GBS DLL booklet 2016_Flip

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>2016</strong> <strong>DLL</strong> Benefits Guide<br />

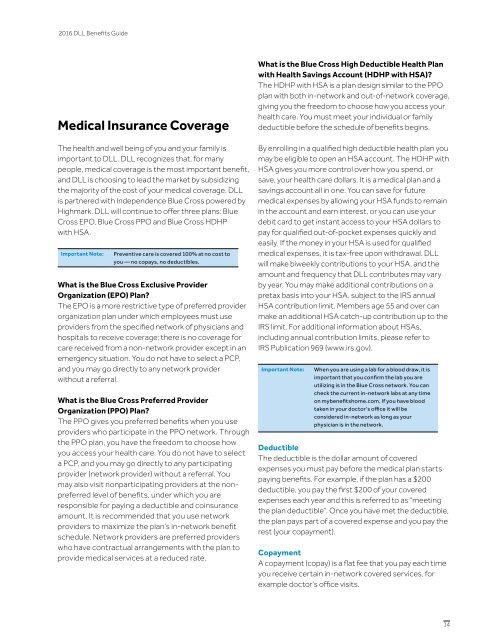

Medical Insurance Coverage<br />

The health and well being of you and your family is<br />

important to <strong>DLL</strong>. <strong>DLL</strong> recognizes that, for many<br />

people, medical coverage is the most important benefit,<br />

and <strong>DLL</strong> is choosing to lead the market by subsidizing<br />

the majority of the cost of your medical coverage. <strong>DLL</strong><br />

is partnered with Independence Blue Cross powered by<br />

Highmark. <strong>DLL</strong> will continue to offer three plans: Blue<br />

Cross EPO, Blue Cross PPO and Blue Cross HDHP<br />

with HSA.<br />

Important Note:<br />

Preventive care is covered 100% at no cost to<br />

you — no copays, no deductibles.<br />

What is the Blue Cross Exclusive Provider<br />

Organization (EPO) Plan?<br />

The EPO is a more restrictive type of preferred provider<br />

organization plan under which employees must use<br />

providers from the specified network of physicians and<br />

hospitals to receive coverage; there is no coverage for<br />

care received from a non-network provider except in an<br />

emergency situation. You do not have to select a PCP,<br />

and you may go directly to any network provider<br />

without a referral.<br />

What is the Blue Cross Preferred Provider<br />

Organization (PPO) Plan?<br />

The PPO gives you preferred benefits when you use<br />

providers who participate in the PPO network. Through<br />

the PPO plan, you have the freedom to choose how<br />

you access your health care. You do not have to select<br />

a PCP, and you may go directly to any participating<br />

provider (network provider) without a referral. You<br />

may also visit nonparticipating providers at the nonpreferred<br />

level of benefits, under which you are<br />

responsible for paying a deductible and coinsurance<br />

amount. It is recommended that you use network<br />

providers to maximize the plan’s in-network benefit<br />

schedule. Network providers are preferred providers<br />

who have contractual arrangements with the plan to<br />

provide medical services at a reduced rate.<br />

What is the Blue Cross High Deductible Health Plan<br />

with Health Savings Account (HDHP with HSA)?<br />

The HDHP with HSA is a plan design similar to the PPO<br />

plan with both in-network and out-of-network coverage,<br />

giving you the freedom to choose how you access your<br />

health care. You must meet your individual or family<br />

deductible before the schedule of benefits begins.<br />

By enrolling in a qualified high deductible health plan you<br />

may be eligible to open an HSA account. The HDHP with<br />

HSA gives you more control over how you spend, or<br />

save, your health care dollars. It is a medical plan and a<br />

savings account all in one. You can save for future<br />

medical expenses by allowing your HSA funds to remain<br />

in the account and earn interest, or you can use your<br />

debit card to get instant access to your HSA dollars to<br />

pay for qualified out-of-pocket expenses quickly and<br />

easily. If the money in your HSA is used for qualified<br />

medical expenses, it is tax-free upon withdrawal. <strong>DLL</strong><br />

will make biweekly contributions to your HSA, and the<br />

amount and frequency that <strong>DLL</strong> contributes may vary<br />

by year. You may make additional contributions on a<br />

pretax basis into your HSA, subject to the IRS annual<br />

HSA contribution limit. Members age 55 and over can<br />

make an additional HSA catch-up contribution up to the<br />

IRS limit. For additional information about HSAs,<br />

including annual contribution limits, please refer to<br />

IRS Publication 969 (www.irs.gov).<br />

Important Note:<br />

When you are using a lab for a blood draw, it is<br />

important that you confirm the lab you are<br />

utilizing is in the Blue Cross network. You can<br />

check the current in-network labs at any time<br />

on mybenefitshome.com. If you have blood<br />

taken in your doctor’s office it will be<br />

considered in-network as long as your<br />

physician is in the network.<br />

Deductible<br />

The deductible is the dollar amount of covered<br />

expenses you must pay before the medical plan starts<br />

paying benefits. For example, if the plan has a $200<br />

deductible, you pay the first $200 of your covered<br />

expenses each year and this is referred to as “meeting<br />

the plan deductible”. Once you have met the deductible,<br />

the plan pays part of a covered expense and you pay the<br />

rest (your copayment).<br />

Copayment<br />

A copayment (copay) is a flat fee that you pay each time<br />

you receive certain in-network covered services, for<br />

example doctor’s office visits.<br />

14

![GBS DLL booklet 2016_V5_EDITS[2]](https://img.yumpu.com/54825056/1/190x245/gbs-dll-booklet-2016-v5-edits2.jpg?quality=85)