Periodical

STATISTICAL REPORT '11 - Floor Covering Institute

STATISTICAL REPORT '11 - Floor Covering Institute

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

20<br />

Resilient<br />

July 23/30, 2012<br />

Vinyl sales hit record high<br />

By Raymond Pina<br />

Sales of vinyl sheet and tile flooring hit a record<br />

high wholesale value of $2.11 billion in the<br />

U.S. last year, according to Catalina Research.<br />

Though total 2011 vinyl floor sales grew 5.8<br />

percent in value and 3.2 percent in volume,<br />

it is the ongoing 15 percent growth in higher<br />

priced luxury vinyl tile (LVT) and fiberglass<br />

sheet flooring that has pushed the segment to<br />

record heights.<br />

Gains in up-market LVT and fiberglass<br />

volume forced 2011 average vinyl floor pricing<br />

up 2.9 percent over 2010. The category’s average<br />

square foot price has jumped a remarkable<br />

22 percent since 2007.<br />

“New innovative products, many incorporating<br />

locking systems for the first time, stimulated<br />

demand and led to vinyl taking share from<br />

every other category,” said Stuart Hirschhorn,<br />

director of research, Catalina Research. “What’s<br />

more, commercial, especially replacement<br />

commercial, faired better during the recession<br />

than the residential sector and vinyl has a huge<br />

concentration of that commercial business.<br />

2011 key points<br />

Vinyl sheet and fl oor tile sales hit record<br />

high with category sales increasing 5.8 percent<br />

in value and 3.2 percent in volume.<br />

Average square foot pricing for vinyl increased<br />

2.9 percent this year over last year<br />

and increased 22 percent from 2007.<br />

Vinyl imports decreased 6.2 percent in<br />

2011 as suppliers increase domestic<br />

production of LVT and fiberglass sheet.<br />

Other resilient flooring — which includes<br />

cork, other plastics, rubber and linoleum —<br />

increased in sales value by 4.2 percent but<br />

decreased 2.5 percent in volume in 2011.<br />

Average square foot pricing has increased<br />

43.7 percent since 2007.<br />

Chart 25<br />

Resilient purchases by end-use market<br />

(Total: $2,396.3 million)<br />

0.6%<br />

0.1%<br />

Vinyl floors also had the highest increases in<br />

pricing due to record oil and raw material costs<br />

but they still remained competitive and highly<br />

desirable, if not more so.”<br />

Sales of commercial vinyl composition<br />

tiles (VCT) also grew an estimated 3.3 percent<br />

in volume to 1.01 billion square feet,<br />

according to Hirschhorn.<br />

Leading executives, who have reported double-digit<br />

increases in their LVT and fiberglass<br />

businesses over the past three years, agreed with<br />

Catalina Research’s overall category growth<br />

rates, but remain hesitant to declare 2011 a<br />

record year.<br />

“Having the category up 5 percent sounds<br />

about right, but I don’t think anyone would<br />

paint 2011 as a historically positive year,” noted<br />

Allen Cubell, vice president, residential product<br />

management, Armstrong Floor Products.<br />

While LVT, fiberglass and VCT continue<br />

to grow, Catalina Research estimates traditional<br />

felt-backed vinyl sheet sales declined<br />

7 percent to 907 million square feet in<br />

2011, with volumes evenly split between the<br />

residential and commercial markets. What’s<br />

more, the report highlights that fiberglass<br />

volumes, accounting for 195 million square<br />

feet of sales in 2011, is trending to reach traditional<br />

felt numbers by 2015.<br />

“We see 2011 fiberglass sales at 184 million<br />

