Periodical

STATISTICAL REPORT '11 - Floor Covering Institute

STATISTICAL REPORT '11 - Floor Covering Institute

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

22<br />

Resilient<br />

July 23/30, 2012<br />

Perspective<br />

What led to vinyl’s record year? Industry<br />

executives Russell Rogg, CEO, Metrofl or;<br />

Keith Lacagnata, vice president of sales and<br />

marketing, FreeFit; Pat Buckley, vice president of<br />

product management, Congoleum; Jonathan<br />

Train, vice president of product development,<br />

EarthWerks; and Allen Cubell, vice president,<br />

residential product management, Armstrong<br />

put it into perspective.<br />

What fueled vinyl flooring’s rapid increase<br />

in sales and market share in 2011?<br />

Rogg: There is no doubt that the advent<br />

of click LVT (luxury vinyl tile) has only<br />

increased the amount of share the category<br />

is taking from laminate fl ooring residentially<br />

and commercially. Laminate has some<br />

drawbacks. Using click LVT has become a<br />

natural next step for folks who were familiar<br />

with installing laminate.<br />

Lacagnata: When you combine the tremendous<br />

gains of LVT and fi berglass sheet, you begin<br />

to understand how these products are<br />

encroaching upon the entire industry. Without<br />

Chart 29<br />

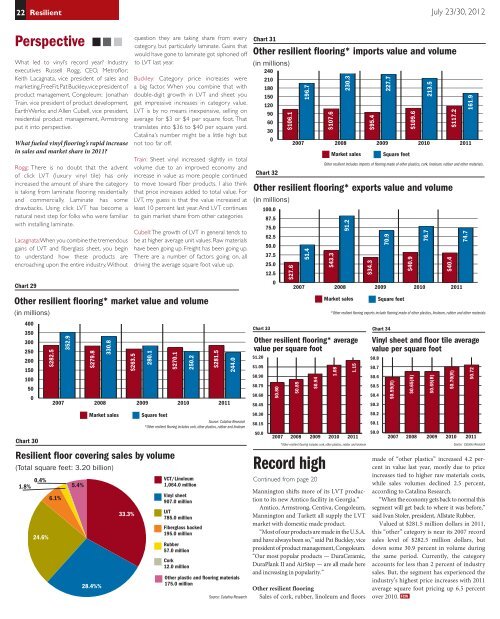

Other resilient flooring* market value and volume<br />

(in millions)<br />

400<br />

350<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

Chart 30<br />

Resilient floor covering sales by volume<br />

(Total square feet: 3.20 billion)<br />

1.8%<br />

0.4%<br />

24.6%<br />

$282.5<br />

2007 2008 2009 2010 2011<br />

6.1%<br />

352.9<br />

5.4%<br />

$279.8<br />

28.4%%<br />

330.8<br />

Market sales<br />

$263.5<br />

33.3%<br />

question they are taking share from every<br />

category, but particularly laminate. Gains that<br />

would have gone to laminate got siphoned off<br />

to LVT last year.<br />

Buckley: Category price increases were<br />

a big factor. When you combine that with<br />

double-digit growth in LVT and sheet you<br />

get impressive increases in category value.<br />

LVT is by no means inexpensive, selling on<br />

average for $3 or $4 per square foot. That<br />

translates into $36 to $40 per square yard.<br />

Catalina’s number might be a little high but<br />

not too far off.<br />

Train: Sheet vinyl increased slightly in total<br />

volume due to an improved economy and<br />

increase in value as more people continued<br />

to move toward fi ber products. I also think<br />

that price increases added to total value. For<br />

LVT, my guess is that the value increased at<br />

least 10 percent last year. And LVT continues<br />

to gain market share from other categories<br />

Cubell: The growth of LVT in general tends to<br />

be at higher average unit values. Raw materials<br />

have been going up. Freight has been going up.<br />

There are a number of factors going on, all<br />

driving the average square foot value up.<br />

280.1<br />

$270.1<br />

250.2<br />

Square feet<br />

Source: Catalina Research<br />

*Other resilient flooring includes cork, other plastics, rubber and linoleum<br />

