DELIVERY & GROWTH FIVE-YEAR FACT BOOK - Shell

DELIVERY & GROWTH FIVE-YEAR FACT BOOK - Shell

DELIVERY & GROWTH FIVE-YEAR FACT BOOK - Shell

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

REVIEW OF THE <strong>YEAR</strong><br />

OUR STRATEGY<br />

Maintaining safe and sustainable operations is our top priority.<br />

Long-term supply-demand fundamentals in oil and gas create<br />

a positive investment climate for <strong>Shell</strong>. The company is well<br />

positioned in upstream and downstream heartlands today, and we<br />

are rejuvenating the portfolio with long-term investments to create<br />

long-term shareholder value.<br />

Our ambitious capital spending programme is focused on<br />

upstream, with some 1 million boe/d of production and 6.5 mtpa<br />

of LNG capacity under construction, and measured growth in<br />

capital employed. In downstream, we have a more concentrated<br />

investment programme, with some 0.3 million b/d of new refining<br />

capacity under construction, and selected growth in petrochemicals<br />

and marketing.<br />

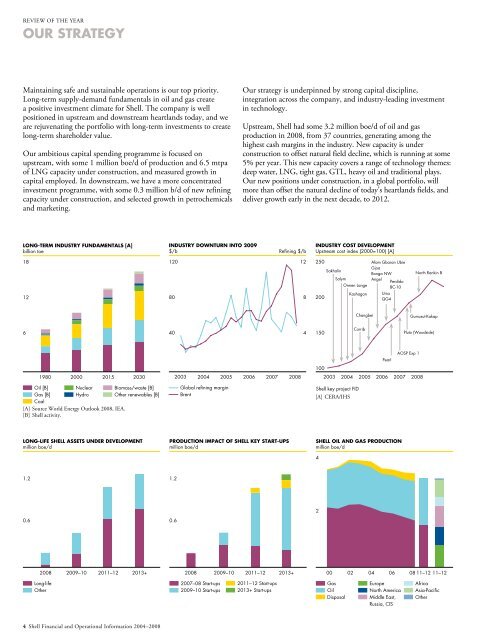

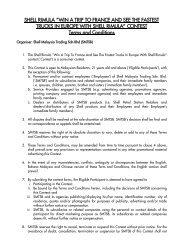

LONG-TERM INDUSTRY FUNDAMENTALS [A]<br />

billion toe<br />

18<br />

12<br />

6<br />

1980 2000<br />

Oil [B]<br />

Gas [B]<br />

Coal<br />

Nuclear<br />

Hydro<br />

2015 2030<br />

[A] Source World Energy Outlook 2008, IEA.<br />

[B] <strong>Shell</strong> activity.<br />

Biomass/waste [B]<br />

Other renewables [B]<br />

LONG-LIFE SHELL ASSETS UNDER DEVELOPMENT<br />

million boe/d<br />

1.2<br />

0.6<br />

Long-life<br />

Other<br />

4 <strong>Shell</strong> Financial and Operational Information 2004–2008<br />

INDUSTRY DOWNTURN INTO 2009<br />

$/b Refining $/b<br />

120 12<br />

80 8<br />

40 4<br />

Global refining margin<br />

Brent<br />

Our strategy is underpinned by strong capital discipline,<br />

integration across the company, and industry-leading investment<br />

in technology.<br />

Upstream, <strong>Shell</strong> had some 3.2 million boe/d of oil and gas<br />

production in 2008, from 37 countries, generating among the<br />

highest cash margins in the industry. New capacity is under<br />

construction to offset natural field decline, which is running at some<br />

5% per year. This new capacity covers a range of technology themes:<br />

deep water, LNG, tight gas, GTL, heavy oil and traditional plays.<br />

Our new positions under construction, in a global portfolio, will<br />

more than offset the natural decline of today’s heartlands fields, and<br />

deliver growth early in the next decade, to 2012.<br />

INDUSTRY COST DEVELOPMENT<br />

Upstream cost index (2000=100) [A]<br />

2003 2004 2005 2006 2007 2008 2003 2004 2005 2006 2007 2008<br />

PRODUCTION IMPACT OF SHELL KEY START-UPS<br />

million boe/d<br />

2008 2009–10 2011–12 2013+ 2008 2009–10 2011–12 2013+<br />

1.2<br />

0.6<br />

2007–08 Start-ups<br />

2009–10 Start-ups<br />

2011–12 Start-ups<br />

2013+ Start-ups<br />

250<br />

200<br />

150<br />

100<br />

Sakhalin<br />

Salym<br />

Ormen Lange<br />

Kashagan<br />

Corrib<br />

<strong>Shell</strong> key project FID<br />

[A] CERA/IHS<br />

Changbei<br />

Afam Gbaran Ubie<br />

Gjoa<br />

Bonga NW<br />

Angel<br />

Perdido<br />

BC-10<br />

Ursa<br />

QG4<br />

Pearl<br />

SHELL OIL AND GAS PRODUCTION<br />

million boe/d<br />

4<br />

2<br />

00 02<br />

Gas<br />

Oil<br />

Disposal<br />

Europe<br />

North America<br />

Middle East,<br />

Russia, CIS<br />

AOSP Exp 1<br />

North Rankin B<br />

Gumusut-Kakap<br />

Pluto (Woodside)<br />

04 06 08 11–12 11–12<br />

Africa<br />

Asia-Pacific<br />

Other