresh the look of a room.<br />

Most of the increase was estimated to<br />

come from sales of imported products, which,<br />

including carpet, were up from $1.86 billion<br />

in 2010 to $2.03 billion in 2011, according to<br />

Catalina. Rugs are estimated to account for<br />

60 to 70 percent of that total.<br />

In many ways, the area rug business is the<br />

opposite of the wall-to-wall carpet business.<br />

Most broadloom sold in the U.S., is made in<br />

the U.S., while most area rugs sold here are<br />

imported. While wool accounts for a low<br />

single digit percent of all U.S. broadloom,<br />

industry sources estimated that more than 90<br />

percent of imported hand knotted and hand<br />

tufted rugs are made of wool.<br />

Challenges<br />

The greatest challenge in 2011 continued<br />

to be price pressure brought about by a combination<br />

of forces, according to Bill Kilbride,<br />

president of Mohawk Home. “First, the U.S.<br />

economy is not fully recovered, so getting the<br />

consumer to spend disposable income on rugs<br />

is an issue,” Kilbride explained. “Those consumers,<br />

who are shopping, are on a quest for<br />

value,” he said. The second issue is the price of<br />

raw materials, whether up or down. “If those<br />

prices increase, it is virtually impossible to reprice<br />

your product, but, if they go down, customers<br />

expect our prices to go down,” he noted.<br />

For importers, conditions in countries<br />

where rugs are made and the cost of shipping<br />

added to the challenge. “Last year was a perfect<br />

storm, where the housing market, as well<br />

as the overall economy, did not show any<br />

signs of relief, while our industry in general<br />

was hit with price increases due to higher cost<br />

of raw materials and labor,” said Alex Peykar,<br />

principal of Nourison.<br />

Aaron Gray, director of marketing for<br />

Oriental Weavers/Sphinx, agreed that the<br />

ever-increasing cost of raw materials is the<br />

greatest challenge as it “obviously eats at our<br />

overall margins.”<br />

Ron Couri, president and CEO of Couristan,<br />

noted, “The greatest challenge was to drive<br />

sales. We introduced 67 new rugs in January,<br />

but the tough part is getting stores to commit.<br />

Our residential area rugs and broadloom businesses<br />

are seeing up ticks, but not as great as our<br />

hospitality business. In our rug business, hand<br />

knotted rugs are the slowest, while outdoor<br />

rugs are growing fastest,” Couri stated.<br />

In terms of channels of distribution, Couri<br />

added, “Department stores, internet retail and<br />

catalogs are performing the best for us. Macy<br />

has reset 180 stores with fresh rugs this year.”<br />

Couristan is looking to broaden distribution<br />

even more, according to Couri. “In rugs,<br />

we are looking at new distribution in home<br />

centers and are considering big boxes too.”<br />

Signs of a better 2012?<br />

Continuing the pattern of the past few years,<br />

the start of 2012 is looking better. Virtually all<br />

2011 key points<br />

Area rugs continued to contend with price<br />

pressure at all levels of the market, but<br />

managed to increase sales by about 6<br />

percent, generated by consumers choosing<br />

a value-priced rug to freshen a room<br />

or accent a new hard surface fl oor.<br />

Competition from imports may be lessening<br />

as labor costs in China and India rise<br />

as well as shipping costs. Currency rates<br />

are also favoring domestic production.<br />

Fashion and innovation are critical as rug<br />

manufacturers win sales with new kinds<br />

of products such as outdoor rugs and explore<br />

new channels of distribution.<br />

the rug suppliers FCW spoke with reported<br />

sales in the first quarter running ahead of the<br />

same period a year ago. Nourison’s first quarter<br />

sales are up 5 percent, according to Peykar<br />

and the company is striving for a double-digit<br />

increase for the year.<br />

In the first quarter, OW was slightly<br />

ahead compared to 2011, as Gray sees more<br />

optimism in the marketplace and expects<br />

that momentum to carry on the rest of the<br />

year. “We are being aggressive in introducing<br />

new products and bringing them to<br />

market,” he added.<br />

Despite escalating raw materials costs<br />

and soft demand, Jeff Brown, division vice<br />

president for Shaw Living, noted a few<br />

bright spots, saying, “New collections and<br />

constructions were well received by customer<br />

base,” and “Comps were better in<br />

the first quarter of 2012 than the previous<br />

year.” Still, Brown cautioned the industry<br />

to “Expect to see slowdown and more<br />

worry about consumer demand,” in the<br />

second half. FCW<br />

Uneven<br />

Continued from page 9<br />

Balancing cost increases, lower demand<br />

During the recession and into an anemic,<br />

uneven recovery, the carpet industry has done<br />

everything possible to serve its customers and<br />

survive. Mills shuttered excess capacity and<br />

cut back labor forces, but all the cost cutting<br />

could not make up for increases in the cost of<br />

raw materials.<br />

“There is no question that over the last five<br />

years, even in this recessionary environment,<br />

manufacturers have experienced a rise in raw<br />

material costs,” Merritt explained. “Certainly<br />

these prices rise and fall over time but the<br />

overall trend has been up. As costs rise, we have<br />

to also consider the first rule of marketing —<br />

supply and demand.”<br />

Even with a highly specialized product,<br />

Interface experienced the same situation.<br />

“We’ve had to pass along cost increases,<br />

where appropriate, to our customers. To<br />

balance raw materials costs, we’re also<br />

constantly driving product innovation and<br />

Chart 6<br />

Carpet & area rugs exports* value and volume<br />

(in billions)<br />

1.5<br />

1.2<br />

0.9<br />

0.6<br />

0.3<br />

0<br />

$1.03<br />

1.05<br />

design.” said Wells.<br />

$1.10<br />

1.09(R)<br />

2007 2008 2009 2010 2011<br />

Market sales<br />

$0.85<br />

2012 and beyond<br />

The carpet industry sees reasons for<br />

optimism in 2012. “Retail sales continue<br />

0.79<br />

$1.00<br />

Square feet<br />

0.95<br />

$1.07<br />

1.01<br />

*Includes exports of roll goods, bathmats, area rugs, auto and aircraft carpeting and artificial grass.<br />

Source: Catalina Research<br />

R=Revised<br />

to be a challenge through every channel,”<br />

Merritt noted. Still, “The new single family<br />

home business has shown some signs of life<br />

and they now believe we will see roughly<br />

369,000 new homes sold in 2012. This<br />

would be nominally a 20 percent increase<br />

over last year, still far from healthy but<br />

better. As we look to the fall, we of course<br />

have the election issues to deal with. Historically,<br />

this has a dampening effect on<br />

the fall business, but once we are past that<br />

event, I look for better things in 2013.”<br />

Lape at Mohawk added, “So far, 2012 has<br />

not been as robust for the residential carpet<br />

market as expected,” he said. “Still there are<br />

positive signs — gas prices were going down,<br />

there is credit available and the builder<br />

market is growing, although nowhere near<br />

the numbers before the recession.”<br />

Boe said that so far in 2012, business<br />

has been start and stop. “We had a surge<br />

in April, May and slowed down again in<br />

June,” he noted.<br />

Dixie is looking to a stronger second half<br />

in 2012. Frierson said, “So far in 2012, residential<br />

started out great in January, then each<br />

month since has been disappointing. We still<br />

have had some growth, but it’s at the upper<br />

end of the business and not as good as it was<br />

in 2011. We think the second half will be<br />

better, but not until after the election.” FCW