Tabreed 06 Prospectus - London Stock Exchange

Tabreed 06 Prospectus - London Stock Exchange

Tabreed 06 Prospectus - London Stock Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Under the Lease Agreement <strong>Tabreed</strong> has undertaken that:<br />

(i) it will not, and will procure that its Subsidiaries will not, create or permit to subsist any<br />

Security Interest upon the whole or any part of its present or future undertaking, assets or<br />

revenues (including uncalled capital) to secure any Relevant Indebtedness or Guarantee of<br />

Relevant Indebtedness without (a) at the same time or prior thereto securing the Certificates<br />

equally and rateably therewith to the satisfaction of the Delegate or (b) providing such other<br />

security for the Certificates as the Delegate may in its absolute discretion consider to be not<br />

materially less beneficial to the interest of the Certificateholders or as may be approved by an<br />

Extraordinary Resolution of Certificateholders;<br />

(ii) it shall not sell, transfer, assign, participate, exchange or otherwise dispose of, or pledge,<br />

mortgage, hypothecate or otherwise encumber (by security interest, lien (statutory or otherwise),<br />

preference, priority or other security agreement or preferential arrangement of any kind or<br />

nature whatsoever or otherwise) (or permit such to occur or suffer such to exist) any part of (i)<br />

its title to the Plants or any interest therein except pursuant to the Transaction Documents or<br />

(ii) its interests in any of the other Trust Assets except pursuant to the Transaction Documents;<br />

(iii) at the end of each Reference Date the ratio of EBITDA for the 12 months ending on such<br />

Reference Date to Total Debt Service for the 12 months ending on such Reference Date shall<br />

not be less than 1:1;<br />

(iv) the ratio of Total Debt to Total Equity shall not at any time exceed 2.76:1; and<br />

(v) it shall not, and will procure that its Subsidiaries will not, enter into a single transaction or a<br />

series of transactions (whether related or not) and whether voluntary or involuntary to sell,<br />

lease, transfer or otherwise dispose of any part of its assets.<br />

This sub-Clause (v) does not apply to any sale, lease, transfer or other disposal:<br />

(a) at Fair Market Value;<br />

(b) undertaken by it or any such Subsidiary solely in connection with an Islamic compliant<br />

financing;<br />

(c) made with the prior written consent of the Delegate;<br />

(d) in the course of solvent reorganisations of the <strong>Tabreed</strong> Group, to other members of the<br />

<strong>Tabreed</strong> Group; or<br />

(e) for a book value which, if aggregated with the book value of assets disposed of (other<br />

than under (a), (b), (c) or (d) above) in any one financial year, does not exceed<br />

US$10,000,000.<br />

Capitalised terms defined in this paragraph are defined in Condition 6.1.<br />

The rental payments under the Lease Agreement will be payable by <strong>Tabreed</strong> on each Rental Payment<br />

Date (being two Business Days prior to the related Periodic Distribution Date). The Rentals will be<br />

an amount of:<br />

(i) in respect of each Rental Payment Date falling in the period from and including the Closing<br />

Date up to and excluding the Completion Date, the Rental Amount less the Security Amount;<br />

(ii) in respect of the Rental Payment Date falling on the Completion Date, the Rental Amount plus<br />

the aggregate of Security Amounts received under the Istisna’a Agreement; and<br />

(iii) in respect of all Rental Payment Dates falling in the period from and excluding the Completion<br />

Date up to and including the Scheduled Dissolution Date, the Rental Amount.<br />

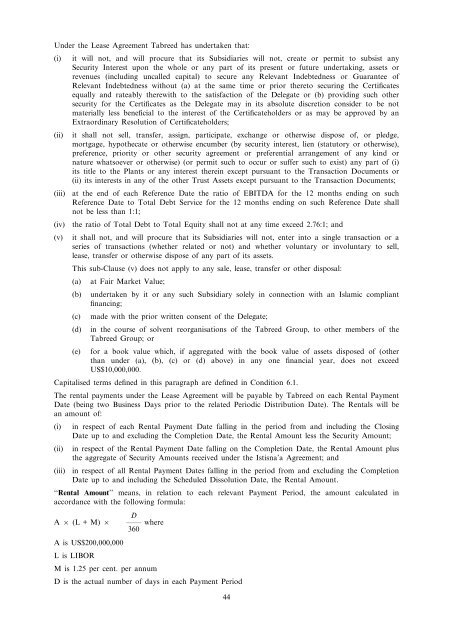

‘‘Rental Amount’’ means, in relation to each relevant Payment Period, the amount calculated in<br />

accordance with the following formula:<br />

D<br />

A 6 (L + M) 6 —— where<br />

360<br />

A is US$200,000,000<br />

L is LIBOR<br />

M is 1.25 per cent. per annum<br />

D is the actual number of days in each Payment Period<br />

44