Tabreed 06 Prospectus - London Stock Exchange

Tabreed 06 Prospectus - London Stock Exchange

Tabreed 06 Prospectus - London Stock Exchange

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

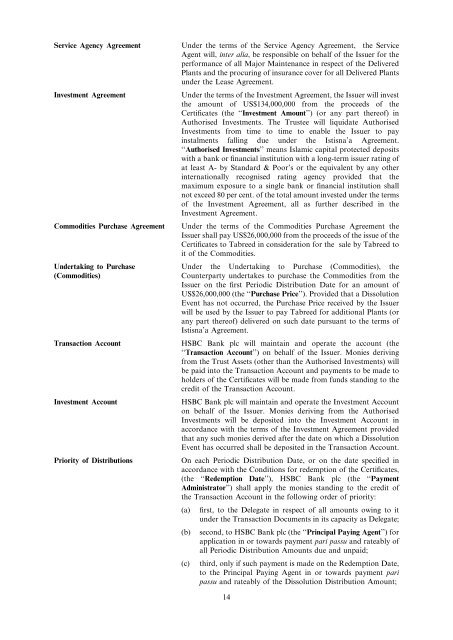

Service Agency Agreement Under the terms of the Service Agency Agreement, the Service<br />

Agent will, inter alia, be responsible on behalf of the Issuer for the<br />

performance of all Major Maintenance in respect of the Delivered<br />

Plants and the procuring of insurance cover for all Delivered Plants<br />

under the Lease Agreement.<br />

Investment Agreement Under the terms of the Investment Agreement, the Issuer will invest<br />

the amount of US$134,000,000 from the proceeds of the<br />

Certificates (the ‘‘Investment Amount’’) (or any part thereof) in<br />

Authorised Investments. The Trustee will liquidate Authorised<br />

Investments from time to time to enable the Issuer to pay<br />

instalments falling due under the Istisna’a Agreement.<br />

‘‘Authorised Investments’’ means Islamic capital protected deposits<br />

with a bank or financial institution with a long-term issuer rating of<br />

at least A- by Standard & Poor’s or the equivalent by any other<br />

internationally recognised rating agency provided that the<br />

maximum exposure to a single bank or financial institution shall<br />

not exceed 80 per cent. of the total amount invested under the terms<br />

of the Investment Agreement, all as further described in the<br />

Investment Agreement.<br />

Commodities Purchase Agreement Under the terms of the Commodities Purchase Agreement the<br />

Issuer shall pay US$26,000,000 from the proceeds of the issue of the<br />

Certificates to <strong>Tabreed</strong> in consideration for the sale by <strong>Tabreed</strong> to<br />

it of the Commodities.<br />

Undertaking to Purchase<br />

(Commodities)<br />

Under the Undertaking to Purchase (Commodities), the<br />

Counterparty undertakes to purchase the Commodities from the<br />

Issuer on the first Periodic Distribution Date for an amount of<br />

US$26,000,000 (the ‘‘Purchase Price’’). Provided that a Dissolution<br />

Event has not occurred, the Purchase Price received by the Issuer<br />

will be used by the Issuer to pay <strong>Tabreed</strong> for additional Plants (or<br />

any part thereof) delivered on such date pursuant to the terms of<br />

Istisna’a Agreement.<br />

Transaction Account HSBC Bank plc will maintain and operate the account (the<br />

‘‘Transaction Account’’) on behalf of the Issuer. Monies deriving<br />

from the Trust Assets (other than the Authorised Investments) will<br />

be paid into the Transaction Account and payments to be made to<br />

holders of the Certificates will be made from funds standing to the<br />

credit of the Transaction Account.<br />

Investment Account HSBC Bank plc will maintain and operate the Investment Account<br />

on behalf of the Issuer. Monies deriving from the Authorised<br />

Investments will be deposited into the Investment Account in<br />

accordance with the terms of the Investment Agreement provided<br />

that any such monies derived after the date on which a Dissolution<br />

Event has occurred shall be deposited in the Transaction Account.<br />

Priority of Distributions On each Periodic Distribution Date, or on the date specified in<br />

accordance with the Conditions for redemption of the Certificates,<br />

(the ‘‘Redemption Date’’), HSBC Bank plc (the ‘‘Payment<br />

Administrator’’) shall apply the monies standing to the credit of<br />

the Transaction Account in the following order of priority:<br />

(a) first, to the Delegate in respect of all amounts owing to it<br />

under the Transaction Documents in its capacity as Delegate;<br />

(b) second, to HSBC Bank plc (the ‘‘Principal Paying Agent’’) for<br />

application in or towards payment pari passu and rateably of<br />

all Periodic Distribution Amounts due and unpaid;<br />

(c) third, only if such payment is made on the Redemption Date,<br />

to the Principal Paying Agent in or towards payment pari<br />

passu and rateably of the Dissolution Distribution Amount;<br />

14