square feet; so we’re in the same ballpark,”<br />

said David Sheehan, vice president of<br />

residential resilient business, Mannington.<br />

“Residentially, we see vinyl sheet at 462 million<br />

square feet. Sheet vinyl was up until 2010<br />

when fiberglass sales started kicking in and<br />

we think fiberglass now represents about 40<br />

percent of residential sheet.”<br />

Similarly, Catalina Research estimates<br />

2011 LVT sales volume at 785 million square<br />

feet. But some companies that focus primarily<br />

on high end branded product said the<br />

number is higher than their own estimates.<br />

“You’d have to think a lot of that number<br />

includes peel-and-stick tiles where the defini-<br />

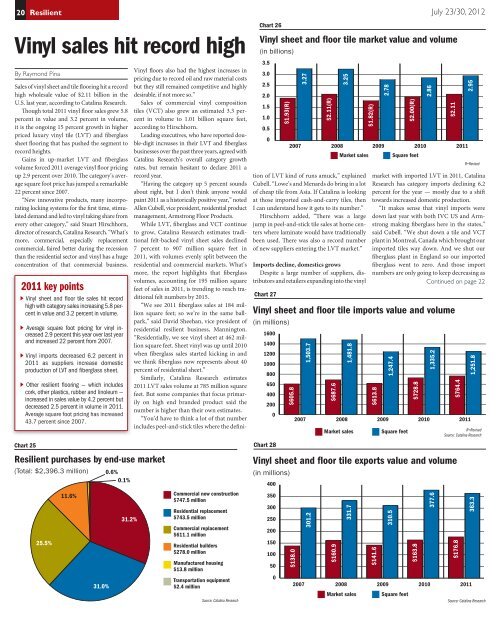

Chart 26<br />

Vinyl sheet and floor tile market value and volume<br />

(in billions)<br />

3.5<br />

3.0<br />

2.5<br />

2.0<br />

1.5<br />

1.0<br />

0.5<br />

0<br />

$1.93(R)<br />

3.27<br />

$2.11(R)<br />

3.25<br />

tion of LVT kind of runs amuck,” explained<br />

Cubell. “Lowe’s and Menards do bring in a lot<br />

of cheap tile from Asia. If Catalina is looking<br />

at those imported cash-and-carry tiles, then<br />

I can understand how it gets to its number.”<br />

Hirschhorn added, “There was a large<br />

jump in peel-and-stick tile sales at home centers<br />

where laminate would have traditionally<br />

been used. There was also a record number<br />

of new suppliers entering the LVT market.”<br />

Imports decline, domestics grows<br />

Despite a large number of suppliers, distributors<br />

and retailers expanding into the vinyl<br />

Chart 27<br />

$1.82(R)<br />

2.78<br />

2007 2008 2009 2010 2011<br />

Market sales Square feet<br />

R=Revised<br />

Vinyl sheet and floor tile imports value and volume<br />

(in millions)<br />

1600<br />

1400<br />

1200<br />

1000<br />

800<br />

650<br />

400<br />

200<br />

0<br />

Chart 28<br />

$605.8<br />

1,503.7<br />

$687.6<br />

1,481.8<br />

$613.8<br />

1,247.4<br />

$2.00(R)<br />

$728.8<br />

2.86<br />

1,335.2<br />

$2.11<br />

$764.4<br />

2007 2008 2009 2010 2011<br />

2.95<br />

1,251.8<br />

Market sales Square feet R=Revised<br />

Source: Catalina Research<br />

Vinyl sheet and floor tile exports value and volume<br />

(in millions)<br />

400<br />

market with imported LVT in 2011, Catalina<br />

Research has category imports declining 6.2<br />

percent for the year — mostly due to a shift<br />

towards increased domestic production.<br />

“It makes sense that vinyl imports were<br />

down last year with both IVC US and Armstrong<br />

making fiberglass here in the states,”<br />

said Cubell. “We shut down a tile and VCT<br />

plant in Montreal, Canada which brought our<br />

imported tiles way down. And we shut our<br />

fiberglass plant in England so our imported<br />

fiberglass went to zero. And those import<br />

numbers are only going to keep decreasing as<br />

Continued on page 22<br />

11.6%<br />

31.2%<br />

Commercial new construction<br />

$747.5 million<br />

Residential replacement<br />

$743.5 million<br />

Commercial replacement<br />

$611.1 million<br />

350<br />

300<br />

250<br />

200<br />

301.2<br />

331.7<br />

310.5<br />

377.6<br />

363.3<br />

25.5%<br />

Residential builders<br />

$278.0 million<br />

Manufactured housing<br />

$13.8 million<br />

150<br />

100<br />

50<br />

$138.0<br />

$160.9<br />

$141.6<br />

$163.8<br />

$176.8<br />

31.0%<br />

Transportation equipment<br />

$2.4 million<br />

Source: Catalina Research<br />

0<br />

2007 2008 2009 2010 2011<br />

Market sales Square feet<br />

Source: Catalina Research