Periodical

STATISTICAL REPORT '11 - Floor Covering Institute

STATISTICAL REPORT '11 - Floor Covering Institute

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

16<br />

Tile & Stone<br />

Tile & stone inch ahead<br />

By Tanja Kern<br />

2011 tile and stone numbers showed that<br />

the U.S. really is seeing the “beginning of the<br />

end” of the recession.<br />

Ceramic tile dollar sales increased by 6<br />

percent to $2.21 billion, while square foot<br />

sales rose by 4.5 percent to 2.08 billion — the<br />

highest rate for any flooring material. Stone<br />

sales were up 0.2 percent to $1.06 billion —<br />

and square foot sales nudged up 0.57 percent<br />

to 261.5 million square feet.<br />

“It was not a great year, but we have already<br />

hit bottom, and we are a little bit ahead of<br />

before,” said Donato Grosser, consultant to<br />

the tile industry and owner of D. Grosser &<br />

Associates, Ltd.<br />

As the overall economy recovered in 2011,<br />

manufacturers felt confident enough to pass<br />

along rising material, energy and transportation<br />

costs to consumers, but price competitiveness<br />

actually improved for ceramic tile<br />

because the sector experienced only moderate<br />

raw material cost increases.<br />

The average square foot price stayed steady<br />

in 2011 — up just a penny. According to<br />

Catalina Research, average square foot selling<br />

prices stood at $1.06 per square foot in 2011<br />

with the category gaining market share — 12.4<br />

percent of total U.S. floor covering dollar sales.<br />

As the struggling housing market shows<br />

signs of improvement, there has been a reversal<br />

in the six-year trend in smaller home sizes,<br />

according to the American Institute of Architects.<br />

This is the case for custom and luxury<br />

homes, as well as for additions to existing<br />

homes. A preference for outdoor living, especially<br />

blended indoor/outdoor living, continues<br />

to increase. These consumer preferences<br />

are opening more doors for natural stone and<br />

high quality porcelain tiles.<br />

Segment breakdown<br />

The current administration’s recent housing<br />

scorecard shows signs of burgeoning<br />

stability in the housing market, with home<br />

equity numbers rising 7.4 percent between<br />

the fourth quarter of 2011 and the first quarter<br />

of 2012. The scorecard, which is compiled<br />

by the U.S. Department of Housing and<br />

Urban Development, the Obama administration<br />

and Treasury, noted that home equity<br />

rose $457.1 billion in the first quarter of 2012.<br />

Catalina Research market segment analysis<br />

showed that homeowners are investing in<br />

their homes with 41 percent of ceramic tile<br />

sales going to residential replacement in 2011.<br />

“Last year was better commercially and we<br />

are seeing some movement in hospitality,<br />

multi-family housing and retail,” said Lori<br />

Kirk-Rolley, senior marketing director for<br />

Dal-Tile. “I think that there is a lot of pent up<br />

demand and we are seeing a lot of that on our<br />

national accounts, on the retail side and with<br />

large retailers.”<br />

Non-residential construction accounted<br />

for 25 percent of the tile market. The commercial<br />

contract market held 19 percent of<br />

the tile market.<br />

“The commercial market is where we<br />

are seeing the growth for Florida Tile,” said<br />

Florida Tile marketing director Sean Cilona.<br />

“The hospitality and healthcare segments are<br />

doing pretty well and those smaller commercial<br />

jobs — those types where people are<br />

installing tile as a replacement floor coverings<br />

are also doing well.”<br />

Gianni Mattioli, president of Marazzi USA,<br />

added, “We are already established in the<br />

residential remodeling market and business<br />

is picking up, but the commercial markets are<br />

where we have made a lot of key investments<br />

in people, marketing and technology.”<br />

Import/Export<br />

Although imports still comprise the majority<br />

