Annual_Report2014

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Annual</strong> Report 2014<br />

13<br />

Examination of issuers’ financial reports<br />

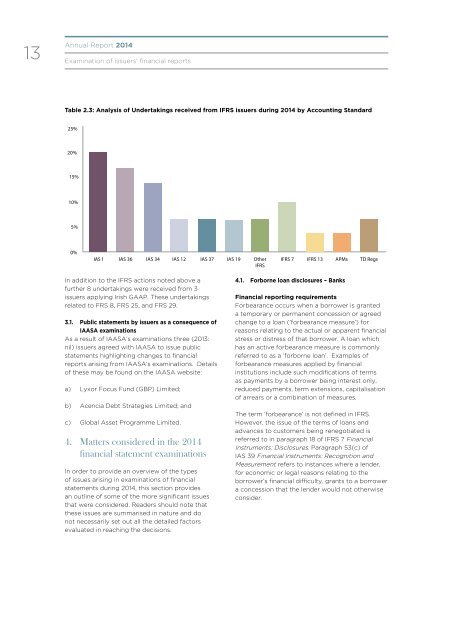

Table 2.3: Analysis of Undertakings received from IFRS issuers during 2014 by Accounting Standard<br />

25%<br />

20%<br />

15%<br />

10%<br />

5%<br />

0%<br />

IAS 1<br />

IAS 36<br />

IAS 34<br />

IAS 12<br />

IAS 37<br />

IAS 19<br />

Other<br />

IFRS<br />

IFRS 7 IFRS 13 APMs TD Regs<br />

In addition to the IFRS actions noted above a<br />

further 8 undertakings were received from 3<br />

issuers applying Irish GAAP. These undertakings<br />

related to FRS 8, FRS 25, and FRS 29.<br />

3.1. Public statements by issuers as a consequence of<br />

IAASA examinations<br />

As a result of IAASA’s examinations three (2013:<br />

nil) issuers agreed with IAASA to issue public<br />

statements highlighting changes to financial<br />

reports arising from IAASA’s examinations. Details<br />

of these may be found on the IAASA website:<br />

a) Lyxor Focus Fund (GBP) Limited;<br />

b) Acencia Debt Strategies Limited; and<br />

c) Global Asset Programme Limited.<br />

4. Matters considered in the 2014<br />

financial statement examinations<br />

In order to provide an overview of the types<br />

of issues arising in examinations of financial<br />

statements during 2014, this section provides<br />

an outline of some of the more significant issues<br />

that were considered. Readers should note that<br />

these issues are summarised in nature and do<br />

not necessarily set out all the detailed factors<br />

evaluated in reaching the decisions.<br />

4.1. Forborne loan disclosures – Banks<br />

Financial reporting requirements<br />

Forbearance occurs when a borrower is granted<br />

a temporary or permanent concession or agreed<br />

change to a loan (‘forbearance measure’) for<br />

reasons relating to the actual or apparent financial<br />

stress or distress of that borrower. A loan which<br />

has an active forbearance measure is commonly<br />

referred to as a ‘forborne loan’. Examples of<br />

forbearance measures applied by financial<br />

institutions include such modifications of terms<br />

as payments by a borrower being interest only,<br />

reduced payments, term extensions, capitalisation<br />

of arrears or a combination of measures.<br />

The term ‘forbearance’ is not defined in IFRS.<br />

However, the issue of the terms of loans and<br />

advances to customers being renegotiated is<br />

referred to in paragraph 18 of IFRS 7 Financial<br />

Instruments: Disclosures. Paragraph 53(c) of<br />

IAS 39 Financial Instruments: Recognition and<br />

Measurement refers to instances where a lender,<br />

for economic or legal reasons relating to the<br />

borrower’s financial difficulty, grants to a borrower<br />

a concession that the lender would not otherwise<br />

consider.