VCT/Linoleum<br />

1,064.0 million<br />

Vinyl sheet<br />

907.0 million<br />

LVT<br />

785.0 million<br />

Fiberglass backed<br />

195.0 million<br />

Rubber<br />

57.0 million<br />

Cork<br />

12.0 million<br />

$281.5<br />

244.0<br />

Other plastic and flooring materials<br />

175.0 million<br />

Source: Catalina Research<br />

Chart 31<br />

Other resilient flooring* imports value and volume<br />

(in millions)<br />

Chart 32<br />

Other resilient flooring* exports value and volume<br />

(in millions)<br />

Chart 33<br />

Other resilient flooring* average<br />

value per square foot<br />

$1.20<br />

$1.05<br />

$0.90<br />

$0.75<br />

$0.60<br />

$0.45<br />

$0.30<br />

$0.15<br />

$0.0<br />

240<br />

210<br />

180<br />

150<br />

120<br />

90<br />

60<br />

30<br />

0<br />

100.0<br />

87.5<br />

75.0<br />

62.5<br />

50.0<br />

37.5<br />

25.0<br />

12.5<br />

0<br />

$0.80<br />

$106.1<br />

$27.6<br />

2007 2008 2009 2010 2011<br />

$0.85<br />

196.7<br />

51.4<br />

$0.94<br />

$43.3<br />

Market sales<br />

1.08<br />

91.2<br />

1.15<br />

2007 2008 2009 2010 2011<br />

*Other resilient flooring includes cork, other plastics, rubber and linoleum<br />

Record high<br />

Continued from page 20<br />

$107.6<br />

230.3<br />

2007 2008 2009 2010 2011<br />

Market sales Square feet<br />

Other resilient Includes imports of flooring made of other plastics, cork, linoleum, rubber and other materials.<br />

Mannington shifts more of its LVT production<br />

to its new Amtico facility in Georgia.”<br />

Amtico, Armstrong, Centiva, Congoleum,<br />

Mannington and Tarkett all supply the LVT<br />

market with domestic made product.<br />

“Most of our products are made in the U.S.A.<br />

and have always been so,” said Pat Buckley, vice<br />

president of product management, Congoleum.<br />

“Our most popular products — DuraCeramic,<br />

DuraPlank II and AirStep — are all made here<br />

and increasing in popularity.”<br />

Other resilient flooring<br />

Sales of cork, rubber, linoleum and floors<br />

$95.4<br />

$34.3<br />

227.7<br />

70.9<br />

Square feet<br />

$109.6<br />

$40.9<br />

213.5<br />

76.7<br />

$117.2<br />

$40.4<br />

74.7<br />

161.9<br />

*Other resilient flooring exports include flooring made of other plastics, linoleum, rubber and other materials<br />

Chart 34<br />

Vinyl sheet and floor tile average<br />

value per square foot<br />

$0.8<br />

$0.7<br />

$0.6<br />

$0.5<br />

$0.4<br />

$0.3<br />

$0.2<br />

$0.1<br />

$0.0<br />

$0.59(R)<br />

$0.65(R)<br />

$0.65(R)<br />

$0.70(R)<br />

$0.72<br />

2007 2008 2009 2010 2011<br />

Source: Catalina Research<br />

made of “other plastics” increased 4.2 percent<br />

in value last year, mostly due to price<br />

increases tied to higher raw materials costs,<br />

while sales volumes declined 2.5 percent,<br />

according to Catalina Research.<br />

“When the economy gets back to normal this<br />

segment will get back to where it was before,”<br />

said Ivan Stoler, president, Allstate Rubber.<br />

Valued at $281.5 million dollars in 2011,<br />

this “other” category is near its 2007 record<br />

sales level of $282.5 million dollars, but<br />

down some 30.9 percent in volume during<br />

the same period. Currently, the category<br />

accounts for less than 2 percent of industry<br />

sales. But, the segment has experienced the<br />

industry’s highest price increases with 2011<br />

average square foot pricing up 6.5 percent<br />

over 2010. FCW