Chairman

SEIL - Annual Report 2011 - Schneider Electric

SEIL - Annual Report 2011 - Schneider Electric

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

FINANCIAL STATEMENTS SCHNEIDER ELECTRIC INFRASTRUCTURE LIMITED<br />

2NOTES TO FINANCIAL STATEMENT<br />

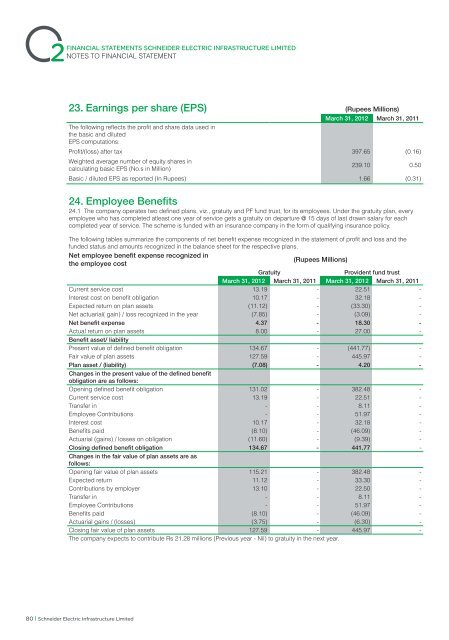

23. Earnings per share (EPS) (Rupees Millions)<br />

March 31, 2012 March 31, 2011<br />

The following reflects the profit and share data used in<br />

the basic and diluted<br />

EPS computations:<br />

Profit/(loss) after tax 397.65 (0.16)<br />

Weighted average number of equity shares in<br />

calculating basic EPS (No.s in Million)<br />

239.10 0.50<br />

Basic / diluted EPS as reported (In Rupees) 1.66 (0.31)<br />

24. Employee Benefits<br />

24.1 The company operates two defined plans, viz., gratuity and PF fund trust, for its employees. Under the gratuity plan, every<br />

employee who has completed atleast one year of service gets a gratuity on departure @ 15 days of last drawn salary for each<br />

completed year of service. The scheme is funded with an insurance company in the form of qualifying insurance policy.<br />

The following tables summarize the components of net benefit expense recognized in the statement of profit and loss and the<br />

funded status and amounts recognized in the balance sheet for the respective plans.<br />

Net employee benefit expense recognized in<br />

the employee cost<br />

(Rupees Millions)<br />

Gratuity<br />

Provident fund trust<br />

March 31, 2012 March 31, 2011 March 31, 2012 March 31, 2011<br />

Current service cost 13.19 - 22.51 -<br />

Interest cost on benefit obligation 10.17 - 32.18 -<br />

Expected return on plan assets (11.12) - (33.30) -<br />

Net actuarial( gain) / loss recognized in the year (7.85) - (3.09) -<br />

Net benefit expense 4.37 - 18.30 -<br />

Actual return on plan assets 8.00 - 27.00 -<br />

Benefit asset/ liability<br />

Present value of defined benefit obligation 134.67 - (441.77) -<br />

Fair value of plan assets 127.59 - 445.97 -<br />

Plan asset / (liability) (7.08) - 4.20 -<br />

Changes in the present value of the defined benefit<br />

obligation are as follows:<br />

Opening defined benefit obligation 131.02 - 382.48 -<br />

Current service cost 13.19 - 22.51 -<br />

Transfer in - - 8.11 -<br />

Employee Contributions - - 51.97 -<br />

Interest cost 10.17 - 32.18 -<br />

Benefits paid (8.10) - (46.09) -<br />

Actuarial (gains) / losses on obligation (11.60) - (9.39) -<br />

Closing defined benefit obligation 134.67 - 441.77 -<br />

Changes in the fair value of plan assets are as<br />

follows:<br />

Opening fair value of plan assets 115.21 - 382.48 -<br />

Expected return 11.12 - 33.30 -<br />

Contributions by employer 13.10 - 22.50 -<br />

Transfer in - - 8.11 -<br />

Employee Contributions - - 51.97 -<br />

Benefits paid (8.10) - (46.09) -<br />

Actuarial gains / (losses) (3.75) - (6.30) -<br />

Closing fair value of plan assets 127.59 - 445.97 -<br />

The company expects to contribute Rs 21.28 millions (Previous year - Nil) to gratuity in the next year.<br />

80 | Schneider Electric Infrastructure Limited