DELIVERY & GROWTH FIVE-YEAR FACT BOOK - Shell

DELIVERY & GROWTH FIVE-YEAR FACT BOOK - Shell

DELIVERY & GROWTH FIVE-YEAR FACT BOOK - Shell

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

UPSTREAM<br />

LNG MARKET<br />

<strong>Shell</strong> expects LNG demand to continue to grow in the mid- to<br />

long-term with growth in all major markets. By some estimates<br />

it will almost triple, from 170 mtpa in 2007 to around 460 mtpa<br />

in 2020 meeting a fifth of global gas needs.<br />

We helped pioneer the LNG sector, providing the technology for<br />

the world’s first commercial liquefaction plant at Arzew, Algeria,<br />

in 1964. Our expertise in LNG is based on 45 years of<br />

technological innovations and experience gained as technical<br />

advisor to operations supplying nearly 40% of global LNG.<br />

<strong>Shell</strong> LNG plants – all joint ventures with partners – have average<br />

CO2 emissions per tonne of LNG that are lower than the industry<br />

average. Some of our LNG projects have the lowest CO2 emissions<br />

in the industry. Qalhat LNG and Oman LNG have the best<br />

performance in tropical conditions and Sakhalin II has been<br />

designed to have good performance in cold climates.<br />

With partners <strong>Shell</strong> is involved in LNG production in Australia,<br />

Brunei, Malaysia, Nigeria, Oman and from March 2009 in<br />

Russia, with total design capacity of 18.5 mtpa.<br />

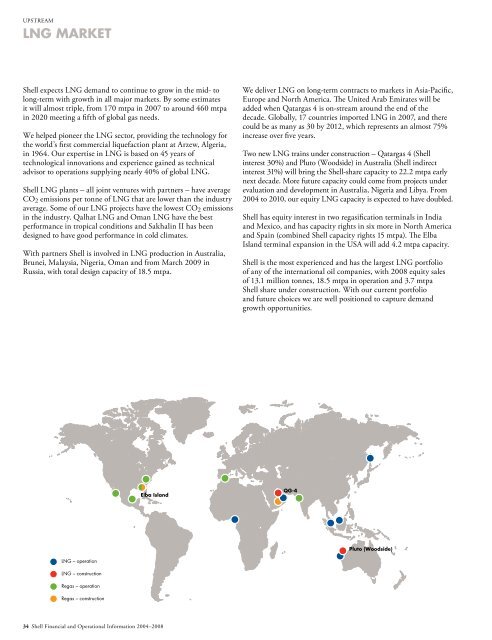

LNG – operation<br />

LNG – construction<br />

Regas – operation<br />

Regas – construction<br />

Elba Island<br />

34 <strong>Shell</strong> Financial and Operational Information 2004–2008<br />

We deliver LNG on long-term contracts to markets in Asia-Pacific,<br />

Europe and North America. The United Arab Emirates will be<br />

added when Qatargas 4 is on-stream around the end of the<br />

decade. Globally, 17 countries imported LNG in 2007, and there<br />

could be as many as 30 by 2012, which represents an almost 75%<br />

increase over five years.<br />

Two new LNG trains under construction – Qatargas 4 (<strong>Shell</strong><br />

interest 30%) and Pluto (Woodside) in Australia (<strong>Shell</strong> indirect<br />

interest 31%) will bring the <strong>Shell</strong>-share capacity to 22.2 mtpa early<br />

next decade. More future capacity could come from projects under<br />

evaluation and development in Australia, Nigeria and Libya. From<br />

2004 to 2010, our equity LNG capacity is expected to have doubled.<br />

<strong>Shell</strong> has equity interest in two regasification terminals in India<br />

and Mexico, and has capacity rights in six more in North America<br />

and Spain (combined <strong>Shell</strong> capacity rights 15 mtpa). The Elba<br />

Island terminal expansion in the USA will add 4.2 mtpa capacity.<br />

<strong>Shell</strong> is the most experienced and has the largest LNG portfolio<br />

of any of the international oil companies, with 2008 equity sales<br />

of 13.1 million tonnes, 18.5 mtpa in operation and 3.7 mtpa<br />

<strong>Shell</strong> share under construction. With our current portfolio<br />

and future choices we are well positioned to capture demand<br />

growth opportunities.<br />

QG-4<br />

Pluto (Woodside)