of U.S. consumption, due to the U.S. dollar<br />

losing value to the Euro, import market penetration<br />

has fallen in each of the last five years.<br />

In 2011, imports accounted for 69.2 percent of<br />

U.S. ceramic tile consumption — the lowest it<br />

has been since 1998, according to Eric Astrachan,<br />

executive director of the Tile Council of<br />

North America (TCNA). “As you can see, we<br />

are moving in the right direction,” he said.<br />

There are six Italian-owned tile plants in the<br />

United States — Marazzi USA with three locations,<br />

Florim USA, Iris-Stonepeak and Florida<br />

Tile. According to Ceramics of Italy, the Italian<br />

tile association, those plants make up 50 percent<br />

of U.S. ceramic tile production. “These companies<br />

invested in the United State due mainly to<br />

weaknesses in the dollar,” Grosser said.<br />

2011 key points<br />

Sales remained on the rise as consumers<br />

continue to turn to hard surface flooring.<br />

Ceramic tile value increased by 6.3 percent<br />

to $2.21 billion, while volume rose<br />

by 4.5 percent to $2.08 billion.<br />

While imports still comprise the majority<br />

of U.S. consumption and sales of imports<br />

continue to grow (by 3.8 percent in 2011,<br />

according to Catalina) the TCNA said that<br />

imported product’s market share in comparison<br />

to domestically made tile declined<br />

over the last five years to 69.2 percent.<br />

Look ahead<br />

Despite the lingering effects of an overbuilt<br />

housing market, the continued difficulty<br />

to obtain financing for real estate projects,<br />

budget shortfalls and the anxiety surrounding<br />

the prolonged European debt crisis, there<br />

are signs that the U.S. design and construction<br />

industry will be improving and with it,<br />

along with tile and stone industry.<br />

Improved price competitiveness and<br />

consumers’ overall rising preference for hard<br />

surface flooring has already helped ceramic<br />

tile experience some of the strongest industry<br />

gains in the first half of 2012.<br />

Ceramic tile sales (shipments minus exports<br />

plus imports) are estimated to increase by 6.5<br />

percent in square feet and 7.7 percent in dollars<br />

in the first half of 2012 over the previous year,<br />

according to Catalina’s second quarter report<br />

for 2012. This could push ceramic tile square<br />

foot sales to account for 12.3 percent of total<br />

U.S. floor coverings square foot sales in the first<br />

half, and 12.7 percent on a dollar basis. FCW<br />

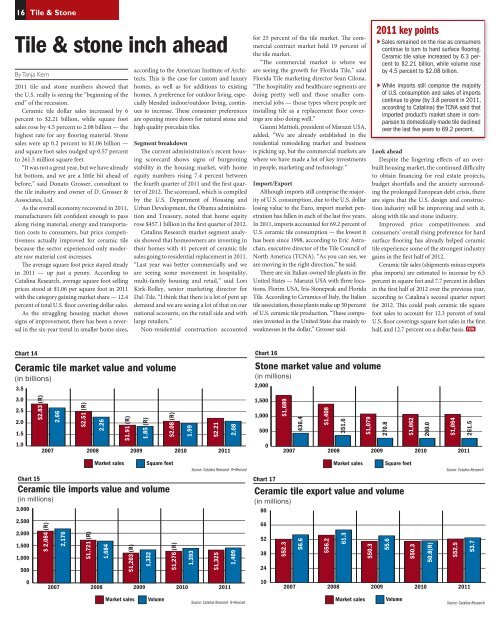

Chart 14<br />

Ceramic tile market value and volume<br />

(in billions)<br />

3.5<br />

3.0<br />

2.5<br />

2.0<br />

1.5<br />

1.0<br />

$2.83 (R)<br />

2.66<br />

$2.51 (R)<br />

2.26<br />

$1.91 (R)<br />

2007 2008 2009 2010 2011<br />

1.85 (R)<br />

$2.08 (R)<br />

1.99<br />

$2.21<br />

2.08<br />

Chart 16<br />

Stone market value and volume<br />

(in millions)<br />

2,000<br />

1,500<br />

1,000<br />

500<br />

0<br />

$1,689<br />

436.4<br />

$1,408<br />

351.6<br />

$1,079<br />

2007 2008 2009 2010 2011<br />

270.8<br />

$1,062<br />

260.0<br />

$1,064<br />

261.5<br />

Chart 15<br />

Market sales<br />

Square feet<br />

Ceramic tile imports value and volume<br />

(in millions)<br />

3,000<br />

Source: Catalina Research R=Revised<br />

Market sales Square feet<br />

Chart 17<br />

Ceramic tile export value and volume<br />

(in millions)<br />

80<br />

Source: Catalina Research<br />

2,500<br />

2,000<br />

1,500<br />

1,000<br />

500<br />

$ 2,084 (R)<br />

2,176<br />

$1,721 (R)<br />

1,684<br />

$1,203 (R)<br />

1,332<br />

$1,276 (R)<br />

1,393<br />

$1,325<br />

1,409<br />

66<br />

52<br />

38<br />

24<br />

$52.3<br />

56.6<br />

$56.2<br />

61.3<br />

$50.3<br />

55.6<br />

$50.3<br />

50.8(R)<br />

$52.5<br />

53.7<br />

0<br />

2007 2008 2009 2010 2011<br />

10<br />

2007 2008 2009 2010 2011<br />

Market sales<br />

Volume<br />

Source: Catalina Research R=Revised<br />

Market sales<br />

Volume<br />

Source: Catalina Research